A rainy day fund is designed for smaller, unexpected expenses like car repairs or minor home maintenance, providing quick financial relief without disrupting your budget. An emergency fund, however, covers more significant, unforeseen events such as job loss or major medical bills, offering a critical safety net for long-term financial stability. Prioritizing both funds ensures comprehensive coverage for varying levels of financial emergencies and helps maintain peace of mind.

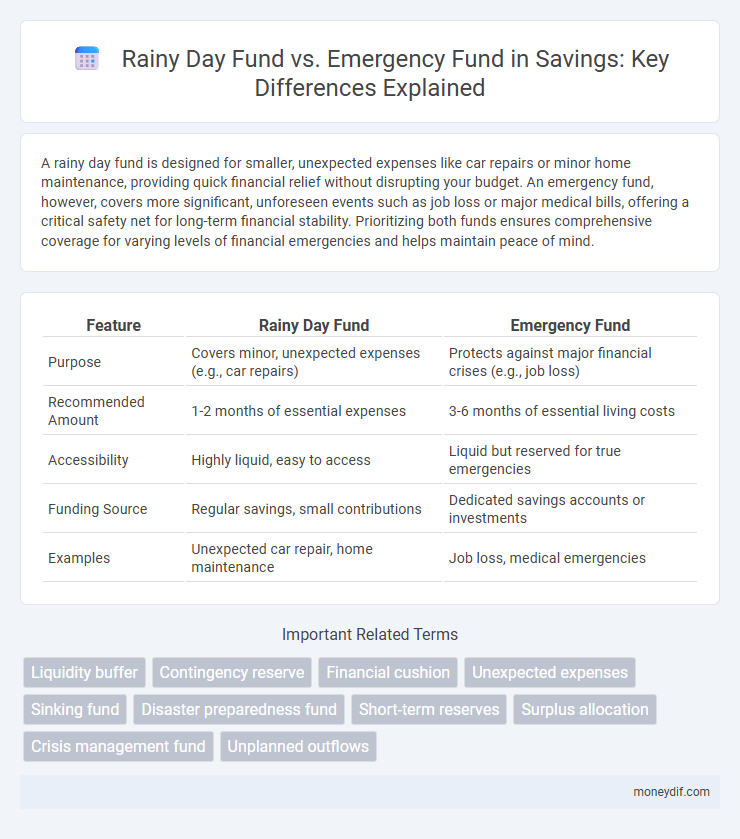

Table of Comparison

| Feature | Rainy Day Fund | Emergency Fund |

|---|---|---|

| Purpose | Covers minor, unexpected expenses (e.g., car repairs) | Protects against major financial crises (e.g., job loss) |

| Recommended Amount | 1-2 months of essential expenses | 3-6 months of essential living costs |

| Accessibility | Highly liquid, easy to access | Liquid but reserved for true emergencies |

| Funding Source | Regular savings, small contributions | Dedicated savings accounts or investments |

| Examples | Unexpected car repair, home maintenance | Job loss, medical emergencies |

Understanding Rainy Day Funds and Emergency Funds

Rainy day funds are smaller savings reserved for minor, unexpected expenses such as car repairs or short-term utility bills, typically covering a few hundred dollars. Emergency funds are larger reserves designed to handle significant financial crises like job loss or major medical emergencies, often covering three to six months of living expenses. Understanding the distinct purposes of these funds ensures better financial preparedness and stability during unforeseen events.

Key Differences Between Rainy Day and Emergency Funds

Rainy day funds typically cover small, unexpected expenses such as car repairs or minor home maintenance, while emergency funds are designed to handle major financial crises like job loss or medical emergencies. The ideal rainy day fund holds three months' worth of essential expenses, whereas an emergency fund usually contains six to twelve months of living costs. Maintaining separate accounts for these funds helps ensure liquidity for routine financial hiccups without depleting the safety net reserved for catastrophic events.

Purpose and Importance of Rainy Day Funds

Rainy day funds are small savings set aside for minor, unexpected expenses like car repairs or medical co-pays, ensuring daily financial stability without resorting to credit. Unlike emergency funds, which cover major crises such as job loss or significant health issues, rainy day funds help maintain regular budget flow and prevent small disruptions from escalating. Establishing a rainy day fund enhances financial resilience by addressing routine, unpredictable costs promptly and preserving larger savings for critical emergencies.

When to Use an Emergency Fund

An emergency fund is essential for unexpected, urgent expenses such as medical emergencies, car repairs, or sudden job loss, providing financial stability when immediate access to cash is necessary. Unlike a rainy day fund, which covers smaller or less urgent expenditures like home maintenance or minor repairs, an emergency fund typically contains three to six months' worth of living expenses tailored for crises. Accessing this fund should be reserved strictly for genuine emergencies to avoid financial strain and maintain a safety net for future unforeseen events.

Ideal Amounts to Save in Each Fund

An ideal rainy day fund typically covers three months of essential living expenses, providing a financial buffer for minor unexpected costs like car repairs or home maintenance. In contrast, an emergency fund should hold six to nine months' worth of living expenses to protect against significant income loss due to job loss, medical emergencies, or major life disruptions. Maintaining these distinct savings ensures both short-term flexibility and long-term financial security.

How to Build a Rainy Day Fund

Building a rainy day fund starts with setting aside small, regular amounts of money from each paycheck to cover minor unexpected expenses, such as car repairs or medical bills. Aim to accumulate at least $500 to $1,000 in a separate, easily accessible savings account to avoid dipping into your main emergency fund. Automating transfers and tracking your spending habits can accelerate growth and maintain consistency in your rainy day fund.

Steps to Establish an Emergency Fund

Establishing an emergency fund begins with calculating monthly essential expenses to determine the ideal savings target, typically three to six months of living costs. Open a separate, easily accessible savings account exclusively for this purpose to avoid accidental spending and earn interest. Consistently automate monthly contributions and periodically review the fund to adjust for changes in expenses or financial goals.

Where to Keep Your Savings: Best Account Options

A rainy day fund is best kept in a high-yield savings account or a money market account to ensure easy access and moderate interest, while an emergency fund should be stored in a liquid, no-penalty account such as a traditional savings account or a cash management account for immediate availability. Both funds benefit from FDIC-insured accounts to protect your savings up to $250,000 per depositor, providing security against bank failures. Avoid keeping emergency funds in investments with market volatility to ensure the funds are readily accessible during financial crises.

Common Mistakes in Managing Savings Funds

Confusing a rainy day fund with an emergency fund often leads to misallocated savings, as rainy day funds typically cover predictable minor expenses while emergency funds are designated for unexpected, significant financial crises. Failing to maintain distinct accounts for each fund risks depleting resources needed for genuine emergencies, undermining financial security. Regularly neglecting to adjust fund sizes based on changing expenses or income can result in insufficient coverage when urgent situations arise.

Tips for Prioritizing Savings Goals

Prioritize building an emergency fund with three to six months' worth of essential expenses, ensuring financial security during unexpected events like job loss or medical emergencies. Establish a rainy day fund as a secondary savings goal, targeting smaller, predictable expenses such as minor car repairs or home maintenance. Allocate monthly savings proportionally, focusing first on the emergency fund while gradually contributing to the rainy day fund to maintain balanced financial preparedness.

Important Terms

Liquidity buffer

A liquidity buffer is a critical financial reserve designed to cover unexpected expenses or income disruptions, often distinguished between rainy day funds, which address minor cash flow gaps, and emergency funds, intended for major financial crises like job loss or medical emergencies. Maintaining an adequately sized liquidity buffer ensures financial stability by enabling quick access to cash without liquidating investments at a loss.

Contingency reserve

A contingency reserve is a budgeted financial buffer separate from a rainy day fund, which covers minor unexpected expenses, and an emergency fund, which provides substantial support during major financial crises.

Financial cushion

A financial cushion is a strategic reserve combining a rainy day fund for short-term expenses and an emergency fund for unforeseen major financial crises.

Unexpected expenses

Emergency funds cover urgent, unforeseen expenses like medical emergencies, while rainy day funds handle smaller, predictable costs such as car repairs or home maintenance.

Sinking fund

A sinking fund is a targeted savings strategy for planned future expenses, differing from rainy day funds and emergency funds which are reserved for unexpected minor repairs and urgent crises respectively.

Disaster preparedness fund

Disaster preparedness funds prioritize immediate response and recovery needs during emergencies, whereas rainy day funds cover short-term financial gaps and emergency funds handle unforeseen urgent expenses.

Short-term reserves

Short-term reserves serve as immediate financial buffers, with rainy day funds typically covering minor unexpected expenses like car repairs or medical bills, while emergency funds are larger pools designed to sustain essential living costs during significant emergencies such as job loss or major disasters. Maintaining a rainy day fund usually involves saving three months' worth of expenses, whereas an emergency fund aims for six to twelve months of living expenses to provide greater financial security.

Surplus allocation

Surplus allocation prioritizes replenishing the Rainy Day Fund for planned fiscal stability before funding the Emergency Fund, which addresses unexpected, urgent financial crises.

Crisis management fund

A crisis management fund is a specialized reserve distinct from a rainy day fund, which covers minor unexpected expenses, and an emergency fund, which addresses major financial setbacks or disasters.

Unplanned outflows

Unplanned outflows are best managed by maintaining both a rainy day fund for minor unexpected expenses and an emergency fund covering three to six months of essential living costs.

Rainy day fund vs Emergency fund Infographic

moneydif.com

moneydif.com