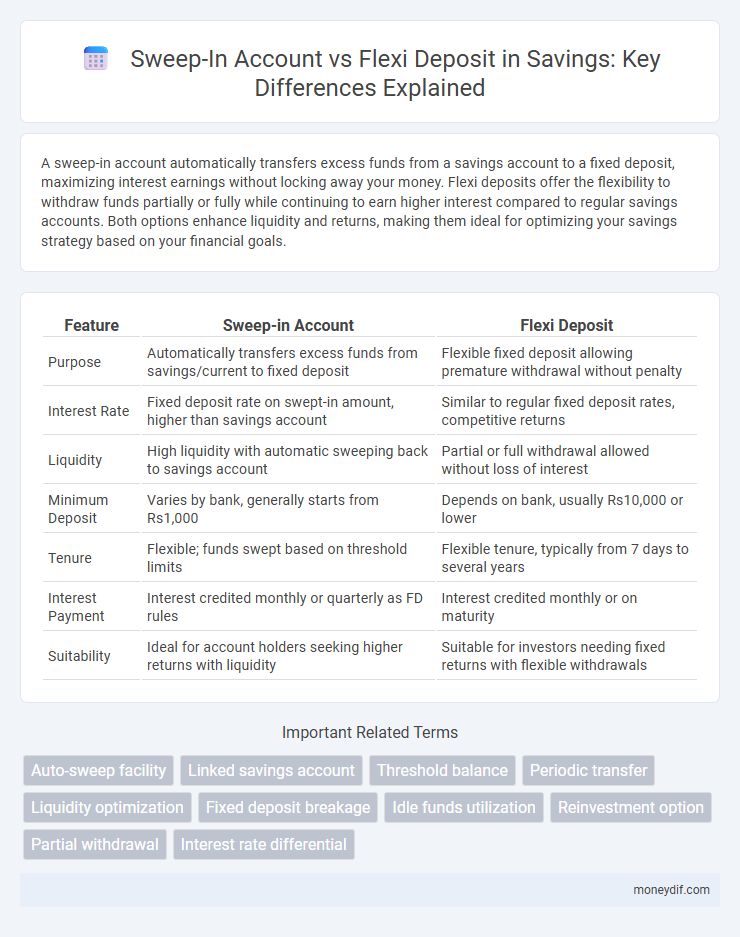

A sweep-in account automatically transfers excess funds from a savings account to a fixed deposit, maximizing interest earnings without locking away your money. Flexi deposits offer the flexibility to withdraw funds partially or fully while continuing to earn higher interest compared to regular savings accounts. Both options enhance liquidity and returns, making them ideal for optimizing your savings strategy based on your financial goals.

Table of Comparison

| Feature | Sweep-in Account | Flexi Deposit |

|---|---|---|

| Purpose | Automatically transfers excess funds from savings/current to fixed deposit | Flexible fixed deposit allowing premature withdrawal without penalty |

| Interest Rate | Fixed deposit rate on swept-in amount, higher than savings account | Similar to regular fixed deposit rates, competitive returns |

| Liquidity | High liquidity with automatic sweeping back to savings account | Partial or full withdrawal allowed without loss of interest |

| Minimum Deposit | Varies by bank, generally starts from Rs1,000 | Depends on bank, usually Rs10,000 or lower |

| Tenure | Flexible; funds swept based on threshold limits | Flexible tenure, typically from 7 days to several years |

| Interest Payment | Interest credited monthly or quarterly as FD rules | Interest credited monthly or on maturity |

| Suitability | Ideal for account holders seeking higher returns with liquidity | Suitable for investors needing fixed returns with flexible withdrawals |

Understanding Sweep-in Accounts

Sweep-in accounts automatically link your savings account with a fixed deposit, enabling seamless fund transfers to maintain minimum balance and earn higher interest. These accounts provide liquidity by allowing immediate withdrawal of funds without breaking the fixed deposit, unlike traditional flexi deposits that may have withdrawal restrictions. Understanding sweep-in accounts helps optimize your savings strategy by maximizing interest earnings while ensuring easy access to funds.

What is a Flexi Deposit?

A Flexi Deposit is a hybrid savings product that combines the liquidity of a savings account with the higher interest rates of a fixed deposit, allowing account holders to earn better returns without locking in their entire balance. Funds can be freely withdrawn from the savings portion while the remaining balance continues to earn interest at fixed deposit rates. This product offers flexible access to funds along with the advantage of compounded interest, making it ideal for those seeking both growth and liquidity in their savings.

Key Features of Sweep-in Accounts

Sweep-in accounts offer automatic fund transfer between savings and fixed deposits, optimizing interest earnings while maintaining liquidity. These accounts provide seamless overdraft facilities using the fixed deposit as collateral, reducing loan interest rates compared to unsecured loans. Sweep-in accounts ensure continuous interest accrual on the fixed deposit portion while allowing easy withdrawal through the linked savings account.

Key Features of Flexi Deposits

Flexi deposits combine the benefits of fixed deposits and savings accounts by allowing automatic transfers from savings to fixed deposits for higher interest accrual. These accounts offer liquidity with easy withdrawals while maintaining competitive interest rates, often higher than regular savings accounts. Key features include flexible tenure options, auto-sweep facility to maximize returns, and the ability to earn interest on the entire balance by optimizing idle funds efficiently.

Interest Rates: Sweep-in vs Flexi Deposit

Sweep-in accounts typically offer lower interest rates compared to flexi deposits, which combine the liquidity of savings with higher fixed deposit returns. Flexi deposits automatically transfer surplus funds from a savings account into a fixed deposit, attracting interest rates that are 2% to 4% higher than regular savings accounts. This structure maximizes interest earnings while maintaining easy access to fund withdrawals without penalty.

Liquidity and Accessibility Comparison

Sweep-in accounts offer higher liquidity with seamless automatic transfers between savings and fixed deposits, ensuring funds remain accessible while earning better interest. Flexi deposits provide moderate liquidity by allowing partial withdrawals without penalty but may require notice or partial interest forfeiture. Both options enhance fund accessibility, yet sweep-in accounts prioritize immediate liquidity, whereas flexi deposits balance accessibility with fixed tenure benefits.

Minimum Balance and Deposit Requirements

Sweep-in accounts have a low minimum balance requirement, typically around Rs5,000, allowing seamless transfer of surplus funds into a fixed deposit to earn higher interest without locking the entire amount. Flexi deposits require an initial fixed deposit amount, usually starting from Rs10,000 to Rs25,000, but offer the flexibility to withdraw funds without penalty while earning better returns than a regular savings account. Both options cater to savings optimization, with sweep-in accounts minimizing idle balance and flexi deposits providing liquidity with competitive interest rates.

Tax Implications for Sweep-in and Flexi Deposits

Sweep-in accounts offer tax benefits by allowing automatic transfer of surplus funds from a savings account to a fixed deposit without breaking the FD prematurely, maintaining interest earned under section 80TTA exemptions up to a limit. Flexi deposits, categorized as fixed deposits, attract tax on the interest earned as per the individual's income tax slab and do not qualify for section 80TTA deductions. Interest income from both is taxable, but sweep-in accounts provide better liquidity with tax efficiency compared to traditional flexi deposits, making them beneficial for short-term tax planning.

Suitable User Profiles for Each Option

Sweep-in accounts suit salaried professionals and business owners seeking seamless liquidity with higher interest on idle balances, enabling easy fund transfer between savings and fixed deposit accounts. Flexi deposits are ideal for conservative investors or fixed-income earners aiming for better returns than regular savings accounts, offering partial withdrawal flexibility without breaking the entire deposit. Both options provide tailored solutions based on the user's need for balance between liquidity and interest maximization.

Which is Better: Sweep-in Account or Flexi Deposit?

A Sweep-in account offers seamless liquidity by automatically transferring funds between your savings and fixed deposit accounts, maximizing interest earnings without locking your money for long periods. Flexi deposits provide higher interest rates than regular savings accounts with the flexibility to withdraw funds partially without breaking the entire deposit, ideal for those seeking both growth and access. Choosing between the two depends on your cash flow needs: Sweep-in accounts suit frequent transactions, while Flexi deposits benefit those prioritizing higher returns with occasional withdrawals.

Important Terms

Auto-sweep facility

Auto-sweep facility automatically transfers surplus funds from a Sweep-in account to a high-interest Flexi deposit, maximizing returns while maintaining liquidity. This seamless movement ensures funds above a predetermined threshold earn higher interest without manual intervention.

Linked savings account

Linked savings accounts with Sweep-in features automatically transfer surplus funds into fixed deposits for higher interest, optimizing liquidity and earnings. In comparison, Flexi deposit accounts allow partial withdrawals without breaking the term, providing flexible access to funds alongside better interest rates than regular savings accounts.

Threshold balance

Threshold balance in a Sweep-in account determines the minimum amount that must be maintained before excess funds are automatically transferred to a Flexi deposit, optimizing interest earnings while ensuring sufficient liquidity. This mechanism enhances financial management by balancing immediate accessibility with higher return potential through secured deposits.

Periodic transfer

Periodic transfer enables automatic movement of funds from a Sweep-in account to a Flexi deposit, optimizing interest earnings by maintaining a minimum balance in the savings account while maximizing deposits in the higher-interest Flexi deposit. This mechanism ensures liquidity for daily transactions through the Sweep-in account and higher returns through the Flexi deposit, balancing convenience and profitability.

Liquidity optimization

Liquidity optimization involves maximizing cash flow efficiency by balancing instant access to funds with higher interest returns; Sweep-in accounts automatically transfer surplus funds from current accounts into Flexi deposits, which offer higher interest rates while maintaining liquidity. This strategy ensures businesses retain immediate operational funds while optimizing earnings on idle balances through flexible, interest-bearing deposits.

Fixed deposit breakage

Fixed deposit breakage penalties vary between Sweep-in accounts and Flexi deposits; Sweep-in accounts allow automatic liquidity by linking savings with fixed deposits, minimizing premature withdrawal impact, while Flexi deposits offer flexible partial withdrawals but may impose higher interest rate reductions if broken early. Choosing between these depends on balancing interest benefits against potential breakage charges and liquidity needs.

Idle funds utilization

Idle funds in a Sweep-in account are automatically transferred to a linked Fixed Deposit, maximizing interest earnings without disrupting liquidity, while Flexi deposits offer flexible partial withdrawals and automatic recourse to savings when funds are insufficient, optimizing fund utilization through seamless integration of savings and fixed deposit features. This combination ensures efficient management of surplus funds by balancing high returns and easy accessibility.

Reinvestment option

The reinvestment option in a Sweep-in account automatically transfers surplus funds into fixed deposits, maximizing interest earnings without manual intervention, while a Flexi deposit allows flexible withdrawals and continuous interest accrual on the remaining balance. Both options optimize liquidity and returns, but Sweep-in accounts focus on seamless fund management, whereas Flexi deposits provide greater control over partial withdrawals and tenure adjustments.

Partial withdrawal

Partial withdrawal from a Flexi deposit allows investors to access funds while keeping the remaining amount invested at a fixed interest rate, ensuring liquidity with potential returns. In contrast, a Sweep-in account automatically transfers surplus funds from a savings account to a fixed deposit, enabling partial withdrawals without breaking the fixed deposit tenor, optimizing both interest earnings and cash availability.

Interest rate differential

Interest rate differential between a Sweep-in account and a Flexi deposit significantly impacts earning potential, as Sweep-in accounts typically offer lower interest rates compared to Flexi deposits, which provide higher returns by locking funds for fixed periods. Utilizing a Sweep-in account ensures liquidity with baseline interest, while Flexi deposits optimize interest income through higher rates on committed amounts, balancing accessibility and profitability.

Sweep-in account vs Flexi deposit Infographic

moneydif.com

moneydif.com