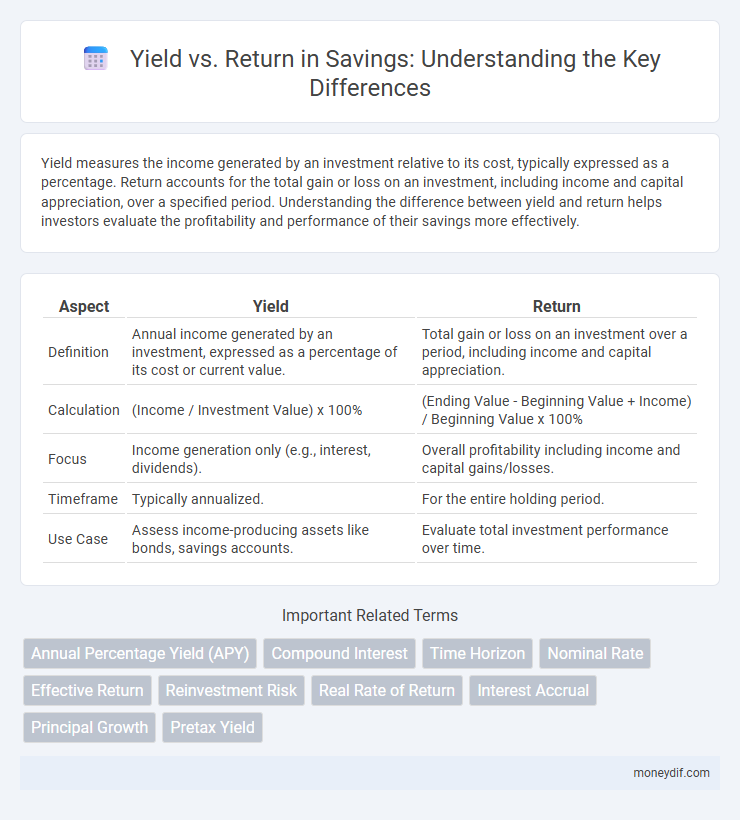

Yield measures the income generated by an investment relative to its cost, typically expressed as a percentage. Return accounts for the total gain or loss on an investment, including income and capital appreciation, over a specified period. Understanding the difference between yield and return helps investors evaluate the profitability and performance of their savings more effectively.

Table of Comparison

| Aspect | Yield | Return |

|---|---|---|

| Definition | Annual income generated by an investment, expressed as a percentage of its cost or current value. | Total gain or loss on an investment over a period, including income and capital appreciation. |

| Calculation | (Income / Investment Value) x 100% | (Ending Value - Beginning Value + Income) / Beginning Value x 100% |

| Focus | Income generation only (e.g., interest, dividends). | Overall profitability including income and capital gains/losses. |

| Timeframe | Typically annualized. | For the entire holding period. |

| Use Case | Assess income-producing assets like bonds, savings accounts. | Evaluate total investment performance over time. |

Understanding Yield and Return in Savings

Yield represents the income earned on savings, often expressed as an annual percentage, reflecting interest or dividends generated. Return encompasses the total gain or loss from an investment, including yield plus any changes in the principal amount. Understanding the distinction between yield and return helps savers evaluate the true performance and profitability of their savings instruments.

Key Differences Between Yield and Return

Yield represents the income generated from an investment, typically expressed as a percentage of the investment's cost or current market value, emphasizing regular earnings like dividends or interest. Return measures the total gain or loss on an investment over a specific period, including income and capital appreciation or depreciation. Key differences between yield and return include yield's focus on periodic income streams, while return captures comprehensive performance, encompassing both income and changes in asset value.

How Yield Impacts Your Savings Growth

Yield represents the percentage earned on your savings over a specific period, directly influencing how quickly your balance increases. A higher yield accelerates the growth of your principal by generating more interest income, which can compound over time. Tracking yield allows savers to compare options effectively and maximize the long-term expansion of their savings portfolio.

Calculating Return on Savings Accounts

Return on savings accounts is calculated by dividing the interest earned by the principal amount deposited, then multiplying by 100 to express it as a percentage. Yield considers the annual percentage rate (APR) and factors in compounding periods, providing a more comprehensive measure of gains over time. Understanding both metrics helps savers accurately assess the performance of their savings and make informed financial decisions.

Fixed vs Variable Yield: What Savers Need to Know

Fixed yield savings accounts provide a predictable, stable interest rate over a set period, ensuring savers receive consistent returns regardless of market fluctuations. Variable yield accounts adjust interest rates based on economic conditions, offering potential for higher returns but with increased risk and uncertainty. Savers seeking security should prioritize fixed yields, while those willing to accept variability for possibly greater gains may consider variable yield options.

The Role of Compound Interest in Return

Compound interest plays a crucial role in maximizing the return on savings by reinvesting earnings, allowing the initial principal and accumulated interest to generate additional gains over time. Yield measures the income generated by an investment, often expressed annually, while return captures the total gain, including both income and capital appreciation. Understanding how compound interest accelerates return growth helps savers optimize long-term wealth accumulation strategies.

Yield vs Return: Which Matters More for Savers?

Yield represents the annual income generated by an investment as a percentage of its current price, while return measures the overall profit or loss, including both income and capital gains, over a specific period. Savers prioritize yield for steady income streams from savings accounts or bonds, but return offers a comprehensive view of total investment performance, critical for long-term growth. Understanding the distinction helps savers balance income needs with capital appreciation goals to optimize their financial strategy.

Factors Affecting Savings Account Yield

Interest rates set by central banks significantly influence the yield on savings accounts, as higher rates typically lead to increased earnings. Inflation impacts real returns by eroding purchasing power, meaning nominal yield must exceed inflation to provide positive growth. Account features such as compounding frequency, minimum balance requirements, and fees also affect the overall yield realized by savers.

Maximizing Return Through Strategic Saving

Maximizing return through strategic saving requires understanding the difference between yield and return, where yield represents the income generated from an investment, typically expressed as an annual percentage, while return encompasses the total gain or loss including capital appreciation or depreciation. Focusing on high-yield savings accounts or certificates of deposit can increase the income portion of returns, but balancing risk and liquidity is essential to optimize overall savings performance. Analyzing interest rates, compounding frequency, and investment duration are critical factors that drive the effective return on savings and help achieve financial goals efficiently.

Common Misconceptions About Yield and Return

Yield often refers to the annual income generated by an investment, usually expressed as a percentage of the investment's cost or current market value, while return encompasses the total gain or loss, including capital appreciation and income. A common misconception is that a higher yield always indicates a better investment, ignoring that high yields can signal increased risk or depreciation in asset value. Understanding the distinction helps investors evaluate investment performance accurately, considering both income and capital growth components.

Important Terms

Annual Percentage Yield (APY)

Annual Percentage Yield (APY) measures the real rate of return on an investment, accounting for compound interest over a year, making it a more accurate indicator than simple return. Yield reflects the income generated by an investment, such as dividends or interest, while return includes total gains or losses, incorporating both income and capital appreciation.

Compound Interest

Compound interest accelerates the growth of an investment's yield by reinvesting earned interest, leading to exponential returns over time. Yield represents the income generated from an investment, while return encompasses the total gain, including both yield and capital appreciation.

Time Horizon

Time horizon significantly influences yield versus return analysis, as longer horizons typically allow compounding effects to enhance total returns despite short-term yield fluctuations. Investors with extended time horizons can prioritize total return, balancing income generation from yield with capital appreciation to optimize portfolio growth.

Nominal Rate

Nominal rate represents the stated interest rate without adjusting for inflation, directly impacting the yield by indicating potential earnings before costs or taxes. Yield reflects the income generated from an investment, while return accounts for total profit or loss, including price appreciation and fees, offering a comprehensive view of investment performance.

Effective Return

Effective Return measures the actual gain or loss on an investment, accounting for compounding periods, fees, and taxes, providing a more accurate representation than simple Yield. Yield represents the income generated from an investment, such as interest or dividends, expressed as a percentage of the principal, but does not fully reflect the total investment performance like Effective Return does.

Reinvestment Risk

Reinvestment risk arises when the returns from an investment, particularly fixed-income securities, must be reinvested at lower interest rates than the original yield, impacting the overall return. This risk affects bond investors as falling interest rates reduce the potential return upon reinvesting coupon payments, causing realized returns to diverge from initial yield projections.

Real Rate of Return

The real rate of return measures the percentage gain on an investment after adjusting for inflation, reflecting the true increase in purchasing power. While yield represents the income generated by an investment, such as interest or dividends, return includes both yield and capital gains, providing a comprehensive view of investment performance.

Interest Accrual

Interest accrual represents the process of accumulating interest on an investment or loan over time, impacting the yield by reflecting the effective earnings generated. Yield measures the annual income earned from an investment, while return incorporates both income and capital gains, showing the total profitability including accrued interest.

Principal Growth

Principal growth refers to the increase in the original investment amount over time, distinguishing it from yield, which represents the income generated by that investment, typically expressed as a percentage. While yield measures periodic earnings such as interest or dividends, return encompasses both principal growth and yield, providing a comprehensive assessment of the total investment performance.

Pretax Yield

Pretax yield measures the income generated by an investment before taxes, expressed as a percentage of its principal, and focuses solely on interest or dividend income without accounting for capital gains or losses. Yield reflects the current income relative to the investment's cost, while return encompasses total profit including price appreciation, reinvested dividends, and tax impacts.

Yield vs Return Infographic

moneydif.com

moneydif.com