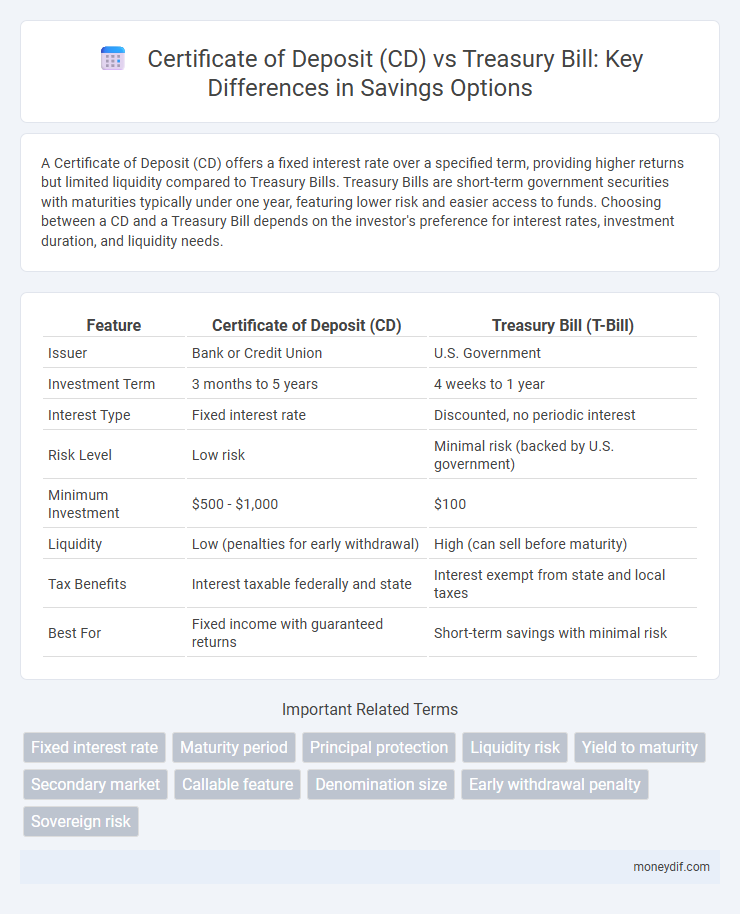

A Certificate of Deposit (CD) offers a fixed interest rate over a specified term, providing higher returns but limited liquidity compared to Treasury Bills. Treasury Bills are short-term government securities with maturities typically under one year, featuring lower risk and easier access to funds. Choosing between a CD and a Treasury Bill depends on the investor's preference for interest rates, investment duration, and liquidity needs.

Table of Comparison

| Feature | Certificate of Deposit (CD) | Treasury Bill (T-Bill) |

|---|---|---|

| Issuer | Bank or Credit Union | U.S. Government |

| Investment Term | 3 months to 5 years | 4 weeks to 1 year |

| Interest Type | Fixed interest rate | Discounted, no periodic interest |

| Risk Level | Low risk | Minimal risk (backed by U.S. government) |

| Minimum Investment | $500 - $1,000 | $100 |

| Liquidity | Low (penalties for early withdrawal) | High (can sell before maturity) |

| Tax Benefits | Interest taxable federally and state | Interest exempt from state and local taxes |

| Best For | Fixed income with guaranteed returns | Short-term savings with minimal risk |

Introduction to Certificate of Deposit (CD) and Treasury Bill

Certificate of Deposit (CD) is a time-bound savings product offered by banks, providing a fixed interest rate over a specified term, typically ranging from a few months to several years. Treasury Bills (T-Bills) are short-term government securities issued at a discount, maturing in one year or less, and backed by the U.S. Treasury, offering a low-risk investment option. Both instruments serve as secure savings tools but differ in issuer type, maturity periods, and yield structures.

What is a Certificate of Deposit (CD)?

A Certificate of Deposit (CD) is a time-bound savings product offered by banks with a fixed interest rate and maturity date, typically ranging from a few months to several years. Unlike Treasury Bills, which are government-issued and have short-term maturities of up to one year, CDs are insured by the FDIC up to $250,000, providing a secure investment option with predictable returns. Investors receive principal and interest at maturity, but early withdrawal often incurs penalties, emphasizing the importance of matching CD terms to individual liquidity needs.

Understanding Treasury Bills (T-Bills)

Treasury Bills (T-Bills) are short-term government debt securities issued at a discount and mature within one year, offering a secure investment with minimal risk. Unlike Certificates of Deposit (CDs), T-Bills do not pay periodic interest but provide returns based on the difference between the purchase price and the maturity value. Their liquidity and backing by the U.S. government make T-Bills an attractive option for conservative investors seeking safety and predictable returns.

Key Differences Between CDs and Treasury Bills

Certificates of Deposit (CDs) typically offer fixed interest rates with terms ranging from a few months to several years, while Treasury Bills (T-Bills) are short-term government securities with maturities of one year or less that are sold at a discount and mature at face value. CDs are insured by the FDIC up to $250,000, providing added security for individual investors, whereas T-Bills are backed by the full faith and credit of the U.S. government, making them virtually risk-free. Liquidity varies as T-Bills can be easily sold in secondary markets, whereas early withdrawal from CDs often incurs penalties, impacting flexibility for savers.

Interest Rates: CD vs Treasury Bill

Certificate of Deposit (CD) interest rates typically surpass those of Treasury Bills (T-Bills) due to longer fixed terms and less liquidity, offering higher yields for committed investments. Treasury Bills, backed by the U.S. government, provide lower but more stable returns, with interest rates influenced by short-term market conditions and auction results. Investors seeking predictable income often prefer CD rates, while those valuing safety and liquidity might lean towards T-Bill yields despite their comparatively lower interest rates.

Safety and Risk: Comparing CDs and Treasury Bills

Certificates of Deposit (CDs) provide a fixed interest rate and are FDIC insured up to $250,000, ensuring principal protection and low risk. Treasury Bills (T-Bills) are backed by the U.S. government, offering virtually risk-free investment due to full faith and credit. Both instruments prioritize safety, but T-Bills carry negligible default risk, while CDs rely on banking institution solvency.

Liquidity: Which Is Easier to Access?

Certificates of Deposit (CDs) typically impose penalties for early withdrawal, making Treasury Bills (T-Bills) more liquid and easier to access before maturity without financial loss. T-Bills mature in shorter periods, often ranging from a few weeks to a year, providing investors with quicker access to their funds. Investors seeking flexibility prefer T-Bills due to their marketability and lower liquidity risk compared to CDs.

Tax Implications: CDs vs Treasury Bills

Certificate of Deposit (CD) interest income is generally subject to federal and state income taxes, while Treasury Bill (T-Bill) earnings are exempt from state and local taxes but fully taxable at the federal level. Investors seeking tax efficiency often prefer T-Bills due to their state and local tax advantages. Understanding these tax implications is crucial for maximizing after-tax returns in a diversified savings portfolio.

Ideal Investors for CDs and Treasury Bills

Certificate of Deposit (CD) investors typically prioritize guaranteed fixed returns and are best suited for conservative savers seeking low-risk, time-bound investments with penalties for early withdrawal. Treasury Bill investors favor short-term government-backed securities that provide high liquidity and minimal credit risk, ideal for those looking to preserve capital while earning modest returns. Both instruments appeal to risk-averse individuals, but CDs attract savers aiming for predictable interest income, whereas Treasury Bills suit investors requiring quick access to funds and federal security.

Which Is Better for Your Savings Strategy?

Certificates of Deposit (CDs) offer fixed interest rates and longer maturity periods, making them ideal for savers seeking predictable returns and minimal risk. Treasury Bills (T-Bills) are short-term government securities with lower returns but higher liquidity and are backed by the U.S. government, providing maximum safety. Choosing between CDs and T-Bills depends on your savings timeline, desired liquidity, and risk tolerance, with CDs favoring stability and T-Bills offering flexibility.

Important Terms

Fixed interest rate

Fixed interest rates in Certificates of Deposit (CDs) provide predictable, stable returns over a specific term, making them ideal for conservative investors seeking guaranteed income. Treasury Bills (T-Bills) are short-term government securities sold at a discount without fixed interest payments, instead offering returns through the difference between purchase price and maturity value, often resulting in lower but highly secure yields compared to CDs.

Maturity period

The maturity period of a Certificate of Deposit (CD) typically ranges from a few months to several years, offering fixed interest payments over the term, whereas Treasury Bills (T-Bills) have shorter maturities, usually ranging from a few days up to one year, and are sold at a discount to face value without periodic interest payments. CDs provide a fixed-rate return upon maturity, while T-Bills are discount securities that pay the full face value at maturity, reflecting accrued interest.

Principal protection

Principal protection ensures the full return of the initial investment, a key feature of Certificates of Deposit (CDs) which offer fixed interest over a specified term backed by FDIC insurance up to $250,000. Treasury Bills (T-Bills) provide principal protection through government backing, selling at a discount and maturing at face value, making both options secure but differing in liquidity and yield profiles.

Liquidity risk

Liquidity risk is higher for Certificates of Deposit (CDs) because they often have fixed terms and penalties for early withdrawal, limiting access to funds before maturity. Treasury Bills (T-Bills) offer greater liquidity due to their short maturities and active secondary markets, allowing investors to sell quickly at market value.

Yield to maturity

Yield to maturity (YTM) on a Certificate of Deposit (CD) typically reflects a fixed interest rate compounded over the investment period, offering predictable returns, whereas Treasury Bills (T-Bills) are sold at a discount and yield is realized at maturity based on the difference between purchase price and face value. CDs often provide higher YTM compared to T-Bills due to longer terms and less liquidity, while T-Bills are favored for their short-term, low-risk, and tax advantages.

Secondary market

The secondary market for Certificates of Deposit (CDs) offers liquidity by enabling investors to buy and sell CDs before maturity, whereas Treasury Bills (T-Bills) are predominantly traded in highly liquid secondary markets with extensive government-backed demand. CDs generally bear fixed interest rates and can include early withdrawal penalties, while T-Bills are short-term, zero-coupon instruments backed by the U.S. government, providing a secure and actively traded option in the secondary market.

Callable feature

Callable Certificates of Deposit (CDs) offer issuers the option to redeem the CD before maturity, typically providing higher interest rates to compensate investors for reinvestment risk, whereas Treasury Bills (T-Bills) are non-callable government securities with fixed maturity dates and lower risk. Investors seeking predictable returns and guaranteed tenure often prefer T-Bills, while those willing to accept potential early redemption may benefit from the elevated yields of callable CDs.

Denomination size

Certificate of Deposit (CD) denominations typically start at $1,000 and can range up to $100,000 or more, offering flexibility for individual investors. Treasury Bills (T-Bills) are issued in minimum denominations of $100,000, primarily targeting institutional investors and reflecting their role as short-term government debt instruments.

Early withdrawal penalty

Early withdrawal penalty on a Certificate of Deposit (CD) typically results in forfeiting several months of accrued interest, reducing overall returns, whereas Treasury Bills (T-Bills) generally have no early withdrawal penalty since they are easily tradable on the secondary market before maturity. Investors seeking liquidity may prefer T-Bills to avoid penalties and maintain access to funds without sacrificing principal value.

Sovereign risk

Sovereign risk, the risk that a government might default on its debt obligations, impacts Certificates of Deposit (CDs) issued by banks in that country more significantly than Treasury Bills (T-Bills) because T-Bills are government-backed securities considered low-risk due to their short maturity and direct government guarantee. Investors typically view T-Bills as safer amid sovereign risk concerns, while CDs carry higher risk linked to the financial health of the issuing bank and the country's creditworthiness.

Certificate of Deposit (CD) vs Treasury Bill Infographic

moneydif.com

moneydif.com