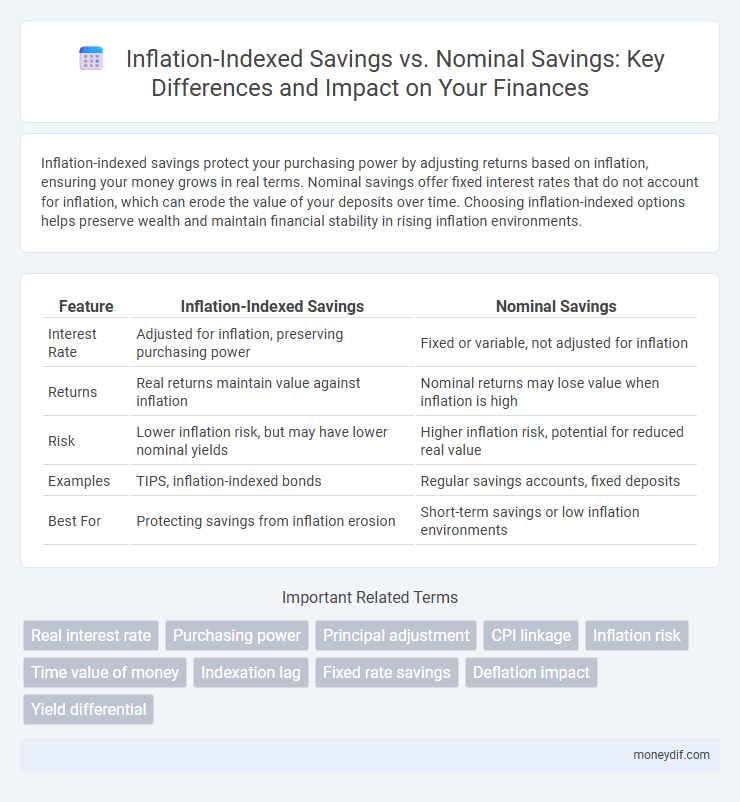

Inflation-indexed savings protect your purchasing power by adjusting returns based on inflation, ensuring your money grows in real terms. Nominal savings offer fixed interest rates that do not account for inflation, which can erode the value of your deposits over time. Choosing inflation-indexed options helps preserve wealth and maintain financial stability in rising inflation environments.

Table of Comparison

| Feature | Inflation-Indexed Savings | Nominal Savings |

|---|---|---|

| Interest Rate | Adjusted for inflation, preserving purchasing power | Fixed or variable, not adjusted for inflation |

| Returns | Real returns maintain value against inflation | Nominal returns may lose value when inflation is high |

| Risk | Lower inflation risk, but may have lower nominal yields | Higher inflation risk, potential for reduced real value |

| Examples | TIPS, inflation-indexed bonds | Regular savings accounts, fixed deposits |

| Best For | Protecting savings from inflation erosion | Short-term savings or low inflation environments |

Understanding Inflation-Indexed Savings

Inflation-indexed savings accounts adjust the principal and interest payments based on the inflation rate, preserving the real purchasing power of the invested funds. Unlike nominal savings, which offer fixed returns that may be eroded by rising inflation, inflation-indexed savings ensure that the returns grow in line with consumer price index (CPI) changes. This mechanism protects savers from the diminishing value of money over time and safeguards their capital against inflationary pressures.

What Are Nominal Savings Accounts?

Nominal savings accounts are traditional savings accounts where the deposited amount earns interest at a fixed nominal rate without adjustment for inflation. The principal and interest are recorded at face value, making these accounts susceptible to loss of purchasing power during periods of high inflation. Unlike inflation-indexed savings, nominal savings do not protect the real value of money, potentially eroding returns over time.

Inflation's Impact on Your Savings

Inflation-indexed savings protect purchasing power by adjusting returns according to inflation rates, unlike nominal savings, which offer fixed interest and risk loss of value during high inflation periods. For example, Treasury Inflation-Protected Securities (TIPS) increase in principal with rising Consumer Price Index (CPI), preserving real value. In contrast, nominal savings accounts may show positive interest but often yield negative real returns when inflation surpasses nominal rates.

Key Differences: Inflation-Indexed vs Nominal Savings

Inflation-indexed savings accounts adjust the principal and interest based on the consumer price index, preserving the purchasing power of the invested funds against rising inflation. Nominal savings accounts offer fixed interest rates, which may erode real returns when inflation exceeds the earned interest. Choosing inflation-indexed savings protects capital value during high inflation periods, while nominal savings might yield lower effective returns in such economic environments.

Interest Rate Comparison

Inflation-indexed savings offer interest rates that adjust according to the inflation rate, preserving the purchasing power of your principal and providing a real return above inflation. Nominal savings accounts typically offer fixed interest rates that may not keep pace with rising inflation, potentially eroding the value of your savings over time. Comparing these options, inflation-indexed savings provide a more reliable hedge against inflation risk, ensuring the interest earned maintains or increases real value.

Protection Against Purchasing Power Erosion

Inflation-indexed savings offer a crucial safeguard against purchasing power erosion by adjusting returns based on inflation rates, ensuring the real value of your money is maintained over time. Nominal savings, on the other hand, provide fixed returns without accounting for inflation, which can result in a decline in real value when inflation rises. Understanding this distinction helps investors protect their capital's purchasing power in inflationary environments.

Risk Factors in Each Savings Type

Inflation-indexed savings protect purchasing power by adjusting returns according to inflation rates, minimizing the risk of real value erosion during high inflation periods. Nominal savings offer fixed interest rates, exposing savers to significant purchasing power loss when inflation rises unexpectedly. However, nominal savings carry less complexity and market risk compared to inflation-indexed options, which may fluctuate with inflation changes and require careful monitoring.

Real-Life Examples and Case Studies

Inflation-indexed savings accounts, such as Treasury Inflation-Protected Securities (TIPS) in the U.S., preserve purchasing power by adjusting principal according to the Consumer Price Index, unlike nominal savings which can lose value during inflation periods; for example, during the 1970s inflation surge, investors in TIPS secured stable real returns while nominal savers experienced erosion of capital. A 2020 case study by the Federal Reserve highlighted how inflation-indexed products outperformed fixed-rate nominal savings accounts amid rising inflation rates, emphasizing the importance of inflation protection in times of economic uncertainty. Real-life applications demonstrate that households relying solely on nominal savings face diminished wealth accumulation compared to those utilizing inflation-indexed options during inflationary cycles.

Which Option is Best for Long-Term Wealth Preservation?

Inflation-indexed savings protect purchasing power by adjusting returns based on inflation rates, ensuring real value growth over time, while nominal savings offer fixed returns that may erode in value during high inflation periods. For long-term wealth preservation, inflation-indexed options such as Treasury Inflation-Protected Securities (TIPS) provide a reliable hedge by maintaining real returns above inflation. Nominal savings accounts or bonds risk diminishing real value, making inflation-indexed savings the superior choice for safeguarding financial assets against inflationary pressures.

Choosing the Right Savings Strategy

Inflation-indexed savings accounts protect purchasing power by adjusting returns based on inflation rates, making them ideal for long-term financial goals amid rising prices. Nominal savings offer fixed returns that may erode in real value if inflation outpaces interest rates, posing risks for savers during inflationary periods. Selecting the right savings strategy involves evaluating inflation trends, investment horizon, and risk tolerance to ensure capital preservation and growth aligned with economic conditions.

Important Terms

Real interest rate

The real interest rate, calculated by subtracting inflation from the nominal interest rate, directly affects the purchasing power of savings, making inflation-indexed savings more attractive as they adjust returns to maintain value despite inflation fluctuations. Nominal savings, while offering fixed interest payments, may lose real value during periods of high inflation, reducing their effectiveness for preserving wealth over time.

Purchasing power

Inflation-indexed savings preserve purchasing power by adjusting returns according to inflation rates, ensuring real value growth, whereas nominal savings may lose purchasing power over time as inflation erodes fixed interest returns. The Consumer Price Index (CPI) often determines inflation adjustments, making inflation-indexed products like Treasury Inflation-Protected Securities (TIPS) more effective for maintaining wealth in inflationary environments.

Principal adjustment

Principal adjustment in inflation-indexed savings ensures that the invested amount grows in line with inflation, preserving purchasing power over time, unlike nominal savings where the principal remains fixed and susceptible to erosion by inflation. This mechanism allows inflation-indexed savings to provide real returns by adjusting the principal, whereas nominal savings often yield lower real returns due to inflation's impact.

CPI linkage

CPI linkage adjusts the principal and interest payments of inflation-indexed savings to reflect changes in the Consumer Price Index, maintaining the real value of returns despite inflation fluctuations. Nominal savings, by contrast, offer fixed interest rates without inflation adjustments, which can erode purchasing power during periods of rising inflation.

Inflation risk

Inflation risk erodes the purchasing power of nominal savings by reducing the real value of fixed returns over time, while inflation-indexed savings protect investors by adjusting principal and interest payments in line with inflation rates. This adjustment mechanism ensures that the real value of inflation-indexed assets remains stable, effectively shielding savers from unexpected increases in consumer price indices.

Time value of money

Inflation-indexed savings preserve purchasing power by adjusting returns to inflation rates, ensuring real value growth, whereas nominal savings offer fixed returns that can be eroded by inflation over time. The time value of money underscores the importance of inflation-indexed instruments in maintaining the future value of invested capital against rising price levels.

Indexation lag

Indexation lag occurs when inflation-indexed savings adjust too slowly to rising consumer prices, reducing their real value compared to the actual inflation rate. Unlike nominal savings, which maintain fixed returns without adjustment, inflation-indexed savings aim to protect purchasing power but can suffer from delayed indexation, impacting effective inflation protection.

Fixed rate savings

Fixed rate savings accounts offer a guaranteed interest rate over the term, protecting returns from nominal value erosion but potentially falling short against inflation, unlike inflation-indexed savings that adjust returns based on inflation rates to preserve purchasing power. Nominal savings provide fixed interest without inflation adjustment, making them less effective during periods of high inflation compared to inflation-indexed savings designed to maintain real value growth.

Deflation impact

Deflation increases the real value of nominal savings by raising purchasing power, while inflation-indexed savings maintain their value relative to inflation, protecting against losing real returns during inflationary periods. Investors in nominal savings face the risk of reduced real returns when inflation rises, whereas deflation benefits nominal savers but can reduce the effectiveness of inflation-indexed instruments if prices fall.

Yield differential

Yield differentials between inflation-indexed savings and nominal savings reflect the compensation investors demand for inflation risk, with inflation-indexed savings typically offering lower nominal yields but preserving real purchasing power. During periods of rising inflation expectations, the yield spread widens as nominal savings yields increase to offset anticipated inflation, while inflation-indexed securities maintain yields closer to real interest rates.

Inflation-indexed savings vs Nominal savings Infographic

moneydif.com

moneydif.com