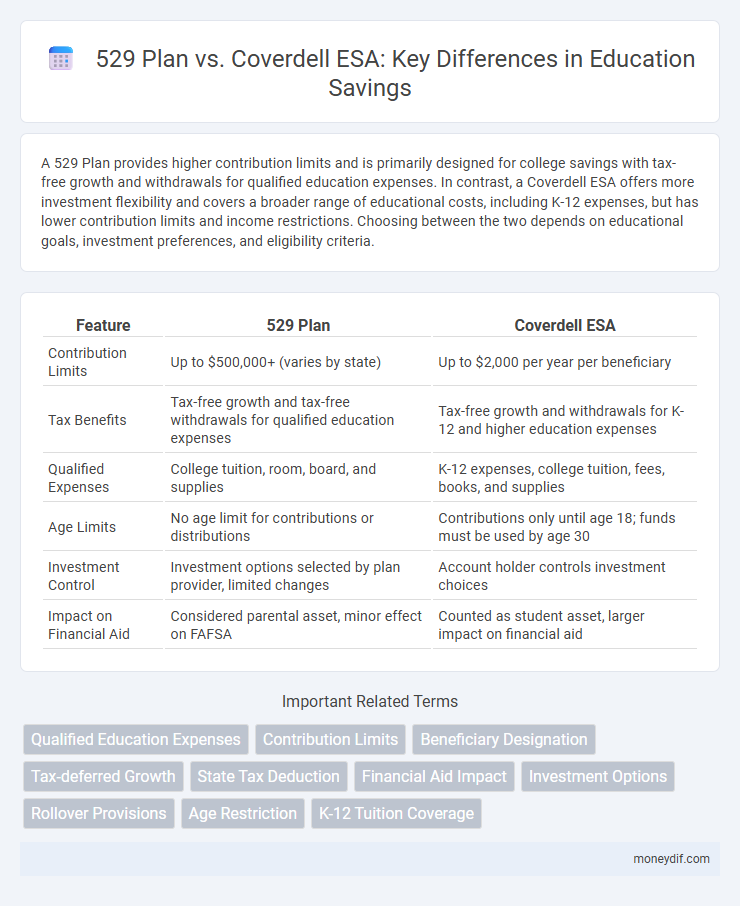

A 529 Plan provides higher contribution limits and is primarily designed for college savings with tax-free growth and withdrawals for qualified education expenses. In contrast, a Coverdell ESA offers more investment flexibility and covers a broader range of educational costs, including K-12 expenses, but has lower contribution limits and income restrictions. Choosing between the two depends on educational goals, investment preferences, and eligibility criteria.

Table of Comparison

| Feature | 529 Plan | Coverdell ESA |

|---|---|---|

| Contribution Limits | Up to $500,000+ (varies by state) | Up to $2,000 per year per beneficiary |

| Tax Benefits | Tax-free growth and tax-free withdrawals for qualified education expenses | Tax-free growth and withdrawals for K-12 and higher education expenses |

| Qualified Expenses | College tuition, room, board, and supplies | K-12 expenses, college tuition, fees, books, and supplies |

| Age Limits | No age limit for contributions or distributions | Contributions only until age 18; funds must be used by age 30 |

| Investment Control | Investment options selected by plan provider, limited changes | Account holder controls investment choices |

| Impact on Financial Aid | Considered parental asset, minor effect on FAFSA | Counted as student asset, larger impact on financial aid |

Understanding the Basics: 529 Plan vs Coverdell ESA

529 Plans offer higher contribution limits and are designed primarily for college expenses, providing tax-free growth and withdrawals when used for qualified education costs. Coverdell ESAs have lower contribution limits but cover a broader range of education expenses, including K-12 tuition, with tax-free earnings growth and withdrawals. Understanding the differences in contribution limits, eligible expenses, and tax benefits helps families choose the right education savings vehicle.

Key Differences Between 529 Plans and Coverdell ESAs

529 Plans offer higher contribution limits, often exceeding $300,000 per beneficiary, compared to Coverdell ESAs which have a $2,000 annual contribution cap. While 529 Plans primarily cover qualified college expenses, Coverdell ESAs allow tax-free withdrawals for K-12 education costs as well. The income eligibility restrictions apply to Coverdell ESA contributors, but 529 Plans have no income limits, making them accessible to all taxpayers.

Eligible Expenses: What Can You Use the Funds For?

529 Plans allow funds to be used for qualified education expenses, including tuition, fees, books, supplies, and room and board at eligible colleges, universities, and vocational schools. Coverdell ESAs cover a broader range of expenses, including K-12 tuition, computers, and tutoring, in addition to higher education costs. Both plans exclude expenses for sports equipment, insurance, transportation, and non-educational costs.

Contribution Limits and Rules

529 Plans allow contributions up to $500,000 or more per beneficiary depending on the state, with no annual limit but subject to gift tax rules. Coverdell ESAs have a strict annual contribution limit of $2,000 per beneficiary and require contributions to stop once the beneficiary turns 18. Both plans offer tax-free growth and withdrawals for qualified education expenses but differ significantly in flexibility and income restrictions.

Tax Advantages and Implications

529 Plans offer significant tax advantages, including tax-free growth and tax-free withdrawals for qualified education expenses, with higher contribution limits compared to Coverdell ESAs. Coverdell ESAs also provide tax-free growth and withdrawals for education costs but impose lower contribution limits and allow funds to be used for K-12 expenses in addition to college costs. Both accounts offer tax benefits, but 529 Plans are generally preferred for higher education savings due to greater flexibility in contributions and fewer income restrictions.

Investment Options and Flexibility

529 Plans offer a broader range of investment options, including age-based portfolios and target-risk funds, allowing customization aligned with the beneficiary's timeline and risk tolerance. Coverdell ESAs provide more flexibility by permitting investments in individual stocks, bonds, and mutual funds, but have lower contribution limits and income restrictions. The choice between the two hinges on whether an investor values diversified, professionally managed portfolios or desires granular control over specific securities within the account.

Beneficiary Changes and Transferability

529 Plans allow for flexible beneficiary changes, permitting account owners to switch the beneficiary to another qualifying family member without tax consequences, enhancing their transferability within a family. Coverdell ESAs also permit beneficiary changes to another eligible family member but impose stricter rules and age limits, which can limit transfer options. Both savings vehicles offer tax advantages, but 529 Plans typically provide greater ease in transferring funds among beneficiaries.

Financial Aid Impact: How Each Account Affects Eligibility

529 Plans have a minor impact on financial aid eligibility by being considered parental assets, typically assessed at a maximum rate of 5.64% in the federal financial aid formula, thus reducing aid slightly. Coverdell ESAs are also treated as parental assets when owned by a parent, affecting aid similarly; however, if owned by the student, the assets are assessed at a higher rate of 20%, significantly impacting aid eligibility. Understanding these differences is crucial for optimizing financial aid outcomes when choosing between a 529 Plan and a Coverdell ESA.

Choosing the Right Savings Option for Your Family

Choosing between a 529 Plan and a Coverdell ESA depends on your family's education savings goals and income limits. A 529 Plan offers higher contribution limits and state tax benefits, making it ideal for college expenses, while a Coverdell ESA provides more flexible investment options and can cover K-12 education costs but has lower contribution limits and income restrictions. Evaluate factors such as eligible expenses, contribution limits, and tax advantages to select the best savings option tailored to your family's educational needs.

Pros and Cons: Comparing 529 Plans and Coverdell ESAs

529 Plans offer high contribution limits and state tax benefits, making them ideal for long-term college savings with flexibility to change beneficiaries. Coverdell ESAs provide more investment options and allow funds to be used for K-12 expenses but have lower annual contribution limits and income restrictions. Both plans grow tax-free, yet choosing between them depends on the family's financial situation and educational goals.

Important Terms

Qualified Education Expenses

Qualified Education Expenses for 529 Plans include tuition, fees, books, supplies, and equipment required for enrollment at eligible colleges or K-12 schools, whereas Coverdell ESAs cover a broader range including K-12 expenses such as tutoring and room and board for college students. Both accounts offer tax-free withdrawals when funds are used for qualified education expenses, but Coverdell ESA contributions have income limits and a $2,000 annual cap, while 529 Plans allow higher aggregate contributions without income restrictions.

Contribution Limits

529 Plan contribution limits vary by state but typically allow for over $300,000 in total account value, whereas Coverdell ESA contributions are capped at $2,000 annually per beneficiary. Both plans offer tax advantages for education savings, but 529 Plans have higher contribution limits and fewer income restrictions compared to Coverdell ESAs.

Beneficiary Designation

Beneficiary designation in a 529 Plan allows the account owner to change the beneficiary to another qualifying family member without tax penalties, offering flexibility in funding education expenses, while Coverdell ESAs also permit beneficiary changes but impose stricter income limits and contribution caps. Unlike Coverdell ESAs, 529 Plans have higher contribution limits and no income restrictions, making beneficiary designation more advantageous for larger educational savings.

Tax-deferred Growth

Tax-deferred growth allows investments in both 529 Plans and Coverdell ESAs to increase without immediate taxation on earnings, maximizing long-term savings for education expenses. 529 Plans often offer higher contribution limits and state tax benefits, while Coverdell ESAs provide more investment flexibility and can be used for a broader range of educational expenses.

State Tax Deduction

State tax deductions for 529 Plans often provide significant benefits, allowing residents to deduct contributions from their taxable income in states like New York and California, which encourages long-term education savings. Coverdell ESAs have limited or no state tax deductions but offer tax-free growth and withdrawals for qualified education expenses, including K-12 costs, making them less favored from a state tax deduction perspective compared to 529 Plans.

Financial Aid Impact

Financial aid calculations typically treat 529 Plan assets owned by parents as parental assets, assessing them at a maximum rate of 5.64% toward expected family contribution, whereas Coverdell ESA funds, if owned by the student, can be assessed up to 20%, potentially reducing aid eligibility more significantly. Understanding these differences helps families strategically manage college savings to maximize financial aid opportunities and minimize out-of-pocket costs.

Investment Options

529 Plans offer higher contribution limits and tax-free growth for education expenses but are limited to qualified institutions, while Coverdell ESAs have lower contribution limits and allow funds to be used for K-12 expenses in addition to college. Both plans provide tax advantages, but 529 Plans are more flexible for larger savings and state tax benefits, whereas Coverdell ESAs permit a broader range of investment choices and cover more education-related expenses.

Rollover Provisions

Rollover provisions for 529 Plans allow tax-free transfers to another beneficiary within the family, enabling flexible use of funds without penalties, whereas Coverdell ESA rollovers must occur within 60 days and to another family member to maintain tax benefits. Unlike 529 Plans, Coverdell ESA funds can be rolled into a 529 Plan but not vice versa, offering additional strategic options for education savings.

Age Restriction

Age restrictions for 529 Plans allow beneficiaries to use funds at any age for qualified education expenses, whereas Coverdell ESAs require funds to be used by age 30, otherwise, earnings are subject to taxes and penalties. Contributions to Coverdell ESAs must stop once the beneficiary turns 18, while 529 Plans have no age limit for contributions or distributions.

K-12 Tuition Coverage

K-12 tuition coverage allows tax-free withdrawals from a 529 Plan up to $10,000 per year per student for private, public, or religious elementary and secondary school tuition. Coverdell ESAs also permit tax-free use for K-12 expenses but have a lower annual contribution limit of $2,000 and impose income eligibility restrictions, making 529 Plans a more flexible option for sizable tuition savings.

529 Plan vs Coverdell ESA Infographic

moneydif.com

moneydif.com