A 529 Plan offers tax advantages specifically for education expenses, allowing contributions to grow tax-free and withdrawals to be exempt from federal taxes when used for qualified education costs. Custodial accounts provide more flexibility in usage but lack the tax benefits tied to education, meaning earnings can be subject to income tax. Choosing between the two depends on whether the primary goal is tax-efficient education savings or broader financial support for the beneficiary.

Table of Comparison

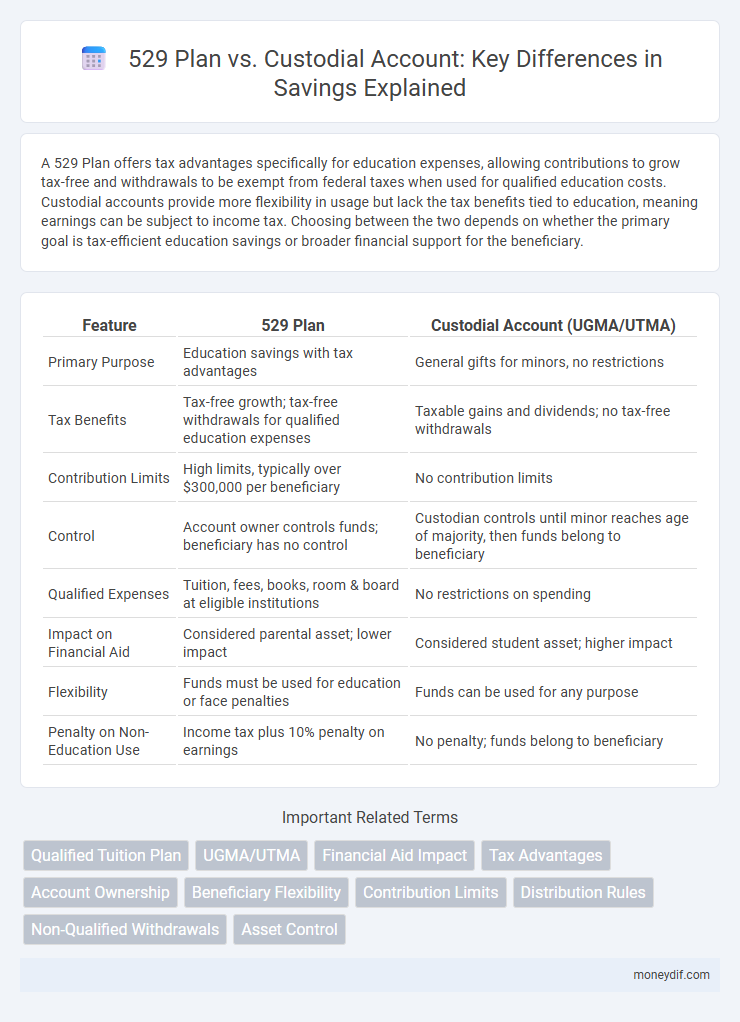

| Feature | 529 Plan | Custodial Account (UGMA/UTMA) |

|---|---|---|

| Primary Purpose | Education savings with tax advantages | General gifts for minors, no restrictions |

| Tax Benefits | Tax-free growth; tax-free withdrawals for qualified education expenses | Taxable gains and dividends; no tax-free withdrawals |

| Contribution Limits | High limits, typically over $300,000 per beneficiary | No contribution limits |

| Control | Account owner controls funds; beneficiary has no control | Custodian controls until minor reaches age of majority, then funds belong to beneficiary |

| Qualified Expenses | Tuition, fees, books, room & board at eligible institutions | No restrictions on spending |

| Impact on Financial Aid | Considered parental asset; lower impact | Considered student asset; higher impact |

| Flexibility | Funds must be used for education or face penalties | Funds can be used for any purpose |

| Penalty on Non-Education Use | Income tax plus 10% penalty on earnings | No penalty; funds belong to beneficiary |

Understanding the Basics: 529 Plan vs Custodial Account

A 529 plan offers tax-advantaged savings exclusively for education expenses, allowing growth to compound tax-free when used for qualified costs, while a custodial account provides general investment flexibility but is subject to fewer tax benefits and may impact financial aid eligibility. Contributions to a 529 plan remain under the account owner's control, whereas assets in a custodial account legally belong to the minor once they reach the age of majority, typically 18 or 21. Understanding these fundamental differences helps determine the best savings vehicle for education goals and overall financial planning.

Key Features of a 529 Plan

A 529 Plan offers tax advantages such as tax-free growth and tax-free withdrawals when funds are used for qualified education expenses, making it a powerful tool for college savings. Contributions to a 529 Plan are made with after-tax dollars, but many states provide tax deductions or credits, enhancing its overall savings potential. The plan also allows high contribution limits and account ownership remains with the donor, ensuring control over distributions without impacting the beneficiary's financial aid eligibility.

Key Features of a Custodial Account

Custodial accounts offer flexible savings with no contribution limits, making them ideal for gifting assets to minors while allowing fund usage for broader purposes beyond education. Managed by a custodian until the minor reaches the age of majority, these accounts provide control over investments such as stocks, bonds, and mutual funds. Unlike 529 plans, custodial accounts do not offer tax-free growth for education expenses but allow funds to be used without restrictions once the beneficiary is of age.

Tax Advantages Compared: 529 Plan vs Custodial Account

529 Plans offer significant tax advantages, including tax-free growth and tax-free withdrawals for qualified education expenses, while contributions may be eligible for state tax deductions or credits. In contrast, custodial accounts have no special tax benefits; earnings are subject to annual taxes, and the first $1,250 of unearned income is tax-free with higher rates applying beyond that threshold. The 529 Plan's tax efficiency often makes it a more attractive choice for educational savings compared to custodial accounts, which may incur higher tax liabilities.

Contribution Limits and Rules

529 Plans offer high contribution limits, often exceeding $300,000 per beneficiary depending on the state, allowing substantial tax-advantaged savings for education. Custodial accounts, governed by the Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA), have no specific contribution limits but are subject to annual gift tax exclusions, typically $17,000 per donor in 2024. Unlike custodial accounts, 529 Plans restrict funds to education expenses and maintain control with the account owner until disbursement.

Eligible Expenses and Usage Flexibility

A 529 Plan allows tax-free withdrawals for qualified education expenses, including tuition, fees, books, and room and board at accredited institutions. Custodial accounts offer greater flexibility, permitting funds to be used for a broader range of expenses beyond education, though distributions are subject to taxes. Understanding the restrictions on eligible expenses and usage flexibility helps optimize savings strategies based on educational goals and financial needs.

Control and Ownership Differences

A 529 Plan offers the account owner--typically a parent or guardian--full control over the funds, retaining ownership and deciding when and how the money is used for qualified educational expenses. Custodial accounts, governed by UGMA/UTMA laws, transfer ownership to the minor once they reach the age of majority, giving the beneficiary full control over the funds. This fundamental difference impacts both the flexibility in fund usage and long-term control, making 529 Plans more restrictive but offering parental oversight, while custodial accounts provide the beneficiary with unrestricted access upon adulthood.

Financial Aid Impact: 529 Plan vs Custodial Account

529 Plans offer favorable treatment for financial aid as they are considered parental assets, typically affecting aid eligibility less, whereas Custodial Accounts are counted as student assets, significantly reducing financial aid opportunities. The Expected Family Contribution (EFC) increases more with Custodial Accounts, potentially decreasing need-based aid by up to 50% of the asset amount. Families aiming to maximize financial aid eligibility often prefer 529 Plans due to their minimal impact on aid calculations compared to Custodial Accounts.

Pros and Cons of 529 Plans

529 Plans offer significant tax advantages, including tax-free growth and tax-free withdrawals for qualified education expenses, making them highly beneficial for college savings. Contributions are limited and typically restricted to educational use, which can be a downside if funds are needed for other purposes, and penalties apply for non-qualified withdrawals. The plan allows for high contribution limits and control by the account owner, but investment options are generally limited compared to other savings accounts like custodial accounts.

Pros and Cons of Custodial Accounts

Custodial accounts offer flexibility in use, allowing funds to be spent on a wide range of expenses beyond education, which is a significant advantage over 529 plans. However, custodial accounts have fewer tax benefits and the assets become the beneficiary's property at the age of majority, reducing parental control. These accounts may also impact financial aid eligibility more negatively compared to 529 plans, making them less advantageous for families focused on maximizing education savings.

Important Terms

Qualified Tuition Plan

Qualified Tuition Plans (QTPs), commonly known as 529 Plans, offer tax-advantaged savings specifically for education expenses, allowing earnings to grow federally tax-free and withdrawals for qualified education costs to avoid federal taxes. Unlike Custodial Accounts (UGMA/UTMA), 529 Plans maintain control with the account owner, provide higher contribution limits, and potential state tax benefits, while Custodial Accounts transfer assets to the beneficiary at legal age and may impact financial aid eligibility more significantly.

UGMA/UTMA

UGMA/UTMA custodial accounts offer flexible investment options and unrestricted use of funds for the beneficiary, unlike 529 plans which are specifically designed for qualified education expenses and provide tax advantages. Contributions to custodial accounts are considered completed gifts and may impact financial aid eligibility more than 529 plans, which allow tax-free growth and withdrawals when used for education.

Financial Aid Impact

Financial aid calculations typically treat 529 Plan assets more favorably than Custodial accounts, as 529 Plans are considered parental assets, reducing expected family contribution and increasing aid eligibility. Custodial accounts are counted as student assets, which can significantly decrease financial aid awards due to higher assessed rates in the FAFSA formula.

Tax Advantages

529 Plans offer tax-free growth and tax-free withdrawals for qualified education expenses, making them highly efficient for college savings compared to custodial accounts. Custodial accounts, such as UGMA/UTMA, are subject to taxes on unearned income and lack the specific tax benefits for education, often resulting in a higher tax burden.

Account Ownership

Account ownership for a 529 Plan is held by the account owner, typically a parent or guardian, who maintains control over investment decisions and disbursements, whereas a Custodial account (UGMA/UTMA) transfers ownership to the minor once they reach the age of majority, offering less control to the custodian. Tax advantages of 529 Plans include tax-free growth and withdrawals for qualified education expenses, while Custodial accounts provide more flexible usage but are subject to taxation on unearned income and financial aid impact.

Beneficiary Flexibility

529 Plans offer greater beneficiary flexibility by allowing account owners to change the designated beneficiary to another qualifying family member without tax penalties, unlike Custodial Accounts, which irrevocably assign ownership to the minor beneficiary. This feature makes 529 Plans more adaptable for families with multiple potential college beneficiaries, whereas Custodial Accounts are fixed once established.

Contribution Limits

529 Plans have annual contribution limits generally set by states, often exceeding $300,000 in total account value, with no income restrictions and tax-free growth for qualified education expenses. Custodial accounts under the Uniform Transfers to Minors Act (UTMA) have no statutory contribution limits but impact financial aid eligibility and lack tax benefits, while the assets are owned by the minor upon reaching adulthood.

Distribution Rules

Distribution rules for 529 Plans require funds to be used for qualified education expenses without incurring federal taxes, whereas Custodial accounts offer more flexible distributions but may trigger capital gains taxes and affect financial aid eligibility. Contributions to 529 Plans grow tax-free and distributions are exempt from federal income tax when used appropriately, while Custodial account withdrawals have no restrictions but result in tax liabilities based on the beneficiary's investment gains.

Non-Qualified Withdrawals

Non-qualified withdrawals from a 529 Plan incur federal income tax on earnings plus a 10% penalty, whereas custodial accounts allow penalty-free withdrawals but subject earnings to estate and gift taxes and potentially higher income tax rates. Unlike 529 Plans, custodial accounts lack tax advantages for education expenses, making 529 Plans more efficient for qualified education funding.

Asset Control

Asset Control within a 529 Plan offers tax-advantaged growth and state-specific benefits while maintaining the account owner's authority over contributions and withdrawals. Custodial accounts, governed by the Uniform Transfers to Minors Act (UTMA/UGMA), transfer asset control to the minor at the age of majority, potentially affecting financial aid eligibility and offering less tax efficiency compared to 529 Plans.

529 Plan vs Custodial account Infographic

moneydif.com

moneydif.com