An NRE account allows Non-Resident Indians to deposit foreign earnings, offering full repatriation benefits and tax-free interest in India, making it ideal for savings in foreign currency. In contrast, an NRO account is designed to manage income earned in India, such as rent or dividends, with restrictions on repatriation and subject to Indian income tax. Choosing between the two depends on the source of funds and the repatriation needs of the account holder.

Table of Comparison

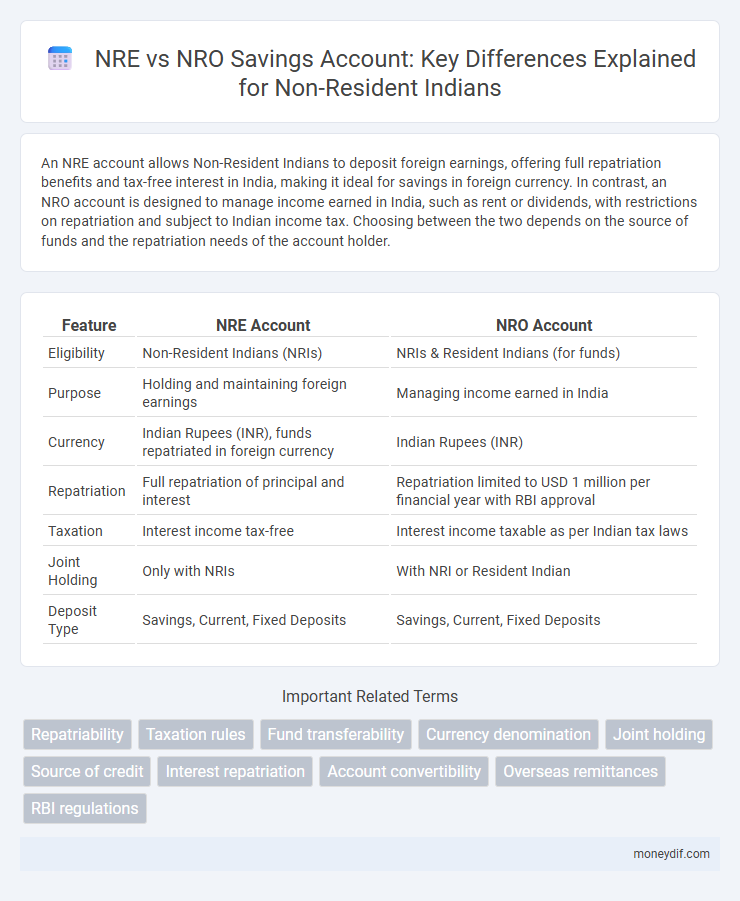

| Feature | NRE Account | NRO Account |

|---|---|---|

| Eligibility | Non-Resident Indians (NRIs) | NRIs & Resident Indians (for funds) |

| Purpose | Holding and maintaining foreign earnings | Managing income earned in India |

| Currency | Indian Rupees (INR), funds repatriated in foreign currency | Indian Rupees (INR) |

| Repatriation | Full repatriation of principal and interest | Repatriation limited to USD 1 million per financial year with RBI approval |

| Taxation | Interest income tax-free | Interest income taxable as per Indian tax laws |

| Joint Holding | Only with NRIs | With NRI or Resident Indian |

| Deposit Type | Savings, Current, Fixed Deposits | Savings, Current, Fixed Deposits |

Understanding NRE and NRO Accounts

NRE (Non-Resident External) accounts allow Non-Resident Indians (NRIs) to hold and manage income earned abroad in Indian rupees with full repatriability and tax exemption on interest. NRO (Non-Resident Ordinary) accounts are used to manage income earned in India, such as rent or dividends, with funds subject to taxes and limited repatriability. Understanding the differences in repatriation rules, tax implications, and deposit sources is crucial for optimizing savings across NRE and NRO accounts.

Key Differences Between NRE and NRO Accounts

NRE (Non-Resident External) accounts allow NRIs to deposit foreign earnings with full repatriation and tax-free interest in India, while NRO (Non-Resident Ordinary) accounts hold income earned in India and have restricted repatriation with applicable taxes on interest. NRE accounts are maintained in Indian rupees but funded by foreign currency, whereas NRO accounts are primarily for managing Indian income such as rent, dividends, or pensions. Interest earned on NRE accounts is tax-exempt, contrasted with NRO account interest which is subject to Indian income tax deductions at source.

Eligibility Criteria for NRE vs NRO Accounts

NRE accounts are exclusively available to Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs) looking to hold and manage foreign income in India, while NRO accounts can be opened by NRIs, PIOs, and residents who receive income in India. Eligibility for NRE accounts requires proof of non-resident status as per the Income Tax Act, unlike NRO accounts which do not have stringent residency criteria and accommodate local income deposits. The NRE account facilitates easy repatriation of foreign earnings, whereas the NRO account primarily manages income earned within India, such as rent, dividends, and pensions.

Interest Rates Comparison: NRE vs NRO

NRE accounts typically offer tax-free interest rates on foreign income deposits, making them attractive for non-resident Indians seeking better returns without tax deductions. NRO accounts usually provide interest rates similar to NRE accounts but are taxable under Indian income tax laws, impacting overall returns. Comparing interest rates, both accounts offer competitive rates set by banks, but the tax treatment makes NRE accounts more beneficial for maximizing post-tax interest earnings.

Taxation Rules for NRE and NRO Accounts

NRE (Non-Resident External) accounts offer tax-free interest earnings in India, exempt from Indian income tax, making them ideal for repatriable savings. In contrast, NRO (Non-Resident Ordinary) accounts are subject to Indian income tax on interest earned, with TDS (Tax Deducted at Source) at 30%, though income up to INR 2.5 lakh may be exempt under individual slabs. Understanding these taxation rules is crucial for NRIs to optimize savings and comply with Indian tax regulations efficiently.

Repatriation of Funds: NRE vs NRO Accounts

NRE accounts allow full repatriation of both principal and interest amounts without any restrictions, making them ideal for non-resident Indians looking to transfer funds abroad easily. In contrast, NRO accounts restrict repatriation to a maximum of USD 1 million per financial year, including principal and interest, subject to payment of applicable taxes and documentation. Understanding these repatriation limits is crucial for effective fund management and compliance with RBI regulations.

Documentation Required for Opening NRE/NRO Accounts

Opening an NRE account requires documentation such as a valid passport, visa or work permit, overseas address proof, Indian address proof, and recent passport-sized photographs. For an NRO account, documents include a valid passport, Indian address proof, foreign address proof, PAN card, and recent photographs. Both account types mandate submission of KYC documents to comply with RBI regulations and facilitate seamless account operation for non-resident Indians.

Benefits and Drawbacks of NRE and NRO Accounts

NRE accounts offer tax-free repatriation of funds and easy access to income earned abroad, making them ideal for non-resident Indians looking to remit savings to India without tax liability. NRO accounts allow management of income earned within India, such as rent or dividends, but come with tax deductions at source and limited repatriability, making them suitable for handling local income. While NRE accounts provide full repatriation benefits and tax exemption on interest, NRO accounts have repatriation limits of up to USD 1 million annually and are subject to Indian income tax regulations.

How to Choose Between NRE and NRO Account

When deciding between an NRE (Non-Resident External) account and an NRO (Non-Resident Ordinary) account, consider the source and repatriation rules of your funds; NRE accounts are ideal for parking foreign earnings with full repatriation, while NRO accounts manage income earned in India with limited repatriation. Tax implications also play a crucial role, as interest earned on NRE accounts is tax-free in India, whereas interest on NRO accounts is taxable. Evaluate your financial goals, source of income, and repatriation needs to select the most suitable account for efficient savings management.

Common FAQs on NRE and NRO Savings Accounts

NRE (Non-Resident External) and NRO (Non-Resident Ordinary) accounts are key savings options for non-resident Indians, with NRE accounts allowing tax-free repatriable funds, and NRO accounts managing income earned in India with applicable taxes. Common FAQs include differences in repatriation, tax treatment, and permissible account holders, where NRE accounts only accept foreign earnings and NRO accounts hold income from Indian sources. Both accounts support deposits in Indian rupees, but funds in NRE accounts can be transferred abroad freely, unlike NRO accounts which have repatriation limits.

Important Terms

Repatriability

Repatriability in the context of NRE (Non-Resident External) accounts allows full repatriation of both principal and interest amounts without restrictions, making it ideal for NRIs to transfer funds abroad. In contrast, NRO (Non-Resident Ordinary) accounts permit repatriation of up to USD 1 million per financial year for specific transactions, primarily including income generated within India, subject to certain regulatory approvals.

Taxation rules

Taxation rules for NRE (Non-Resident External) accounts exempt interest income from Indian tax, allowing full repatriation without any tax deductions, while NRO (Non-Resident Ordinary) accounts attract a 30% tax on interest income, and repatriation limits are capped at $1 million per financial year with applicable documentation. Interest earned in NRO accounts is subject to Tax Deducted at Source (TDS), and filing Indian tax returns can help in claiming refunds or adjusting tax liabilities.

Fund transferability

NRE accounts offer full fund transferability abroad with principal and interest freely repatriable, whereas NRO accounts restrict repatriation up to USD 1 million per financial year for current income only. NRE accounts are primarily used for income earned outside India with unrestricted outward transfers, while NRO accounts manage income generated within India subject to repatriation limits and documentation.

Currency denomination

Currency denomination in an NRE (Non-Resident External) account is strictly in Indian Rupees (INR), allowing seamless repatriation of both principal and interest without any currency conversion restrictions. In contrast, an NRO (Non-Resident Ordinary) account also holds funds in INR but is primarily used for managing income earned in India, with repatriation limits imposed by the Reserve Bank of India, making currency conversion subject to regulatory approval.

Joint holding

Joint holding in NRE accounts allows non-resident Indians to hold funds jointly with other NREs or resident Indians, facilitating seamless repatriation and tax benefits under Indian regulations. Conversely, joint holding in NRO accounts permits multiple residents or NRIs to manage income earned in India, but repatriation is subject to stricter limits and taxation varies based on residency status.

Source of credit

Credit in an NRE account primarily comes from foreign income or remittances from abroad, ensuring tax-free interest earnings and repatriable funds. In contrast, an NRO account is credited by domestic income such as rent, dividends, or pension from India, with interest subject to applicable Indian taxes and limited repatriability.

Interest repatriation

Interest repatriation from NRE accounts is fully permissible without restrictions, allowing non-resident Indians to transfer earnings abroad freely, whereas interest earned on NRO accounts is subject to regulatory limits and taxation before repatriation. NRE account interest is tax-free in India, facilitating easier global fund transfers, while NRO account interest attracts tax deductions at source and has repatriation capped at USD 1 million per financial year.

Account convertibility

Account convertibility in the context of NRE (Non-Resident External) and NRO (Non-Resident Ordinary) accounts defines the ease with which foreign currency holdings can be converted to Indian rupees and vice versa; NRE accounts offer full repatriability and free convertibility of funds, enabling seamless transfer of principal and interest abroad. In contrast, NRO accounts are subject to limited repatriability with restrictions on fund transfers overseas, primarily catering to income earned within India by non-residents.

Overseas remittances

Overseas remittances to India can be credited to either NRE (Non-Resident External) accounts, which permit repatriation of funds and tax-free interest earnings, or NRO (Non-Resident Ordinary) accounts, designed for managing income earned in India with repatriation subject to limits and interest income taxable. NRE accounts facilitate seamless foreign currency deposits converted to INR, ideal for savings and investments abroad, while NRO accounts handle local income like rent or dividends, offering restricted repatriation and higher tax implications.

RBI regulations

RBI regulations stipulate that NRE (Non-Resident External) accounts allow repatriation of funds and foreign currency deposits, while NRO (Non-Resident Ordinary) accounts are primarily for managing income earned in India with restrictions on repatriation. NRE accounts must be maintained in Indian rupees with full repatriability, whereas NRO accounts have limits on repatriating principal and interest, subject to RBI approval.

NRE account vs NRO account Infographic

moneydif.com

moneydif.com