A sweep account automatically transfers excess funds into a higher-interest investment option, maximizing savings potential without manual intervention. Traditional accounts typically offer lower interest rates and require customers to manage transfers themselves. Choosing a sweep account can optimize cash flow and improve overall returns on idle funds.

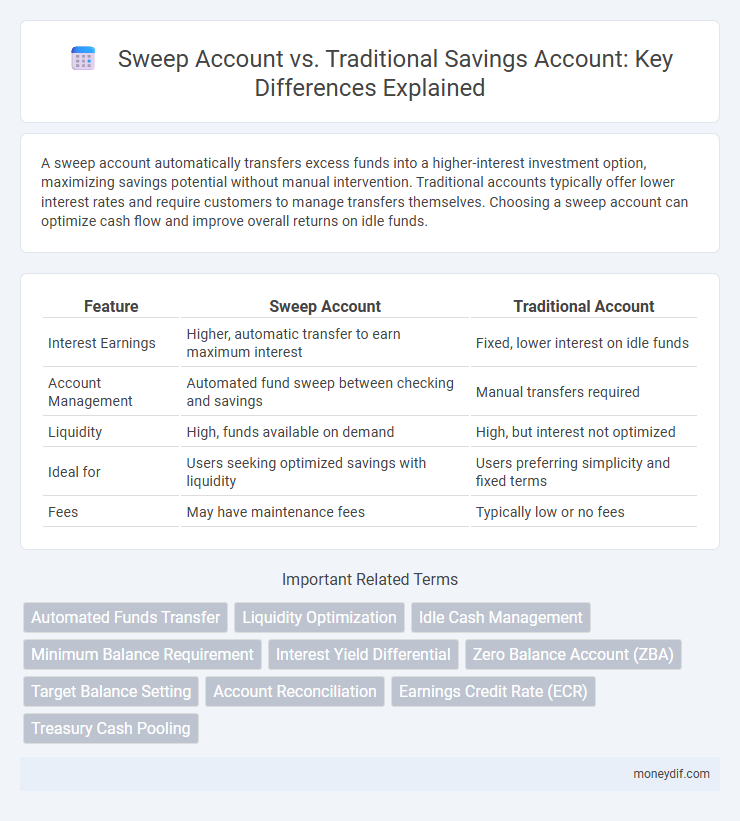

Table of Comparison

| Feature | Sweep Account | Traditional Account |

|---|---|---|

| Interest Earnings | Higher, automatic transfer to earn maximum interest | Fixed, lower interest on idle funds |

| Account Management | Automated fund sweep between checking and savings | Manual transfers required |

| Liquidity | High, funds available on demand | High, but interest not optimized |

| Ideal for | Users seeking optimized savings with liquidity | Users preferring simplicity and fixed terms |

| Fees | May have maintenance fees | Typically low or no fees |

Overview of Sweep Accounts and Traditional Accounts

Sweep accounts automatically transfer excess funds from a checking account to a higher-interest savings or investment account, optimizing cash flow and increasing returns without manual intervention. Traditional accounts, such as regular savings or checking accounts, offer straightforward deposit and withdrawal capabilities but often lack automated fund management or enhanced interest benefits. Sweep accounts provide a dynamic approach to managing idle balances, while traditional accounts focus on ease of access and simplicity.

Key Features of Sweep Accounts

Sweep accounts automatically transfer excess funds from a traditional checking account into a higher-interest savings or investment account, maximizing earnings on idle balances. These accounts provide liquidity and convenience by ensuring funds remain accessible while optimizing interest income through daily or periodic sweeps. Businesses and high-net-worth individuals benefit from reduced manual transfers and enhanced cash management efficiency with sweep accounts.

Key Features of Traditional Savings Accounts

Traditional savings accounts offer a secure place to store funds with easy access and typically provide a fixed interest rate that compounds periodically. These accounts usually have low minimum balance requirements and are insured by federal agencies such as the FDIC, ensuring the safety of deposits up to $250,000. Unlike sweep accounts, traditional savings accounts do not automatically transfer excess balances but prioritize liquidity and straightforward growth.

How Sweep Accounts Maximize Returns

Sweep accounts automatically transfer excess funds into higher-yield investment vehicles such as money market funds or short-term securities, maximizing returns by minimizing idle cash. Unlike traditional accounts that keep balances static, sweep accounts optimize liquidity and earnings potential without sacrificing accessibility. This dynamic allocation helps savers take advantage of better interest rates while maintaining seamless access to their funds.

Interest Rates: Sweep vs Traditional Accounts

Sweep accounts typically offer higher interest rates compared to traditional savings accounts by automatically transferring excess funds into interest-bearing investments. Traditional accounts often provide lower, fixed interest rates with less flexibility in fund transfers. This strategic movement of funds in sweep accounts maximizes interest earnings while maintaining liquidity.

Liquidity and Accessibility Comparison

Sweep accounts automatically transfer excess funds into higher-yield investments, offering greater liquidity by enabling quick access to cash without manual intervention. Traditional savings accounts provide straightforward accessibility with immediate withdrawal options but typically offer lower interest rates and less efficient fund utilization. The enhanced liquidity of sweep accounts is ideal for optimizing returns while maintaining quick access, whereas traditional accounts emphasize simplicity and direct availability.

Risks and Security Considerations

Sweep accounts offer automated fund transfers that minimize idle cash, but they may expose account holders to increased counterparty risk due to frequent movement between accounts. Traditional savings accounts provide FDIC insurance protection up to $250,000 per depositor, ensuring principal security against bank failure. Investors must evaluate the trade-off between liquidity, potential interest yield, and the inherent risks related to sweep account agreements and bank stability.

Fees and Minimum Balance Requirements

Sweep accounts typically have lower fees and require higher minimum balances compared to traditional savings accounts, making them ideal for customers who maintain substantial funds. Traditional accounts often impose monthly maintenance fees unless a lower minimum balance is maintained, usually between $300 and $1,000. Choosing a sweep account can optimize liquidity by automatically transferring excess funds to higher-interest investments, while traditional accounts prioritize straightforward access with fewer balance thresholds.

Who Should Choose a Sweep Account?

A sweep account is ideal for individuals and businesses seeking to maximize idle cash by automatically transferring surplus funds into higher-interest investment accounts daily. This option suits those who prioritize liquidity and are comfortable with short-term investments to enhance savings efficiency. Traditional accounts, by contrast, are better for users needing straightforward access without the complexity of automated fund transfers.

Choosing the Right Account for Your Savings Goals

Sweep accounts optimize savings by automatically transferring excess funds into higher-interest investments, maximizing returns without sacrificing liquidity. Traditional savings accounts offer steady interest rates and easy access, making them ideal for emergency funds and short-term goals. Selecting between these depends on your risk tolerance, desired liquidity, and financial objectives to align with optimal wealth growth.

Important Terms

Automated Funds Transfer

Automated Funds Transfer (AFT) enhances liquidity management by seamlessly moving excess funds from a Sweep Account to a Traditional Account, optimizing interest earnings and minimizing idle cash. Unlike Traditional Accounts, Sweep Accounts automate the transfer of surplus balances into higher-yield investment vehicles, improving cash flow efficiency and reducing manual intervention in fund allocation.

Liquidity Optimization

Liquidity optimization leverages sweep accounts to automatically transfer excess funds into higher-yield investments, enhancing cash flow efficiency compared to traditional accounts that retain idle balances. Corporations benefit by maximizing interest earnings and maintaining sufficient liquidity for operational needs without manual fund management.

Idle Cash Management

Idle cash management strategies optimize liquidity by automatically transferring excess funds from a traditional account to a sweep account, which invests surplus cash in short-term instruments to maximize returns. Sweep accounts minimize idle balances, reduce opportunity cost, and enhance cash flow efficiency compared to traditional accounts that hold static funds without automated reinvestment.

Minimum Balance Requirement

Minimum balance requirements for sweep accounts are typically lower or flexible compared to traditional accounts, as sweep accounts automatically transfer excess funds to higher interest-bearing accounts, optimizing liquidity and reducing the risk of falling below required thresholds. Traditional accounts often mandate maintaining a fixed minimum balance, which can restrict cash flow and limit earning potential compared to the dynamic balance management inherent in sweep accounts.

Interest Yield Differential

Interest yield differential between sweep accounts and traditional accounts significantly impacts the effective return on idle funds; sweep accounts typically transfer excess balances into higher-yielding investment vehicles overnight, enhancing liquidity with potentially greater interest income. Traditional accounts, while offering steady interest rates, usually provide lower yields due to fixed balance structures and less frequent compounding, making sweep accounts advantageous for optimizing interest earnings through daily balance optimization.

Zero Balance Account (ZBA)

Zero Balance Account (ZBA) enables businesses to maintain multiple sub-accounts with zero balances by automatically transferring funds from a master sweep account, optimizing cash management and reducing idle funds. Compared to traditional accounts, ZBAs linked with sweep accounts enhance liquidity control and minimize the need for manual fund transfers, thereby improving operational efficiency.

Target Balance Setting

Target Balance Setting optimizes liquidity management by maintaining a predetermined balance in a primary account before funds are swept to a secondary account, typically enhancing cash flow control compared to traditional accounts. Sweep accounts automatically transfer excess funds above the target balance into higher-interest investment accounts, while traditional accounts lack this dynamic cash optimization feature.

Account Reconciliation

Account reconciliation between sweep accounts and traditional accounts highlights how sweep accounts automatically transfer excess funds into higher-interest investment options, optimizing cash management and reducing idle balances, while traditional accounts require manual transfer and monitoring for balance adjustments. This automation in sweep accounts enhances liquidity efficiency and minimizes reconciliation errors compared to the static nature of traditional accounts.

Earnings Credit Rate (ECR)

The Earnings Credit Rate (ECR) determines the interest credit a bank provides on balances in Sweep Accounts, often higher than Traditional Accounts due to the use of overnight investments to maximize returns. Sweep Accounts optimize liquidity by automatically transferring excess funds into higher-yielding investment vehicles, thereby enhancing the effective ECR compared to the typically lower fixed rates of Traditional Accounts.

Treasury Cash Pooling

Treasury Cash Pooling optimizes liquidity management by consolidating multiple accounts into a single balance, with Sweep Accounts automatically transferring excess funds daily to maximize interest earnings or reduce borrowing costs, unlike Traditional Accounts that require manual transfers and often result in inefficient cash utilization. Sweep Accounts enhance real-time cash flow control and reduce overdraft fees by maintaining optimal balances across subsidiaries, whereas Traditional Accounts may lead to idle cash and higher banking fees due to fragmented cash management.

Sweep Account vs Traditional Account Infographic

moneydif.com

moneydif.com