Laddering involves spreading investments across multiple maturities to reduce risk and maintain liquidity, while lump-sum investing puts all funds into the market at once, potentially maximizing returns if timed well. Laddering offers steady income and less exposure to interest rate fluctuations, making it ideal for conservative savers. Lump-sum investing suits those with higher risk tolerance seeking greater growth opportunities in a shorter time frame.

Table of Comparison

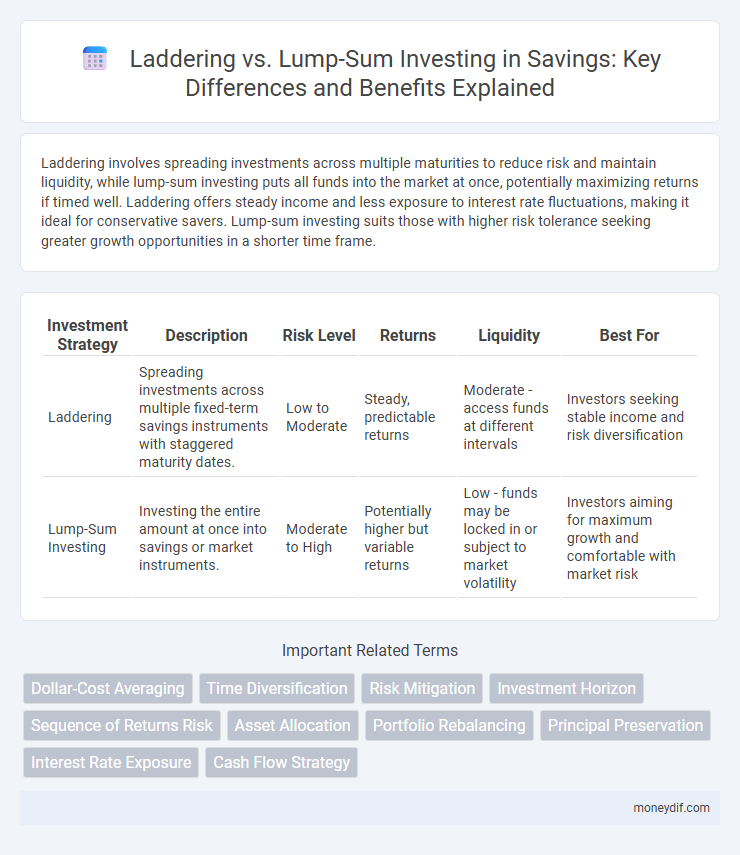

| Investment Strategy | Description | Risk Level | Returns | Liquidity | Best For |

|---|---|---|---|---|---|

| Laddering | Spreading investments across multiple fixed-term savings instruments with staggered maturity dates. | Low to Moderate | Steady, predictable returns | Moderate - access funds at different intervals | Investors seeking stable income and risk diversification |

| Lump-Sum Investing | Investing the entire amount at once into savings or market instruments. | Moderate to High | Potentially higher but variable returns | Low - funds may be locked in or subject to market volatility | Investors aiming for maximum growth and comfortable with market risk |

Understanding Laddering and Lump-Sum Investing

Laddering involves spreading investments across multiple fixed-income securities with staggered maturity dates, reducing interest rate risk and providing regular liquidity. Lump-sum investing deploys the entire capital at once, aiming to maximize market exposure and potential returns but with higher risk from market volatility. Understanding these strategies helps investors balance risk tolerance and cash flow needs to optimize savings growth.

Key Differences Between Laddering and Lump-Sum Investing

Laddering involves dividing investments across multiple fixed-income securities with staggered maturities, providing regular liquidity and reducing interest rate risk through diversification. Lump-sum investing commits a large amount at once, aiming to capitalize on immediate market opportunities but exposing the investor to higher timing risk and market volatility. The key difference lies in risk management: laddering smooths returns and offers consistent access to funds, whereas lump-sum investing seeks potentially higher returns with increased exposure to market fluctuations.

Pros and Cons of Laddering in Savings Strategies

Laddering in savings strategies involves spreading investments across multiple fixed-term deposits or bonds with staggered maturity dates, providing enhanced liquidity and reduced interest rate risk compared to lump-sum investing. This approach allows savers to access portions of their funds periodically while potentially benefiting from higher interest rates on longer-term instruments, though it may yield lower overall returns if rates rise consistently. Laddering mitigates the risk of reinvesting all funds at unfavorable rates and offers regular cash flow, making it suitable for conservative investors seeking balance between growth and safety.

Advantages and Disadvantages of Lump-Sum Investing

Lump-sum investing offers the advantage of immediate market exposure, potentially maximizing returns if the market rises soon after the investment. However, it carries the risk of significant losses if invested right before a market downturn, leading to high volatility in portfolio value. This strategy requires strong market timing skills and tolerance for short-term risk compared to more gradual investment approaches like laddering.

Risk Management: Laddering vs Lump-Sum Approaches

Laddering reduces risk by spreading investments across multiple maturities, minimizing the impact of interest rate fluctuations and market volatility. Lump-sum investing exposes the entire amount to market timing risk, potentially leading to significant losses if markets decline shortly after investment. By managing cash flow and reinvestment timing, laddering provides a more stable and predictable return, enhancing long-term financial security.

Maximizing Returns: Which Strategy Performs Better?

Laddering investment in multiple bonds or CDs over staggered periods reduces interest rate risk and provides steady returns, while lump-sum investing can capitalize on market upswings for higher immediate gains. Historical data shows lump-sum investing often outperforms laddering during bull markets due to the advantage of full capital exposure. However, laddering offers better risk management and liquidity, making it ideal for conservative savers aiming for reliable income streams.

Suitability: Who Should Choose Laddering or Lump-Sum Investing?

Laddering suits conservative investors seeking to reduce interest rate risk and maintain liquidity by spreading investments across multiple maturities, ensuring access to funds at staggered intervals. Lump-sum investing benefits those with a higher risk tolerance aiming to maximize returns by investing a large amount at once, capitalizing on current market conditions. Investors prioritizing predictable income and risk mitigation should opt for laddering, while those focused on growth potential and market timing may prefer lump-sum strategies.

Tax Implications of Laddering vs Lump-Sum Investing

Laddering fixed-income investments can spread out taxable interest income over multiple years, potentially keeping investors in lower tax brackets and reducing overall tax liability. Lump-sum investing often results in immediate exposure to full taxable income and capital gains in the year of investment, which might push investors into higher tax brackets. Tax-efficient laddering strategies, such as using tax-advantaged accounts or municipal bonds, can optimize after-tax returns compared to lump-sum approaches.

Real-World Examples of Laddering and Lump-Sum in Action

Laddering involves spreading investments across multiple fixed-income securities with staggered maturities, as demonstrated by retirees who build bond ladders to ensure steady income streams and reduced interest-rate risk. In contrast, lump-sum investing is exemplified by investors deploying large sums immediately, such as those investing inheritance money into a diversified stock portfolio to capture market growth quickly. Real-world data shows that laddering helps manage liquidity and reinvestment risk, while lump-sum investing can maximize returns during bull markets but may expose investors to timing risks.

Choosing the Right Savings Strategy for Your Financial Goals

Laddering divides investments across multiple maturity dates, reducing interest rate risk and providing consistent liquidity, ideal for conservative savers with medium-term goals. Lump-sum investing allocates all funds at once, maximizing potential returns if markets perform well but increasing exposure to volatility, better suited for long-term investors with higher risk tolerance. Selecting the right strategy depends on your financial objectives, risk appetite, and the need for access to funds during the investment period.

Important Terms

Dollar-Cost Averaging

Dollar-cost averaging systematically invests a fixed amount into assets over time, minimizing the risk of market timing compared to lump-sum investing, which deploys capital all at once and carries higher volatility exposure. Laddering investment strategies in bonds or fixed-income securities align with dollar-cost averaging by staggering maturities and reinvestment periods, enhancing portfolio liquidity and reducing interest rate risk.

Time Diversification

Time diversification reduces investment risk by spreading purchases over multiple periods, which can be effectively implemented through laddering--a strategy of staggering investments across different maturities to manage interest rate fluctuations and liquidity needs. In contrast, lump-sum investing involves deploying the entire capital at once, maximizing market exposure but increasing vulnerability to timing risk during volatile market conditions.

Risk Mitigation

Risk mitigation in laddering strategy involves spreading investments across multiple maturities to reduce exposure to interest rate fluctuations, while lump-sum investing concentrates risk but can yield higher returns if timed correctly. Laddering provides a balanced approach by enhancing liquidity and lowering reinvestment risk compared to lump-sum investments, which face greater market timing and volatility risks.

Investment Horizon

Investment horizon significantly influences the choice between laddering and lump-sum investing strategies; laddering matches staggered maturity dates with varying market conditions to reduce interest rate risk over time, while lump-sum investing maximizes potential returns by deploying a large capital amount immediately, benefiting from longer market exposure. Investors with longer horizons may prefer lump-sum for compounding growth, whereas laddering suits those seeking steady income and risk mitigation within fixed time frames.

Sequence of Returns Risk

Sequence of returns risk significantly impacts investment outcomes, especially when withdrawing funds during market downturns; laddering mitigates this risk by spreading investments over time, providing consistent returns and reducing exposure to market volatility. Lump-sum investing exposes the entire portfolio to immediate market fluctuations, increasing vulnerability to poor returns early in the investment period.

Asset Allocation

Asset allocation strategies differ significantly between laddering and lump-sum investing, with laddering focusing on spreading investments across multiple maturities to reduce interest rate risk and enhance liquidity, while lump-sum investing allocates the entire amount at once, aiming for immediate full market exposure to potentially maximize returns. Laddering suits investors seeking predictable income streams and risk mitigation through staggered bond maturities, whereas lump-sum investing aligns with those willing to accept market volatility for higher growth potential.

Portfolio Rebalancing

Portfolio rebalancing is essential for maintaining target asset allocation, where laddering involves gradually adjusting investments over time to reduce interest rate risk and market volatility, while lump-sum investing deploys capital all at once, potentially maximizing returns during favorable market conditions but increasing short-term exposure. Employing laddering strategies within rebalancing helps smooth cash flow and manage risk, whereas lump-sum investing may require more frequent rebalancing to address market fluctuations and maintain portfolio alignment.

Principal Preservation

Principal preservation strategies focus on safeguarding the original investment amount from losses while generating steady returns, with laddering offering staggered bond maturities to reduce interest rate risk and provide liquidity. In contrast, lump-sum investing involves deploying the entire capital at once, which can maximize potential gains but exposes the principal to market volatility and timing risks.

Interest Rate Exposure

Interest rate exposure varies significantly between laddering and lump-sum investing; laddering mitigates risk by spreading investments across bonds with staggered maturities, reducing sensitivity to fluctuating interest rates. Lump-sum investing concentrates exposure at a single point, increasing vulnerability to market rate changes but potentially benefiting from immediate reinvestment opportunities at higher yields.

Cash Flow Strategy

Cash flow strategy in investing balances liquidity and returns by using laddering to stagger bond or fixed-income maturities, ensuring steady income and reduced reinvestment risk. Lump-sum investing, contrastingly, allocates capital all at once, aiming for immediate market exposure but with higher timing risk and potential cash flow volatility.

Laddering vs Lump-Sum Investing Infographic

moneydif.com

moneydif.com