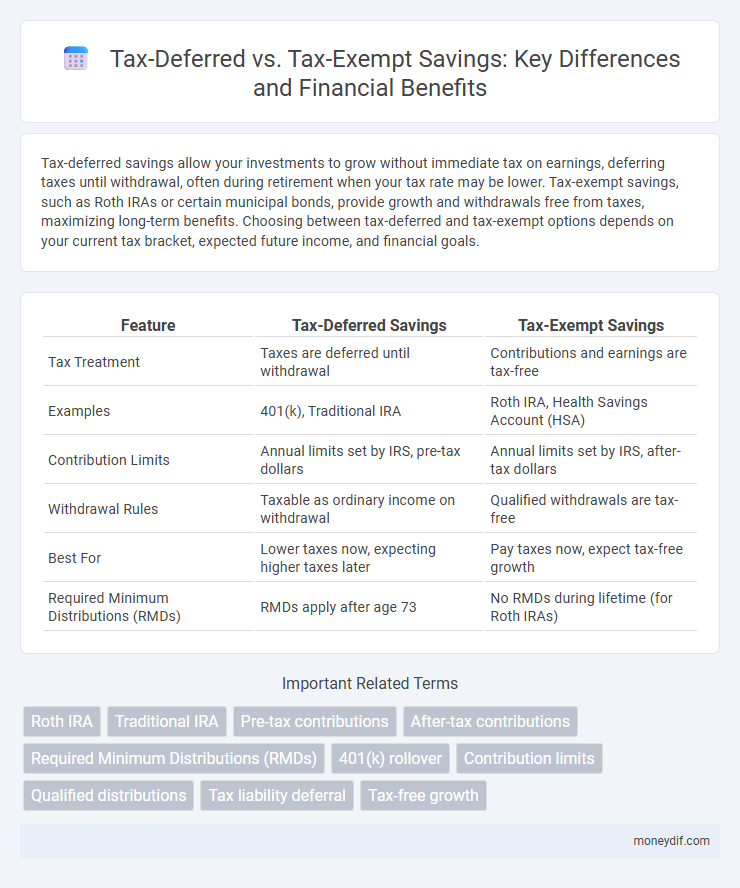

Tax-deferred savings allow your investments to grow without immediate tax on earnings, deferring taxes until withdrawal, often during retirement when your tax rate may be lower. Tax-exempt savings, such as Roth IRAs or certain municipal bonds, provide growth and withdrawals free from taxes, maximizing long-term benefits. Choosing between tax-deferred and tax-exempt options depends on your current tax bracket, expected future income, and financial goals.

Table of Comparison

| Feature | Tax-Deferred Savings | Tax-Exempt Savings |

|---|---|---|

| Tax Treatment | Taxes are deferred until withdrawal | Contributions and earnings are tax-free |

| Examples | 401(k), Traditional IRA | Roth IRA, Health Savings Account (HSA) |

| Contribution Limits | Annual limits set by IRS, pre-tax dollars | Annual limits set by IRS, after-tax dollars |

| Withdrawal Rules | Taxable as ordinary income on withdrawal | Qualified withdrawals are tax-free |

| Best For | Lower taxes now, expecting higher taxes later | Pay taxes now, expect tax-free growth |

| Required Minimum Distributions (RMDs) | RMDs apply after age 73 | No RMDs during lifetime (for Roth IRAs) |

Understanding Tax-Deferred Savings

Tax-deferred savings allow individuals to invest money without paying taxes on earnings until withdrawal, commonly seen in retirement accounts like 401(k)s and traditional IRAs. These accounts enable investments to grow tax-free during the accumulation phase, potentially increasing overall savings due to compounding interest. Understanding the timing of tax liabilities and required minimum distributions is crucial for optimizing long-term financial planning and minimizing tax burdens.

What Are Tax-Exempt Savings Accounts?

Tax-exempt savings accounts, such as Roth IRAs and Health Savings Accounts (HSAs), allow individuals to contribute after-tax income and withdraw earnings tax-free, provided specific conditions are met. These accounts promote long-term savings by eliminating taxes on qualified distributions, enhancing overall investment growth. Tax-exempt status contrasts with tax-deferred accounts, where taxes are postponed until withdrawal, offering a different strategy for tax-efficient savings.

Key Differences Between Tax-Deferred and Tax-Exempt

Tax-deferred savings accounts, such as traditional IRAs and 401(k)s, allow contributions to grow without immediate taxation, with taxes paid upon withdrawal, typically during retirement. Tax-exempt accounts, like Roth IRAs and Health Savings Accounts (HSAs), provide after-tax contributions but offer tax-free withdrawals, including earnings, under qualifying conditions. The key difference lies in the timing of tax benefits: tax-deferred plans postpone taxes until distribution, while tax-exempt plans eliminate taxes on qualified withdrawals entirely.

Tax-Deferred Accounts: Pros and Cons

Tax-deferred accounts, such as traditional IRAs and 401(k)s, allow investments to grow without immediate taxation, delaying income taxes until withdrawals begin, often at retirement. This deferral can enable larger compound growth over time, but withdrawals are taxed as ordinary income, potentially resulting in higher taxes if taken during a high-income retirement phase. Required Minimum Distributions (RMDs) starting at age 73 can force withdrawals regardless of need, which may limit long-term tax planning flexibility.

Tax-Exempt Accounts: Benefits and Limitations

Tax-exempt accounts, such as Roth IRAs and Municipal Bonds, offer the benefit of tax-free growth and withdrawals, making them ideal for long-term savings with predictable tax outcomes. Contributions to these accounts are made with after-tax dollars, which means no tax deductions upfront but qualified distributions are entirely tax-free, enhancing net returns over time. Limitations include contribution caps and income eligibility requirements that restrict who can utilize these accounts effectively, impacting their suitability for high-income earners.

How Tax-Deferred Savings Reduce Immediate Tax Burden

Tax-deferred savings accounts, such as traditional IRAs and 401(k)s, allow contributions to grow without being taxed until withdrawal, reducing the immediate tax burden by lowering taxable income during the contribution years. This deferral enables more capital to compound over time compared to taxable accounts, enhancing long-term growth potential. In contrast, tax-exempt accounts like Roth IRAs require after-tax contributions but offer tax-free withdrawals, making tax-deferred options advantageous for those seeking immediate tax relief.

When to Choose Tax-Exempt Savings Options

Choosing tax-exempt savings options is ideal when you expect to be in a higher tax bracket during retirement or anticipate significant long-term growth, as withdrawals are tax-free. These accounts, such as Roth IRAs or Roth 401(k)s, provide the advantage of tax-free income, reducing future tax liabilities significantly. Tax-exempt savings also benefit those prioritizing estate planning, as assets can be passed on without incurring income taxes.

Impact on Retirement Planning

Tax-deferred accounts, such as traditional IRAs and 401(k)s, delay taxes until withdrawals begin, potentially lowering taxable income during early retirement years and allowing investments to grow uninterrupted. Tax-exempt accounts, like Roth IRAs, require contributions with after-tax dollars but offer tax-free withdrawals, providing predictable income and shielding gains from future tax increases. Strategic use of both account types can optimize tax efficiency, enhance cash flow flexibility, and improve overall retirement income stability.

Tax Implications: Withdrawals and Distributions

Tax-deferred accounts such as traditional IRAs and 401(k)s allow contributions to grow without immediate taxation, but withdrawals are taxed as ordinary income, potentially affecting retirement income planning. Tax-exempt accounts like Roth IRAs provide tax-free withdrawals if qualified, ensuring distributions do not increase taxable income during retirement. Understanding these tax implications helps optimize savings strategies and manage long-term financial goals effectively.

Choosing the Right Savings Strategy for Your Goals

Choosing the right savings strategy depends on your financial goals and tax situation. Tax-deferred accounts, like traditional IRAs and 401(k)s, allow contributions to grow without immediate tax, ideal for those expecting lower taxes in retirement. Tax-exempt options, such as Roth IRAs or municipal bonds, offer tax-free growth and withdrawals, benefiting savers who anticipate higher future tax rates or want flexible access to funds.

Important Terms

Roth IRA

Roth IRA contributions are made with after-tax dollars, allowing for tax-exempt growth and tax-free withdrawals in retirement, contrasting with traditional IRAs where earnings grow tax-deferred but withdrawals are taxed as income. This tax-exempt feature of Roth IRAs provides long-term tax benefits, especially for investors expecting higher future tax rates.

Traditional IRA

Traditional IRAs offer tax-deferred growth, allowing contributions to reduce taxable income in the contribution year while taxes are paid upon withdrawal during retirement. Unlike Roth IRAs, Traditional IRAs do not provide tax-exempt withdrawals; instead, taxes are deferred until distributions begin, typically after age 59 1/2.

Pre-tax contributions

Pre-tax contributions to retirement accounts reduce taxable income in the contribution year, allowing earnings to grow tax-deferred until withdrawal, when distributions are taxed as ordinary income. In contrast, tax-exempt contributions, such as those to Roth accounts, are made with after-tax dollars, enabling qualified withdrawals of both contributions and earnings to be entirely tax-free.

After-tax contributions

After-tax contributions are made with income that has already been taxed, allowing earnings to grow tax-exempt upon withdrawal, contrasting with tax-deferred contributions where taxes are paid upon distribution. Understanding the difference between after-tax and tax-deferred accounts is crucial for optimizing tax strategies in retirement planning.

Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs) mandate withdrawals from tax-deferred retirement accounts such as traditional IRAs and 401(k)s starting at age 73, resulting in taxable income for the year of withdrawal. In contrast, tax-exempt accounts like Roth IRAs do not require RMDs during the owner's lifetime, allowing tax-free growth and withdrawals.

401(k) rollover

A 401(k) rollover maintains tax-deferred status by transferring funds into another qualified retirement account, preserving the growth potential without immediate tax liability. Rolling over into a Roth IRA converts tax-deferred contributions into tax-exempt status, triggering taxes on the converted amount but enabling tax-free withdrawals in retirement.

Contribution limits

Tax-deferred accounts like traditional IRAs and 401(k)s have annual contribution limits set by the IRS, which for 2024 are $6,500 for IRAs and $23,000 for 401(k)s, allowing earnings to grow tax-free until withdrawal. Tax-exempt accounts such as Roth IRAs have similar contribution limits but offer tax-free growth and withdrawals, making contribution timing and income eligibility critical factors in financial planning.

Qualified distributions

Qualified distributions from tax-exempt accounts, such as Roth IRAs, are tax-free because contributions were made with after-tax dollars, whereas qualified distributions from tax-deferred accounts like traditional IRAs are taxed as ordinary income since earnings and contributions were not previously taxed. Understanding the distinction between tax-deferred and tax-exempt accounts is essential for effective tax planning and maximizing retirement savings.

Tax liability deferral

Tax liability deferral allows taxpayers to postpone paying taxes on certain income or gains until a later date, often used in retirement accounts like 401(k)s or IRAs where contributions grow tax-deferred until withdrawal. In contrast, tax-exempt accounts, such as Roth IRAs or municipal bonds, provide income or gains that are permanently free from federal income tax, offering distinct advantages in long-term tax planning.

Tax-free growth

Tax-free growth allows investments to increase in value without incurring taxes on gains, differing from tax-deferred accounts where taxes are paid upon withdrawal and tax-exempt accounts that permanently exclude certain income from taxation. Emphasizing tax-free growth strategies benefits long-term wealth accumulation by eliminating future tax liabilities, contrasting with tax-deferred growth that postpones tax payments and tax-exempt growth that never taxes specific earnings.

Tax-deferred vs Tax-exempt Infographic

moneydif.com

moneydif.com