Cash sweep automatically transfers excess cash from a checking account to a higher-interest savings account, maximizing returns without manual intervention. Auto-sweep offers flexible, predefined thresholds that trigger fund transfers between accounts, optimizing liquidity and minimizing idle balances. Both methods enhance savings efficiency by ensuring funds are actively managed and earning interest.

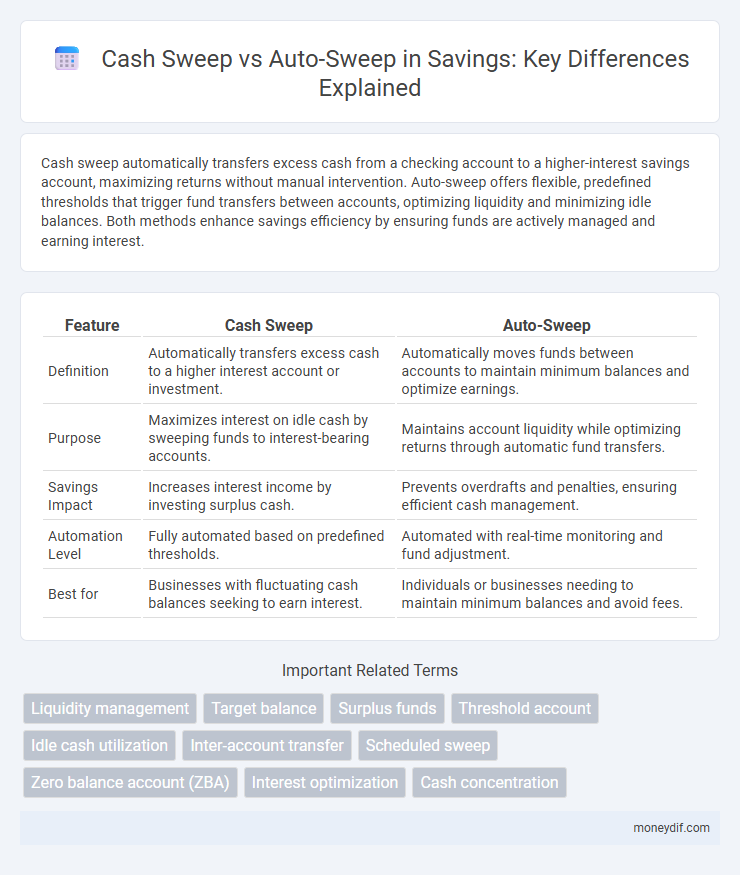

Table of Comparison

| Feature | Cash Sweep | Auto-Sweep |

|---|---|---|

| Definition | Automatically transfers excess cash to a higher interest account or investment. | Automatically moves funds between accounts to maintain minimum balances and optimize earnings. |

| Purpose | Maximizes interest on idle cash by sweeping funds to interest-bearing accounts. | Maintains account liquidity while optimizing returns through automatic fund transfers. |

| Savings Impact | Increases interest income by investing surplus cash. | Prevents overdrafts and penalties, ensuring efficient cash management. |

| Automation Level | Fully automated based on predefined thresholds. | Automated with real-time monitoring and fund adjustment. |

| Best for | Businesses with fluctuating cash balances seeking to earn interest. | Individuals or businesses needing to maintain minimum balances and avoid fees. |

Introduction to Savings Tools: Cash Sweep and Auto-Sweep

Cash sweep and auto-sweep are savings tools designed to maximize interest earnings by automatically transferring excess funds between accounts. Cash sweep moves surplus cash from a checking account to a higher-interest savings or money market account at the end of each business day. Auto-sweep extends this concept by enabling continuous, real-time transfers between accounts to optimize liquidity and ensure funds earn the best possible interest rates without manual intervention.

What is a Cash Sweep?

A cash sweep is a financial mechanism that automatically transfers excess funds from one account to another to maximize interest earnings or minimize borrowing costs. It ensures idle cash in a primary account is moved to higher-yield accounts or investment instruments, optimizing liquidity management. Cash sweeps are commonly used by businesses to enhance cash flow efficiency and improve overall financial returns.

What is an Auto-Sweep Facility?

An Auto-Sweep Facility is a financial service that automatically transfers surplus funds from a savings account to a fixed deposit or liquid account, maximizing interest earnings without manual intervention. This seamless transfer ensures optimal liquidity while enhancing returns, as idle cash is efficiently moved to higher-yield instruments. By maintaining a minimum balance in the savings account and sweeping excess funds, it provides a smart solution for effective savings management and cash flow optimization.

Key Differences: Cash Sweep vs Auto-Sweep

Cash sweep automates the transfer of excess cash from a checking to a savings account to maximize interest earnings, while auto-sweep involves automatic movement of funds between multiple accounts based on predefined thresholds to maintain minimum balances or optimize liquidity. Cash sweep primarily targets idle funds, ensuring they earn higher returns, whereas auto-sweep focuses on maintaining account balances and preventing overdrafts. Understanding these differences helps in selecting the right method for efficient cash management and optimized savings growth.

Interest Rates: Which Option Pays More?

Cash sweep accounts typically offer higher interest rates by automatically transferring excess funds into higher-yield investment options, maximizing returns on idle cash. Auto-sweep features, while also moving surplus funds, often provide slightly lower interest rates due to the convenience and liquidity they prioritize. Comparing average interest rates, cash sweep generally pays more, especially for larger balances or long-term idle funds.

Liquidity and Accessibility Comparison

Cash sweep automatically transfers excess funds from a checking account to a higher-interest savings or investment account overnight, maximizing liquidity by keeping funds accessible while earning better returns. Auto-sweep, on the other hand, typically moves funds between primary and secondary accounts within the same bank to prevent overdrafts or maintain minimum balances, offering seamless accessibility but potentially lower interest gains. Both methods enhance liquidity management, with cash sweep prioritizing optimized returns and auto-sweep focusing on immediate fund availability and account balance maintenance.

Benefits of Using Cash Sweep Facilities

Cash sweep facilities automate the transfer of surplus funds from a primary account to higher-yielding investment or savings accounts, maximizing interest earnings without manual intervention. Auto-sweep enhances liquidity management by ensuring optimal use of idle balances, reducing the risk of overdrafts and improving cash flow efficiency. Utilizing cash sweep services offers a seamless way to grow savings while maintaining immediate access to funds when needed.

Advantages of Auto-Sweep Accounts

Auto-sweep accounts offer seamless fund management by automatically transferring excess balances from a savings account to a fixed deposit, optimizing interest earnings without manual intervention. These accounts enhance liquidity by allowing instant access to funds while maximizing returns through higher fixed deposit rates. Auto-sweep minimizes idle cash, ensuring optimal utilization of savings with better interest accumulation compared to traditional cash sweep methods.

Suitability: Who Should Choose Cash Sweep or Auto-Sweep?

Cash sweep is suitable for businesses or individuals seeking to maximize interest earnings by automatically transferring excess cash into a higher-yield investment account, providing better control over liquidity management. Auto-sweep is ideal for account holders who prefer seamless cash flow management, where surplus funds are automatically moved between savings and current accounts to maintain minimum balance requirements and avoid penalties. Both options enhance savings efficiency, but cash sweep prioritizes interest optimization, while auto-sweep emphasizes convenience and account maintenance.

How to Set Up Cash Sweep and Auto-Sweep Accounts

To set up a cash sweep account, link your primary bank account to a money market or savings account where excess funds automatically transfer daily to maximize interest earnings. For auto-sweep accounts, coordinate with your bank to enable automatic transfers between your savings and current accounts, ensuring minimum balance requirements are met and idle funds are efficiently utilized. Both setups require contacting your bank's customer service or using online banking platforms to customize sweep thresholds and frequencies based on your financial needs.

Important Terms

Liquidity management

Cash sweep automates the transfer of excess funds from operating accounts to investment or debt repayment accounts, enhancing liquidity management by optimizing cash utilization. Auto-sweep continuously monitors account balances and automatically reallocates funds to maximize interest earnings or minimize borrowing costs, ensuring efficient cash flow control.

Target balance

Target balance is the predetermined minimum amount maintained in a cash account before excess funds trigger a cash sweep or auto-sweep mechanism. Cash sweep transfers surplus funds automatically into investment or debt repayment accounts, while auto-sweep allocates excess cash into predetermined instruments, maximizing liquidity management and optimizing interest earnings.

Surplus funds

Surplus funds in cash management are efficiently handled through cash sweep or auto-sweep mechanisms that automatically transfer excess balances from transactional accounts to higher-interest or investment accounts, maximizing liquidity and returns. Cash sweep typically involves manual or predetermined transfers at set intervals, whereas auto-sweep continuously monitors balances in real-time to optimize fund allocation without manual intervention.

Threshold account

Threshold accounts automate fund transfers by setting specific balance limits to optimize liquidity management, enabling either cash sweep or auto-sweep features. Cash sweep moves excess cash above the threshold to investment or interest-bearing accounts, while auto-sweep dynamically transfers funds to cover shortfalls or maximize returns based on preset rules.

Idle cash utilization

Idle cash utilization maximizes liquidity management by deploying excess funds through Cash Sweep and Auto-Sweep mechanisms, where Cash Sweep typically transfers idle balances exceeding a set threshold into interest-bearing accounts or investments. Auto-Sweep automates this process in real-time or at defined intervals, ensuring continuous optimization of idle cash by minimizing idle balances while maintaining operational cash needs.

Inter-account transfer

Inter-account transfer between Cash sweep and Auto-sweep involves moving surplus funds automatically to maximize interest earnings or liquidity management; Cash sweep typically transfers idle cash to an interest-bearing account, while Auto-sweep adjusts transfers based on preset thresholds to maintain minimum balances and optimize cash flow. Financial institutions use these mechanisms to enhance fund utilization by dynamically reallocating excess balances across linked accounts.

Scheduled sweep

Scheduled sweep automates the transfer of funds at predetermined intervals to optimize liquidity management, contrasting with cash sweep which moves excess cash to pay down debt or invest, while auto-sweep dynamically manages surplus funds between accounts to maximize interest earnings or reduce fees. This process enhances financial control by ensuring timely fund allocation tailored to specific cash flow needs and investment strategies.

Zero balance account (ZBA)

A Zero Balance Account (ZBA) consolidates funds by automatically transferring excess cash to a master account, similar to a cash sweep that moves idle balances to optimize liquidity, while auto-sweep differs by dynamically reallocating funds between accounts based on preset thresholds to maximize interest earnings or minimize borrowing costs. Both ZBA and auto-sweep mechanisms streamline cash management but vary in their operational rules and customization to business liquidity strategies.

Interest optimization

Interest optimization involves maximizing returns by strategically managing excess cash through mechanisms like cash sweep and auto-sweep. Cash sweep automatically transfers surplus funds to pay down debt or invest, while auto-sweep continuously moves idle balances into interest-earning accounts, enhancing liquidity management and boosting overall interest income.

Cash concentration

Cash concentration centralizes funds from multiple accounts into a master account, optimizing liquidity management and reducing idle cash balances. Cash sweep automatically transfers excess funds based on pre-set thresholds, while auto-sweep dynamically reallocates funds between accounts daily to maximize interest earnings and minimize overdraft risks.

Cash sweep vs Auto-sweep Infographic

moneydif.com

moneydif.com