A Rainy Day Fund is a designated savings account set aside for unexpected expenses or emergencies, offering financial security during unforeseen events. In contrast, a Slush Fund refers to money reserved for discretionary or non-essential spending, often lacking strict budgeting or transparency. Prioritizing a Rainy Day Fund ensures preparedness and stability, while a Slush Fund provides flexibility but can undermine long-term financial goals.

Table of Comparison

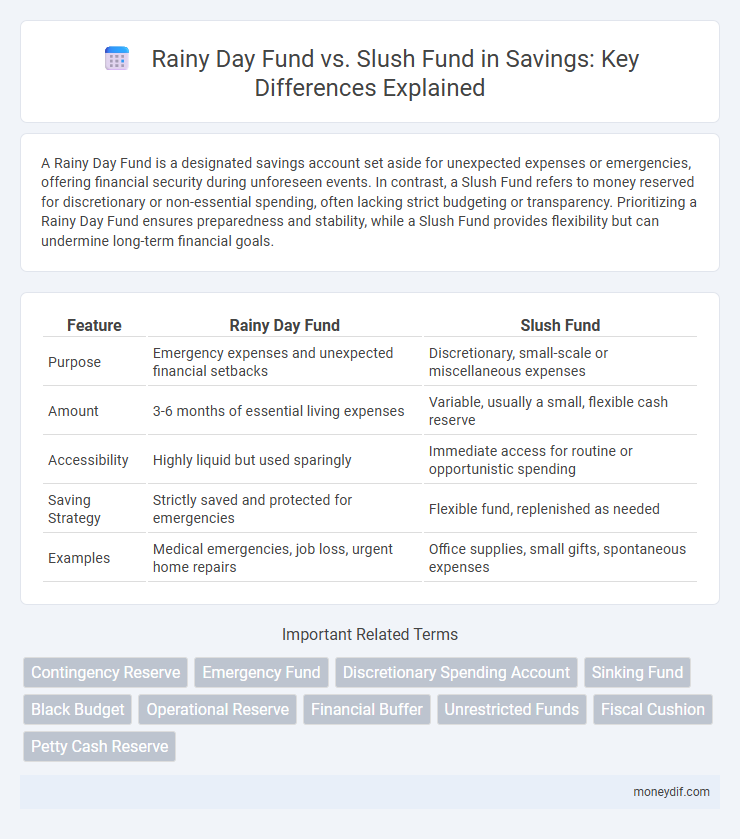

| Feature | Rainy Day Fund | Slush Fund |

|---|---|---|

| Purpose | Emergency expenses and unexpected financial setbacks | Discretionary, small-scale or miscellaneous expenses |

| Amount | 3-6 months of essential living expenses | Variable, usually a small, flexible cash reserve |

| Accessibility | Highly liquid but used sparingly | Immediate access for routine or opportunistic spending |

| Saving Strategy | Strictly saved and protected for emergencies | Flexible fund, replenished as needed |

| Examples | Medical emergencies, job loss, urgent home repairs | Office supplies, small gifts, spontaneous expenses |

Understanding Rainy Day Funds

A Rainy Day Fund is a designated savings reserve specifically set aside for unexpected expenses or financial emergencies, ensuring financial stability during unforeseen circumstances. It typically covers short-term needs such as medical bills, car repairs, or job loss, helping avoid debt accumulation. Unlike a slush fund, which may lack clear purpose or discipline, a Rainy Day Fund is strategically planned and managed to protect against economic disruptions.

What Is a Slush Fund?

A slush fund is an unregulated reserve of money set aside for miscellaneous or often illicit expenses, differing from a Rainy Day Fund which is intended for genuine emergencies and unavoidable costs. Typically lacking transparency or formal accounting, slush funds may be used to cover discretionary or unauthorized expenditures without official approval. Understanding the distinction is crucial for effective personal finance management and ethical budgeting practices.

Key Differences Between Rainy Day and Slush Funds

Rainy day funds are designated for unexpected but necessary expenses such as medical emergencies or urgent home repairs, typically holding three to six months' worth of living expenses. Slush funds, on the other hand, are informal reserves used for discretionary or flexible spending, often lacking strict budgeting rules or specific allocation. The key difference lies in the purpose and discipline: rainy day funds prioritize financial security for essential needs, whereas slush funds cater to unplanned, often non-essential expenditures.

Purpose and Uses of Rainy Day Funds

Rainy day funds are specifically set aside to cover unexpected expenses or financial emergencies, such as medical bills, car repairs, or temporary loss of income, ensuring financial stability without incurring debt. These funds typically hold three to six months' worth of living expenses and are kept in highly liquid accounts for quick access. Unlike slush funds, which are used for discretionary or flexible spending, rainy day funds prioritize essential, unforeseen needs to protect long-term financial health.

Typical Uses for Slush Funds

Slush funds are typically used for small, discretionary expenses that don't require formal budgeting, such as office supplies or impromptu social events. Unlike rainy day funds designed for emergencies or unexpected financial hardships, slush funds provide flexibility for minor, routine expenditures. Organizations and individuals allocate slush funds to cover incidental costs without impacting primary savings or operational budgets.

Pros and Cons of Maintaining a Rainy Day Fund

Maintaining a rainy day fund provides financial security by covering unexpected expenses such as medical emergencies or car repairs, reducing reliance on high-interest debt. However, the funds are often kept in low-yield savings accounts, which may result in opportunity costs compared to investing in higher-return assets. While a rainy day fund promotes disciplined saving and peace of mind, it requires regular contributions that could otherwise be allocated to long-term wealth-building strategies.

Risks and Drawbacks of Slush Funds

Slush funds pose significant financial risks due to their lack of transparency and regulation, making it difficult to track expenditures and potentially leading to misuse or fraud. Unlike a rainy day fund, which is specifically allocated for emergencies, slush funds often lack clear guidelines, increasing the risk of depletion during non-essential spending. This financial ambiguity can result in unmanaged debt and undermine long-term savings stability.

Building Your Rainy Day Fund: Best Practices

Building your rainy day fund involves setting aside three to six months' worth of essential living expenses in a separate, easily accessible account to cover unexpected emergencies. Prioritize consistent contributions by automating transfers from your main checking to a dedicated savings account, ensuring steady growth without disrupting your budget. Avoid mixing this fund with discretionary spending slush funds to maintain its integrity and readiness for true financial emergencies.

Legal and Ethical Considerations of Slush Funds

Slush funds often raise significant legal and ethical concerns due to their lack of transparency and potential misuse for unauthorized or illicit purposes. Unlike rainy day funds, which are earmarked for genuine emergencies and financial stability, slush funds may violate regulatory standards and financial reporting laws, leading to legal penalties and reputational damage. Maintaining strict compliance with accounting principles and ethical guidelines is essential to distinguish legitimate reserves from questionable slush fund practices.

Choosing the Right Fund for Your Savings Goals

A Rainy Day Fund is designed for unexpected expenses like medical emergencies or urgent home repairs, typically covering three to six months of essential living costs, making it a crucial safety net for financial stability. In contrast, a Slush Fund is a more flexible pool of money for discretionary spending or minor, non-urgent expenses, often used for lifestyle choices without jeopardizing core savings. Prioritize building a Rainy Day Fund first to secure financial resilience, then allocate excess savings to a Slush Fund to enjoy discretionary spending without undermining long-term goals.

Important Terms

Contingency Reserve

A Contingency Reserve is a designated fund set aside to address unforeseen expenses or emergencies, often compared to a Rainy Day Fund which is strictly saved for genuine fiscal emergencies, whereas a Slush Fund refers to unregulated money used for discretionary, sometimes unethical, spending. Properly managed Contingency Reserves enhance financial stability by providing transparent and accountable resources, contrasting sharply with the lack of oversight typically associated with Slush Funds.

Emergency Fund

An Emergency Fund is a dedicated savings reserve designed to cover unexpected expenses such as medical emergencies, job loss, or urgent home repairs, distinguishing it from a Rainy Day Fund which typically handles smaller, predictable expenses like minor car repairs or household maintenance. Unlike a Slush Fund, which often lacks strict oversight and may be used for discretionary or non-essential spending, an Emergency Fund maintains clear financial boundaries to ensure funds are available strictly for genuine emergencies.

Discretionary Spending Account

A Discretionary Spending Account typically allows for flexible allocation of funds, distinguishing it from a Rainy Day Fund, which is reserved strictly for unexpected emergencies or financial shortfalls. Unlike a Slush Fund, which implies unregulated or opaque use of money, a Discretionary Spending Account operates under defined budgets and transparent policies, ensuring accountability and proper fund management.

Sinking Fund

A sinking fund is a dedicated reserve for repaying debt or replacing assets, distinct from a rainy day fund, which is reserved for unexpected expenses or emergencies, and a slush fund, which is typically an unregulated or discretionary reserve often used for illicit purposes. Proper management of a sinking fund ensures planned financial obligations are met without destabilizing operational budgets, unlike the unpredictable nature of slush funds.

Black Budget

The Black Budget refers to classified government spending often contrasted with the Rainy Day Fund, which is a transparent reserve meant for economic downturns, while a Slush Fund implies discretionary spending with less oversight. Understanding the distinction highlights the Black Budget's role in national security versus the fiscal responsibility embodied by a Rainy Day Fund and the potential misuse linked to Slush Funds.

Operational Reserve

Operational Reserve serves as a designated financial buffer to ensure the continuity of essential government services during revenue shortfalls, distinct from the Rainy Day Fund, which specifically targets economic downturns or emergencies, and unlike a Slush Fund, which implies discretionary or unaccounted spending. The Rainy Day Fund prioritizes transparency and fiscal prudence for unforeseen crises, while Operational Reserves provide routine budget stability without the negative connotation associated with Slush Funds.

Financial Buffer

A Financial Buffer is a reserved amount of money set aside to cover unexpected expenses, with a Rainy Day Fund specifically designated for genuine emergencies like medical bills or job loss, ensuring financial stability. In contrast, a Slush Fund typically refers to discretionary or untracked money that may lack transparency and can be used for non-essential or irregular expenses, often carrying negative connotations.

Unrestricted Funds

Unrestricted funds provide organizations with flexible financial resources that can be allocated without legal or donor-imposed restrictions, making them essential for maintaining operational stability. Unlike a rainy day fund, which is earmarked for unexpected emergencies, or a slush fund, often associated with lack of transparency and misuse, unrestricted funds support general expenses and strategic initiatives.

Fiscal Cushion

A fiscal cushion is a financial reserve designed to ensure government stability during economic downturns, often represented by a Rainy Day Fund which is transparently managed and legally restricted for emergencies. In contrast, a Slush Fund lacks formal oversight, allowing discretionary spending that can undermine fiscal responsibility and erode public trust.

Petty Cash Reserve

A Petty Cash Reserve is a small amount of cash kept on hand for minor, unexpected expenses, similar to a Rainy Day Fund which serves as a dedicated financial cushion for unforeseen emergencies. Unlike a Slush Fund, which often implies discretionary or untraceable spending, a Petty Cash Reserve maintains transparent and legitimate use within standard business operations.

Rainy Day Fund vs Slush Fund Infographic

moneydif.com

moneydif.com