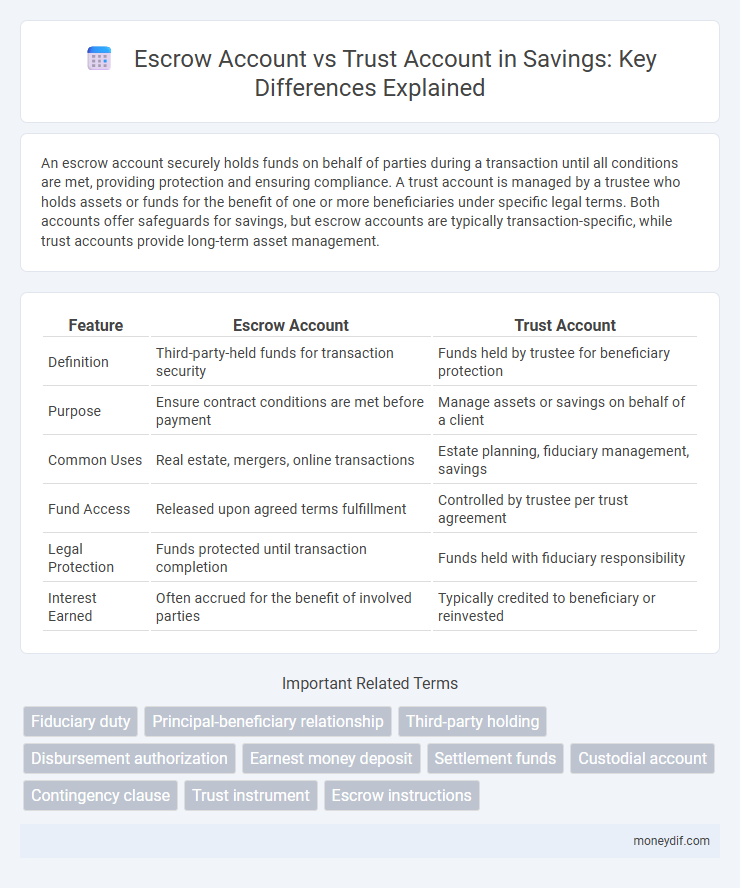

An escrow account securely holds funds on behalf of parties during a transaction until all conditions are met, providing protection and ensuring compliance. A trust account is managed by a trustee who holds assets or funds for the benefit of one or more beneficiaries under specific legal terms. Both accounts offer safeguards for savings, but escrow accounts are typically transaction-specific, while trust accounts provide long-term asset management.

Table of Comparison

| Feature | Escrow Account | Trust Account |

|---|---|---|

| Definition | Third-party-held funds for transaction security | Funds held by trustee for beneficiary protection |

| Purpose | Ensure contract conditions are met before payment | Manage assets or savings on behalf of a client |

| Common Uses | Real estate, mergers, online transactions | Estate planning, fiduciary management, savings |

| Fund Access | Released upon agreed terms fulfillment | Controlled by trustee per trust agreement |

| Legal Protection | Funds protected until transaction completion | Funds held with fiduciary responsibility |

| Interest Earned | Often accrued for the benefit of involved parties | Typically credited to beneficiary or reinvested |

Understanding Escrow Accounts: Definition and Purpose

Escrow accounts serve as neutral holding accounts managed by a third party to secure funds during transactions, ensuring all contractual conditions are met before disbursing payments. They protect buyers and sellers in real estate and online transactions by mitigating risks associated with fraud or default. Unlike trust accounts, which hold assets on behalf of beneficiaries with fiduciary duties, escrow accounts are strictly transactional and dissolve upon completion of the agreement.

What is a Trust Account? Key Features Explained

A trust account is a specialized financial arrangement where funds are held by a trustee on behalf of one or more beneficiaries, ensuring legal protection and fiduciary responsibility. Key features include strict regulatory oversight, segregation of funds from the trustee's personal assets, and transparent record-keeping to prevent misuse. Trust accounts are commonly used in estate planning, legal settlements, and real estate transactions to safeguard client funds.

Escrow vs Trust Accounts: Core Differences

Escrow accounts hold funds temporarily during transactions to ensure terms are met before release, providing security in real estate or business deals. Trust accounts manage assets on behalf of beneficiaries, often established by legal agreements for estate planning or asset management. Unlike trust accounts, escrow accounts are limited in duration and transaction-specific, emphasizing neutral third-party oversight during exchanges.

When to Use an Escrow Account for Savings

An escrow account is ideal for savings when funds must be held securely by a neutral third party during transactions, such as home purchases or legal settlements. This ensures that money is only released upon meeting agreed conditions, providing protection and reducing risk. Unlike trust accounts, escrow accounts are typically used for short-term, conditional holding rather than long-term wealth management.

Situations Ideal for Trust Accounts

Trust accounts are ideal for managing client funds in legal and fiduciary situations, including estate planning, probate, and real estate transactions where precise fund handling is essential. They ensure compliance with state regulations by keeping client money separate from the firm's operating accounts, providing transparency and protection against mismanagement. These accounts offer a structured approach to safeguarding beneficiary interests, making them crucial for attorneys, fiduciaries, and trustees handling third-party funds.

Legal Protections: Escrow vs Trust for Your Money

Escrow accounts provide legal protections by holding funds with a neutral third party until contractual obligations are met, ensuring secure transactions in real estate or business deals. Trust accounts offer legal safeguards by placing assets under a trustee's control, who must manage the funds according to fiduciary duties and the trust agreement's terms. Understanding these distinctions helps individuals choose the appropriate legal framework to protect their money during complex financial arrangements.

Costs and Fees: Comparing Escrow and Trust Accounts

Escrow accounts typically involve fixed fees or a percentage of the transaction amount, which can vary depending on the service provider and complexity of the transaction, often making them more cost-effective for one-time deals. Trust accounts usually incur ongoing management fees, administrative costs, and sometimes performance-based charges, reflecting the fiduciary responsibilities and long-term nature of the arrangement. Understanding the fee structures helps in selecting the right account type for savings strategies that balance cost efficiency with specific financial goals.

Who Manages Escrow and Trust Accounts?

Escrow accounts are typically managed by a neutral third party such as an escrow agent or company, ensuring funds are held securely until contract conditions are fulfilled. Trust accounts are managed by a trustee who has a fiduciary duty to handle the assets on behalf of the beneficiaries according to the terms of the trust agreement. The management of both accounts requires strict adherence to legal and financial regulations to protect the interests of all parties involved.

Security and Risk Factors in Escrow vs Trust Accounts

Escrow accounts provide enhanced security due to third-party oversight, ensuring funds are only released upon meeting specific contract terms, which reduces the risk of misappropriation. Trust accounts, while secure, depend heavily on the trustee's fiduciary responsibility, posing higher risk if the trustee mishandles funds or acts in bad faith. The regulatory frameworks governing escrow accounts often offer stricter protections compared to trust accounts, minimizing potential financial loss for parties involved.

Choosing the Right Account: Escrow or Trust for Your Savings

Choosing the right account for your savings depends on the purpose and control you require; an escrow account offers a secure, temporary holding space managed by a neutral third party, ideal for transactions like real estate deals. A trust account provides long-term management with fiduciary responsibility, designed to protect and distribute assets according to specific terms set by the grantor. Evaluate your need for accessibility, duration, and legal safeguards to determine whether an escrow or trust account best suits your financial goals.

Important Terms

Fiduciary duty

Fiduciary duty requires handling client funds with the highest level of care and loyalty, where escrow accounts hold funds temporarily for specific transactions, ensuring impartial control, while trust accounts manage longer-term assets on behalf of beneficiaries with strict regulatory compliance. Both account types mandate transparency, segregation of client funds, and accurate record-keeping to uphold fiduciary responsibilities in real estate and legal industries.

Principal-beneficiary relationship

The principal-beneficiary relationship in escrow accounts involves a neutral third party holding funds until contractual obligations are met, ensuring secured transactions without direct control transfer. In trust accounts, the trustee manages assets on behalf of the beneficiary with fiduciary duties, allowing ongoing control and administration of the funds according to the trust agreement.

Third-party holding

Third-party holding involves managing funds on behalf of others, commonly divided into Escrow accounts and Trust accounts, where Escrow accounts securely hold funds until contract conditions are met, and Trust accounts maintain funds for beneficiaries under fiduciary responsibility. Escrow accounts are typically used in real estate or business transactions, while Trust accounts are managed by trustees for legal or financial asset protection.

Disbursement authorization

Disbursement authorization in escrow accounts involves the payer's explicit approval before releasing funds held by a neutral third party, ensuring transaction security for real estate or legal settlements. Trust account disbursement authorization requires fiduciaries, such as attorneys or brokers, to manage client funds according to agreement terms and regulatory compliance, emphasizing legal oversight and client protection.

Earnest money deposit

Earnest money deposit commonly held in an escrow account ensures impartial third-party management until transaction completion, providing security and compliance with contract terms. In contrast, trust accounts managed by brokers directly hold earnest money, requiring strict adherence to fiduciary duties and regulatory guidelines to protect clients' funds.

Settlement funds

Settlement funds held in an escrow account are managed by a neutral third party and are released only when all contractual conditions are met, ensuring transaction security and compliance. Trust accounts, often used by attorneys or real estate agents, hold settlement funds on behalf of clients with fiduciary responsibility, requiring strict regulatory adherence and precise record-keeping to protect client interests.

Custodial account

A custodial account is a financial account managed by a custodian on behalf of a minor or beneficiary, differing from an escrow account which temporarily holds funds until contractual conditions are met, and a trust account that is established to manage assets under the terms of a trust agreement for beneficiaries. Custodial accounts provide direct management over assets without the formal legal structure of a trust, while escrow accounts ensure transactional security and trust accounts offer comprehensive asset protection and distribution according to settlor instructions.

Contingency clause

A contingency clause in real estate contracts often requires certain conditions to be met before funds are released from an escrow account, ensuring buyer or seller protections. Unlike a trust account, which holds funds on behalf of clients with fiduciary responsibilities, escrow accounts specifically manage transaction-related monies until contract contingencies are satisfied and cleared.

Trust instrument

A trust instrument legally establishes the terms under which a trust account holds and manages assets, ensuring fiduciary responsibilities are met, whereas an escrow account acts as a neutral holding place for funds pending the fulfillment of specific contractual conditions. Unlike escrow accounts, trust accounts provide broader management powers to a trustee, allowing for ongoing administration and distribution according to the trust instrument's directives.

Escrow instructions

Escrow instructions detail the terms and conditions under which funds are held in an escrow account, ensuring third-party management until contractual obligations are met, while trust accounts are legally fiduciary accounts used to hold assets for beneficiaries with broader purposes beyond transactional conditions. The primary distinction lies in escrow accounts being purpose-specific for transaction security, whereas trust accounts serve ongoing fiduciary responsibilities and asset management.

Escrow account vs Trust account Infographic

moneydif.com

moneydif.com