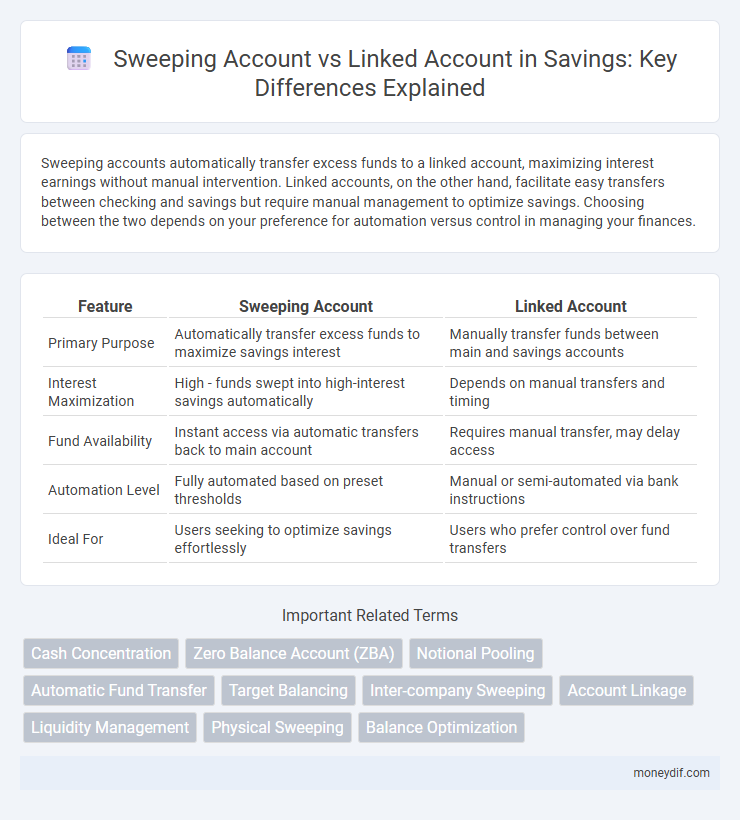

Sweeping accounts automatically transfer excess funds to a linked account, maximizing interest earnings without manual intervention. Linked accounts, on the other hand, facilitate easy transfers between checking and savings but require manual management to optimize savings. Choosing between the two depends on your preference for automation versus control in managing your finances.

Table of Comparison

| Feature | Sweeping Account | Linked Account |

|---|---|---|

| Primary Purpose | Automatically transfer excess funds to maximize savings interest | Manually transfer funds between main and savings accounts |

| Interest Maximization | High - funds swept into high-interest savings automatically | Depends on manual transfers and timing |

| Fund Availability | Instant access via automatic transfers back to main account | Requires manual transfer, may delay access |

| Automation Level | Fully automated based on preset thresholds | Manual or semi-automated via bank instructions |

| Ideal For | Users seeking to optimize savings effortlessly | Users who prefer control over fund transfers |

Introduction to Sweeping and Linked Accounts

Sweeping accounts automatically transfer surplus funds from a primary account to a linked savings or investment account, optimizing liquidity and maximizing interest earnings. Linked accounts connect a checking account to a savings or investment account, enabling manual or automatic transfers between accounts to manage cash flow effectively. Understanding the differences helps in choosing the right strategy for efficient money management and enhanced savings growth.

How Sweeping Accounts Work

Sweeping accounts automatically transfer excess funds from a primary checking or linked account into a higher-interest savings or investment account at the end of each business day, optimizing liquidity and maximizing interest earnings. This automatic transfer helps maintain a minimum balance in the checking account to avoid overdraft fees while ensuring idle cash generates returns. Financial institutions use algorithms to analyze daily balances and execute these transfers seamlessly, enhancing efficient cash management for individuals and businesses.

How Linked Accounts Function

Linked accounts function by connecting multiple bank accounts to allow seamless transfers and consolidated management of funds, enhancing liquidity and convenience. They enable automatic fund transfers between savings and checking accounts to cover overdrafts or optimize interest earnings. This integration supports efficient cash flow management and helps maintain minimum balance requirements across accounts.

Key Differences Between Sweeping and Linked Accounts

Sweeping accounts automatically transfer excess funds from a primary account to a high-interest savings or investment account, optimizing liquidity and returns, while linked accounts are manually connected accounts allowing transfers without automation. Sweeping accounts enhance cash flow management by maintaining minimum balances and maximizing interest earned, whereas linked accounts primarily facilitate seamless transactions and overdraft protection between checking and savings. The automation in sweeping accounts eliminates the need for manual transfers, offering superior efficiency compared to the passive linkage of linked accounts.

Pros and Cons of Sweeping Accounts

Sweeping accounts automatically transfer excess funds from a primary account to a higher-interest savings account, maximizing interest earnings while maintaining liquidity for daily transactions. This system reduces idle cash, improving overall financial efficiency but may incur fees or require minimum balance thresholds, impacting cost-effectiveness for some users. The automated nature enhances cash flow management but limits immediate access to funds compared to linked accounts where transfers must be initiated manually.

Pros and Cons of Linked Accounts

Linked accounts offer seamless fund transfers between checking and savings, enhancing liquidity and simplifying financial management. They provide quick access to overdraft protection but may carry fees or limitations on withdrawal frequency as regulated by federal rules. While linked accounts improve convenience and cash flow control, they might reduce interest-earning potential compared to dedicated savings accounts with higher rates.

Suitability: Who Should Use Sweeping or Linked Accounts?

Sweeping accounts suit individuals or businesses seeking automated fund transfers to optimize interest earnings by moving excess balances into higher-yield savings. Linked accounts are ideal for those wanting seamless access between checking and savings for overdraft protection or quick transfers without automated sweeps. Choosing between these depends on the preference for automation and maximizing interest versus manual control and flexibility in fund management.

Impact on Savings Growth and Management

A sweeping account automatically transfers excess funds from a linked account into a high-interest savings account, maximizing interest earnings and accelerating savings growth. Linked accounts, while providing easy fund access, may not optimize interest accumulation since funds remain in lower-yield accounts. Utilizing sweeping accounts enhances cash management by ensuring surplus balances consistently earn higher returns without manual intervention.

Security and Accessibility Considerations

Sweeping accounts enhance security by automatically transferring excess funds into higher-interest savings, reducing exposure to fraud in transactional accounts. Linked accounts offer seamless accessibility, allowing instant transfers between checking and savings but may expose both accounts to risk if one is compromised. Evaluating the trade-off between automated fund protection in sweeping accounts and the convenience of linked accounts is crucial for optimizing savings security and liquidity.

Choosing the Right Account Type for Your Financial Goals

Choosing the right account type depends on your financial goals and cash flow needs; swept accounts automatically transfer excess funds into higher-interest savings, maximizing returns without manual intervention. Linked accounts provide easy access between checking and savings, ideal for managing liquidity and avoiding overdraft fees. Understanding the differences helps optimize savings growth while maintaining flexibility for daily transactions.

Important Terms

Cash Concentration

Cash concentration optimizes liquidity management by consolidating funds from multiple accounts into a single master account, using sweeping accounts to automate transfers based on predefined thresholds, enhancing cash availability and reducing idle balances. Linked accounts connect multiple bank accounts for simplified access and transfers but lack the automated, rules-based aggregation features that sweeping accounts provide for optimized cash flow control.

Zero Balance Account (ZBA)

Zero Balance Accounts (ZBA) automatically transfer surplus funds to a master sweeping account, maintaining a zero balance for efficient cash flow management, whereas linked accounts are connected for transactional convenience but don't necessarily maintain zero balances. ZBA optimizes liquidity by consolidating funds daily, while linked accounts provide flexibility without automatic fund pooling.

Notional Pooling

Notional pooling optimizes liquidity by offsetting credit and debit balances across multiple accounts without physically transferring funds, contrasting with sweeping accounts that aggregate balances by moving money into a central account. Linked accounts typically share transactional capabilities but do not offer the same interest netting benefits inherent in notional pooling structures.

Automatic Fund Transfer

Automatic Fund Transfer enables seamless movement of funds between accounts, with Sweeping Accounts maximizing liquidity by transferring surplus balances automatically at predefined intervals, whereas Linked Accounts facilitate transfers on demand by connecting multiple accounts under one relationship for immediate fund availability. Businesses and individuals leverage Sweeping Accounts to optimize cash management and Linked Accounts for flexible access and consolidated banking services.

Target Balancing

Target balancing allocates funds between accounts to maintain a predetermined minimum balance, often moving excess cash from a Sweeping Account to a Linked Account to optimize liquidity. This method ensures efficient cash management, reduces overdraft risks, and maximizes interest earnings by automatically transferring funds based on target thresholds.

Inter-company Sweeping

Inter-company sweeping automates fund transfers between related entities to optimize cash management, where a Sweeping Account consolidates surplus funds for centralized control, while a Linked Account facilitates real-time balance adjustments without physical movement of funds. This distinction enhances liquidity management and reduces intercompany financing costs by leveraging automated sweeps and intra-group account linkages.

Account Linkage

Account linkage involves connecting a linked account to a sweeping account to enable automatic fund transfers, optimizing cash flow management and liquidity. A sweeping account consolidates balances from multiple linked accounts, allowing efficient cash concentration and reducing idle funds.

Liquidity Management

Liquidity management involves optimizing cash flow by using sweeping accounts to automatically transfer excess funds between sub-accounts, enhancing efficient cash utilization and minimizing idle balances. Linked accounts facilitate manual or scheduled transfers between main and subsidiary accounts, offering flexibility but requiring closer oversight to maintain optimal liquidity levels.

Physical Sweeping

Physical sweeping involves the automatic transfer of funds between a primary bank account and linked accounts to optimize cash management. This process minimizes idle balances in the sweeping account by consolidating funds into a linked account based on predefined threshold limits and schedules.

Balance Optimization

Balance optimization between sweeping accounts and linked accounts maximizes liquidity management by automatically transferring excess funds from linked accounts to the sweeping account, ensuring optimal cash utilization and minimizing idle balances. This process enhances cash flow efficiency and reduces overdraft risks by maintaining target balance thresholds across multiple accounts.

Sweeping Account vs Linked Account Infographic

moneydif.com

moneydif.com