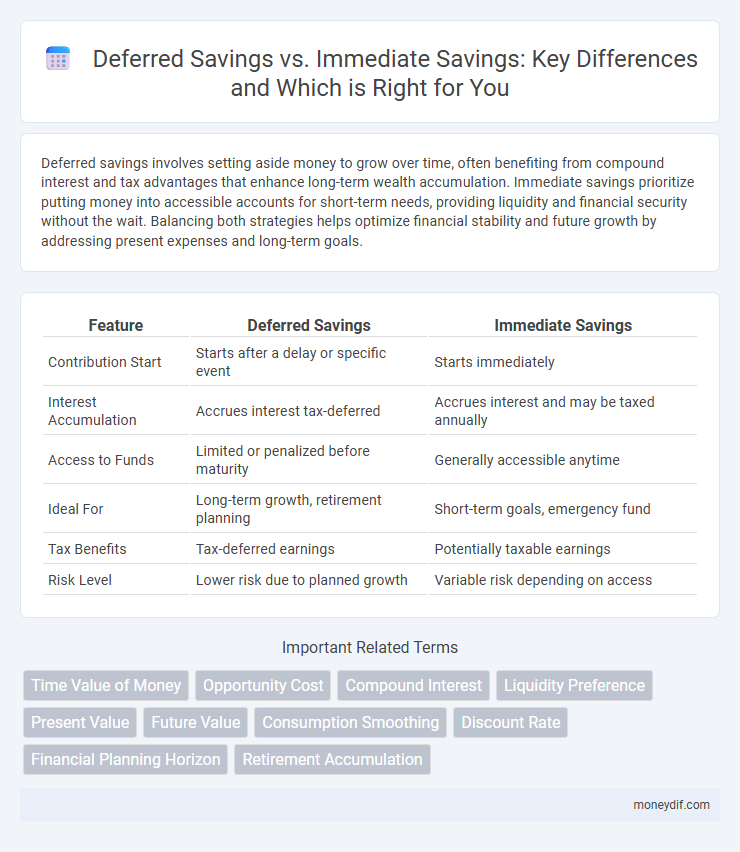

Deferred savings involves setting aside money to grow over time, often benefiting from compound interest and tax advantages that enhance long-term wealth accumulation. Immediate savings prioritize putting money into accessible accounts for short-term needs, providing liquidity and financial security without the wait. Balancing both strategies helps optimize financial stability and future growth by addressing present expenses and long-term goals.

Table of Comparison

| Feature | Deferred Savings | Immediate Savings |

|---|---|---|

| Contribution Start | Starts after a delay or specific event | Starts immediately |

| Interest Accumulation | Accrues interest tax-deferred | Accrues interest and may be taxed annually |

| Access to Funds | Limited or penalized before maturity | Generally accessible anytime |

| Ideal For | Long-term growth, retirement planning | Short-term goals, emergency fund |

| Tax Benefits | Tax-deferred earnings | Potentially taxable earnings |

| Risk Level | Lower risk due to planned growth | Variable risk depending on access |

Understanding Deferred Savings and Immediate Savings

Deferred savings involve setting aside money to be accessed at a later date, allowing interest or investment returns to accumulate over time, which can significantly enhance future financial security. Immediate savings focus on reserving funds that are readily available for short-term needs or emergencies, providing liquidity and peace of mind without sacrificing access. Understanding the balance between deferred and immediate savings is essential for effective financial planning and achieving both short-term flexibility and long-term growth.

Key Differences Between Deferred and Immediate Savings

Deferred savings involve setting aside funds to accumulate growth over time, typically through investment vehicles that benefit from compound interest and tax advantages. Immediate savings prioritize liquidity and accessibility, offering instant access to funds but usually with lower interest returns. The key difference lies in the balance between long-term growth potential in deferred savings and the ready availability of cash in immediate savings.

Benefits of Deferred Savings

Deferred savings offer the advantage of tax-deferred growth, allowing investments to compound without immediate tax liability, which maximizes long-term returns. This approach enables savers to contribute more during peak earning years and withdraw funds during retirement when income and tax brackets may be lower. Utilizing deferred savings vehicles like 401(k) plans or IRAs can significantly enhance retirement readiness through disciplined, long-term wealth accumulation.

Advantages of Immediate Savings

Immediate savings provide quick access to funds, allowing for greater financial flexibility and emergency preparedness. These savings earn interest or returns right away, enabling compounded growth over time without delay. By starting immediately, they reduce the risk of losing purchasing power due to inflation compared to deferred savings plans.

Risks Associated with Deferred Savings

Deferred savings carry the risk of inflation eroding the purchasing power of future funds, resulting in less real value than initially anticipated. Market volatility can impact investment returns, making the amount available at withdrawal uncertain compared to immediate savings with guaranteed returns. Unexpected financial needs may arise during the deferral period, limiting access to these funds and increasing reliance on high-interest debt options.

Flexibility of Immediate Savings Options

Immediate savings options offer greater flexibility by allowing account holders to access funds without penalties or waiting periods, enabling them to respond quickly to unexpected expenses or investment opportunities. Unlike deferred savings plans, which lock in funds until a specified maturity date, immediate savings accounts provide liquidity and ease of withdrawals, supporting short-term financial goals and cash flow management. This accessibility is particularly beneficial for managing emergencies and maintaining financial stability without sacrificing returns.

Long-term Growth: Deferred Savings Potential

Deferred savings offers significant long-term growth potential by allowing funds to compound over extended periods without early withdrawals. This strategy maximizes interest accumulation, often benefiting from tax-deferred growth depending on the account type. Compared to immediate savings, deferred savings can result in substantially higher returns through exponential compounding effects and strategic investment growth.

Accessibility and Liquidity in Immediate Savings

Immediate savings accounts offer high accessibility and liquidity, allowing account holders to withdraw funds anytime without penalties or delays. This contrasts with deferred savings, where funds are typically locked in for a set period, limiting access and reducing liquidity. The convenience of immediate savings makes them ideal for emergency funds and short-term financial needs.

Which Savings Strategy Fits Your Financial Goals?

Deferred savings involves postponing contributions to prioritize immediate expenses or investments, allowing potential growth through compound interest over time. Immediate savings emphasizes setting aside funds now to build an emergency fund or short-term goals, enhancing financial security and liquidity. Choosing between deferred and immediate savings depends on your financial goals, risk tolerance, and timeline for accessing funds.

Choosing Between Deferred and Immediate Savings: A Comparative Summary

Choosing between deferred and immediate savings depends on individual financial goals and time horizons. Deferred savings accounts typically offer higher interest rates due to longer lock-in periods, making them ideal for long-term objectives like retirement planning. Immediate savings provide quick access to funds and flexibility, suitable for emergency funds or short-term financial needs.

Important Terms

Time Value of Money

Deferred savings benefit from compound interest growth over time, increasing the future value compared to immediate savings deposited now. Immediate savings provide liquidity but may lose potential gains that deferred contributions accumulate through interest compounding and market returns.

Opportunity Cost

Opportunity cost quantifies the potential benefits lost when choosing immediate savings over deferred savings, as immediate savings might offer quick financial relief but miss out on higher future returns through compounding interest. Deferred savings leverage time and interest accumulation, often resulting in greater overall wealth compared to the shorter-term gains of immediate savings solutions.

Compound Interest

Compound interest significantly amplifies the growth of deferred savings by allowing interest to accumulate over a longer period before withdrawals begin, maximizing the effect of exponential growth compared to immediate savings, where interest compounds on a lower principal due to earlier withdrawals. Choosing deferred savings leverages the time value of money more effectively, resulting in substantially higher long-term returns than immediate savings under equivalent interest rates and compounding frequencies.

Liquidity Preference

Liquidity preference influences individual choices between deferred savings, which offer higher returns through long-term investment, and immediate savings, favored for easy access to funds and reduced risk. The trade-off reflects a balance between the desire for liquidity and the potential benefits of future financial growth.

Present Value

Present value calculations highlight that deferred savings often yield lower financial advantage compared to immediate savings due to the time value of money, where funds available now can be invested to generate returns. Immediate savings increase purchasing power and investment potential today, making them more valuable when discounted back to their present value.

Future Value

The future value of deferred savings typically grows larger over time due to compounded interest, whereas immediate savings start accumulating interest right away, potentially resulting in higher overall wealth if the interest rate is favorable. Choosing between deferred and immediate savings depends on the interest rate, time horizon, and the investor's cash flow needs, with deferred savings often benefiting from tax advantages and the power of compounding over a longer period.

Consumption Smoothing

Consumption smoothing involves balancing spending over time to maintain stable utility despite income fluctuations, achieved through deferred savings that postpone consumption for future use or immediate savings that provide liquidity for near-term expenses. Deferred savings often yield higher returns through interest accumulation but limit current consumption flexibility, while immediate savings offer quick access to funds but may sacrifice potential long-term growth.

Discount Rate

The discount rate quantifies the present value difference between deferred savings and immediate savings, reflecting the opportunity cost of capital and inflation expectations. A higher discount rate diminishes the attractiveness of deferred savings by increasing the value of immediate savings in today's terms.

Financial Planning Horizon

Financial planning horizon significantly influences the choice between deferred savings and immediate savings, as longer horizons favor deferred savings due to compounded growth benefits and tax advantages. Shorter horizons prioritize immediate savings to ensure liquidity and address near-term financial goals with minimal risk exposure.

Retirement Accumulation

Retirement accumulation hinges on the power of compound interest, making deferred savings typically more advantageous than immediate savings by allowing funds to grow longer before withdrawal. Choosing deferred savings plans often results in a larger retirement nest egg due to extended investment horizons and tax-deferred growth benefits.

Deferred Savings vs Immediate Savings Infographic

moneydif.com

moneydif.com