Tax-advantaged savings accounts, such as IRAs and 401(k)s, offer significant tax benefits that help your investments grow faster by deferring or exempting taxes on earnings. In contrast, taxable savings accounts allow more flexibility in withdrawals but may reduce overall returns due to taxes on interest, dividends, and capital gains. Choosing between the two depends on your financial goals, time horizon, and tax situation to maximize long-term wealth accumulation.

Table of Comparison

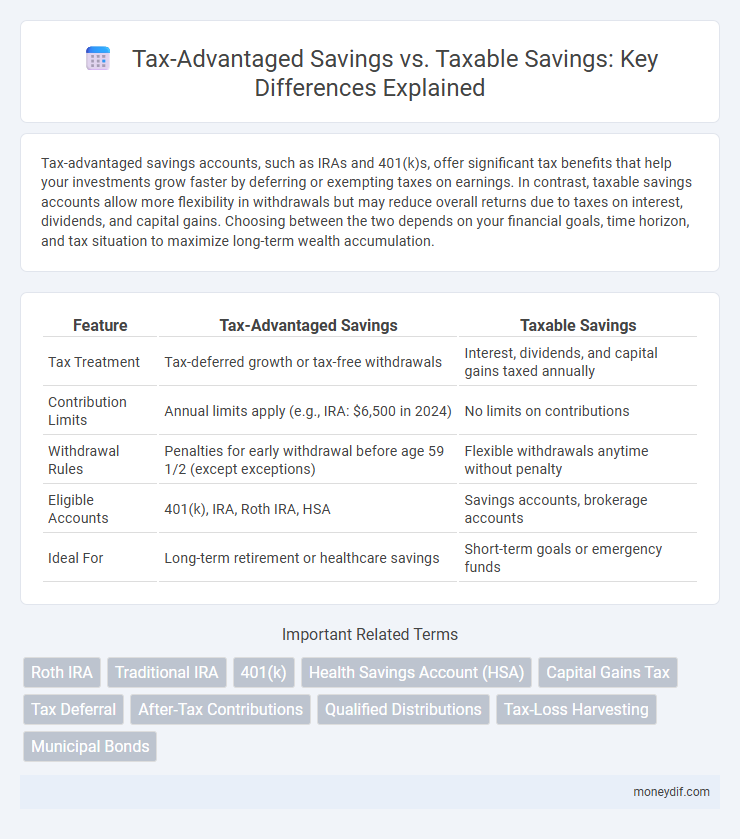

| Feature | Tax-Advantaged Savings | Taxable Savings |

|---|---|---|

| Tax Treatment | Tax-deferred growth or tax-free withdrawals | Interest, dividends, and capital gains taxed annually |

| Contribution Limits | Annual limits apply (e.g., IRA: $6,500 in 2024) | No limits on contributions |

| Withdrawal Rules | Penalties for early withdrawal before age 59 1/2 (except exceptions) | Flexible withdrawals anytime without penalty |

| Eligible Accounts | 401(k), IRA, Roth IRA, HSA | Savings accounts, brokerage accounts |

| Ideal For | Long-term retirement or healthcare savings | Short-term goals or emergency funds |

Understanding Tax-Advantaged Savings Accounts

Tax-advantaged savings accounts, such as 401(k)s and IRAs, offer specific tax benefits like deferred taxes on earnings or tax-free withdrawals, which can significantly enhance long-term growth compared to taxable accounts. Contributions to these accounts might reduce taxable income in the contribution year, and the compounding returns grow without annual taxation, maximizing overall savings. Understanding the distinct rules and limits set by the IRS for each type is crucial to optimizing investment strategies and minimizing tax liabilities over time.

What Are Taxable Savings Accounts?

Taxable savings accounts are financial accounts where interest earnings and investment gains are subject to ordinary income tax rates each year. Unlike tax-advantaged accounts such as IRAs or 401(k)s, these accounts offer no special tax benefits, providing greater flexibility for withdrawals without penalties or restrictions. Common examples include regular savings accounts, money market accounts, and brokerage accounts, which allow for easy access but require reporting interest and dividends as taxable income.

Key Differences Between Tax-Advantaged and Taxable Savings

Tax-advantaged savings accounts, such as Roth IRAs and 401(k)s, offer benefits like tax-free growth or tax-deductible contributions, reducing your overall taxable income. Taxable savings accounts do not provide these tax benefits, and interest or dividends earned are subject to annual taxes. The key differences lie in tax treatment, contribution limits, and the impact on long-term growth and withdrawals.

Tax Benefits of Retirement Accounts

Tax-advantaged retirement accounts, such as 401(k)s and IRAs, offer significant tax benefits by allowing contributions to grow tax-deferred or even tax-free, which can substantially increase long-term savings. Contributions to traditional retirement accounts often reduce taxable income in the year they are made, lowering current tax liability, while Roth accounts provide qualified withdrawals free from federal income tax. These tax advantages contrast with taxable savings accounts where earnings are subject to annual taxation, reducing overall investment growth potential.

Flexibility and Accessibility: A Comparative Analysis

Tax-advantaged savings accounts, such as IRAs and 401(k)s, offer significant tax benefits but often impose restrictions on withdrawals, limiting flexibility and accessibility. Taxable savings accounts provide unrestricted access to funds at any time, allowing greater liquidity and ease of use for unexpected expenses. Understanding the trade-offs between tax savings and withdrawal flexibility is crucial for optimizing personal financial strategies.

Impact on Long-Term Wealth Growth

Tax-advantaged savings accounts, such as IRAs and 401(k)s, offer significant benefits by allowing investments to grow tax-deferred or tax-free, enhancing long-term wealth accumulation. In contrast, taxable savings accounts are subject to annual taxes on interest, dividends, and capital gains, which can erode overall returns over time. Utilizing tax-advantaged accounts strategically maximizes compound growth potential and preserves more wealth for retirement or future financial goals.

Contribution Limits and Withdrawal Rules

Tax-advantaged savings accounts, such as IRAs and 401(k)s, have annual contribution limits set by the IRS, typically $6,500 for IRAs and $22,500 for 401(k)s in 2024, with additional catch-up contributions allowed for individuals over 50. Withdrawals from tax-advantaged accounts before age 59 1/2 often incur penalties and taxes, though qualified distributions from Roth IRAs can be tax-free. Taxable savings accounts have no contribution limits and offer unrestricted access to funds, but earnings are subject to ordinary income tax.

Tax Implications: Growth, Withdrawal, and Inheritance

Tax-advantaged savings accounts offer growth that is often tax-deferred or tax-free, reducing the immediate tax burden on earned interest or capital gains, while taxable savings incur taxes annually on interest, dividends, and realized gains. Withdrawals from tax-advantaged accounts may be tax-free or taxed at potentially lower rates depending on the account type and purpose, whereas withdrawals from taxable accounts typically have no tax impact since taxes are paid yearly. Inheritance of tax-advantaged accounts can involve specific rules such as required minimum distributions (RMDs) or potential tax liabilities for heirs, contrasting with taxable accounts where the stepped-up cost basis often minimizes capital gains taxes for beneficiaries.

Ideal Scenarios for Using Each Account Type

Tax-advantaged savings accounts like IRAs and 401(k)s are ideal for long-term goals due to their tax deferral or tax-free growth, maximizing retirement savings. Taxable savings accounts offer greater flexibility and accessibility, making them suitable for short-term goals, emergency funds, or large purchases without early withdrawal penalties. Choosing the right account depends on your financial timeline, tax bracket, and liquidity needs.

Strategic Tips for Maximizing Your Savings

Maximize your savings by prioritizing tax-advantaged accounts such as 401(k)s, IRAs, and Health Savings Accounts (HSAs), which offer tax deductions, tax-free growth, or tax-free withdrawals. Diversify with taxable savings accounts for liquidity and additional investment opportunities but optimize contributions to tax-advantaged accounts first to benefit from long-term tax savings. Regularly review contribution limits and employer matching programs to fully leverage available tax benefits and compound interest growth.

Important Terms

Roth IRA

A Roth IRA offers significant tax advantages by allowing contributions with after-tax dollars and enabling tax-free withdrawals of both contributions and earnings in retirement, unlike taxable savings accounts where interest and gains are subject to annual taxes. This tax-advantaged structure makes Roth IRAs a powerful tool for long-term growth and retirement planning, providing investors with a way to maximize income without future tax liabilities.

Traditional IRA

Traditional IRAs offer tax-deferred growth on contributions, allowing individuals to lower their taxable income during the contribution year, unlike taxable savings accounts where interest and dividends are taxed annually. Withdrawals from Traditional IRAs in retirement are taxed as ordinary income, providing significant tax advantages for long-term retirement planning compared to the immediate tax liabilities incurred with taxable savings.

401(k)

A 401(k) plan offers tax-advantaged savings by allowing pre-tax contributions that reduce taxable income and enable tax-deferred growth until withdrawal, contrasting with taxable savings accounts where earnings are subject to annual taxes. This tax deferral in a 401(k) enhances long-term retirement accumulation compared to the immediate tax liability on interest, dividends, and capital gains in taxable accounts.

Health Savings Account (HSA)

Health Savings Accounts (HSAs) offer tax-advantaged savings by allowing contributions, earnings, and qualified withdrawals to be tax-free, unlike taxable savings accounts where interest income is subject to ordinary income tax. HSAs provide a unique triple tax benefit, making them an efficient tool for medical expense savings compared to traditional taxable accounts.

Capital Gains Tax

Capital Gains Tax applies to profits made from the sale of assets in taxable savings accounts, reducing the overall return compared to tax-advantaged savings vehicles like IRAs or 401(k)s, which often allow capital gains to grow tax-deferred or tax-free. Choosing tax-advantaged savings accounts can significantly enhance long-term investment growth by minimizing or eliminating capital gains tax liabilities.

Tax Deferral

Tax deferral allows investment earnings in tax-advantaged savings accounts, such as 401(k)s and IRAs, to grow without immediate tax liability, enhancing compound growth compared to taxable savings accounts where earnings are taxed annually. Utilizing tax-deferral strategies optimizes long-term wealth accumulation by postponing income tax until withdrawal, often during retirement when tax rates may be lower.

After-Tax Contributions

After-tax contributions to a tax-advantaged savings account allow for tax-free growth and qualified withdrawals, contrasting with taxable savings where earnings are subject to annual income tax. This strategy maximizes long-term investment gains by leveraging deferred taxation, unlike taxable accounts that incur taxes on dividends and capital gains each year.

Qualified Distributions

Qualified distributions from tax-advantaged savings accounts such as Roth IRAs or 529 plans are generally tax-free when used for eligible expenses, maximizing investment growth without tax erosion. In contrast, withdrawals from taxable savings accounts are subject to capital gains taxes and ordinary income taxes on interest, reducing the net return compared to qualified distributions from tax-advantaged accounts.

Tax-Loss Harvesting

Tax-loss harvesting strategically reduces taxable capital gains by offsetting profits with realized losses, enhancing after-tax returns in taxable savings accounts where capital gains taxes apply. Tax-advantaged savings, such as IRAs and 401(k)s, inherently defer or eliminate taxes on investment gains, minimizing the immediate benefits of tax-loss harvesting compared to taxable accounts.

Municipal Bonds

Municipal bonds offer tax-exempt interest income at the federal level and often at the state and local levels, making them a strategic choice for tax-advantaged savings compared to taxable savings accounts or bonds, which generate taxable interest income. Investors in higher tax brackets benefit significantly from municipal bonds' tax advantages, enhancing after-tax returns and reducing overall tax liability.

Tax-Advantaged Savings vs Taxable Savings Infographic

moneydif.com

moneydif.com