Money market accounts typically offer higher interest rates compared to traditional savings accounts, making them a valuable option for maximizing returns on savings. While both options provide easy access to funds, money market accounts often require higher minimum balances and may have limited transaction capabilities. Choosing between the two depends on your financial goals, liquidity needs, and willingness to meet balance requirements.

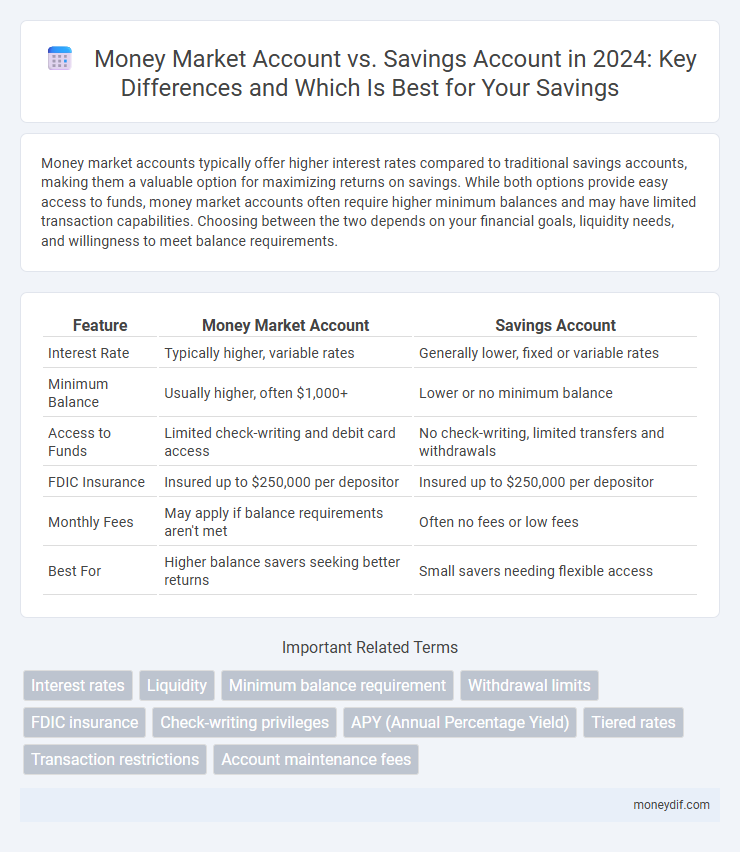

Table of Comparison

| Feature | Money Market Account | Savings Account |

|---|---|---|

| Interest Rate | Typically higher, variable rates | Generally lower, fixed or variable rates |

| Minimum Balance | Usually higher, often $1,000+ | Lower or no minimum balance |

| Access to Funds | Limited check-writing and debit card access | No check-writing, limited transfers and withdrawals |

| FDIC Insurance | Insured up to $250,000 per depositor | Insured up to $250,000 per depositor |

| Monthly Fees | May apply if balance requirements aren't met | Often no fees or low fees |

| Best For | Higher balance savers seeking better returns | Small savers needing flexible access |

Key Differences Between Money Market and Savings Accounts

Money market accounts typically offer higher interest rates compared to traditional savings accounts, making them more attractive for earning returns on larger balances. Unlike savings accounts, money market accounts often provide limited check-writing privileges and debit card access, enhancing liquidity and transaction flexibility. Savings accounts usually have lower minimum balance requirements and fewer fees, making them accessible for regular savers with smaller deposits.

Interest Rates: Money Market vs Savings Accounts

Money market accounts typically offer higher interest rates compared to traditional savings accounts, driven by their investment in short-term, low-risk securities. Savings accounts provide more stable but generally lower interest yields due to their liquidity and lower risk profile. Comparing APYs (Annual Percentage Yields) reveals money market accounts often outperform savings accounts, especially with higher minimum balance requirements.

Accessibility and Withdrawal Restrictions

Money market accounts typically offer higher accessibility with check-writing privileges and limited debit card use, whereas savings accounts often restrict direct withdrawals to six per month under federal Regulation D. Savings accounts prioritize preserving funds with fewer transaction options, making them less flexible for frequent access compared to money market accounts. Withdrawal restrictions on money market accounts are generally more lenient, providing easier access to funds while still maintaining some limitations to encourage saving.

Minimum Balance Requirements Compared

Money market accounts typically require a higher minimum balance, often ranging from $1,000 to $2,500, whereas savings accounts may have minimum balance requirements as low as $0 to $100. Failing to maintain the minimum balance in a money market account can result in monthly fees or reduced interest rates, while savings accounts generally have fewer penalties or lower fees. Choosing between the two should consider access to funds, interest rates, and minimum balance policies tailored to your financial goals.

Fees and Maintenance Costs

Money market accounts typically have higher minimum balance requirements but often come with lower monthly maintenance fees compared to regular savings accounts. Savings accounts generally offer more lenient balance thresholds but may charge monthly fees if the balance falls below a certain limit. Understanding fee structures and maintenance costs is essential for maximizing returns and minimizing expenses in chosen savings products.

Safety and FDIC Insurance Coverage

Money market accounts and savings accounts both provide FDIC insurance coverage up to $250,000 per depositor, ensuring a high level of safety for deposited funds at insured banks. Money market accounts often offer slightly higher interest rates while maintaining liquidity, but both account types protect principal investments similarly under federal regulations. Customers seeking secure, government-backed savings options can confidently use either, knowing their money is safeguarded against bank failures.

Ideal Uses for Each Account Type

Money market accounts are ideal for savers seeking higher interest rates and limited check-writing privileges, making them suitable for emergency funds or short-term savings with easy access. Savings accounts are better for individuals prioritizing simplicity and frequent deposits, ideal for building long-term savings with consistent contributions. Both account types offer FDIC insurance and variable interest rates, but money market accounts often require higher minimum balances.

Which Account Suits Your Savings Goals?

Money market accounts offer higher interest rates and limited check-writing privileges, ideal for savers seeking liquidity and better returns. Savings accounts provide easy access with lower minimum balance requirements, making them suitable for emergency funds and short-term goals. Choosing between these accounts depends on your need for accessibility, interest earnings, and account features aligning with your savings objectives.

Pros and Cons of Money Market Accounts

Money market accounts offer higher interest rates compared to traditional savings accounts, making them ideal for earning more on idle funds. They provide limited check-writing and debit card access, enhancing liquidity, but often require a higher minimum balance, which can be a barrier for some savers. The combination of competitive returns and moderate accessibility positions money market accounts as a flexible yet sometimes costlier savings option.

Pros and Cons of Savings Accounts

Savings accounts offer easy access to funds and typically provide a higher interest rate than checking accounts, making them ideal for emergency funds and short-term savings. However, their interest rates are generally lower than money market accounts, and many impose limits on monthly withdrawals, which can restrict liquidity. The low risk and federal insurance through the FDIC make savings accounts a safe option, but the trade-off is often slower growth compared to other investment options.

Important Terms

Interest rates

Money market accounts typically offer higher interest rates than traditional savings accounts due to their investment in short-term, low-risk securities, providing better returns while maintaining liquidity. Savings accounts generally have lower interest rates but offer easier access through frequent transactions and minimal balance requirements.

Liquidity

Liquidity in a money market account typically exceeds that of a savings account due to easier access to funds through check-writing and debit card features, while savings accounts may limit withdrawals per month under federal regulations. Money market accounts often require higher minimum balances but offer competitive interest rates, balancing liquidity with potential earnings compared to savings accounts.

Minimum balance requirement

Money market accounts typically require a higher minimum balance, often ranging from $1,000 to $2,500, compared to savings accounts that may have minimums as low as $0 to $500. Maintaining the minimum balance in money market accounts is crucial to avoid fees and to earn the advertised higher interest rates, whereas savings accounts generally offer more flexibility with lower balance requirements.

Withdrawal limits

Withdrawal limits on money market accounts often allow up to six pre-authorized transactions per month, similar to savings accounts, but may include limited check-writing or debit card access, enhancing liquidity compared to standard savings accounts. Federal regulations, such as Regulation D, traditionally capped withdrawals and transfers to six per month for both account types, though enforcement has varied, influencing how banks set specific withdrawal policies.

FDIC insurance

FDIC insurance protects deposits up to $250,000 per depositor, per insured bank, covering both money market accounts and savings accounts to ensure the safety of funds. While both account types are federally insured, money market accounts often offer higher interest rates and limited check-writing privileges, whereas savings accounts typically provide easier access but with lower yields.

Check-writing privileges

Money market accounts typically offer check-writing privileges, allowing limited checks to be written directly from the account, whereas savings accounts generally do not permit check-writing, focusing more on deposits and withdrawals through transfers or ATMs. This feature makes money market accounts a versatile option for those seeking liquidity combined with higher interest rates compared to standard savings accounts.

APY (Annual Percentage Yield)

Money market accounts typically offer higher APY compared to traditional savings accounts due to their investment in short-term, low-risk securities, providing better returns while maintaining liquidity. Savings accounts generally have lower APY but offer easier access and minimal balance requirements, making them suitable for emergency funds and short-term savings goals.

Tiered rates

Tiered rates in money market accounts typically offer higher interest yields based on increased account balances, providing better returns for larger deposits compared to standard savings accounts. Savings accounts often feature flat or minimally tiered interest rates, resulting in more consistent but generally lower earnings across all balance levels.

Transaction restrictions

Transaction restrictions on money market accounts typically allow up to six convenient transfers or withdrawals per month under federal Regulation D, with some banks imposing additional limits or fees for excess transactions. Savings accounts share similar limitations, often restricting certain types of withdrawals and transfers to no more than six per month, making both account types suitable for saving rather than frequent spending.

Account maintenance fees

Money market accounts typically have higher account maintenance fees compared to savings accounts due to offering check-writing privileges and higher interest rates. Savings accounts often feature lower or no monthly maintenance fees, making them a cost-effective option for building emergency funds and long-term savings.

Money market account vs Savings account Infographic

moneydif.com

moneydif.com