Daily compounding maximizes the growth of savings by calculating interest every day, allowing earnings to generate interest more frequently compared to quarterly compounding. With quarterly compounding, interest is added only four times a year, resulting in slower accumulation of returns over time. Choosing daily compounding leads to higher overall returns and faster wealth accumulation through more frequent application of interest.

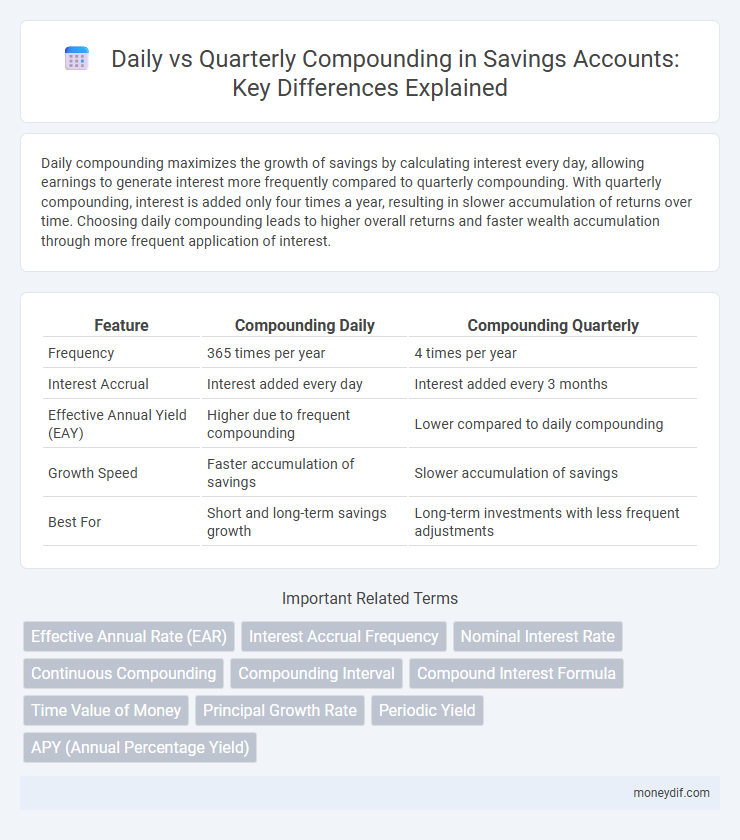

Table of Comparison

| Feature | Compounding Daily | Compounding Quarterly |

|---|---|---|

| Frequency | 365 times per year | 4 times per year |

| Interest Accrual | Interest added every day | Interest added every 3 months |

| Effective Annual Yield (EAY) | Higher due to frequent compounding | Lower compared to daily compounding |

| Growth Speed | Faster accumulation of savings | Slower accumulation of savings |

| Best For | Short and long-term savings growth | Long-term investments with less frequent adjustments |

Understanding Compounding: Daily vs Quarterly

Compounding daily accelerates interest growth by calculating and adding interest every day, which maximizes returns over time compared to quarterly compounding that applies interest only four times annually. The effective annual rate (EAR) from daily compounding consistently exceeds that of quarterly compounding due to more frequent interest-on-interest calculations. Understanding these differences is crucial for optimizing savings strategies and maximizing investment growth over extended periods.

How Compounding Frequency Impacts Savings Growth

Compounding frequency significantly impacts savings growth by determining how often interest is calculated and added to the principal balance. Daily compounding results in interest being computed every day, which accelerates the growth of savings compared to quarterly compounding, where interest is added only four times per year. Over time, higher compounding frequency leads to greater accumulated returns, maximizing the effect of interest on interest in your savings account.

The Mathematics Behind Daily and Quarterly Compounding

Compounding daily involves calculating interest on the initial principal and the accumulated interest every day, resulting in a higher effective annual rate compared to quarterly compounding, which calculates interest four times per year. The formula for daily compounding uses the expression A = P(1 + r/n)^(nt) where n equals 365, while quarterly compounding uses n equal to 4, demonstrating how increased compounding frequency accelerates growth of savings. Due to the exponential nature of compounding, the difference in accumulated interest between daily and quarterly compounding becomes more significant over longer investment horizons and higher interest rates.

Interest Rate Differences: Daily vs Quarterly Compounding

Daily compounding results in higher effective interest rates compared to quarterly compounding due to interest earning interest more frequently, accelerating growth on savings accounts. An interest rate compounded daily yields a greater annual percentage yield (APY) than the same nominal rate compounded quarterly, increasing the overall return on investments. This difference is particularly impactful for long-term savings, as the frequency of compounding amplifies the power of accumulated interest over time.

Real-World Examples: Daily vs Quarterly Compounding

Daily compounding accelerates interest growth by calculating and adding interest every day, leading to higher returns compared to quarterly compounding, which only updates interest four times a year. For example, an investment of $10,000 at a 5% annual interest rate compounded daily yields approximately $10,511 after one year, whereas quarterly compounding results in about $10,506. Over long periods, daily compounding significantly amplifies compound interest benefits, making it a preferable choice for savers seeking maximum growth.

Advantages of Daily Compounding for Savers

Daily compounding increases the frequency of interest calculations, allowing savers to earn interest on previously accrued interest more often than quarterly compounding. This results in higher effective annual returns and faster growth of savings over time. For long-term savers, daily compounding maximizes the power of exponential growth, enhancing overall investment gains.

When Quarterly Compounding Might Be Better

Quarterly compounding can be advantageous for investors who prefer predictable, periodic interest calculations that align with their cash flow schedules or tax planning strategies. In some cases, financial institutions offer higher nominal rates on quarterly compounding accounts, which may offset the more frequent compounding benefit of daily interest. For savers with longer-term horizons or those who plan to make periodic withdrawals, quarterly compounding can provide better alignment with their financial goals and reduce the complexity of tracking daily interest accruals.

Calculating Returns: Daily vs Quarterly Compounding Explained

Calculating returns with daily compounding involves interest being added to the principal balance every day, resulting in a higher effective annual rate compared to quarterly compounding, where interest is added four times per year. The formula for daily compounding is A = P(1 + r/365)^(365t), which captures the impact of frequent interest accumulation on investment growth. Quarterly compounding uses A = P(1 + r/4)^(4t), generally producing lower returns over time due to less frequent interest addition.

Common Savings Accounts: Which Compounding Do They Offer?

Common savings accounts typically offer compounding quarterly rather than daily, which affects interest growth over time. Daily compounding calculates interest on the principal and accumulated interest each day, resulting in faster growth compared to quarterly compounding that adds interest every three months. Understanding the compounding frequency in your savings account helps maximize returns by selecting accounts with more frequent compounding schedules.

Choosing the Best Compounding Option for Your Savings Goals

Compounding daily maximizes interest accumulation by calculating and adding earnings every day, significantly boosting savings growth compared to quarterly compounding which adds interest only four times a year. For high-yield savings accounts and long-term goals, daily compounding results in higher effective annual returns, enhancing overall portfolio value. Evaluating the compounding frequency alongside interest rates helps investors optimize their savings strategy for maximum financial gain.

Important Terms

Effective Annual Rate (EAR)

The Effective Annual Rate (EAR) measures the true annual interest earned, reflecting the impact of compounding frequency; compounding daily results in a higher EAR compared to compounding quarterly due to interest being calculated and added to the principal more frequently. For example, a nominal rate of 6% compounded daily yields an EAR of approximately 6.18%, whereas the same rate compounded quarterly results in an EAR of about 6.14%, illustrating the benefit of more frequent compounding on investment growth.

Interest Accrual Frequency

Interest accrual frequency significantly impacts effective yield, with daily compounding generating higher returns than quarterly compounding due to interest being added to the principal more frequently, thus increasing the base for subsequent interest calculations. This effect is amplified over longer periods, where compounding daily maximizes the exponential growth of investments or loans compared to quarterly intervals.

Nominal Interest Rate

Nominal interest rate represents the stated annual rate without accounting for compounding frequency, but the effective annual rate differs significantly when compounding daily versus compounding quarterly due to the more frequent interest accrual in daily compounding. Daily compounding increases the accumulated interest yield compared to quarterly compounding, making it crucial for investors and borrowers to understand how nominal rates translate into actual returns or costs.

Continuous Compounding

Continuous compounding calculates interest assuming it is being compounded an infinite number of times per year, resulting in a higher effective annual rate compared to daily or quarterly compounding. While daily compounding applies interest 365 times annually and quarterly compounding only 4 times, continuous compounding maximizes growth by using the mathematical constant e raised to the power of the interest rate times time.

Compounding Interval

Compounding interval determines how frequently interest is calculated and added to the principal balance, with daily compounding applying interest every day and quarterly compounding every three months. Daily compounding results in higher effective annual returns compared to quarterly compounding due to more frequent interest calculations and reinvestment.

Compound Interest Formula

The compound interest formula A = P(1 + r/n)^(nt) calculates investment growth, where daily compounding (n=365) yields higher returns than quarterly compounding (n=4) due to more frequent interest application. Over the same period and interest rate, daily compounding maximizes the effective annual rate by continuously adding interest to the principal, resulting in greater accumulated wealth.

Time Value of Money

Compounding daily increases the effective annual yield due to interest being calculated and added to the principal more frequently than quarterly compounding, resulting in higher accumulated value over time. This effect is more pronounced with higher interest rates and longer investment periods, highlighting the importance of compounding frequency in maximizing the time value of money.

Principal Growth Rate

Principal Growth Rate accelerated by compounding daily results in higher effective returns compared to compounding quarterly due to more frequent interest calculations. The formula \( A = P \left(1 + \frac{r}{n}\right)^{nt} \) shows that increasing compounding frequency \( n \) directly enhances the exponential growth of the principal over time.

Periodic Yield

Periodic yield differs significantly between daily and quarterly compounding due to the frequency of interest application, with daily compounding producing higher effective returns despite a lower nominal rate per period. The increased compounding intervals in daily compounding accelerate interest accumulation, maximizing investment growth compared to quarterly compounding where interest is applied four times a year.

APY (Annual Percentage Yield)

Annual Percentage Yield (APY) reflects the real rate of return on an investment, accounting for compounding frequency differences such as daily versus quarterly compounding. Daily compounding results in a higher APY compared to quarterly compounding due to interest being calculated and added to the principal more frequently, maximizing the effect of interest-on-interest.

Compounding Daily vs Compounding Quarterly Infographic

moneydif.com

moneydif.com