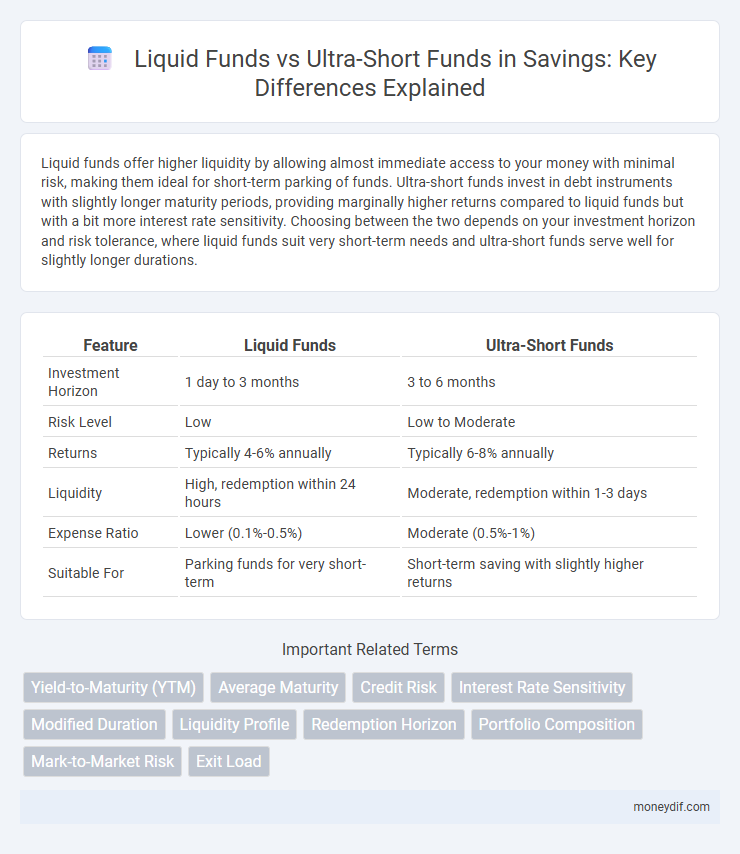

Liquid funds offer higher liquidity by allowing almost immediate access to your money with minimal risk, making them ideal for short-term parking of funds. Ultra-short funds invest in debt instruments with slightly longer maturity periods, providing marginally higher returns compared to liquid funds but with a bit more interest rate sensitivity. Choosing between the two depends on your investment horizon and risk tolerance, where liquid funds suit very short-term needs and ultra-short funds serve well for slightly longer durations.

Table of Comparison

| Feature | Liquid Funds | Ultra-Short Funds |

|---|---|---|

| Investment Horizon | 1 day to 3 months | 3 to 6 months |

| Risk Level | Low | Low to Moderate |

| Returns | Typically 4-6% annually | Typically 6-8% annually |

| Liquidity | High, redemption within 24 hours | Moderate, redemption within 1-3 days |

| Expense Ratio | Lower (0.1%-0.5%) | Moderate (0.5%-1%) |

| Suitable For | Parking funds for very short-term | Short-term saving with slightly higher returns |

Understanding Liquid Funds and Ultra-short Funds

Liquid funds invest in highly liquid money market instruments with maturities up to 91 days, offering low risk and easy access to cash, ideal for parking surplus funds short-term. Ultra-short funds hold debt and money market securities with slightly longer maturities, typically between 3 to 6 months, providing moderately higher returns with marginally increased risk compared to liquid funds. Both fund types aim for capital preservation and liquidity but differ in duration exposure and yield potential.

Key Features of Liquid Funds

Liquid funds provide high liquidity and low risk by investing primarily in money market instruments such as treasury bills, commercial paper, and certificates of deposit with maturities up to 91 days. These funds offer stable returns and are ideal for parking short-term surplus cash, allowing easy access to funds with minimal interest rate sensitivity. Unlike ultra-short funds, liquid funds typically have shorter maturity profiles, resulting in lower volatility and quicker redemption turnaround times.

Key Features of Ultra-short Funds

Ultra-short funds invest in debt and money market instruments with a maturity of 3 to 6 months, offering higher liquidity and lower interest rate risk compared to liquid funds. These funds aim to provide slightly better returns than liquid funds by taking marginally higher credit and duration risk. Key features include short duration, moderate credit risk, and suitability for investors seeking marginally higher yields with quick access to their money.

Investment Horizon: Liquid vs Ultra-short Funds

Liquid funds are ideal for very short investment horizons, typically ranging from a few hours to 3 months, offering high liquidity with minimal risk. Ultra-short funds suit investors with a slightly longer horizon of 3 to 6 months, balancing moderate returns and low interest rate sensitivity. Choosing between liquid and ultra-short funds depends on the investor's need for quick access to cash versus the desire for marginally higher returns over a brief period.

Risk Factors: Comparing Liquid and Ultra-short Funds

Liquid funds primarily invest in highly liquid money market instruments with maturity up to 91 days, offering lower credit risk and interest rate risk compared to ultra-short funds, which invest in debt and money market instruments with a slightly longer maturity profile of up to 3 months. Ultra-short funds carry moderate interest rate risk due to longer duration but often provide higher returns than liquid funds, making them suitable for investors willing to accept marginally increased risk. Credit risk in ultra-short funds can be higher if they invest in lower-rated papers, while liquid funds generally maintain high credit quality to minimize default risk.

Returns Potential: Which Fund Performs Better?

Liquid funds typically offer lower returns compared to ultra-short duration funds due to their investment in highly liquid money market instruments with minimal credit risk. Ultra-short funds invest in debt securities with slightly longer maturities and marginally higher risk, resulting in better returns potential, especially in rising interest rate environments. Historical data from Morningstar indicates ultra-short funds have outperformed liquid funds by an average of 0.5% to 1% annually over the past five years.

Liquidity and Redemption Differences

Liquid funds offer high liquidity with same-day or T+1 redemption, making them ideal for immediate access to cash, while Ultra-short funds typically have a slightly longer redemption cycle of 1-3 days. Liquid funds primarily invest in instruments with maturities up to 91 days, ensuring quick fund availability, whereas Ultra-short funds invest in debt securities with maturities ranging from 3 to 6 months, leading to marginally lower liquidity. This difference in redemption timelines affects their suitability for short-term parking of surplus cash and emergency fund needs.

Tax Implications for Investors

Liquid funds typically offer lower interest rates but enjoy more favorable tax treatment under short-term capital gains, taxed at the investor's income slab if held for less than three years. Ultra-short funds, with slightly higher returns due to longer maturity, qualify for long-term capital gains tax at 20% with indexation benefits if held over three years, resulting in better tax efficiency for long-term investors. Choosing between these depends on the investment horizon and the investor's tax bracket, influencing after-tax returns significantly.

Suitable Investor Profiles for Each Fund

Liquid funds suit conservative investors seeking low risk and high liquidity with short-term investment horizons, typically less than 90 days. Ultra-short funds attract moderately risk-tolerant investors aiming for slightly higher returns over a 3 to 6-month period with low interest rate sensitivity. Both offer capital preservation but differ in duration flexibility and expected yield, aligning with distinct investor profiles.

How to Choose: Liquid Funds or Ultra-short Funds?

Choosing between liquid funds and ultra-short funds depends on your investment horizon and risk tolerance. Liquid funds offer high liquidity with low risk, ideal for parking cash for a few days to a month, while ultra-short funds carry slightly higher risk and yield, suitable for investment periods ranging from one to three months. Assess your need for quick access to funds against your return expectations to determine the best option for your savings strategy.

Important Terms

Yield-to-Maturity (YTM)

Yield-to-Maturity (YTM) in Liquid funds typically reflects lower risk and higher liquidity, resulting in slightly lower returns compared to Ultra-short funds, which have marginally higher YTM due to their longer maturity profiles and moderate interest rate sensitivity. Investors seeking better yield with controlled risk often prefer Ultra-short funds over Liquid funds, as Ultra-short funds balance liquid asset management with enhanced income potential through longer duration securities.

Average Maturity

Average maturity for liquid funds typically ranges from 1 to 91 days, offering high liquidity with minimal interest rate risk, while ultra-short duration funds have a slightly longer average maturity, generally between 3 to 6 months, providing marginally higher returns by assuming moderate interest rate risk. Investors seeking quick access to funds with low volatility prefer liquid funds, whereas those willing to accept slight risk for better yields often choose ultra-short duration funds.

Credit Risk

Credit risk in liquid funds tends to be higher than in ultra-short funds due to the varying credit quality of underlying securities, with liquid funds often investing in lower-rated instruments. Ultra-short funds generally focus on higher credit quality and shorter duration securities, which helps minimize default risk and preserve capital stability.

Interest Rate Sensitivity

Interest rate sensitivity in liquid funds is typically lower than in ultra-short funds due to their shorter average maturity and duration, which minimizes price volatility when interest rates fluctuate. Ultra-short funds, with slightly longer durations, exhibit higher sensitivity to rate changes, offering potentially better yields at the cost of increased interest rate risk.

Modified Duration

Modified Duration measures a bond fund's sensitivity to interest rate changes, with liquid funds typically exhibiting lower modified duration (around 0.1-0.5 years) due to ultra-short maturity instruments, whereas ultra-short funds have slightly higher modified duration (0.5-1.5 years) reflecting longer average maturities. This difference impacts interest rate risk and return volatility, making liquid funds more suitable for ultra-low risk profiles and ultra-short funds better for moderate returns with manageable risk.

Liquidity Profile

Liquidity profiles of liquid funds and ultra-short funds differ primarily in maturity and risk, with liquid funds investing in debt securities with maturities up to 91 days ensuring high liquidity and minimal interest rate risk, while ultra-short funds hold debt instruments with maturities ranging from 3 to 6 months offering slightly higher returns but marginally lower liquidity. Investors seeking immediate cash access prefer liquid funds, whereas those willing to accept moderate liquidity risk for better yields opt for ultra-short funds.

Redemption Horizon

Redemption Horizon for Liquid funds typically ranges from immediate to T+1 day, offering high liquidity with minimal risk, while Ultra-short funds generally have a Redemption Horizon of T+1 to T+3 days, balancing slightly higher returns with moderate liquidity constraints due to investments in securities with maturities up to three months. Choosing between Liquid funds and Ultra-short funds depends on an investor's need for quick access to capital versus seeking marginally better yields with a commitment of a few additional days for redemption processing.

Portfolio Composition

Portfolio composition involving liquid funds and ultra-short funds balances liquidity and yield, with liquid funds offering higher daily liquidity but generally lower returns, while ultra-short funds provide marginally higher yields by investing in slightly longer maturities without significantly compromising safety. Allocating assets between these fund types enhances short-term cash management efficiency, optimizing returns versus risk based on the investor's liquidity needs and market interest rate trends.

Mark-to-Market Risk

Mark-to-Market Risk in liquid funds is generally lower compared to ultra-short funds due to their higher portfolio liquidity and shorter maturities, which reduce sensitivity to interest rate fluctuations. Ultra-short funds, with marginally longer durations and slightly lower liquidity, face increased volatility in NAV from market price changes under varying interest rate scenarios.

Exit Load

Exit load on liquid funds is generally lower or negligible compared to ultra-short funds due to the former's higher liquidity and shorter maturity profile. Ultra-short funds may impose exit loads to discourage frequent withdrawals and manage portfolio stability in response to slightly longer average maturities.

Liquid funds vs Ultra-short funds Infographic

moneydif.com

moneydif.com