A custodial account is managed by an adult custodian on behalf of a minor, offering control over savings until the child reaches adulthood, while a joint account is shared between two or more individuals who have equal access to funds. Custodial accounts typically provide a structured way to save for a child's future expenses, whereas joint accounts offer flexibility for shared financial responsibilities among adults. Understanding the distinct control, access, and purpose of each account type is essential for optimizing savings strategies.

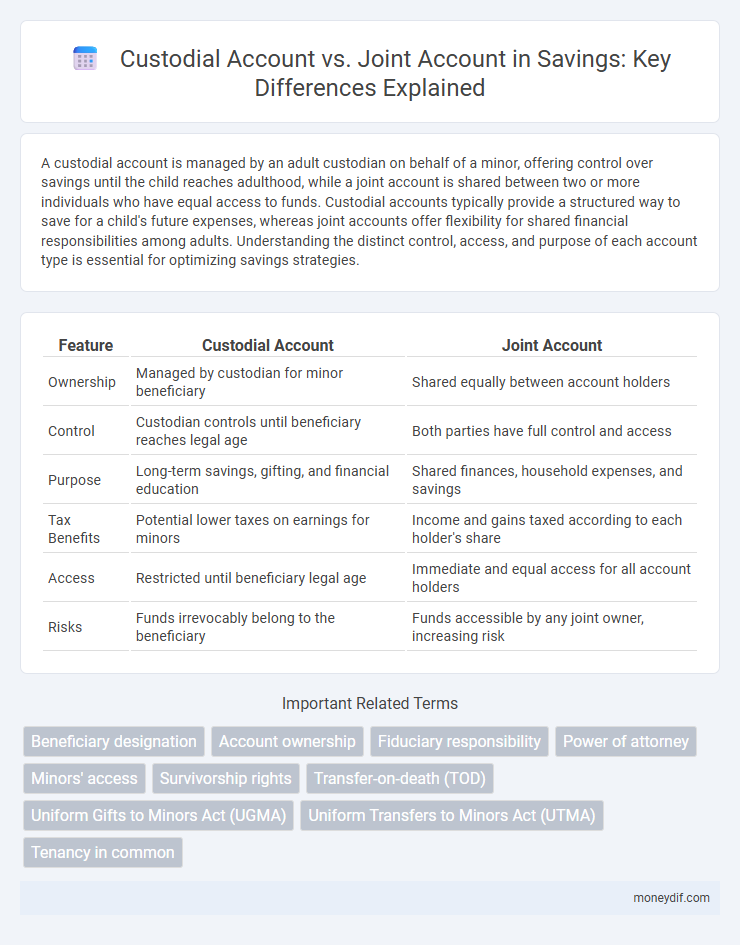

Table of Comparison

| Feature | Custodial Account | Joint Account |

|---|---|---|

| Ownership | Managed by custodian for minor beneficiary | Shared equally between account holders |

| Control | Custodian controls until beneficiary reaches legal age | Both parties have full control and access |

| Purpose | Long-term savings, gifting, and financial education | Shared finances, household expenses, and savings |

| Tax Benefits | Potential lower taxes on earnings for minors | Income and gains taxed according to each holder's share |

| Access | Restricted until beneficiary legal age | Immediate and equal access for all account holders |

| Risks | Funds irrevocably belong to the beneficiary | Funds accessible by any joint owner, increasing risk |

Understanding Custodial and Joint Accounts

Custodial accounts are designed for minors, where an adult custodian manages the assets until the beneficiary reaches legal age, offering control and oversight for savings or investments. Joint accounts allow two or more individuals equal access and ownership, often used by couples or business partners to manage shared finances efficiently. Understanding the distinctions between custodial and joint accounts helps optimize savings strategies based on control, access, and beneficiary considerations.

Key Differences Between Custodial and Joint Accounts

Custodial accounts are managed by an adult on behalf of a minor, granting the custodian control until the beneficiary reaches legal age, whereas joint accounts are shared equally by two or more adults with immediate access to all account holders. Custodial accounts often have specific tax advantages and restrictions designed for minors, while joint accounts provide flexible access and easy asset transfer among owners. The key difference lies in ownership: custodial accounts legally belong to the minor but are controlled by the custodian, whereas joint accounts are owned collectively by all named account holders.

Eligibility Requirements for Each Account Type

Custodial accounts require the account holder to be a minor, with a designated adult custodian managing the funds until the minor reaches the age of majority, typically 18 or 21 depending on state law. Joint accounts mandate that all account holders are legally competent adults, each with equal access and ownership rights to the account assets, often used by couples or business partners. Eligibility criteria for custodial accounts focus on the minor's status, while joint accounts emphasize the legal capacity and agreement of all involved parties.

Control and Access: Custodial vs Joint Accounts

Custodial accounts grant legal control to the custodian until the minor reaches adulthood, limiting the beneficiary's access, while joint accounts provide equal control and immediate access to all account holders. In custodial accounts, the custodian manages funds exclusively for the minor's benefit, ensuring restricted transactions until ownership transfers. Joint accounts enable shared decision-making and easy access to funds, increasing flexibility but also requiring mutual trust between holders.

Tax Implications of Custodial and Joint Accounts

Custodial accounts are taxed under the child's Social Security number, often benefiting from lower tax rates on unearned income but may trigger the "kiddie tax" if earnings exceed a certain threshold. Joint accounts attribute income and gains to all owners based on ownership percentage, potentially increasing overall tax liability depending on each owner's tax bracket. Understanding the tax implications can help optimize savings strategies and minimize tax burdens for both custodial and joint account holders.

Ownership and Beneficiary Considerations

Custodial accounts assign legal ownership to the custodian managing assets on behalf of the minor beneficiary until they reach adulthood, ensuring clear control and transfer of funds. Joint accounts provide shared ownership rights directly to all account holders, allowing equal access and beneficiary designation flexibility but increasing exposure to risks such as creditor claims or disputes. Understanding these ownership structures and beneficiary implications is crucial for strategic savings and estate planning.

Pros and Cons of Custodial Accounts

Custodial accounts offer adult guardians control over savings for minors, providing tax advantages like lower rates on unearned income. They limit the minor's access until the age of majority, ensuring funds are used for designated purposes such as education. However, custodial accounts transfer ownership to the beneficiary at adulthood, removing parental control and potentially impacting financial aid eligibility.

Pros and Cons of Joint Accounts

Joint accounts offer shared access and control, making them ideal for couples or partners managing finances together, but they also pose risks such as potential conflicts over withdrawals and lack of individual account privacy. Cons include liability for each other's debts and expenses, which can complicate financial responsibilities if one account holder overspends. Despite these drawbacks, joint accounts provide convenience for paying shared bills and building trust through transparent money management.

Common Uses for Custodial and Joint Savings Accounts

Custodial accounts are commonly used for managing and saving money on behalf of minors, allowing parents or guardians to control assets until the child reaches adulthood. Joint savings accounts are frequently utilized by couples, business partners, or family members to facilitate shared access to funds and simplify bill payments or emergency savings. Both account types offer tailored advantages depending on the goal of shared ownership or custodial control over funds.

How to Choose Between Custodial and Joint Accounts

When choosing between custodial and joint accounts, consider the account's purpose and control requirements: custodial accounts grant an adult full control until the minor reaches adulthood, making them ideal for savings designated for children's expenses or education. Joint accounts offer shared ownership and equal access to funds, suitable for shared financial goals such as household savings or partnership expenses. Assess factors like tax implications, withdrawal restrictions, and beneficiary rights to determine the best fit for your savings strategy.

Important Terms

Beneficiary designation

Beneficiary designation in custodial accounts ensures assets transfer directly to the named beneficiary at the custodian's death, while joint accounts typically pass ownership to the surviving account holder without requiring a separate beneficiary designation.

Account ownership

Account ownership in custodial accounts is typically held by a minor beneficiary with a custodian managing the assets until the minor reaches legal age, whereas joint accounts have shared ownership between two or more individuals, allowing equal access and control over the funds. Custodial accounts are commonly used for transferring assets to minors and have specific fiduciary responsibilities, while joint accounts facilitate shared financial management among partners or family members with survivorship rights.

Fiduciary responsibility

Fiduciary responsibility in custodial accounts requires the custodian to manage assets solely for the minor's benefit, whereas joint account holders share equal ownership and fiduciary duties over the account's assets.

Power of attorney

A power of attorney grants authorized control over a custodial account, while a joint account inherently provides equal ownership and access rights to all named account holders.

Minors' access

Minors' access to funds is typically more restricted in custodial accounts, where the custodian controls transactions until the minor reaches legal age, compared to joint accounts that allow minors immediate transactional rights alongside the co-owner.

Survivorship rights

Survivorship rights in joint accounts grant the surviving co-owner automatic ownership of the entire account upon one owner's death, bypassing probate, whereas custodial accounts, managed by a custodian for a minor beneficiary, transfer assets to the beneficiary only after reaching legal age without survivorship privileges. Joint accounts typically provide immediate asset transfer benefits for co-owners but lack the controlled transfer conditions found in custodial accounts designed for minors.

Transfer-on-death (TOD)

A Transfer-on-death (TOD) designation in a custodial account allows assets to pass directly to a named beneficiary upon the account holder's death without probate, whereas joint accounts with rights of survivorship automatically transfer ownership to the surviving account holder(s).

Uniform Gifts to Minors Act (UGMA)

The Uniform Gifts to Minors Act (UGMA) establishes custodial accounts that legally transfer asset control to a minor while differentiating them from joint accounts, which involve shared ownership and control between account holders.

Uniform Transfers to Minors Act (UTMA)

The Uniform Transfers to Minors Act (UTMA) allows a custodian to manage assets in a custodial account for the benefit of a minor until they reach the age of majority, with transfer restrictions and tax advantages tailored to minors. Unlike joint accounts, which provide shared access and control to multiple account holders, custodial accounts under UTMA legally vest ownership of the assets to the minor while granting management authority solely to the custodian.

Tenancy in common

Tenancy in common allows multiple owners to hold fractional shares in a property independently, whereas custodial accounts manage assets for minors under a custodian, and joint accounts provide shared ownership with rights of survivorship for all account holders.

Custodial account vs Joint account Infographic

moneydif.com

moneydif.com