Certificates of deposit offer fixed interest rates over a set term, providing predictable returns with FDIC insurance protection, making them suitable for risk-averse savers. Treasury bills are short-term government securities sold at a discount and mature at face value, offering low-risk investment backed by the U.S. government with tax advantages on interest income. Comparing liquidity, Treasury bills are generally more liquid due to shorter maturities and active secondary markets, while certificates of deposit may impose penalties for early withdrawal.

Table of Comparison

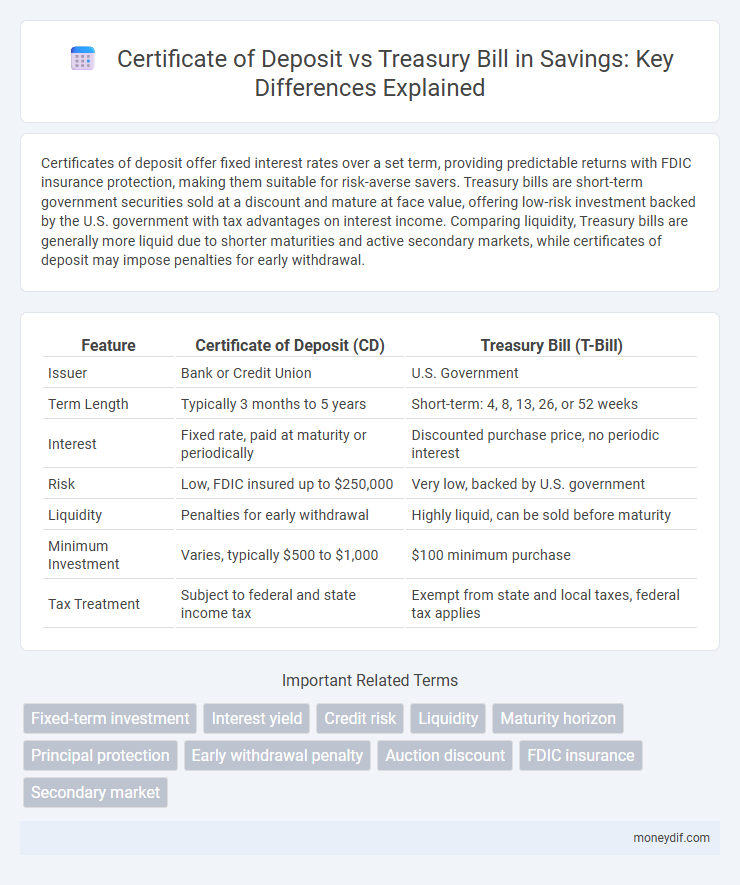

| Feature | Certificate of Deposit (CD) | Treasury Bill (T-Bill) |

|---|---|---|

| Issuer | Bank or Credit Union | U.S. Government |

| Term Length | Typically 3 months to 5 years | Short-term: 4, 8, 13, 26, or 52 weeks |

| Interest | Fixed rate, paid at maturity or periodically | Discounted purchase price, no periodic interest |

| Risk | Low, FDIC insured up to $250,000 | Very low, backed by U.S. government |

| Liquidity | Penalties for early withdrawal | Highly liquid, can be sold before maturity |

| Minimum Investment | Varies, typically $500 to $1,000 | $100 minimum purchase |

| Tax Treatment | Subject to federal and state income tax | Exempt from state and local taxes, federal tax applies |

Understanding Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are time-bound savings instruments offered by banks with fixed interest rates and maturities ranging from a few months to several years, providing predictable returns. Unlike Treasury bills, which are short-term government securities with durations typically under one year, CDs offer higher interest rates due to bank risk exposure and early withdrawal penalties. Investors seeking stable income and guaranteed principal without market volatility often prefer CDs for medium-term savings strategies.

What Are Treasury Bills (T-Bills)?

Treasury Bills (T-Bills) are short-term government securities issued by the U.S. Department of the Treasury with maturities ranging from a few days to one year. They are sold at a discount from their face value and do not pay periodic interest, with the return realized upon maturity when the full face value is paid. T-Bills are considered low-risk investments backed by the full faith and credit of the U.S. government, making them a popular choice for conservative savers seeking liquidity and safety.

Key Differences Between CDs and T-Bills

Certificates of deposit (CDs) typically offer fixed interest rates and longer maturity periods ranging from months to several years, while Treasury bills (T-Bills) are short-term government securities with maturities of one year or less and are sold at a discount to face value. CDs are issued by banks and credit unions with FDIC insurance protection, providing lower risk for savers, whereas T-Bills are backed by the U.S. government, considered one of the safest investments but without FDIC insurance. Liquidity differs as T-Bills can be easily sold in secondary markets before maturity, while early withdrawal from CDs often incurs penalties.

Interest Rates: CDs vs Treasury Bills

Certificate of deposit (CD) interest rates generally exceed those of Treasury bills (T-bills), reflecting higher risk and longer maturity periods. CDs offer fixed, often higher rates locked in for terms ranging from a few months to several years, while T-bills provide lower yields due to their short-term maturity and government-backed security. Investors seeking guaranteed returns with minimal risk may choose T-bills despite lower interest rates, whereas those aiming for higher yields may prefer CDs despite the potential liquidity constraints.

Safety and Risk Comparison

Certificates of deposit (CDs) typically offer fixed interest rates insured by the FDIC up to $250,000, ensuring principal protection and minimal risk for savers. Treasury bills, backed by the U.S. government, are considered one of the safest investments globally due to their sovereign guarantee, though they have variable yields based on auction results. While both options prioritize capital safety, CDs carry minimal default risk with bank insurance, and Treasury bills present virtually risk-free returns but are subject to interest rate fluctuations affecting reinvestment.

Liquidity: Accessing Your Money

Certificates of deposit (CDs) typically require funds to be locked in for a fixed term, limiting liquidity and often imposing penalties for early withdrawal. Treasury bills (T-bills) offer higher liquidity since they mature within a short period, usually from a few days to one year, and can also be sold on the secondary market before maturity without penalties. Investors seeking quick access to their money often prefer T-bills due to their flexible redemption options and shorter maturity periods.

Tax Implications for CD and T-Bill Investors

Interest earned on Certificates of Deposit (CDs) is subject to federal and state income taxes in the year it is paid or accrued, potentially increasing investors' taxable income annually. Treasury bills (T-Bills), however, are exempt from state and local taxes, with investors only liable for federal income tax on the discount earned upon maturity. This distinction often makes T-Bills more tax-efficient for investors in higher state tax brackets seeking tax-advantaged savings options.

Minimum Investment Requirements

Certificate of deposit (CD) minimum investment requirements typically start at $500 to $1,000, making them accessible for small to medium savers. Treasury bills (T-bills) require a minimum investment of $100 when purchased through TreasuryDirect, appealing to investors seeking government-backed securities with low entry barriers. Both options offer secure savings vehicles, but T-bills provide more flexibility for investors with limited capital.

Which Savings Option Matches Your Goals?

Certificate of Deposit (CD) offers fixed interest rates and higher yields over longer terms, making it ideal for savers seeking predictable returns with minimal risk. Treasury bills (T-bills) provide short-term government-backed security with lower yields but greater liquidity and flexibility for quick access to funds. Choosing between CDs and T-bills depends on your savings timeline, risk tolerance, and need for accessibility.

Choosing Between CDs and Treasury Bills

When choosing between Certificates of Deposit (CDs) and Treasury Bills (T-Bills), consider the investment duration and risk tolerance. CDs offer fixed interest rates with terms typically ranging from a few months to several years, providing predictable returns but limited liquidity. T-Bills are short-term government securities with maturities up to one year, known for their low risk, high liquidity, and exemption from state and local taxes.

Important Terms

Fixed-term investment

Fixed-term investments such as Certificates of Deposit (CDs) and Treasury Bills (T-Bills) offer secure options for capital preservation with differing liquidity and yield profiles; CDs typically provide higher interest rates over fixed periods but limit access until maturity, while T-Bills are short-term government securities with lower yields and high liquidity. Investors seeking predictable returns and minimal risk weigh the credit risk, duration, and tax implications of these fixed-income instruments to optimize portfolio diversification.

Interest yield

Interest yield on Certificates of Deposit often exceeds Treasury Bill rates due to longer maturities and slightly higher risk profiles, reflecting bank credit exposure compared to government-backed securities. Treasury Bills, backed by the U.S. government, typically offer lower yields with minimal risk, making them a benchmark for risk-free interest rates in the money market.

Credit risk

Credit risk for certificates of deposit (CDs) is higher compared to Treasury bills due to the potential default risk posed by issuing banks, whereas Treasury bills backed by the U.S. government are considered virtually risk-free. Investors typically demand a higher yield on CDs to compensate for the issuer's credit risk, while Treasury bills offer lower yields reflecting their superior credit quality.

Liquidity

Liquidity in financial instruments varies significantly between Certificates of Deposit (CDs) and Treasury Bills (T-Bills); T-Bills are highly liquid, easily tradable on secondary markets with maturities typically of one year or less, while CDs often impose early withdrawal penalties that reduce their liquidity despite fixed interest rates. Investors seeking short-term, highly liquid government-backed securities prefer T-Bills, whereas CDs attract those willing to lock funds for higher interest returns, sacrificing liquidity for stability.

Maturity horizon

The maturity horizon for certificates of deposit (CDs) typically ranges from a few months to several years, with fixed terms that offer higher interest rates compared to Treasury bills (T-bills), which generally have shorter maturities of one month to one year. Investors seeking longer-term, stable returns often prefer CDs due to their fixed rates and longer duration, while T-bills provide highly liquid, short-term government-backed investments with lower yields but minimal risk.

Principal protection

Principal protection in certificates of deposit (CDs) is ensured through fixed interest rates and FDIC insurance up to $250,000, providing guaranteed return of the invested amount at maturity. Treasury bills, backed by the U.S. government, offer principal protection by being sold at a discount and redeemable at face value upon maturity, making them a low-risk, short-term investment.

Early withdrawal penalty

Early withdrawal penalty for Certificate of Deposit (CD) often results in forfeiting several months' worth of interest, reducing overall returns significantly. In contrast, Treasury bills (T-bills) can be sold before maturity in the secondary market without penalty, offering greater liquidity and flexibility.

Auction discount

Auction discounts reflect the difference between the purchase price and the face value of Treasury bills and certificates of deposit (CDs), with T-bills typically offering lower yields due to government backing and higher liquidity. Certificates of deposit often carry higher auction discounts to compensate for longer maturities and early withdrawal penalties compared to the shorter-term, risk-free Treasury bills.

FDIC insurance

FDIC insurance protects Certificates of Deposit (CDs) up to $250,000 per depositor, providing safety against bank failure, whereas Treasury bills are backed by the full faith and credit of the U.S. government and do not require FDIC insurance. CDs typically offer fixed interest rates with varying term lengths, while Treasury bills are short-term government securities sold at a discount and mature at face value, reflecting a risk-free investment profile.

Secondary market

Secondary markets for Certificates of Deposit (CDs) and Treasury Bills (T-Bills) provide liquidity by enabling investors to buy and sell these fixed-income securities before maturity. While CDs typically have less active secondary markets due to issuer restrictions and lower demand, T-Bills benefit from highly liquid and widely traded secondary markets supported by government backing and short-term maturity profiles.

Certificate of deposit vs Treasury bill Infographic

moneydif.com

moneydif.com