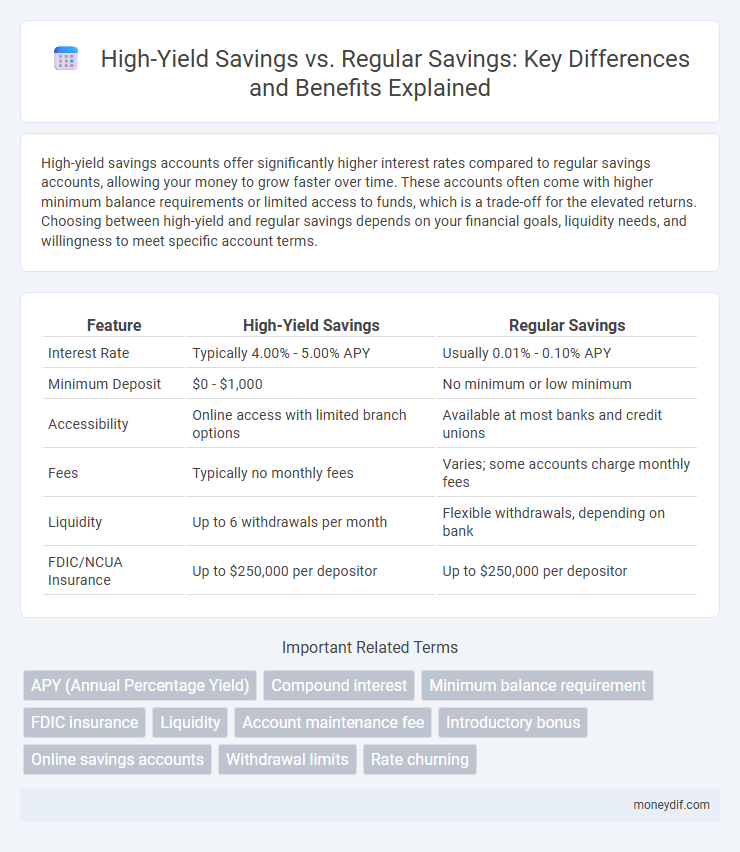

High-yield savings accounts offer significantly higher interest rates compared to regular savings accounts, allowing your money to grow faster over time. These accounts often come with higher minimum balance requirements or limited access to funds, which is a trade-off for the elevated returns. Choosing between high-yield and regular savings depends on your financial goals, liquidity needs, and willingness to meet specific account terms.

Table of Comparison

| Feature | High-Yield Savings | Regular Savings |

|---|---|---|

| Interest Rate | Typically 4.00% - 5.00% APY | Usually 0.01% - 0.10% APY |

| Minimum Deposit | $0 - $1,000 | No minimum or low minimum |

| Accessibility | Online access with limited branch options | Available at most banks and credit unions |

| Fees | Typically no monthly fees | Varies; some accounts charge monthly fees |

| Liquidity | Up to 6 withdrawals per month | Flexible withdrawals, depending on bank |

| FDIC/NCUA Insurance | Up to $250,000 per depositor | Up to $250,000 per depositor |

Understanding High-Yield Savings Accounts

High-yield savings accounts offer significantly higher interest rates compared to regular savings accounts, often yielding annual percentage rates (APRs) upwards of 3% or more versus the typical 0.01% to 0.1% found in standard accounts. These accounts are usually offered by online banks or financial institutions optimized for digital services, enabling them to pass on higher returns to customers due to lower overhead costs. They provide a strategic option for savers seeking to maximize passive income while maintaining liquidity and FDIC insurance up to $250,000 per depositor.

What Defines a Regular Savings Account

A regular savings account is defined by its low minimum balance requirements and easy access to funds, making it ideal for everyday savings and emergency funds. Interest rates on regular savings accounts are generally lower than high-yield savings accounts, reflecting their convenience and liquidity. These accounts are typically offered by most banks and credit unions with FDIC or NCUA insurance, ensuring security for deposited money.

Interest Rates: High-Yield vs Regular Savings

High-yield savings accounts typically offer interest rates ranging from 0.40% to 1.00% APY, significantly higher than regular savings accounts, which average around 0.01% to 0.10% APY. The elevated interest rates in high-yield accounts enable savers to grow their funds faster, compounding monthly or daily, whereas regular accounts provide minimal earnings, barely outpacing inflation. Choosing a high-yield savings account maximizes the return on deposits, making it a strategic option for long-term savings goals.

Accessibility and Account Requirements

High-yield savings accounts typically require higher minimum deposits and may limit the frequency of withdrawals to maintain elevated interest rates. Regular savings accounts offer greater accessibility with lower minimum balance requirements and more flexible transaction policies, making them ideal for everyday use. Choosing between the two depends on balancing the need for higher returns with the convenience of easy access to funds.

Fees and Minimum Balance Differences

High-yield savings accounts typically offer higher interest rates but may require a higher minimum balance to avoid monthly fees, often ranging from $500 to $1,000. Regular savings accounts usually have lower minimum balance requirements and fewer or no monthly maintenance fees, making them more accessible for everyday savers. Evaluating fee structures and balance thresholds is crucial to maximize returns and minimize costs in both account types.

Safety and FDIC Insurance Comparison

High-yield savings accounts offer significantly higher interest rates while maintaining the same FDIC insurance coverage as regular savings accounts, protecting deposits up to $250,000 per depositor, per insured bank. Both account types provide federal safety guarantees, ensuring that funds remain secure even in the event of bank failure. Choosing a high-yield savings account enhances earnings potential without sacrificing the insured security that regular savings accounts provide.

When to Choose High-Yield Savings

High-yield savings accounts offer significantly higher interest rates compared to regular savings, making them ideal for emergency funds or long-term savings goals where growth outpaces inflation. These accounts are best chosen when you can maintain minimum balance requirements and avoid frequent withdrawals to maximize returns. Opting for high-yield savings suits individuals seeking better financial growth without the risk of investments, especially in a low-interest-rate economic environment.

When a Regular Savings Account Makes Sense

A regular savings account makes sense when prioritizing easy access to funds and maintaining low minimum balance requirements. These accounts often offer sufficient liquidity for emergency funds or short-term goals without the restrictions of high-yield savings tiers. Regular savings accounts also benefit account holders who prefer traditional banking services with minimal fees.

Impact on Long-Term Savings Goals

High-yield savings accounts offer significantly higher interest rates compared to regular savings, accelerating the growth of long-term savings and helping to combat inflation's erosion of purchasing power. Over extended periods, the compounded returns from high-yield accounts can lead to substantially larger nest eggs, crucial for meeting goals like retirement, education, or major purchases. Choosing high-yield savings optimizes wealth accumulation by maximizing interest earnings while maintaining liquidity and safety.

Choosing the Best Savings Option for You

High-yield savings accounts typically offer interest rates several times higher than regular savings accounts, allowing your money to grow faster with minimal risk. Regular savings accounts provide more liquidity and easier access to funds, often with lower minimum balance requirements, making them suitable for emergency savings. Assess your financial goals, risk tolerance, and need for accessibility to select between high-yield and regular savings options that best support your wealth-building strategy.

Important Terms

APY (Annual Percentage Yield)

High-yield savings accounts typically offer an APY of 3% or more, significantly surpassing the 0.01% to 0.10% APY provided by regular savings accounts to maximize interest earnings.

Compound interest

High-yield savings accounts generate significantly more compound interest over time compared to regular savings accounts, leading to greater long-term growth of your deposits.

Minimum balance requirement

High-yield savings accounts typically require higher minimum balances than regular savings accounts to earn competitive interest rates.

FDIC insurance

FDIC insurance fully protects deposits up to $250,000 per account holder in both high-yield and regular savings accounts, making both equally secure options despite differences in interest rates.

Liquidity

High-yield savings accounts offer lower liquidity compared to regular savings accounts due to potential withdrawal limits and variable interest rates.

Account maintenance fee

High-yield savings accounts typically have higher account maintenance fees compared to regular savings accounts due to their enhanced interest rates and additional features. Regular savings accounts often offer lower or no maintenance fees, making them a more cost-effective option for basic saving needs.

Introductory bonus

High-yield savings accounts offer a significantly higher introductory bonus interest rate compared to regular savings accounts, maximizing early returns on deposits.

Online savings accounts

High-yield online savings accounts offer significantly higher interest rates than regular savings accounts, allowing you to grow your money faster with the same level of security and liquidity.

Withdrawal limits

High-yield savings accounts typically have stricter withdrawal limits compared to regular savings accounts, often restricting transactions to six per month to comply with federal regulations.

Rate churning

Rate churning occurs when savers move funds between high-yield savings accounts to capitalize on fluctuating interest rates, often resulting in higher overall returns compared to the typically stable but lower rates of regular savings accounts. This strategy exploits promotional offers and rate increases from online banks, maximizing yield while managing minimal risk.

High-yield savings vs Regular savings Infographic

moneydif.com

moneydif.com