A piggyback account allows you to attach your credit history to a more established account, improving your credit score by leveraging the primary account holder's creditworthiness. In contrast, a linked account connects two bank accounts for easy transfers or overdraft protection but does not affect your credit history. Choosing between a piggyback and a linked account depends on whether your priority is credit improvement or seamless fund management.

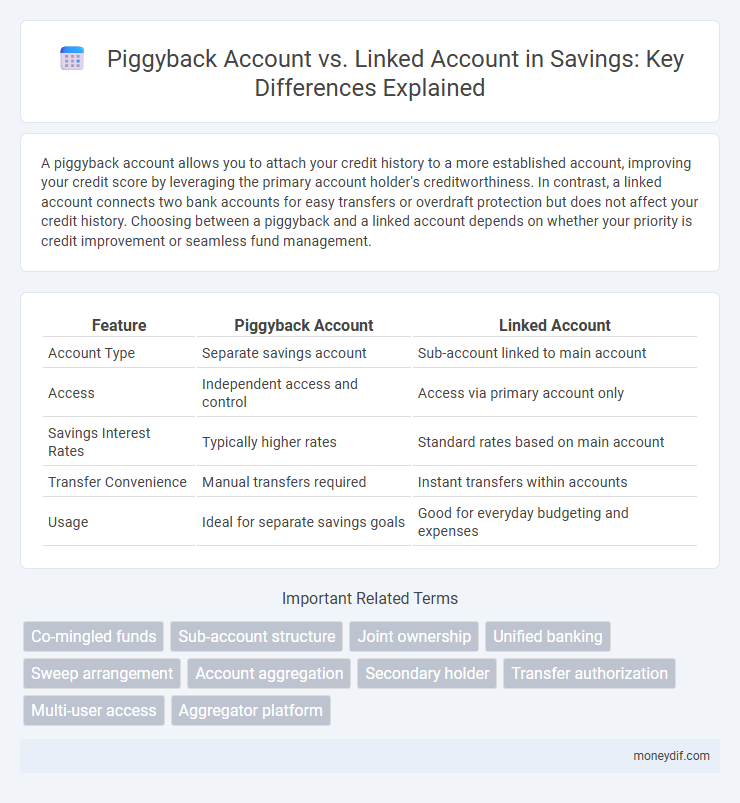

Table of Comparison

| Feature | Piggyback Account | Linked Account |

|---|---|---|

| Account Type | Separate savings account | Sub-account linked to main account |

| Access | Independent access and control | Access via primary account only |

| Savings Interest Rates | Typically higher rates | Standard rates based on main account |

| Transfer Convenience | Manual transfers required | Instant transfers within accounts |

| Usage | Ideal for separate savings goals | Good for everyday budgeting and expenses |

Introduction to Piggyback and Linked Accounts

Piggyback accounts allow users to leverage an existing credit profile by adding them as an authorized user, boosting credit scores without creating a new account. Linked accounts connect multiple bank or credit accounts for streamlined management and consolidated transactions but do not directly impact credit scores. Understanding the distinction helps individuals optimize their financial strategy by enhancing credit through piggybacking or simplifying account access via linked accounts.

Defining Piggyback Accounts

A Piggyback account is a type of bank account that links to a primary account to facilitate shared access or benefits like deposit insurance coverage beyond standard limits. Unlike a linked account, which simply connects separate accounts for easy fund transfers, a Piggyback account combines account ownership features without merging balances. This structure helps in maximizing FDIC insurance protection by designating the secondary holder as a co-owner rather than just an authorized user.

What Are Linked Accounts?

Linked accounts are multiple bank or savings accounts connected under a single customer profile, allowing seamless transfers and consolidated management of funds. They enable efficient tracking of finances and can provide benefits like linked overdraft protection or easier bill payments. This setup enhances convenience and financial organization by integrating various accounts into a unified system.

Key Differences Between Piggyback and Linked Accounts

Piggyback accounts allow users to build credit by being added as an authorized user on someone else's credit card, whereas linked accounts typically refer to associating multiple bank accounts for easier money management. Piggyback accounts impact credit scores and credit history, while linked accounts primarily facilitate fund transfers and consolidated financial oversight. The key difference lies in credit reporting eligibility for piggyback accounts versus transactional convenience for linked accounts.

Pros and Cons of Piggyback Accounts

Piggyback accounts enable individuals to build or improve credit by being added as an authorized user on another person's credit card, often benefiting from the primary account holder's positive payment history and credit utilization. The major advantage includes easy credit score enhancement without requiring a new credit application, but risks include potential negative impacts if the primary account holder mismanages the account or accumulates high debt. Unlike linked accounts that share bank balances for seamless transactions, piggyback accounts primarily impact credit profiles and offer less financial control or direct account access to the secondary user.

Advantages and Disadvantages of Linked Accounts

Linked accounts offer streamlined fund transfers and consolidated financial management, reducing the need to maintain multiple credentials and simplifying bill payments. However, linked accounts may pose security risks if one account is compromised, potentially exposing all connected accounts and increasing vulnerability to unauthorized access. Additionally, linked accounts can limit flexibility since funds are often tied together, restricting the ability to maximize interest rates or benefits offered by independent accounts.

Security Features: Piggyback vs. Linked Accounts

Piggyback accounts offer enhanced security features by allowing users to build credit with a higher level of control and oversight from the primary account holder, minimizing the risk of unauthorized access. Linked accounts share direct access to funds, which may increase vulnerability to fraud if either party's credentials are compromised. Security protocols in piggyback accounts often include dual-authentication and monitoring systems that provide an extra layer of protection compared to traditional linked accounts.

Best Use Cases for Piggyback Accounts

Piggyback accounts are best used for building or rehabilitating credit by leveraging an authorized user's positive credit history on another person's account, typically a trusted family member or friend. These accounts can help individuals with limited or poor credit history gain access to better credit opportunities and improve credit scores quickly without the risks associated with traditional loans or credit applications. Ideal users include young adults, first-time borrowers, or those recovering from financial setbacks who need to establish a strong credit foundation.

When to Choose Linked Accounts

Linked accounts are ideal for individuals seeking seamless access to funds between their checking and savings accounts, enabling quick transfers for bill payments or emergency expenses. Choose linked accounts when prioritizing liquidity, automatic overdraft protection, and consolidated financial management within one institution. This option suits those who want to optimize cash flow without sacrificing the benefits of having a dedicated savings vehicle.

Making the Right Choice for Your Savings

Choosing between a Piggyback account and a Linked account depends on your savings goals and financial habits. A Piggyback account allows easier access and joint control, ideal for shared savings or emergency funds, while a Linked account offers seamless transfers and automated savings from your primary account. Evaluating interest rates, fees, and accessibility ensures the right choice for optimizing your savings growth.

Important Terms

Co-mingled funds

Co-mingled funds pool assets from multiple investors into a single portfolio, offering diversified exposure, while a Co-mingled Piggyback account allows one investor to replicate another's trades within the same fund structure, optimizing execution and fees. In contrast, a Linked account connects separate individual accounts under one management to facilitate consolidated reporting and strategy alignment without merging assets.

Sub-account structure

A sub-account structure allows for segmented account management under a primary account, distinguishing piggyback accounts that share transaction privileges and resources from linked accounts that maintain separate control but enable consolidated reporting. Piggyback accounts optimize shared access and resource utilization, while linked accounts facilitate independent activity tracking within an integrated financial framework.

Joint ownership

Joint ownership allows multiple individuals to share control and liability of a single Piggyback account, enabling co-account holders to build credit simultaneously. Linked accounts, however, connect separate individual accounts to facilitate shared transactions or fund transfers without merging credit profiles or ownership rights.

Unified banking

Unified banking integrates multiple financial services into a single platform, offering streamlined access and management compared to traditional linked accounts, which require separate authentication for each service. Piggyback accounts enhance credit profiles by leveraging the primary account holder's credit history, unlike linked accounts that merely connect financial accounts without credit-sharing benefits.

Sweep arrangement

Sweep arrangements automate the transfer of excess funds between linked accounts to maximize interest or optimize cash flow. Piggyback accounts, a type of linked account, allow customers to boost credit history by adding authorized users, but do not inherently feature automatic fund transfer like sweep arrangements.

Account aggregation

Account aggregation consolidates financial data from multiple sources into a single platform, enhancing user experience and financial oversight. Piggyback accounts allow users to access third-party financial information without full account ownership, whereas linked accounts require direct user authorization and ownership for data synchronization.

Secondary holder

A secondary holder in a piggyback account gains credit benefits by being added to a primary account with good credit history, while a linked account involves two separate accounts connected for financial management but does not share credit history. Piggybacking typically impacts credit scores positively for the secondary holder, whereas linked accounts primarily facilitate joint access without directly affecting credit reports.

Transfer authorization

Transfer authorization allows account holders to designate permissions for third parties to initiate transactions, with Piggyback accounts typically providing secondary access under primary account privileges, while Linked accounts operate independently but share transaction capabilities through authorized connections. Understanding the difference between Piggyback and Linked accounts is crucial for managing access controls, security protocols, and transaction limitations within financial institutions.

Multi-user access

Multi-user access in Piggyback accounts enables shared usage under a single primary login, facilitating transactions and activity visibility without separate credentials. Linked accounts, however, involve individual login credentials connected for consolidated management, allowing distinct user control while synchronizing access and account data.

Aggregator platform

An aggregator platform consolidates financial data from multiple sources, allowing users to manage Piggyback accounts, which are indirectly linked through a primary account, alongside directly connected Linked accounts for seamless transaction tracking. Piggyback accounts offer extended access by leveraging permissions from Linked accounts, enhancing user control and data integration within a unified interface.

Piggyback account vs Linked account Infographic

moneydif.com

moneydif.com