Liquid funds invest primarily in short-term debt instruments with maturities up to 91 days, offering high liquidity and low risk ideal for parking surplus cash temporarily. Ultra short-term funds hold slightly longer maturity debt securities, typically ranging from 3 to 6 months, providing marginally higher returns with minimal interest rate sensitivity. Both funds are suitable for conservative investors seeking stability and quick access to funds, but ultra short-term funds may offer better yields during rising interest rate cycles.

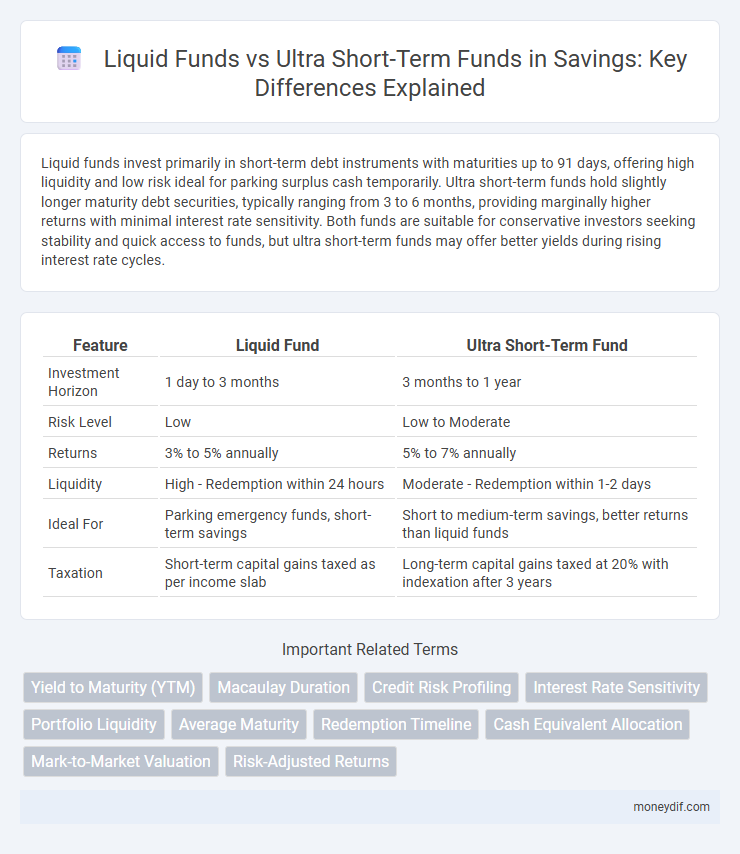

Table of Comparison

| Feature | Liquid Fund | Ultra Short-Term Fund |

|---|---|---|

| Investment Horizon | 1 day to 3 months | 3 months to 1 year |

| Risk Level | Low | Low to Moderate |

| Returns | 3% to 5% annually | 5% to 7% annually |

| Liquidity | High - Redemption within 24 hours | Moderate - Redemption within 1-2 days |

| Ideal For | Parking emergency funds, short-term savings | Short to medium-term savings, better returns than liquid funds |

| Taxation | Short-term capital gains taxed as per income slab | Long-term capital gains taxed at 20% with indexation after 3 years |

Understanding Liquid Funds and Ultra Short-Term Funds

Liquid funds invest primarily in highly liquid money market instruments with maturities up to 91 days, offering high safety and quick access to cash with minimal interest rate risk. Ultra short-term funds invest in debt securities with slightly longer maturities, typically ranging from three to six months, balancing moderate returns with low credit and interest rate risk. Both fund types provide better liquidity than fixed deposits but differ in return potential and risk exposure due to the maturity spectrum of their underlying assets.

Key Differences Between Liquid and Ultra Short-Term Funds

Liquid funds primarily invest in instruments with maturities up to 91 days, offering high liquidity and low risk, whereas ultra short-term funds invest in debt securities with maturities typically ranging from 3 to 6 months, targeting slightly higher returns with moderate risk. Liquid funds are ideal for parking surplus cash for very short durations with instant access, while ultra short-term funds suit investors willing to hold for a slightly longer horizon to earn better yields. Expense ratios tend to be lower for liquid funds compared to ultra short-term funds, reflecting differences in portfolio management and credit risk exposure.

Investment Objectives: Which Fund Suits Your Goals?

Liquid funds prioritize capital preservation and liquidity by investing in highly liquid money market instruments with maturities up to 91 days, making them ideal for short-term parking of surplus funds. Ultra short-term funds target slightly higher returns by investing in debt securities with a maturity profile ranging from 3 to 6 months, balancing liquidity with moderate income generation. Choosing between the two depends on your investment horizon and risk tolerance, as liquid funds suit goals requiring immediate access to cash, while ultra short-term funds align with objectives seeking marginally better yields over a slightly longer period.

Risk Comparison: Liquid Funds vs Ultra Short-Term Funds

Liquid funds generally carry lower risk due to their investment in highly liquid money market instruments with very short maturities, typically up to 91 days. Ultra short-term funds invest in debt securities with slightly longer durations, generally ranging from 3 to 6 months, leading to higher interest rate sensitivity and marginally increased risk compared to liquid funds. Investors seeking minimal volatility and high liquidity often prefer liquid funds, while those willing to accept moderate risk for potentially higher returns may opt for ultra short-term funds.

Returns Potential: What to Expect from Each Fund

Liquid funds typically offer lower returns compared to ultra short-term funds due to their investment in highly liquid money market instruments with maturities up to 91 days. Ultra short-term funds invest in fixed income securities with slightly longer maturities, generally up to 1 year, resulting in higher yield potential and moderate interest rate risk. Investors seeking better returns with manageable risk often prefer ultra short-term funds while prioritizing liquidity, liquid funds remain a suitable choice.

Liquidity and Redemption Process

Liquid funds provide superior liquidity with same-day redemption and credit of proceeds typically within one business day, making them ideal for immediate cash needs. Ultra short-term funds offer slightly longer redemption timelines, usually crediting proceeds within two to three business days, reflecting their investment in marginally less liquid instruments. The redemption process in liquid funds is streamlined for quick access, whereas ultra short-term funds balance liquidity with potentially higher returns by investing in instruments with slightly longer maturities.

Tax Implications for Investors

Liquid funds and ultra short-term funds differ significantly in tax treatment, impacting investors' net returns. Gains from liquid funds held under 3 years are subject to short-term capital gains tax at the investor's income tax slab rate, while ultra short-term funds incur short-term capital gains tax if held for less than 36 months, also taxed at the slab rate. Long-term capital gains above Rs1 lakh from both funds are taxed at 20% with indexation benefits, making tax efficiency a key consideration for savers optimizing post-tax yields.

Ideal Investment Horizon for Each Fund

Liquid funds are ideal for investors seeking to park surplus cash for very short durations, typically from a few days up to three months, offering high liquidity with minimal interest rate risk. Ultra short-term funds suit those with an investment horizon ranging from three to six months, balancing moderate return potential with slightly higher risk compared to liquid funds. Choosing between these funds depends on the investor's need for liquidity and risk tolerance within the specified timeframe.

Expense Ratios and Costs Involved

Liquid funds typically have lower expense ratios compared to ultra short-term funds, making them more cost-effective for short-duration investments. Expense ratios for liquid funds usually range from 0.1% to 0.5%, whereas ultra short-term funds can have ratios between 0.2% and 0.8%. Lower costs in liquid funds contribute to higher net returns, especially when held for brief periods, while ultra short-term funds may offer marginally higher yields at the expense of increased management fees.

Choosing the Right Fund for Your Savings Strategy

Liquid funds offer high liquidity and low risk, making them ideal for parking emergency savings with easy access. Ultra short-term funds typically provide higher returns by investing in slightly longer maturities, suitable for investors with a moderate risk tolerance and a savings horizon of a few months. Choose liquid funds for immediate access and ultra short-term funds for optimizing returns while maintaining relative safety in your savings strategy.

Important Terms

Yield to Maturity (YTM)

Yield to Maturity (YTM) measures the total return expected on a bond if held until maturity, serving as a critical metric for evaluating fixed-income investments like liquid funds and ultra short-term funds. Ultra short-term funds typically offer higher YTM compared to liquid funds due to their investment in slightly longer-duration and higher-yielding debt instruments, balancing liquidity with improved returns.

Macaulay Duration

Macaulay Duration measures the weighted average time until a fund's cash flows are received, with liquid funds typically having shorter durations compared to ultra short-term funds, reflecting lower interest rate risk and higher liquidity. Ultra short-term funds have slightly longer Macaulay Durations, balancing moderate yield opportunities with minimal sensitivity to interest rate fluctuations.

Credit Risk Profiling

Credit risk profiling evaluates the potential default risk associated with liquid funds, which generally invest in high-quality, low-risk instruments, versus ultra short-term funds that may hold slightly higher risk securities with marginally longer durations. Investors assessing credit risk profiles consider factors such as the fund's exposure to corporate debt ratings, average maturity, and historical default rates to balance liquidity and return expectations.

Interest Rate Sensitivity

Interest rate sensitivity measures how fund prices react to changes in interest rates, with liquid funds typically exhibiting minimal sensitivity due to their short maturity and high liquidity, whereas ultra short-term funds have slightly higher sensitivity as they invest in instruments with marginally longer durations. Investors seeking lower risk exposure amid interest rate fluctuations may prefer liquid funds, while those aiming for marginally better yields might consider ultra short-term funds, accepting moderate sensitivity.

Portfolio Liquidity

Portfolio liquidity is enhanced by liquid funds due to their high daily redemption capacity and minimal interest rate risk, making them ideal for managing short-term cash needs. Ultra short-term funds offer slightly higher returns with marginally increased interest rate sensitivity, providing a balance between liquidity and yield for investors seeking moderate risk in their fixed-income portfolio.

Average Maturity

Average maturity in liquid funds typically ranges from a few days to 91 days, focusing on high liquidity and minimal interest rate risk, whereas ultra short-term funds have a longer average maturity of up to 6 months, offering slightly higher returns through exposure to short-term debt instruments with moderate interest rate sensitivity. Investors prioritize liquid funds for immediate liquidity and capital preservation, while ultra short-term funds suit those aiming for marginally better yields with a tolerance for modest interest rate fluctuations.

Redemption Timeline

Redemption timelines for liquid funds typically range from same-day to T+1 settlement, enabling quick access to funds within 24 hours, while ultra short-term funds generally offer redemption settlements around T+1 to T+3 days, reflecting their slightly higher maturity periods. Liquid funds maintain high liquidity with low credit risk, whereas ultra short-term funds balance liquidity and yield by investing in debt securities with slightly longer maturities.

Cash Equivalent Allocation

Cash equivalent allocation prioritizes liquidity and low risk, with liquid funds offering daily liquidity and moderate returns by investing in short-term money market instruments, while ultra short-term funds provide slightly higher yields by holding instruments with marginally longer maturities and minimal interest rate sensitivity. Investors seeking immediate access to funds prefer liquid funds, whereas those targeting incremental income with limited risk exposure opt for ultra short-term funds within their cash equivalent strategy.

Mark-to-Market Valuation

Mark-to-Market valuation reflects the current market price of assets, causing Liquid funds to exhibit lower NAV volatility due to their investment in highly liquid, short-term securities, while Ultra short-term funds may show slightly higher NAV fluctuations as they invest in securities with marginally longer maturities and interest rate sensitivity. Investors seeking minimal price risk and stable returns often prefer Liquid funds, whereas those willing to accept modest mark-to-market variability may benefit from the higher yield potential of Ultra short-term funds.

Risk-Adjusted Returns

Risk-adjusted returns measure the profitability of investments like liquid funds and ultra short-term funds by accounting for their volatility and risk exposure. Ultra short-term funds typically exhibit higher risk-adjusted returns than liquid funds due to their slightly longer maturity profiles, which allow for better yield opportunities while maintaining low credit risk.

Liquid fund vs Ultra short-term fund Infographic

moneydif.com

moneydif.com