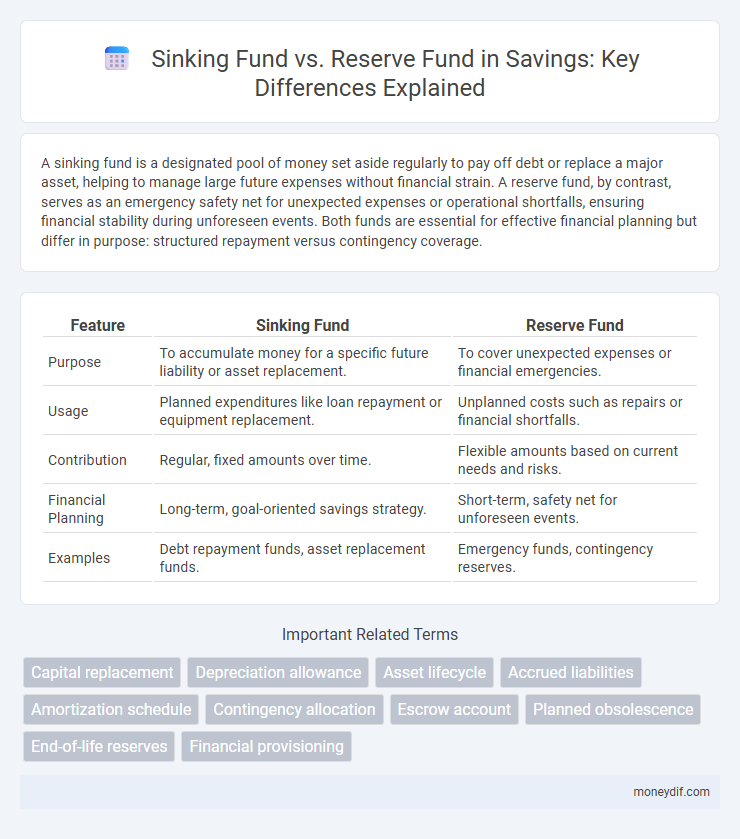

A sinking fund is a designated pool of money set aside regularly to pay off debt or replace a major asset, helping to manage large future expenses without financial strain. A reserve fund, by contrast, serves as an emergency safety net for unexpected expenses or operational shortfalls, ensuring financial stability during unforeseen events. Both funds are essential for effective financial planning but differ in purpose: structured repayment versus contingency coverage.

Table of Comparison

| Feature | Sinking Fund | Reserve Fund |

|---|---|---|

| Purpose | To accumulate money for a specific future liability or asset replacement. | To cover unexpected expenses or financial emergencies. |

| Usage | Planned expenditures like loan repayment or equipment replacement. | Unplanned costs such as repairs or financial shortfalls. |

| Contribution | Regular, fixed amounts over time. | Flexible amounts based on current needs and risks. |

| Financial Planning | Long-term, goal-oriented savings strategy. | Short-term, safety net for unforeseen events. |

| Examples | Debt repayment funds, asset replacement funds. | Emergency funds, contingency reserves. |

Understanding Sinking Funds: Definition and Purpose

A sinking fund is a financial strategy where a company or individual sets aside money periodically to repay a debt or replace a long-term asset, ensuring funds are available when obligations mature. Unlike a reserve fund, which provides a general safety net for unexpected expenses, a sinking fund is specifically earmarked for planned liabilities, enhancing fiscal discipline and reducing refinancing risk. Understanding the purpose of sinking funds helps in effective debt management and long-term financial planning.

What Are Reserve Funds? Key Characteristics

Reserve funds are specially designated savings set aside by organizations or individuals to cover unexpected expenses or financial emergencies, ensuring long-term financial stability. These funds typically maintain a minimum balance and are replenished regularly to address unforeseen liabilities, such as repairs, legal costs, or economic downturns. Unlike sinking funds, reserve funds provide flexible financial security without a predetermined payout schedule, emphasizing liquidity and risk management.

Sinking Fund vs Reserve Fund: Core Differences

A sinking fund is a dedicated savings account created to repay debt or replace a significant asset at a specific future date, ensuring financial obligations are met without strain. A reserve fund, however, serves as a financial safety net designed to cover unexpected expenses or emergencies, maintaining operational stability. The core difference lies in their purpose: sinking funds are goal-oriented and time-bound, while reserve funds provide ongoing financial security.

When to Use a Sinking Fund in Personal Finance

A sinking fund is ideal for personal finance when saving for specific, planned expenses such as a major purchase, home repairs, or upcoming debt repayments. It allows individuals to set aside money gradually over time, avoiding large lump-sum withdrawals or new debt. This strategy ensures financial preparedness and reduces stress by matching savings with anticipated financial obligations.

Best Scenarios for Utilizing a Reserve Fund

Reserve funds are best utilized in scenarios requiring long-term financial stability for unexpected expenses, such as emergency repairs in property management or unforeseen operational costs in businesses. These funds provide a safety net to cover irregular, high-cost events without disrupting regular budgeting or cash flows. Using a reserve fund ensures continuity and reduces reliance on external financing during fiscal uncertainties.

Financial Planning: Which Fund Suits Your Needs?

A sinking fund is ideal for planned, large expenses such as debt repayment or asset replacement, promoting disciplined savings through scheduled contributions. Reserve funds provide a financial safety net for unexpected emergencies or operational shortfalls, enhancing overall financial stability by maintaining liquidity. Understanding your cash flow patterns and risk tolerance helps determine which fund aligns best with your financial goals and planning strategy.

Benefits of Maintaining a Sinking Fund

Maintaining a sinking fund ensures systematic savings for future debt repayment or large asset replacement, reducing financial strain and improving creditworthiness. It provides a clear financial plan that mitigates the risk of unexpected expenses, promoting long-term fiscal stability. Regular contributions to a sinking fund enhance liquidity management and support strategic investment decisions.

Advantages of Building a Reserve Fund

Building a reserve fund offers financial stability by ensuring readily available resources to cover unexpected expenses or emergencies, reducing reliance on debt. Unlike sinking funds, reserve funds provide flexibility as they are not tied to specific asset replacement schedules, facilitating improved cash flow management. Maintaining a reserve fund strengthens an organization's creditworthiness and long-term sustainability by demonstrating prudent financial planning.

Common Mistakes: Sinking Fund and Reserve Fund Confusion

Confusing sinking funds with reserve funds often leads to improper financial planning and unmet future liabilities. Sinking funds are specifically designed for repaying debt or replacing assets, while reserve funds cover unexpected expenses and emergencies. Misallocating funds between these accounts can cause cash flow problems and undermine long-term savings goals.

Strategic Tips for Managing Sinking and Reserve Funds

Develop a clear timeline and funding goals to manage sinking funds efficiently, ensuring periodic contributions align with future debt repayments or asset replacements. Reserve funds require regular assessments of potential risks and unexpected expenses, maintaining liquidity without compromising financial stability. Utilize automated transfers and adjust contributions based on cash flow analysis to optimize the growth and availability of both sinking and reserve funds.

Important Terms

Capital replacement

A sinking fund systematically accumulates capital to replace assets at the end of their useful life, whereas a reserve fund is maintained to cover unexpected repairs or maintenance costs without a predetermined replacement schedule.

Depreciation allowance

Depreciation allowance funds asset value reduction by allocating costs, while sinking funds specifically accumulate capital for future asset replacement, and reserve funds provide general financial security without designated asset replacement purposes.

Asset lifecycle

Asset lifecycle management involves strategically allocating funds to ensure long-term maintenance and replacement, where a sinking fund accumulates money over time specifically for future asset replacement, while a reserve fund provides a broad financial buffer for unexpected repairs or emergencies. Sinking funds are often planned with precise timelines aligned to the asset's expected lifespan, whereas reserve funds offer flexibility to address various financial contingencies throughout the asset's operational duration.

Accrued liabilities

Accrued liabilities represent obligations for expenses incurred but not yet paid, affecting the sinking fund used to repay debt, whereas the reserve fund, designated for unforeseen expenses, generally does not directly impact accrued liabilities.

Amortization schedule

An amortization schedule outlines periodic loan payments including principal and interest, while sinking funds accumulate targeted amounts over time to repay debt, and reserve funds store resources for unforeseen expenses, each serving distinct financial planning purposes.

Contingency allocation

Contingency allocation involves strategically distributing funds between a sinking fund, designated for repaying debt or replacing assets, and a reserve fund, set aside for unforeseen expenses or emergencies.

Escrow account

An escrow account securely holds funds for specific obligations, often linked to sinking funds that systematically repay debt over time versus reserve funds, which are accumulated for unforeseen expenses or asset repairs. Sinking funds are legally designated for scheduled debt retirement, while reserve funds provide financial stability by covering unexpected costs without impacting principal debt obligations.

Planned obsolescence

Planned obsolescence accelerates asset replacement schedules, making sinking funds essential for systematically accumulating capital, while reserve funds provide flexible financial buffers for unexpected repairs or replacements.

End-of-life reserves

End-of-life reserves are financial provisions specifically accumulated within sinking funds to systematically retire debt, while reserve funds are broader financial resources set aside to manage unexpected expenses during a project's lifecycle.

Financial provisioning

Financial provisioning involves setting aside a sinking fund for debt repayment and a reserve fund for unexpected expenses to ensure organizational financial stability.

Sinking fund vs Reserve fund Infographic

moneydif.com

moneydif.com