Flexible savings accounts provide easy access to funds without penalties, allowing users to deposit and withdraw money anytime to manage unexpected expenses. Locked-in savings offer higher interest rates in exchange for fixed terms, encouraging disciplined saving for long-term goals. Choosing between the two depends on your need for liquidity versus maximizing interest earnings.

Table of Comparison

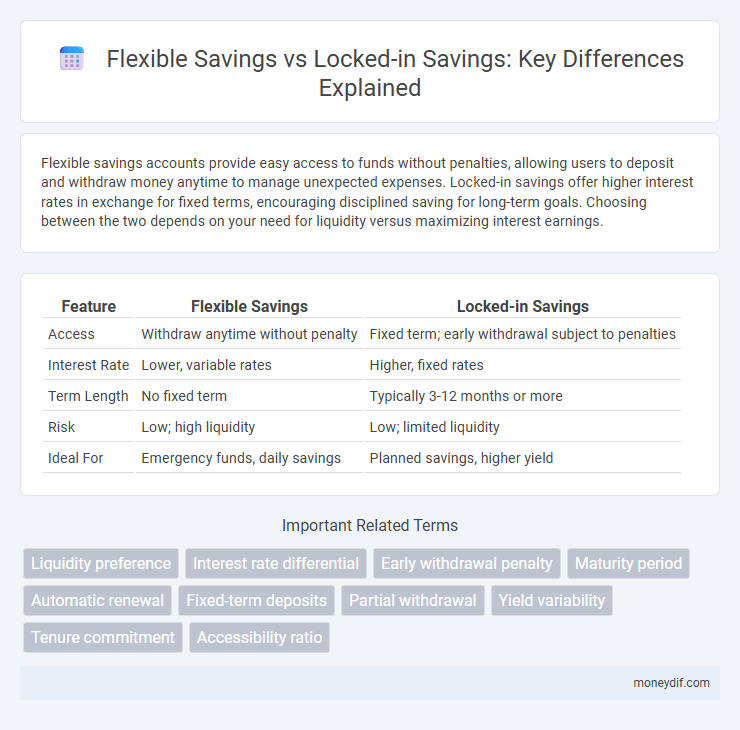

| Feature | Flexible Savings | Locked-in Savings |

|---|---|---|

| Access | Withdraw anytime without penalty | Fixed term; early withdrawal subject to penalties |

| Interest Rate | Lower, variable rates | Higher, fixed rates |

| Term Length | No fixed term | Typically 3-12 months or more |

| Risk | Low; high liquidity | Low; limited liquidity |

| Ideal For | Emergency funds, daily savings | Planned savings, higher yield |

Understanding Flexible vs Locked-In Savings

Flexible savings accounts offer liquidity by allowing users to withdraw funds anytime without penalties, making them ideal for emergency funds. Locked-in savings, such as fixed deposits, provide higher interest rates by restricting access to funds for a predetermined period, maximizing returns through commitment. Understanding the trade-off between accessibility and interest growth is key to optimizing a savings strategy based on individual financial goals.

Key Features of Flexible Savings

Flexible savings accounts offer easy access to funds without withdrawal penalties, allowing savers to deposit or withdraw money anytime. Interest rates on flexible savings may be variable, reflecting market conditions, while providing liquidity and flexibility for short-term financial goals. These accounts often support automatic transfers and are ideal for emergency funds or building savings with the freedom to adjust contributions as needed.

Core Benefits of Locked-In Savings

Locked-in savings accounts offer higher interest rates compared to flexible savings, maximizing your returns over time. These accounts provide a secure way to grow your funds without the temptation of frequent withdrawals, ensuring disciplined saving habits. The guaranteed interest and fixed term length make locked-in savings ideal for long-term financial goals like retirement or major purchases.

Interest Rates Comparison

Flexible savings accounts typically offer lower interest rates compared to locked-in savings options due to the increased liquidity and accessibility they provide. Locked-in savings accounts or fixed deposits often yield higher interest rates as funds are committed for a predetermined period, reducing withdrawal flexibility. Comparing average annual percentage yields, locked-in savings can outperform flexible accounts by 0.5% to 2%, depending on the institution and term length.

Liquidity and Accessibility Differences

Flexible savings accounts offer high liquidity, allowing easy access to funds without penalties or restrictions, making them ideal for emergency expenses or short-term goals. Locked-in savings, such as fixed deposits or certificates of deposit, restrict access to funds until maturity, enhancing interest rates but reducing accessibility and imposing penalties for early withdrawal. Choosing between flexible and locked-in savings depends on the need for immediate access versus maximizing returns through longer-term commitments.

Risk Factors in Both Options

Flexible savings accounts offer higher liquidity but may expose funds to fluctuating interest rates, posing interest rate risk. Locked-in savings accounts typically provide fixed interest rates, reducing market risk but limiting access to funds before maturity, which can lead to penalty fees or loss of accrued interest. Understanding these risk factors helps investors balance accessibility needs against potential returns and financial stability.

Ideal Users for Flexible Savings

Flexible savings accounts are ideal for individuals seeking liquidity and easy access to their funds without penalties, such as freelancers or those with variable monthly expenses. These accounts cater to users who prioritize financial agility and prefer to adjust their savings contributions or withdrawals based on changing income patterns. Flexible savings offer a practical solution for emergency funds or short-term goals, contrasting with locked-in savings designed for long-term commitments.

Who Should Choose Locked-In Savings?

Locked-in savings accounts are ideal for individuals seeking higher interest rates and who do not need immediate access to their funds, such as long-term planners or those saving for future goals like home purchases or retirement. These accounts enforce restrictions on withdrawals, encouraging disciplined saving and offering better returns compared to flexible savings options. Investors with a stable financial situation and a clear timeline benefit most from the predictability and growth potential of locked-in savings.

Early Withdrawal Penalties Explained

Flexible savings accounts allow account holders to withdraw funds at any time without incurring early withdrawal penalties, providing liquidity and financial flexibility. Locked-in savings accounts, such as certificates of deposit (CDs) or fixed deposits, impose early withdrawal penalties, often reducing the principal amount or accrued interest if funds are accessed before the maturity date. Understanding the specific penalty structure and terms associated with locked-in savings is essential to avoid unexpected financial losses when considering early withdrawals.

Making the Right Savings Choice for Your Goals

Choosing between flexible savings and locked-in savings depends on your financial goals and need for access to funds. Flexible savings accounts offer easy withdrawals and higher liquidity, making them ideal for emergency funds or short-term goals. Locked-in savings provide higher interest rates with restricted access, better suited for long-term objectives like retirement or major purchases.

Important Terms

Liquidity preference

Liquidity preference reflects individuals' tendency to hold cash or liquid assets rather than locking funds in fixed-term savings, influencing the choice between flexible savings accounts, which offer easy access but typically lower interest rates, and locked-in savings, providing higher returns at the cost of reduced liquidity. Economic theories highlight that higher liquidity preferences drive demand for flexible savings, whereas lower liquidity preferences favor locked-in options due to their superior yields.

Interest rate differential

Interest rate differential significantly impacts returns between flexible savings accounts, which typically offer lower interest rates for liquidity, and locked-in savings accounts that provide higher rates in exchange for restricted access. Understanding this rate gap helps investors maximize yield by balancing accessibility needs against potential earnings in savings strategies.

Early withdrawal penalty

Early withdrawal penalties typically apply to locked-in savings accounts, where funds are committed for a fixed term to earn higher interest rates, discouraging premature access. Flexible savings accounts offer more liquidity without penalties but generally provide lower interest returns due to the ease of withdrawal.

Maturity period

The maturity period for flexible savings accounts varies as funds can be withdrawn anytime without penalties, while locked-in savings have a fixed maturity period typically ranging from 6 months to several years, requiring funds to remain deposited until the end of the term to earn full interest. Locked-in savings often offer higher interest rates compared to flexible savings due to the commitment of funds over the specified duration.

Automatic renewal

Automatic renewal for Flexible Savings allows users to maintain liquidity by rolling over funds without locking them, whereas Locked-in Savings automatically renew with a fixed term, ensuring consistent interest rates but limiting access until maturity. Choosing between the two depends on the user's preference for flexibility versus higher, stable returns tied to fixed lock-in periods.

Fixed-term deposits

Fixed-term deposits offer higher interest rates compared to flexible savings accounts due to their locked-in nature, ensuring a fixed return over a specified period without the possibility of early withdrawal. Unlike flexible savings, which allow easy access and withdrawals anytime, fixed-term deposits prioritize capital preservation and interest accumulation by restricting funds until maturity, aligning more closely with locked-in savings strategies.

Partial withdrawal

Partial withdrawal in flexible savings accounts allows account holders to access a portion of their funds without penalties, unlike locked-in savings where withdrawals are restricted until maturity. This feature enhances liquidity and suits individuals seeking both growth and access to capital.

Yield variability

Yield variability in flexible savings accounts is generally higher compared to locked-in savings due to fluctuating interest rates and market conditions, offering liquidity at the expense of predictable returns. Locked-in savings provide stable, fixed interest rates over a set term, minimizing yield fluctuations but restricting access until maturity.

Tenure commitment

Tenure commitment in flexible savings accounts offers users the advantage of withdrawal flexibility without penalties, contrasting with locked-in savings which require funds to remain deposited for a fixed period, typically yielding higher interest rates due to the reduced liquidity. Investors prioritize locked-in savings when seeking guaranteed returns over a specific term, while flexible savings cater to those needing access to funds on short notice without forfeiting earned interest.

Accessibility ratio

The accessibility ratio measures the proportion of funds available for withdrawal in Flexible Savings compared to Locked-in Savings, highlighting higher liquidity and user control in Flexible Savings accounts. This ratio reflects how locked-in savings restrict access, often requiring penalties or waiting periods, while flexible savings offer immediate or near-immediate access to funds.

Flexible savings vs Locked-in savings Infographic

moneydif.com

moneydif.com