Tax-deferred savings allow your investments to grow without immediate tax on earnings, postponing taxes until withdrawal, often during retirement when you might be in a lower tax bracket. Tax-exempt savings provide tax-free growth and withdrawals, making them ideal for long-term goals like education or healthcare expenses. Understanding the benefits and limitations of each option helps maximize your after-tax savings and align with your financial objectives.

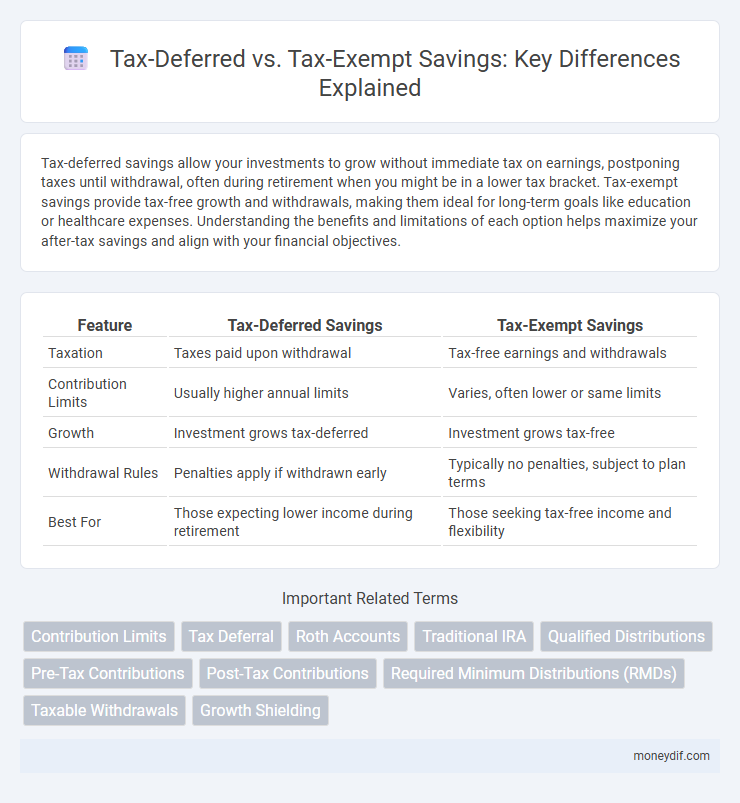

Table of Comparison

| Feature | Tax-Deferred Savings | Tax-Exempt Savings |

|---|---|---|

| Taxation | Taxes paid upon withdrawal | Tax-free earnings and withdrawals |

| Contribution Limits | Usually higher annual limits | Varies, often lower or same limits |

| Growth | Investment grows tax-deferred | Investment grows tax-free |

| Withdrawal Rules | Penalties apply if withdrawn early | Typically no penalties, subject to plan terms |

| Best For | Those expecting lower income during retirement | Those seeking tax-free income and flexibility |

Understanding Tax-Deferred and Tax-Exempt Savings

Tax-deferred savings accounts, such as traditional IRAs and 401(k)s, allow earnings to grow without immediate tax liability, with taxes paid upon withdrawal typically during retirement. Tax-exempt savings, like Roth IRAs and municipal bonds, provide tax-free growth and withdrawals, given specific conditions are met, maximizing long-term tax efficiency. Understanding the distinction helps investors optimize retirement planning by balancing immediate tax benefits against future tax-free income.

How Tax-Deferred Savings Accounts Work

Tax-deferred savings accounts allow individuals to invest money without paying taxes on the contributions or earnings until withdrawals are made, often during retirement when income may be lower. Contributions reduce taxable income in the year they are made, providing an immediate tax benefit, while earnings grow tax-free until distribution. Common examples include traditional IRAs and 401(k) plans, which help maximize long-term savings through compound growth on pre-tax investments.

Key Features of Tax-Exempt Savings Accounts

Tax-exempt savings accounts, such as Roth IRAs and Health Savings Accounts (HSAs), allow contributions and earnings to grow without incurring federal income tax on withdrawals, provided certain conditions are met. These accounts offer tax-free growth and qualified distributions, making them ideal for long-term savings goals with tax advantages. Contributions are made with after-tax dollars, eliminating tax liability on future earnings and distributions.

Comparing Tax Benefits: Deferred vs Exempt

Tax-deferred savings accounts, such as traditional IRAs and 401(k)s, allow investments to grow tax-free until withdrawal, typically during retirement when income may be lower, potentially reducing overall tax liability. Tax-exempt savings, like Roth IRAs and municipal bonds, provide no tax deductions on contributions but offer tax-free withdrawals, including earnings, if certain conditions are met. Comparing tax benefits hinges on your current and expected future tax brackets, with deferred savings favoring those anticipating lower retirement taxes, while tax-exempt accounts benefit those expecting higher future tax rates or desiring tax-free growth.

Growth Potential in Tax-Deferred Savings

Tax-deferred savings accounts allow investments to grow tax-free until withdrawal, maximizing growth potential through compound interest on untaxed earnings. Contributions to accounts like traditional IRAs or 401(k)s reduce taxable income, enabling larger initial investments and accelerated growth. Over time, deferred taxes on gains and dividends enhance the compounding effect, typically resulting in greater accumulation compared to tax-exempt savings vehicles.

Withdrawal Rules and Penalties

Tax-deferred savings accounts, such as traditional IRAs and 401(k)s, require withdrawals after age 59 1/2 to avoid a 10% early withdrawal penalty, and mandatory minimum distributions begin at age 73. Tax-exempt savings accounts, like Roth IRAs, allow penalty-free and tax-free withdrawals of contributions at any time, while earnings can be withdrawn tax-free after age 59 1/2 and meeting the five-year holding requirement. Early withdrawals of earnings from tax-exempt accounts before meeting these conditions typically incur income taxes and a 10% penalty.

Impact on Retirement Planning

Tax-deferred savings accounts, such as 401(k)s and traditional IRAs, allow investments to grow without immediate tax liability, deferring taxes until withdrawals are made in retirement, which can result in lower tax brackets and increased compound growth. Tax-exempt savings options, like Roth IRAs, provide tax-free withdrawals, enabling retirees to access funds without additional tax burdens and plan for predictable income streams. Understanding the differences between these accounts is crucial for optimizing retirement income, managing tax liabilities, and maximizing overall savings growth.

Long-Term Tax Implications

Tax-deferred savings accounts, such as traditional IRAs and 401(k)s, allow investments to grow tax-free until withdrawal, typically resulting in taxable income during retirement, which could lead to higher tax liabilities depending on future tax rates. Tax-exempt savings accounts, like Roth IRAs, provide tax-free growth and tax-free qualified withdrawals, eliminating tax burdens in retirement but requiring contributions to be made with after-tax dollars. Evaluating long-term tax implications involves considering current tax brackets, expected retirement income, and the potential for tax rate changes to optimize overall retirement savings outcomes.

Choosing the Right Savings Option

Choosing the right savings option depends on your current tax bracket, future income expectations, and financial goals. Tax-deferred savings accounts, such as traditional IRAs and 401(k)s, allow you to postpone taxes until withdrawal, potentially lowering taxable income during high-earning years. Tax-exempt savings options like Roth IRAs offer tax-free growth and withdrawals, making them ideal for those expecting higher taxes in retirement or seeking tax diversification.

Maximizing Returns with Strategic Savings Choices

Tax-deferred savings accounts like 401(k)s and traditional IRAs allow investments to grow without immediate tax burdens, increasing the potential for compound growth over time. In contrast, tax-exempt savings options such as Roth IRAs and municipal bonds offer tax-free withdrawals, providing clear advantages for long-term, post-retirement income. Balancing contributions between tax-deferred and tax-exempt vehicles maximizes after-tax returns by optimizing tax liabilities based on current income and future financial goals.

Important Terms

Contribution Limits

Tax-deferred savings accounts, such as 401(k)s and traditional IRAs, have annual contribution limits set by the IRS, currently $22,500 for 401(k) plans and $6,500 for IRAs in 2024, allowing earnings to grow tax-deferred until withdrawal. Tax-exempt savings accounts like Roth IRAs have the same contribution limits but offer tax-free growth and withdrawals, provided certain conditions are met, offering distinct tax benefits depending on an individual's current and future tax bracket.

Tax Deferral

Tax deferral allows investment earnings to grow without being taxed until withdrawal, contrasting with tax-exempt savings where earnings are never taxed, providing immediate tax benefits. Choosing between tax-deferred savings accounts like traditional IRAs and tax-exempt options like Roth IRAs depends on factors such as current income tax rates, retirement plans, and anticipated future tax brackets.

Roth Accounts

Roth accounts offer tax-exempt growth and tax-free withdrawals on qualified distributions, distinguishing them from traditional tax-deferred savings accounts where contributions are made pre-tax but withdrawals are taxed as ordinary income. The primary advantage of Roth accounts lies in their post-tax contribution structure, enabling tax-free income in retirement, while tax-deferred accounts provide immediate tax relief but incur taxes during distribution.

Traditional IRA

Traditional IRAs offer tax-deferred savings by allowing contributions to grow without immediate taxation, with taxes paid upon withdrawal during retirement, contrasting with Roth IRAs where qualified withdrawals are tax-exempt. This tax-deferred growth strategy can reduce taxable income during high-earning years, optimizing long-term retirement savings.

Qualified Distributions

Qualified distributions from tax-deferred savings accounts, such as traditional IRAs or 401(k)s, are taxable as ordinary income upon withdrawal, typically after reaching age 59 1/2 and meeting holding period requirements. In contrast, qualified distributions from tax-exempt savings accounts, like Roth IRAs, are tax-free if the account has been held for at least five years and the account holder is over 59 1/2 or meets other qualified conditions.

Pre-Tax Contributions

Pre-tax contributions reduce taxable income by allowing employees to invest before taxes, fostering tax-deferred savings where growth is taxed upon withdrawal. In contrast, tax-exempt savings involve contributions made with after-tax dollars but offer tax-free growth and withdrawals, exemplified by Roth IRAs or HSAs.

Post-Tax Contributions

Post-tax contributions involve investing money already taxed, allowing future withdrawals to be tax-exempt, as seen in Roth IRAs or Roth 401(k)s. Tax-deferred savings, like traditional IRAs or 401(k)s, delay tax payments until withdrawal, reducing taxable income upfront but taxing distributions as ordinary income.

Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs) apply to tax-deferred savings accounts such as traditional IRAs and 401(k)s, mandating withdrawals starting at age 73 to avoid penalties and include the distribution as taxable income. Tax-exempt savings accounts like Roth IRAs do not require RMDs during the account holder's lifetime, allowing tax-free growth and withdrawals without mandatory distribution rules.

Taxable Withdrawals

Taxable withdrawals from tax-deferred savings accounts, such as traditional IRAs and 401(k)s, are subject to ordinary income tax upon distribution, reducing the net amount available for use. In contrast, tax-exempt savings accounts like Roth IRAs allow qualified withdrawals free of federal income tax, preserving the full value of accumulated earnings and contributions.

Growth Shielding

Growth shielding involves strategically choosing between tax-deferred savings accounts, such as traditional IRAs or 401(k)s, where taxes are paid upon withdrawal, and tax-exempt savings options, like Roth IRAs or Roth 401(k)s, which offer tax-free growth and withdrawals. Investors maximize long-term wealth accumulation by considering factors like current tax rates, expected future income, and the benefits of compounding without immediate tax erosion.

Tax-Deferred Savings vs Tax-Exempt Savings Infographic

moneydif.com

moneydif.com