Choosing between annuity and lump-sum savings depends on your financial goals and risk tolerance. Annuities provide a steady stream of income over time, offering financial stability and predictable cash flow. Lump-sum savings allow for greater flexibility and potential growth through investments but come with higher market risk and require disciplined management.

Table of Comparison

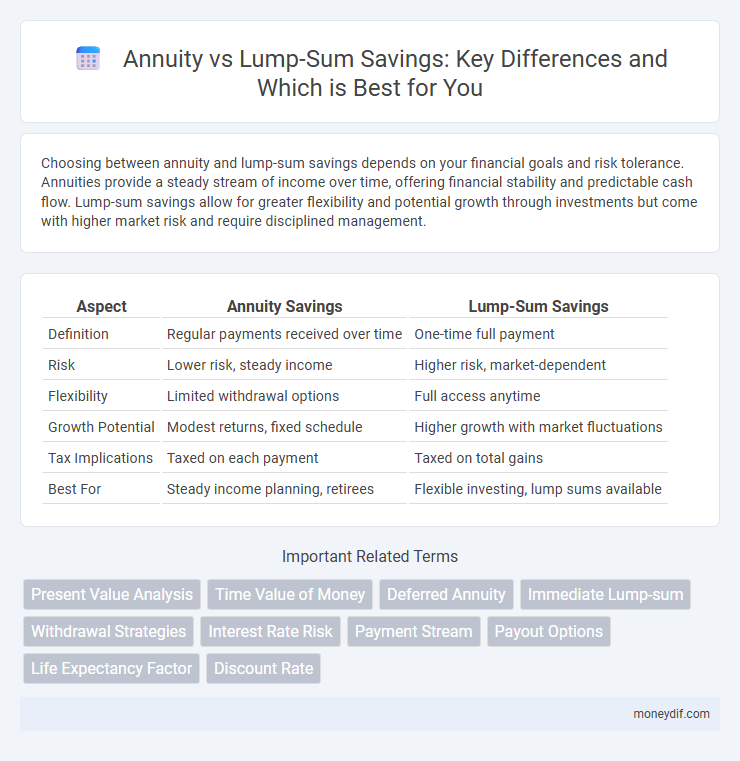

| Aspect | Annuity Savings | Lump-Sum Savings |

|---|---|---|

| Definition | Regular payments received over time | One-time full payment |

| Risk | Lower risk, steady income | Higher risk, market-dependent |

| Flexibility | Limited withdrawal options | Full access anytime |

| Growth Potential | Modest returns, fixed schedule | Higher growth with market fluctuations |

| Tax Implications | Taxed on each payment | Taxed on total gains |

| Best For | Steady income planning, retirees | Flexible investing, lump sums available |

Understanding Annuity and Lump-Sum Savings

Annuity savings provide a steady income stream through regular payments over time, ensuring financial stability during retirement. Lump-sum savings involve investing or using a one-time large amount, offering flexibility but requiring careful management to avoid depletion. Understanding the trade-offs between predictable annuity income and the control of lump-sum funds is crucial for effective retirement planning.

Key Differences Between Annuity and Lump-Sum Options

Annuities provide a steady stream of income over time, offering financial security with regular payments typically used for retirement planning, whereas lump-sum savings involve receiving or investing a large amount of money at once, allowing for immediate use or growth potential. Annuities reduce the risk of outliving savings by converting assets into guaranteed payouts, while lump-sum options carry market risk but offer greater flexibility and control over investment choices. Understanding these key differences helps tailor savings strategies to individual financial goals and risk tolerance.

Pros and Cons of Annuity Savings

Annuity savings offer a steady income stream, providing financial security and predictable cash flow, which is ideal for retirement planning. However, they often lack liquidity, limiting access to funds before maturity, and may offer lower returns compared to lump-sum investments due to fees and fixed interest rates. Choosing an annuity requires weighing guaranteed income benefits against reduced flexibility and potential inflation risk.

Pros and Cons of Lump-Sum Savings

Lump-sum savings provide immediate access to a large amount of money, allowing for flexible investment opportunities and potential for higher returns. However, the risk lies in market volatility, which can significantly impact the principal value if invested improperly. Lack of steady income and temptation for premature spending are common drawbacks compared to annuities.

How Interest Rates Impact Annuity vs Lump-Sum

High interest rates increase the growth potential of lump-sum savings by compounding earnings over time, often leading to higher overall returns compared to annuities. Annuities provide fixed or variable payments that may not keep pace with rising interest rates, potentially reducing purchasing power in a high-rate environment. Investors should evaluate current and projected interest rates when choosing between lump-sum investments and annuity contracts to optimize long-term savings growth.

Tax Implications of Annuity vs Lump-Sum Savings

Annuity payments are typically taxed as ordinary income over the payout period, spreading the tax burden and potentially lowering annual tax liability. Lump-sum savings withdrawals may result in a significant tax hit in the year of withdrawal, including potential penalties for early distribution from retirement accounts. Understanding the tax implications of annuities versus lump sums is crucial for optimizing after-tax returns and aligning with long-term financial goals.

Risk Factors in Annuity and Lump-Sum Investments

Annuity investments carry risks such as inflation erosion and issuer credit risk, which can reduce purchasing power and result in potential loss if the insurer defaults. Lump-sum savings are exposed to market volatility and timing risk, where investing a large amount at once may lead to significant losses in a declining market. Diversification and careful risk assessment are essential in managing uncertainties associated with both annuity and lump-sum investment strategies.

Suitability: Who Benefits from Annuity or Lump-Sum?

Annuities suit individuals seeking steady, guaranteed income streams during retirement, especially those cautious about outliving their savings or needing predictable cash flow. Lump-sum savings benefit those who prefer full control over their funds, have higher risk tolerance, and may want to invest or spend larger amounts upfront. Choosing between annuity and lump-sum depends on factors like age, financial goals, risk appetite, and income stability needs.

Long-Term Growth Potential of Each Savings Method

Annuities offer steady, guaranteed income streams over time, making them suitable for risk-averse individuals seeking predictable long-term returns. Lump-sum investments have the potential for higher long-term growth through market exposure and compounding interest but carry increased volatility and risk. Choosing between annuity and lump-sum savings depends on balancing growth potential with risk tolerance and income stability preferences.

Making the Right Choice: Annuity or Lump-Sum?

Choosing between annuity and lump-sum savings depends on financial goals and risk tolerance. Annuities provide a steady income stream, ideal for long-term security and retirement planning, while lump-sum offers immediate access to the entire amount for investments or large expenses. Evaluating cash flow needs, tax implications, and market conditions helps in making the right choice tailored to individual financial situations.

Important Terms

Present Value Analysis

Present Value Analysis calculates the current worth of future cash flows by discounting annuity payments or lump-sum amounts at a specific interest rate, emphasizing the time value of money. Comparing annuities, which provide periodic payments, to lump-sum savings highlights differences in total value depending on payment frequency, interest rate, and investment horizon.

Time Value of Money

The Time Value of Money (TVM) concept reveals that receiving an annuity--equal periodic payments--can accumulate more wealth over time compared to a single lump-sum savings due to the effect of compound interest on each installment. Annuities leverage consistent contributions and interest compounding to enhance future value, while lump-sum investments depend solely on the initial principal's growth rate.

Deferred Annuity

Deferred annuities provide a stream of income starting at a future date, allowing savings to grow tax-deferred compared to lump-sum savings that offer immediate access but lack tax deferral benefits. Choosing deferred annuities optimizes retirement income planning by balancing growth potential and income security versus the liquidity and flexibility of lump-sum distributions.

Immediate Lump-sum

Immediate lump-sum withdrawals provide instant access to savings, contrasting with annuities that distribute fixed payments over time, optimizing liquidity for urgent financial needs. Selecting between an annuity and lump-sum savings impacts tax liabilities and long-term income stability, with immediate lump-sum options offering flexibility but potentially higher tax burdens.

Withdrawal Strategies

Withdrawal strategies for annuities typically focus on generating steady, guaranteed income streams over a specified period or the retiree's lifetime, leveraging products such as immediate or fixed annuities to reduce longevity risk. Lump-sum savings emphasize flexible withdrawal methods like the 4% rule or systematic withdrawals, balancing growth potential with the risk of depleting funds prematurely.

Interest Rate Risk

Interest rate risk significantly impacts the relative value of annuity payments versus lump-sum savings, as fluctuating rates alter the present value and purchasing power of fixed annuity streams. Higher interest rates typically favor lump-sum investments by increasing potential returns, while lower rates enhance the appeal of guaranteed annuity income.

Payment Stream

Payment stream in annuities provides predictable, periodic disbursements over a set period or lifetime, optimizing steady income flow and financial planning reliability. In contrast, lump-sum savings offer immediate access to a large amount but lack ongoing income structure, demanding disciplined withdrawal strategies to sustain long-term financial stability.

Payout Options

Annuity payout options provide a steady stream of income over time, ideal for long-term financial security, whereas lump-sum distributions offer immediate access to the entire savings amount but carry the risk of quicker depletion. Choosing between annuity and lump-sum depends on individual retirement goals, risk tolerance, and tax implications associated with each payout method.

Life Expectancy Factor

Life expectancy significantly influences the choice between annuity and lump-sum savings, as longer lifespans favor annuities for guaranteed lifetime income and financial security. Actuarial data shows individuals with higher life expectancy benefit more from annuity products by mitigating longevity risk and ensuring steady cash flow throughout retirement.

Discount Rate

The discount rate is crucial in comparing annuity versus lump-sum savings because it determines the present value of future cash flows, influencing the attractiveness of receiving periodic payments versus a single upfront amount. Higher discount rates reduce the present value of annuity payments, often making lump-sum withdrawals more financially advantageous.

Annuity vs Lump-sum savings Infographic

moneydif.com

moneydif.com