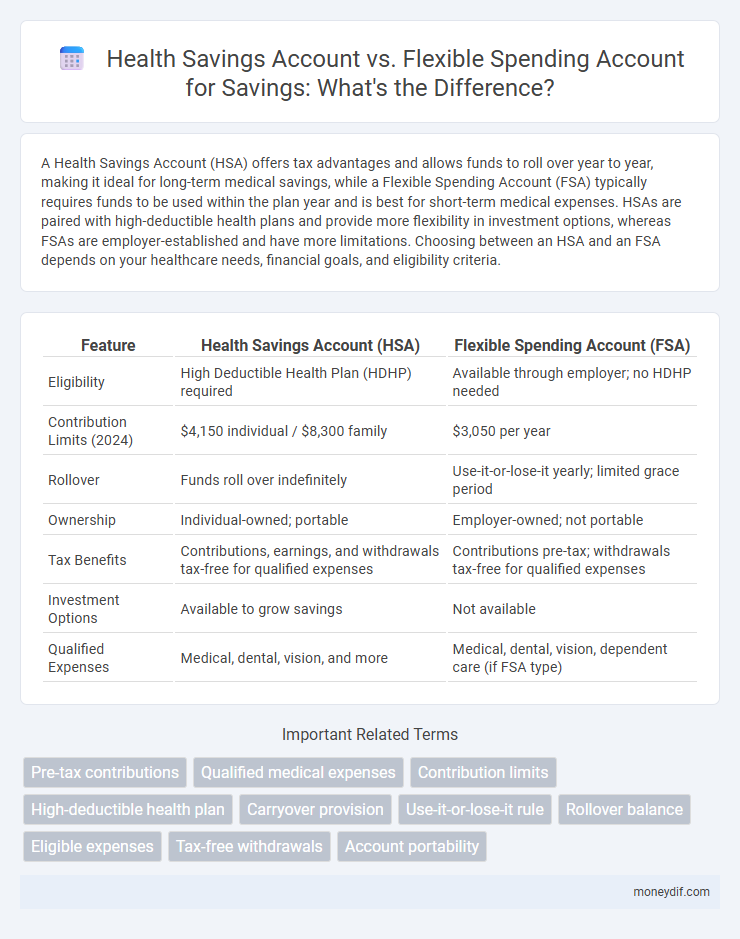

A Health Savings Account (HSA) offers tax advantages and allows funds to roll over year to year, making it ideal for long-term medical savings, while a Flexible Spending Account (FSA) typically requires funds to be used within the plan year and is best for short-term medical expenses. HSAs are paired with high-deductible health plans and provide more flexibility in investment options, whereas FSAs are employer-established and have more limitations. Choosing between an HSA and an FSA depends on your healthcare needs, financial goals, and eligibility criteria.

Table of Comparison

| Feature | Health Savings Account (HSA) | Flexible Spending Account (FSA) |

|---|---|---|

| Eligibility | High Deductible Health Plan (HDHP) required | Available through employer; no HDHP needed |

| Contribution Limits (2024) | $4,150 individual / $8,300 family | $3,050 per year |

| Rollover | Funds roll over indefinitely | Use-it-or-lose-it yearly; limited grace period |

| Ownership | Individual-owned; portable | Employer-owned; not portable |

| Tax Benefits | Contributions, earnings, and withdrawals tax-free for qualified expenses | Contributions pre-tax; withdrawals tax-free for qualified expenses |

| Investment Options | Available to grow savings | Not available |

| Qualified Expenses | Medical, dental, vision, and more | Medical, dental, vision, dependent care (if FSA type) |

Introduction to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

Health Savings Accounts (HSAs) offer tax-advantaged savings specifically for medical expenses, available to individuals with high-deductible health plans (HDHPs). Flexible Spending Accounts (FSAs) provide pre-tax funds set aside by employers for eligible healthcare costs, typically with a use-it-or-lose-it policy annually. Both HSAs and FSAs help reduce taxable income while covering qualified medical expenses, but HSAs offer greater flexibility and rollover potential compared to FSAs.

Key Differences Between HSAs and FSAs

Health Savings Accounts (HSAs) offer tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses with no use-it-or-lose-it rule, allowing funds to roll over year to year. Flexible Spending Accounts (FSAs) are employer-established accounts with pre-tax contributions, but unused funds typically forfeit at year-end unless a limited grace period or carryover is provided. HSAs require enrollment in a high-deductible health plan (HDHP), whereas FSAs have no health plan restrictions but are often limited by lower contribution limits.

Eligibility Requirements for HSAs and FSAs

Health Savings Accounts (HSAs) require enrollment in a High Deductible Health Plan (HDHP) to qualify, with no other health coverage except for specific permitted insurance. Flexible Spending Accounts (FSAs) have no health plan requirements but are only available through employer-established benefit plans, with employees typically needing to elect participation during open enrollment. Eligibility for HSAs is also restricted to individuals who are not claimed as dependents on another's tax return, whereas FSAs impose no such limitation.

Contribution Limits for HSAs vs FSAs

Health Savings Accounts (HSAs) have a contribution limit of $3,850 for individuals and $7,750 for families in 2024, offering higher flexibility and rollover options compared to Flexible Spending Accounts (FSAs), which limit contributions to $3,050 annually. Unlike FSAs, which are generally use-it-or-lose-it accounts tied to employers, HSAs allow unused funds to accumulate year over year. The difference in contribution caps reflects HSAs' alignment with high-deductible health plans and their long-term savings potential for medical expenses.

Tax Benefits of HSAs Compared to FSAs

Health Savings Accounts (HSAs) offer triple tax advantages: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-exempt. Flexible Spending Accounts (FSAs) provide pre-tax contributions but do not allow funds to accumulate year-over-year, leading to possible forfeiture if not used within the plan year. HSAs provide greater long-term tax benefits and flexibility compared to FSAs, making them a more advantageous option for healthcare savings.

Rollover Rules: What Happens to Unused Funds?

Health Savings Accounts (HSAs) allow unused funds to roll over year after year with no expiration, growing tax-free and available for future medical expenses. Flexible Spending Accounts (FSAs) typically require funds to be spent within the plan year, with some allowing a limited rollover amount (usually up to $610) or a short grace period to use remaining money. Understanding the rollover rules is crucial for maximizing savings and avoiding potential forfeiture of unused FSA funds.

Qualified Medical Expenses Covered by HSAs and FSAs

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) both cover qualified medical expenses such as doctor visits, prescription medications, and medical equipment, but HSAs offer a broader range of eligible expenses including long-term care services and certain Medicare costs. FSAs typically restrict qualified expenses to those incurred during the plan year and exclude expenses like long-term care or insurance premiums. HSAs provide greater flexibility with funds rolling over year to year, allowing for more strategic savings on medical expenses.

Portability: Keeping Your HSA or FSA When Changing Jobs

Health Savings Accounts (HSAs) offer greater portability compared to Flexible Spending Accounts (FSAs), as HSAs remain with you even after changing jobs, allowing continued access to saved funds for qualified medical expenses. In contrast, FSAs are typically tied to your employer, and unused funds are often forfeited upon leaving the company, limiting portability. Understanding the portability differences between HSAs and FSAs is essential for maintaining healthcare savings during job transitions.

Investment Opportunities in HSAs vs FSAs

Health Savings Accounts (HSAs) offer significant investment opportunities by allowing account holders to invest in stocks, bonds, and mutual funds, potentially growing their savings tax-free over time. Flexible Spending Accounts (FSAs) do not provide investment options, as funds must be used within the plan year or are forfeited. This key difference makes HSAs a more valuable tool for long-term health care savings and wealth accumulation.

Choosing the Right Account: HSA or FSA for Your Needs

Health Savings Accounts (HSAs) offer tax advantages, contribution limits up to $3,850 for individuals and $7,750 for families in 2024, and funds roll over year to year, making them ideal for long-term medical savings. Flexible Spending Accounts (FSAs) have lower contribution limits, typically $3,050 annually, with a use-it-or-lose-it policy, favoring short-term healthcare expenses and predictable yearly costs. Evaluate your healthcare needs, savings goals, and employer offerings to select the account that maximizes tax benefits and expense coverage.

Important Terms

Pre-tax contributions

Pre-tax contributions to Health Savings Accounts (HSAs) are tax-deductible, grow tax-free, and can be rolled over annually without expiration, offering long-term savings benefits for qualified medical expenses. Flexible Spending Accounts (FSAs) also allow pre-tax contributions but typically have a "use-it-or-lose-it" policy each plan year, limiting rollover options and encouraging immediate healthcare spending.

Qualified medical expenses

Qualified medical expenses for Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) typically include costs such as doctor visits, prescription medications, and medical equipment; however, HSAs offer greater flexibility by allowing unused funds to roll over indefinitely with tax advantages, while FSAs generally require funds to be used within the plan year or a short grace period. Both accounts cover similar eligible expenses defined by IRS Publication 502, but HSAs are exclusive to high-deductible health plan (HDHP) enrollees and can be used for long-term savings, whereas FSAs are employer-established with contribution limits and may be forfeited if not spent timely.

Contribution limits

Health Savings Accounts (HSAs) have a higher annual contribution limit, with 2024 limits set at $4,150 for individuals and $8,300 for families, while Flexible Spending Accounts (FSAs) have a lower limit of $3,050 per year. HSAs allow unused funds to roll over year-to-year and offer triple tax advantages, whereas FSAs typically have a "use-it-or-lose-it" rule, forfeiting unspent money at the end of the plan year.

High-deductible health plan

High-deductible health plans (HDHPs) are often paired with Health Savings Accounts (HSAs), which allow individuals to save pre-tax money for qualified medical expenses and offer funds that roll over annually without expiration. In contrast, Flexible Spending Accounts (FSAs) are employer-established benefit accounts with use-it-or-lose-it funds, typically requiring enrollment independent of HDHPs and lacking rollover flexibility.

Carryover provision

Carryover provisions allow unused funds to be transferred to the next plan year, enhancing the flexibility of Flexible Spending Accounts (FSAs) by permitting up to $610 to roll over, whereas Health Savings Accounts (HSAs) do not impose such limits, allowing funds to accumulate indefinitely without forfeiture. FSAs' carryover feature contrasts with HSAs' tax-advantaged growth and portability, making HSAs more suitable for long-term healthcare savings.

Use-it-or-lose-it rule

The Use-it-or-lose-it rule applies primarily to Flexible Spending Accounts (FSAs), requiring account holders to spend their allocated funds within the plan year or forfeit the remaining balance, whereas Health Savings Accounts (HSAs) allow funds to roll over indefinitely without expiration. FSAs offer immediate tax savings but less flexibility, while HSAs provide long-term savings potential and greater control, particularly for individuals with high-deductible health plans.

Rollover balance

Rollover balance in Health Savings Accounts (HSAs) allows unspent funds to carry over indefinitely, maximizing long-term health expense savings, whereas Flexible Spending Accounts (FSAs) often have limited rollover options or a use-it-or-lose-it policy, reducing their balance retention potential. HSAs provide tax advantages and investment opportunities, making rollover balances a key benefit for individuals seeking ongoing healthcare funding.

Eligible expenses

Eligible expenses for Health Savings Accounts (HSAs) include qualified medical, dental, and vision costs such as doctor visits, prescription medications, and certain over-the-counter items, with funds rolling over year to year. Flexible Spending Accounts (FSAs) cover similar healthcare expenses but usually require spending within the plan year or a short grace period, and funds typically do not roll over.

Tax-free withdrawals

Tax-free withdrawals from Health Savings Accounts (HSAs) cover qualified medical expenses, including doctor visits, prescriptions, and certain over-the-counter items, whereas Flexible Spending Accounts (FSAs) also allow tax-free spending but often have stricter use-it-or-lose-it rules and limited rollover options. HSAs offer greater long-term tax advantages and can be used as an investment vehicle, while FSAs provide more immediate tax benefits but lack portability and investment opportunities.

Account portability

Account portability in Health Savings Accounts (HSAs) allows individuals to maintain and carry over funds without expiration, providing long-term tax advantages and flexibility across jobs. In contrast, Flexible Spending Accounts (FSAs) typically have limited portability with funds forfeited if unused by the plan year's end, restricting their use to immediate healthcare expenses.

Health savings account vs Flexible spending account Infographic

moneydif.com

moneydif.com