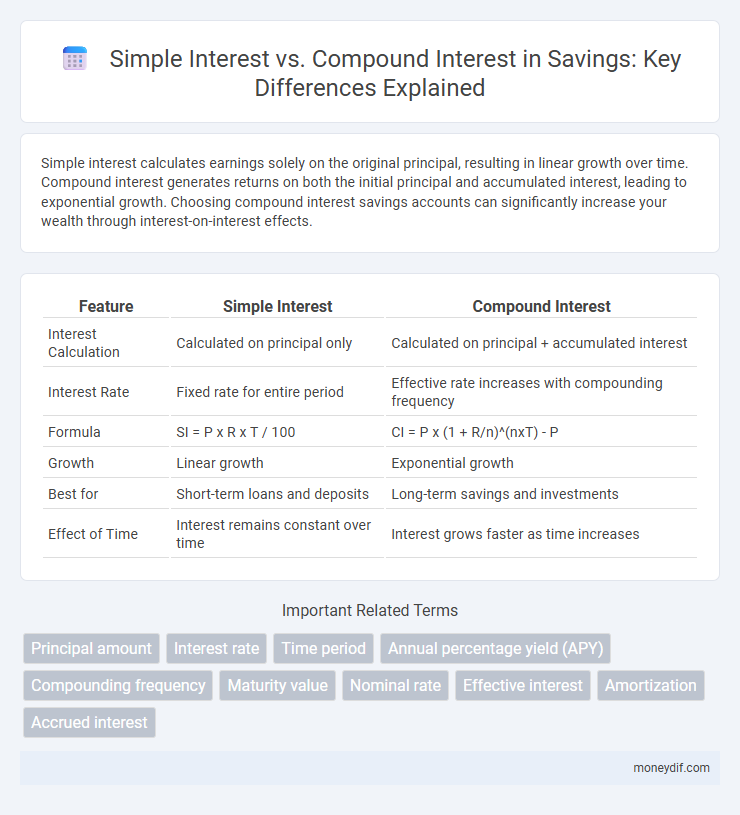

Simple interest calculates earnings solely on the original principal, resulting in linear growth over time. Compound interest generates returns on both the initial principal and accumulated interest, leading to exponential growth. Choosing compound interest savings accounts can significantly increase your wealth through interest-on-interest effects.

Table of Comparison

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Interest Calculation | Calculated on principal only | Calculated on principal + accumulated interest |

| Interest Rate | Fixed rate for entire period | Effective rate increases with compounding frequency |

| Formula | SI = P x R x T / 100 | CI = P x (1 + R/n)^(nxT) - P |

| Growth | Linear growth | Exponential growth |

| Best for | Short-term loans and deposits | Long-term savings and investments |

| Effect of Time | Interest remains constant over time | Interest grows faster as time increases |

Understanding Simple Interest in Savings

Simple interest in savings calculates earnings based solely on the original principal amount, resulting in linear growth over time. This method is straightforward, with interest earned being constant each period, making it easier for savers to predict their returns. Unlike compound interest, simple interest does not reinvest earnings, which may lead to lower gains on long-term savings.

The Basics of Compound Interest

Compound interest calculates interest on both the initial principal and the accumulated interest from previous periods, leading to exponential growth of savings. Unlike simple interest, which applies only to the original principal, compound interest accelerates wealth accumulation by reinvesting earned interest. Key factors influencing compound interest growth include the principal amount, interest rate, compounding frequency, and investment duration.

Key Differences Between Simple and Compound Interest

Simple interest calculates earnings based solely on the original principal, providing a fixed return over time, whereas compound interest generates returns on both the principal and accumulated interest, resulting in exponential growth. Simple interest is commonly used for short-term loans and deposits, while compound interest maximizes growth potential in long-term investments. The key difference lies in the interest-on-interest effect found only in compound interest, making it more advantageous for accumulating wealth.

How Simple Interest Affects Your Savings Growth

Simple interest grows your savings linearly by applying a fixed percentage to the original principal amount, resulting in consistent but limited gains over time. This method does not reinvest earned interest, so the total interest earned remains constant each period, which can slow overall savings growth compared to compound interest. For short-term savings goals, simple interest can provide predictable returns, but it may significantly underperform in building wealth over longer durations.

The Power of Compounding Over Time

Compound interest significantly enhances savings growth by earning interest on both the initial principal and accumulated interest, unlike simple interest, which is calculated solely on the principal amount. Over time, the effect of compounding dramatically increases the total returns, especially with frequent compounding intervals such as monthly or quarterly. This exponential growth demonstrates why long-term investments with compound interest often outperform simple interest savings accounts.

Real-Life Examples: Simple vs Compound Interest

Simple interest on a savings account paying 5% annually means that $1,000 earns $50 every year, totaling $500 over 10 years. Compound interest at the same rate, compounded yearly, grows the initial $1,000 to approximately $1,629 after 10 years, illustrating how interest on interest accelerates growth. Real-life examples include fixed deposits for simple interest and mutual funds or retirement accounts for compound interest growth.

Which Savings Account Type is Right for You?

Simple interest accounts calculate earnings solely on the principal amount, offering predictable growth suitable for short-term savings goals. Compound interest accounts, by reinvesting earnings, generate exponential growth ideal for long-term savings and wealth accumulation. Choosing the right savings account depends on your financial timeline and goals, with compound interest often maximizing returns over extended periods.

Factors Influencing Interest Calculations

Simple interest depends primarily on the principal amount, interest rate, and time period, calculating interest only on the original principal. Compound interest factors in the principal plus accumulated interest, which accelerates growth due to interest-on-interest effects over time. The frequency of compounding intervals, such as annually, semiannually, quarterly, or monthly, significantly influences the overall return on savings.

Common Mistakes in Interest Selection

Choosing simple interest over compound interest often leads to underestimated earnings, as simple interest calculates only on the principal amount, ignoring interest-on-interest growth. Many savers mistakenly assume compound interest always yields higher returns, overlooking scenarios with shorter terms or lower compounding frequencies where simple interest might be more beneficial. Failure to analyze the interest period, frequency, and rate nuances can result in suboptimal savings growth and missed financial opportunities.

Maximizing Savings Through Smart Interest Choices

Choosing compound interest over simple interest significantly maximizes your savings growth by earning interest on both the initial principal and accumulated interest. Simple interest calculates only on the original amount, limiting total returns over time. Prioritizing investment options with compound interest accelerates wealth accumulation and enhances long-term financial goals.

Important Terms

Principal amount

The principal amount is the initial sum of money on which simple interest is calculated linearly over time, whereas compound interest is calculated on the principal plus accumulated interest, resulting in exponential growth.

Interest rate

Simple interest is calculated on the principal amount only, while compound interest is calculated on the principal plus accumulated interest, resulting in higher returns over time.

Time period

Simple interest is typically calculated over short time periods, such as months or a few years, making it suitable for loans or investments with fixed, linear growth. Compound interest applies over longer durations where interest is reinvested, leading to exponential growth and significantly higher returns as the time period increases.

Annual percentage yield (APY)

Annual Percentage Yield (APY) measures the real rate of return on an investment by accounting for the effect of compounding interest, which grows the investment faster than simple interest that calculates interest only on the principal. APY provides a more accurate comparison of financial products by including the frequency of compounding periods, highlighting the benefit of compound interest over simple interest.

Compounding frequency

Compounding frequency significantly increases compound interest growth compared to simple interest, which remains fixed regardless of frequency.

Maturity value

Maturity value with simple interest is calculated by adding the principal and the interest earned linearly over time, whereas compound interest maturity value grows exponentially by adding interest on both the principal and accrued interest.

Nominal rate

The nominal rate represents the stated interest rate before compounding, influencing simple interest calculations directly while compound interest accounts for interest on accumulated interest.

Effective interest

Effective interest rate reflects the true cost of borrowing or return on investment by accounting for compound interest, unlike simple interest which calculates interest only on the principal amount.

Amortization

Amortization schedules differ significantly between simple interest loans, which calculate interest only on the principal, and compound interest loans, where interest accrues on both principal and accumulated interest, affecting total payment amounts and loan duration.

Accrued interest

Accrued interest represents the accumulated interest earned or owed on a principal amount, calculated using simple interest as a linear growth over time or compound interest as interest on both the principal and previously earned interest.

Simple interest vs Compound interest Infographic

moneydif.com

moneydif.com