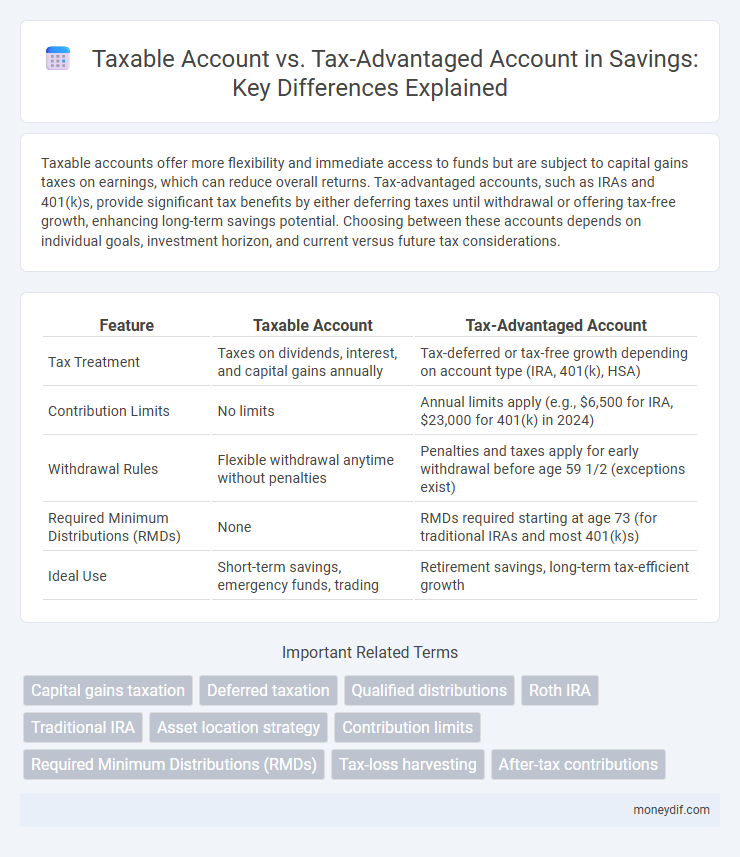

Taxable accounts offer more flexibility and immediate access to funds but are subject to capital gains taxes on earnings, which can reduce overall returns. Tax-advantaged accounts, such as IRAs and 401(k)s, provide significant tax benefits by either deferring taxes until withdrawal or offering tax-free growth, enhancing long-term savings potential. Choosing between these accounts depends on individual goals, investment horizon, and current versus future tax considerations.

Table of Comparison

| Feature | Taxable Account | Tax-Advantaged Account |

|---|---|---|

| Tax Treatment | Taxes on dividends, interest, and capital gains annually | Tax-deferred or tax-free growth depending on account type (IRA, 401(k), HSA) |

| Contribution Limits | No limits | Annual limits apply (e.g., $6,500 for IRA, $23,000 for 401(k) in 2024) |

| Withdrawal Rules | Flexible withdrawal anytime without penalties | Penalties and taxes apply for early withdrawal before age 59 1/2 (exceptions exist) |

| Required Minimum Distributions (RMDs) | None | RMDs required starting at age 73 (for traditional IRAs and most 401(k)s) |

| Ideal Use | Short-term savings, emergency funds, trading | Retirement savings, long-term tax-efficient growth |

Understanding Taxable Accounts

Taxable accounts offer flexible access to investments without contribution limits or withdrawal restrictions, making them ideal for short- and medium-term savings goals. Earnings in taxable accounts are subject to annual capital gains, dividends, and interest taxes, influencing after-tax returns based on income and investment type. Understanding cost basis and tax-loss harvesting strategies can help optimize tax efficiency and maximize net investment gains.

What Are Tax-Advantaged Accounts?

Tax-advantaged accounts, such as IRAs, 401(k)s, and HSAs, offer unique benefits like tax deferral or tax-free growth on contributions and earnings. These accounts help investors optimize savings by reducing taxable income or eliminating taxes on qualified withdrawals, enhancing long-term wealth accumulation. Unlike taxable accounts, tax-advantaged accounts impose contribution limits and potential withdrawal restrictions to maintain their preferential tax status.

Key Differences Between Taxable and Tax-Advantaged Accounts

Taxable accounts have no contribution limits, allowing unlimited deposits but subject earnings to annual capital gains and dividend taxes. Tax-advantaged accounts like IRAs and 401(k)s offer tax deferral or exemption on contributions and investment growth, often with restrictions on withdrawals and contribution limits. Understanding these differences is crucial for optimizing investment growth and minimizing tax liabilities over time.

Tax Implications: Gains, Losses, and Withdrawals

Taxable accounts incur capital gains taxes on profits from asset sales, with rates depending on the holding period and income bracket. Tax-advantaged accounts, such as IRAs and 401(k)s, offer tax-deferred growth or tax-free withdrawals, depending on the account type, but early withdrawals may trigger penalties and taxes. Understanding the tax implications of gains, losses, and withdrawals helps optimize savings strategies and maximize after-tax returns.

Contribution Limits and Flexibility

Taxable accounts offer no contribution limits and allow unlimited deposits, providing greater flexibility for savers who want unrestricted access to their funds. Tax-advantaged accounts, such as IRAs and 401(k)s, impose annual contribution limits defined by the IRS--currently $6,500 for IRAs and $23,000 for 401(k)s in 2024--restricting the amount you can invest each year. While tax-advantaged accounts offer benefits like tax deferral or tax-free growth, their withdrawal rules and contribution caps limit flexibility compared to taxable accounts.

Investment Options and Restrictions

Taxable accounts offer a broad range of investment options, including stocks, bonds, mutual funds, and ETFs without restrictions on contribution limits or withdrawal timing. Tax-advantaged accounts like IRAs and 401(k)s provide tax benefits but impose specific investment restrictions, contribution caps, and potential penalties for early withdrawals. Understanding the balance between flexibility in taxable accounts and tax efficiency in tax-advantaged accounts is essential for optimizing investment strategies.

Liquidity and Accessibility of Funds

Taxable accounts offer greater liquidity and immediate access to funds without penalties, enabling investors to withdraw money at any time. Tax-advantaged accounts, such as IRAs and 401(k)s, often restrict access until certain conditions are met, with early withdrawals typically incurring taxes and penalties. The accessibility difference makes taxable accounts more suitable for short-term savings or emergency funds, while tax-advantaged accounts are geared towards long-term retirement savings.

Suitability for Different Financial Goals

Taxable accounts offer flexibility and easy access to funds, making them suitable for short-term goals or emergency savings, while tax-advantaged accounts like IRAs and 401(k)s are ideal for long-term retirement planning due to their tax-deferred growth and potential tax deductions. Investors targeting education funding may prefer 529 plans, which provide tax benefits specifically for qualified educational expenses. Understanding the unique tax implications and withdrawal restrictions of each account type is essential to align savings strategies with specific financial objectives.

Long-Term Growth Potential

Taxable accounts offer flexibility but subject investments to annual capital gains taxes, which can reduce long-term growth potential compared to tax-advantaged accounts like IRAs or 401(k)s that allow tax-deferred or tax-free growth. Tax-advantaged accounts enable compound growth without immediate tax liabilities, maximizing asset accumulation over decades. Investors aiming for substantial long-term wealth often prioritize tax-advantaged accounts to enhance growth efficiency and minimize tax drag.

Choosing the Right Account for Your Savings Strategy

Selecting the appropriate account for your savings strategy depends on your financial goals and tax situation. Taxable accounts offer flexibility and no contribution limits, making them ideal for short-term savings or investments that require liquidity. Tax-advantaged accounts such as IRAs and 401(k)s provide tax benefits like deferred growth or tax-free withdrawals, suited for long-term retirement planning and maximizing compound growth.

Important Terms

Capital gains taxation

Capital gains in taxable accounts are subject to annual taxes based on holding periods, whereas tax-advantaged accounts like IRAs and 401(k)s allow gains to grow tax-deferred or tax-free, depending on the account type.

Deferred taxation

Deferred taxation allows investments in tax-advantaged accounts to grow tax-free until withdrawal, unlike taxable accounts where earnings are taxed annually.

Qualified distributions

Qualified distributions from tax-advantaged accounts are tax-free, whereas withdrawals from taxable accounts are subject to capital gains taxes on earnings.

Roth IRA

A Roth IRA offers tax-free growth and withdrawals, making it a tax-advantaged account compared to taxable accounts where investment gains are subject to annual taxes.

Traditional IRA

Traditional IRAs offer tax-deferred growth by allowing contributions to reduce taxable income, unlike taxable accounts that incur annual taxes on dividends and capital gains.

Asset location strategy

An effective asset location strategy maximizes after-tax returns by placing high-growth, tax-inefficient investments like bonds in tax-advantaged accounts and tax-efficient, dividend-paying stocks in taxable accounts to minimize tax liabilities.

Contribution limits

Taxable accounts have no annual contribution limits but incur capital gains taxes, whereas tax-advantaged accounts like IRAs and 401(k)s impose strict annual contribution limits while offering tax deferral or tax-free growth benefits.

Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs) apply exclusively to tax-advantaged accounts such as traditional IRAs and 401(k)s, mandating withdrawals starting at age 73 to avoid penalties. Taxable accounts do not have RMD rules, allowing investors to manage withdrawals flexibly while potentially benefiting from favorable capital gains tax treatment.

Tax-loss harvesting

Tax-loss harvesting maximizes after-tax returns by offsetting capital gains in taxable accounts, whereas tax-advantaged accounts like IRAs and 401(k)s offer deferred or tax-free growth, making harvesting unnecessary.

After-tax contributions

After-tax contributions in a taxable account grow without immediate tax benefits but offer flexibility for withdrawals and are subject to capital gains tax on earnings; tax-advantaged accounts like Roth IRAs or 401(k)s provide tax-free growth and qualified withdrawals, optimizing long-term savings by deferring or eliminating taxes on investment gains. Strategic allocation between these accounts depends on current tax brackets, expected future income, and retirement goals to maximize after-tax wealth accumulation.

Taxable account vs Tax-advantaged account Infographic

moneydif.com

moneydif.com