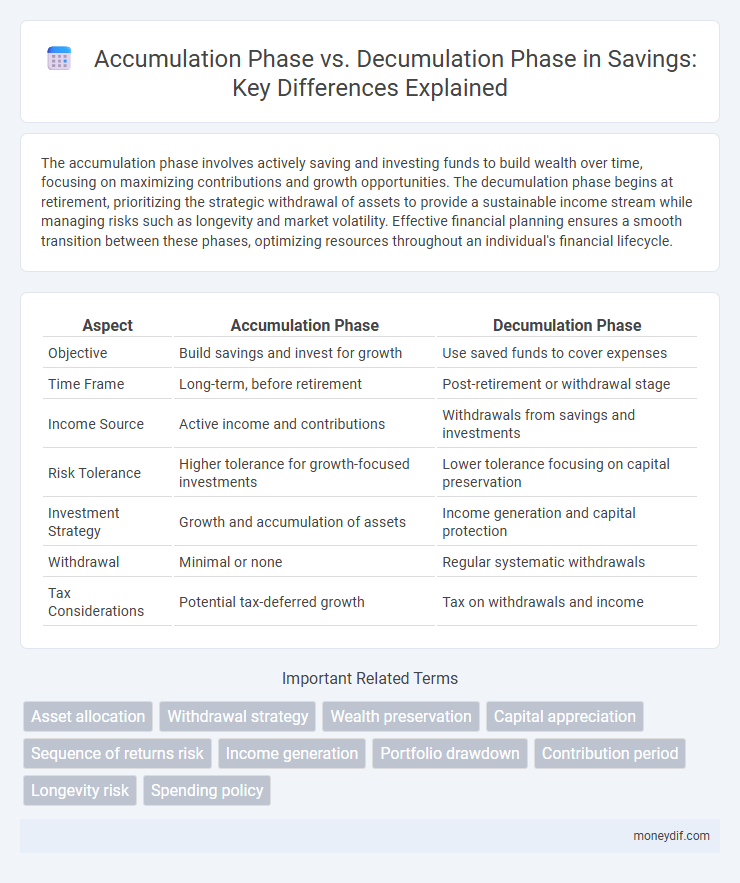

The accumulation phase involves actively saving and investing funds to build wealth over time, focusing on maximizing contributions and growth opportunities. The decumulation phase begins at retirement, prioritizing the strategic withdrawal of assets to provide a sustainable income stream while managing risks such as longevity and market volatility. Effective financial planning ensures a smooth transition between these phases, optimizing resources throughout an individual's financial lifecycle.

Table of Comparison

| Aspect | Accumulation Phase | Decumulation Phase |

|---|---|---|

| Objective | Build savings and invest for growth | Use saved funds to cover expenses |

| Time Frame | Long-term, before retirement | Post-retirement or withdrawal stage |

| Income Source | Active income and contributions | Withdrawals from savings and investments |

| Risk Tolerance | Higher tolerance for growth-focused investments | Lower tolerance focusing on capital preservation |

| Investment Strategy | Growth and accumulation of assets | Income generation and capital protection |

| Withdrawal | Minimal or none | Regular systematic withdrawals |

| Tax Considerations | Potential tax-deferred growth | Tax on withdrawals and income |

Understanding the Savings Lifecycle: Accumulation vs. Decumulation

The savings lifecycle comprises the accumulation phase, where individuals actively contribute and grow their financial assets through investments and regular savings, and the decumulation phase, where these assets are strategically withdrawn to provide income during retirement. Effective management of both phases involves understanding risk tolerance, tax implications, and withdrawal strategies to ensure long-term financial security. Maximizing the accumulation phase with diversified portfolios and optimizing the decumulation phase by balancing income streams reduces the risk of outliving savings.

Key Differences Between Accumulation and Decumulation Phases

The accumulation phase centers on actively saving and investing funds to build wealth over time, typically characterized by contributing to retirement accounts and increasing asset allocation toward growth-oriented investments. In contrast, the decumulation phase involves strategically withdrawing funds to cover living expenses, prioritizing income generation and capital preservation to ensure financial sustainability throughout retirement. Risk tolerance shifts from high during accumulation to conservative during decumulation, with a focus on tax-efficient withdrawal strategies and minimizing sequence-of-returns risk.

Setting Financial Goals for Each Phase

During the accumulation phase, setting financial goals focuses on maximizing income, increasing savings rate, and investing for long-term growth to build a substantial retirement fund. In the decumulation phase, goals shift toward managing withdrawal rates, preserving capital, and ensuring income stability to sustain living expenses throughout retirement. Tailoring financial strategies to the unique objectives of each phase supports effective wealth management and retirement success.

Strategies for Growing Wealth During Accumulation

Maximizing contributions to tax-advantaged retirement accounts and diversifying investments across equities, bonds, and real estate are essential strategies for wealth growth during the accumulation phase. Leveraging compound interest by starting early and maintaining consistent savings accelerates portfolio expansion. Strategic asset allocation that adjusts for risk tolerance and market conditions optimizes returns and mitigates potential losses throughout this growth period.

Transitioning Smoothly from Accumulation to Decumulation

Efficient transitioning from the accumulation phase to the decumulation phase is crucial for maintaining financial stability during retirement. Strategic withdrawal plans and diversification of retirement assets help mitigate risks such as market volatility and inflation, preserving capital longevity. Comprehensive retirement planning that anticipates changing income needs ensures a smooth shift while optimizing tax efficiency and sustainable income streams.

Managing Risks in Both Phases of Saving

Managing risks during the accumulation phase involves diversifying investments to mitigate market volatility and maintaining consistent contributions to build a robust savings base. In the decumulation phase, prioritizing sustainable withdrawal rates and adjusting spending based on market performance helps preserve capital and prevent premature depletion of assets. Employing strategies such as asset allocation shifts and insurance products can optimize financial security throughout both phases of the saving lifecycle.

Income Planning: Decumulation Phase Best Practices

During the decumulation phase, effective income planning prioritizes sustainable withdrawal strategies to ensure funds last throughout retirement. Utilizing a mix of guaranteed income sources, such as annuities and Social Security benefits, helps mitigate longevity risk and market volatility. Strategically sequencing withdrawals from taxable, tax-deferred, and tax-exempt accounts optimizes tax efficiency and maximizes overall retirement income.

Tax Implications in the Accumulation and Decumulation Phases

During the accumulation phase, contributions to retirement accounts often benefit from tax deferral or deductions, allowing investments to grow tax-free until withdrawal. In the decumulation phase, withdrawals are typically subject to ordinary income tax, impacting the net income retirees receive. Strategic planning around timing and source of distributions can optimize tax liabilities in both phases.

Common Mistakes to Avoid in Each Savings Phase

In the accumulation phase, common mistakes include underestimating the impact of inflation and failing to diversify investments, which reduces potential growth and increases risk. During the decumulation phase, errors such as withdrawing funds too quickly or neglecting tax-efficient withdrawal strategies can deplete savings prematurely. Avoiding these pitfalls ensures sustained financial security and maximizes the longevity of retirement funds.

Role of Financial Advisors in Accumulation and Decumulation

Financial advisors play a critical role in the accumulation phase by helping clients establish disciplined savings plans, select diversified investment portfolios, and optimize tax-advantaged accounts like 401(k)s or IRAs. During the decumulation phase, advisors assist in creating sustainable withdrawal strategies, managing distribution timelines to minimize tax impacts, and adjusting asset allocation to preserve capital while generating income. Their expertise ensures smooth transitions between phases, aligning financial goals with market conditions and individual risk tolerance.

Important Terms

Asset allocation

Asset allocation during the accumulation phase focuses on growth-oriented investments like equities and high-yield assets to maximize portfolio value, while in the decumulation phase, the strategy shifts toward capital preservation and income generation through bonds, dividend stocks, and cash equivalents to manage withdrawal risks. Balancing risk tolerance and liquidity needs in each phase is critical for achieving long-term financial security.

Withdrawal strategy

Withdrawal strategy focuses on optimizing cash flow by balancing asset liquidation during the decumulation phase without compromising growth achieved in the accumulation phase. Effective withdrawal plans consider tax implications, sequence of returns risk, and sustainable withdrawal rates to ensure long-term portfolio viability after retirement.

Wealth preservation

Wealth preservation involves strategies tailored to both the accumulation phase--focused on growing assets through investments and savings--and the decumulation phase, which emphasizes protecting those assets while generating sustainable income during retirement. Effective preservation balances risk management and liquidity to maintain financial stability across both phases.

Capital appreciation

Capital appreciation during the accumulation phase focuses on maximizing asset growth through higher-risk investments, while the decumulation phase prioritizes preserving capital and generating steady income to fund retirement needs. Strategic asset allocation shifts from aggressive growth to conservative, income-generating holdings to balance growth with principal protection during decumulation.

Sequence of returns risk

Sequence of returns risk significantly impacts the Decumulation phase, as negative market returns early in retirement can deplete savings quickly, whereas during the Accumulation phase, the effect is mitigated by ongoing contributions and market recovery potential. Managing this risk involves strategies like diversified portfolios and systematic withdrawals to preserve capital and ensure sustainable income during retirement.

Income generation

Income generation during the accumulation phase focuses on increasing capital through investments like stocks, bonds, and retirement accounts to build wealth over time. In the decumulation phase, income generation shifts towards reliable cash flow streams such as pensions, annuities, and systematic withdrawals to support living expenses during retirement.

Portfolio drawdown

Portfolio drawdown measures the decline from a peak in asset value and is typically more critical during the decumulation phase when withdrawals intensify the impact of losses on retirement sustainability. In the accumulation phase, drawdowns may be tolerated as investors have time to recover, but in the decumulation phase, minimizing drawdown is vital to preserve capital and maintain income streams.

Contribution period

The contribution period, or Accumulation phase, involves consistent saving and investing to build a retirement fund, while the Decumulation phase focuses on strategically withdrawing assets to sustain income during retirement. Optimizing the contribution period length and amount directly impacts the total retirement savings and financial security during the decumulation phase.

Longevity risk

Longevity risk primarily affects the decumulation phase, where retirees face the challenge of outliving their retirement savings, unlike the accumulation phase, which focuses on building wealth over time. Effective retirement planning requires strategies that address longevity risk by ensuring sufficient income streams during the decumulation phase, balancing withdrawal rates against life expectancy and market volatility.

Spending policy

Spending policy during the accumulation phase focuses on maximizing savings and investment growth, prioritizing contributions to retirement accounts and minimizing withdrawals to build a substantial nest egg. In contrast, the decumulation phase emphasizes systematic withdrawals aligned with retirees' income needs and longevity risk, balancing sustainable spending with portfolio preservation to ensure financial security throughout retirement.

Accumulation phase vs Decumulation phase Infographic

moneydif.com

moneydif.com