Dividend reinvestment allows investors to grow their savings exponentially by purchasing additional shares with earned dividends, effectively compounding returns over time. Simple interest, on the other hand, calculates returns solely on the initial principal, resulting in linear growth without the benefit of compounding. Choosing dividend reinvestment can significantly enhance long-term wealth accumulation compared to relying on simple interest alone.

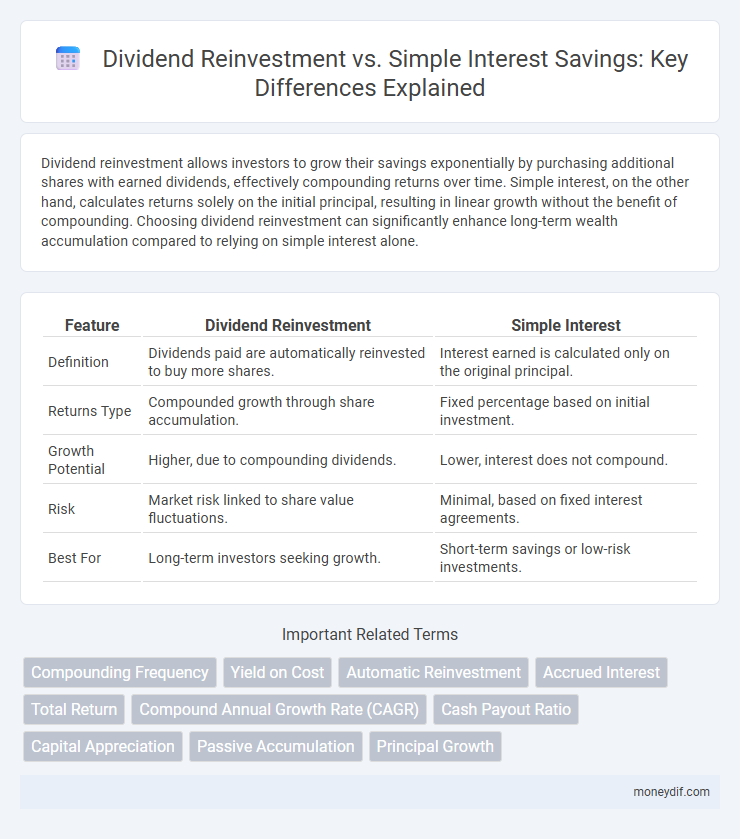

Table of Comparison

| Feature | Dividend Reinvestment | Simple Interest |

|---|---|---|

| Definition | Dividends paid are automatically reinvested to buy more shares. | Interest earned is calculated only on the original principal. |

| Returns Type | Compounded growth through share accumulation. | Fixed percentage based on initial investment. |

| Growth Potential | Higher, due to compounding dividends. | Lower, interest does not compound. |

| Risk | Market risk linked to share value fluctuations. | Minimal, based on fixed interest agreements. |

| Best For | Long-term investors seeking growth. | Short-term savings or low-risk investments. |

Understanding Dividend Reinvestment Strategies

Dividend reinvestment strategies involve using dividends earned from stocks or mutual funds to purchase additional shares, compounding investment growth over time. This approach contrasts with simple interest savings, which generates fixed returns without reinvesting earnings, resulting in slower portfolio growth. Investors seeking to maximize long-term wealth often prefer dividend reinvestment plans (DRIPs) because they leverage compound interest and market appreciation simultaneously.

What Is Simple Interest in Savings?

Simple interest in savings is a straightforward method where the interest is calculated only on the initial principal amount throughout the investment period. This means the interest does not compound, leading to a linear growth of savings over time. Simple interest is commonly used in short-term savings accounts and fixed deposits where the focus is on predictable, easy-to-calculate returns.

Key Differences Between Dividend Reinvestment and Simple Interest

Dividend reinvestment involves using earned dividends to purchase additional shares, compounding returns through stock accumulation, while simple interest calculates earnings solely on the original principal without compounding. Dividend reinvestment can lead to exponential growth over time due to compounding effects, whereas simple interest grows linearly, making it less effective for long-term wealth building. The choice between these methods depends on investment goals, with dividend reinvestment suited for growth-focused investors and simple interest for predictable, fixed returns.

How Dividend Reinvestment Boosts Your Savings Growth

Dividend reinvestment amplifies your savings growth by compounding returns through purchasing additional shares automatically, leveraging market gains over time. This strategy enhances capital accumulation beyond simple interest, which only earns on the principal amount. By continuously reinvesting dividends, investors capitalize on exponential growth, optimizing long-term wealth accumulation.

The Pros and Cons of Simple Interest Accounts

Simple interest accounts offer straightforward growth by calculating interest solely on the principal, making them easy to understand and predict. They lack the compounding benefit found in dividend reinvestment, which can limit overall returns over time. These accounts provide stability and lower risk, but may underperform compared to investments that capitalize on compound interest or dividends.

Compound Growth: The Power of Reinvesting Dividends

Reinvesting dividends harnesses compound growth by using dividend payouts to purchase additional shares, increasing the total investment and potential future earnings exponentially. Unlike simple interest, where returns are calculated solely on the initial principal, dividend reinvestment leverages the power of compounding by generating returns on both the original investment and accumulated dividends. This strategy significantly accelerates wealth accumulation over time, outperforming traditional interest-bearing savings accounts.

Risk Factors: Dividend Reinvestment vs Simple Interest

Dividend reinvestment involves market risk as dividends are used to purchase additional shares, potentially exposing investors to stock price volatility. Simple interest offers lower risk with fixed returns, ensuring principal preservation without the fluctuations seen in equity markets. Evaluating personal risk tolerance is crucial when choosing between dividend reinvestment and simple interest savings strategies.

Which Savings Method Suits Your Financial Goals?

Dividend reinvestment compounds your savings by automatically purchasing additional shares, maximizing long-term growth potential through market appreciation and dividend accumulation. Simple interest provides predictable earnings based on the principal amount, suitable for short-term goals or low-risk preferences. Choose dividend reinvestment for aggressive wealth building and simple interest for stability and easy access to funds.

Calculating Returns: Dividend Reinvestment vs Simple Interest

Calculating returns with dividend reinvestment involves compounding, where dividends are used to purchase more shares, leading to exponential growth over time. Simple interest, on the other hand, calculates returns solely on the principal amount without reinvesting earnings, resulting in linear growth. Over long periods, dividend reinvestment typically yields significantly higher returns compared to simple interest due to the power of compounding.

Making the Right Choice for Long-Term Savings

Dividend reinvestment accelerates the growth of long-term savings by compounding returns through the automatic purchase of additional shares, resulting in higher potential capital appreciation. Simple interest offers predictable, fixed earnings on the principal amount without compounding, which may limit growth over extended periods. Choosing dividend reinvestment over simple interest typically leads to greater wealth accumulation due to exponential growth driven by reinvested dividends.

Important Terms

Compounding Frequency

Compounding frequency significantly impacts investment growth, with dividend reinvestment benefiting from more frequent compounding periods compared to simple interest, which only applies interest to the principal amount without accumulating earnings. Higher compounding frequencies in dividend reinvestment lead to exponential growth by continuously adding dividends to the principal, whereas simple interest yields linear growth since interest is calculated solely on the original investment.

Yield on Cost

Yield on Cost (YOC) measures the return on an initial investment based on the dividend income relative to the original purchase price, significantly enhanced by dividend reinvestment which compounds returns over time. Unlike simple interest, which calculates returns solely on the principal, reinvesting dividends increases the number of shares owned, driving exponential growth in income and portfolio value.

Automatic Reinvestment

Automatic reinvestment of dividends enhances compound growth by purchasing additional shares, leveraging dividend reinvestment to maximize shareholder value compared to simple interest, which accumulates only on the principal without compounding. This strategy increases total returns by continuously expanding the investment base, whereas simple interest yields linear growth limited to the initial capital.

Accrued Interest

Accrued interest in dividend reinvestment plans (DRIPs) reflects the accumulated earnings on dividends reinvested to purchase additional shares, compounding over time and enhancing total returns. In contrast, simple interest on dividends involves calculating returns solely on the initial principal, without compounding, resulting in lower growth compared to DRIPs.

Total Return

Total return measures investment performance by combining capital gains and dividends, reflecting the full growth of an asset. Dividend reinvestment enhances total return through compound interest, whereas simple interest calculates gains solely on the principal, resulting in comparatively lower long-term growth.

Compound Annual Growth Rate (CAGR)

The Compound Annual Growth Rate (CAGR) measures investment growth by factoring in reinvested dividends, resulting in higher overall returns compared to simple interest, which calculates gains solely on the initial principal without compounding. Dividend reinvestment leverages the power of compounding by using earned dividends to purchase more shares, accelerating portfolio growth and outperforming simple interest strategies.

Cash Payout Ratio

The cash payout ratio measures the percentage of earnings a company distributes as dividends, which directly impacts the effectiveness of dividend reinvestment plans (DRIPs) by providing more funds for compounding compared to simple interest. Higher cash payout ratios enhance dividend reinvestment benefits by converting dividends into additional shares, whereas simple interest generates fixed returns without leveraging dividend growth potential.

Capital Appreciation

Capital appreciation refers to the increase in the value of an asset over time, which can be significantly enhanced through dividend reinvestment, as dividends purchased buy more shares that compound growth. In contrast, simple interest calculates returns solely on the principal amount, failing to capture the exponential growth potential driven by reinvesting dividends for capital appreciation.

Passive Accumulation

Passive accumulation through dividend reinvestment leverages the power of compounding returns by automatically purchasing additional shares with dividends received, effectively increasing the investment base over time. In contrast, simple interest generates earnings solely on the initial principal, resulting in linear growth without the exponential benefits of reinvested dividends in a dividend reinvestment strategy.

Principal Growth

Principal Growth through Dividend Reinvestment significantly outperforms Simple Interest by compounding returns as dividends are used to purchase additional shares, increasing the investment base over time. This exponential growth effect contrasts with Simple Interest, which generates returns only on the initial principal, resulting in linear, slower accumulation of wealth.

Dividend Reinvestment vs Simple Interest Infographic

moneydif.com

moneydif.com