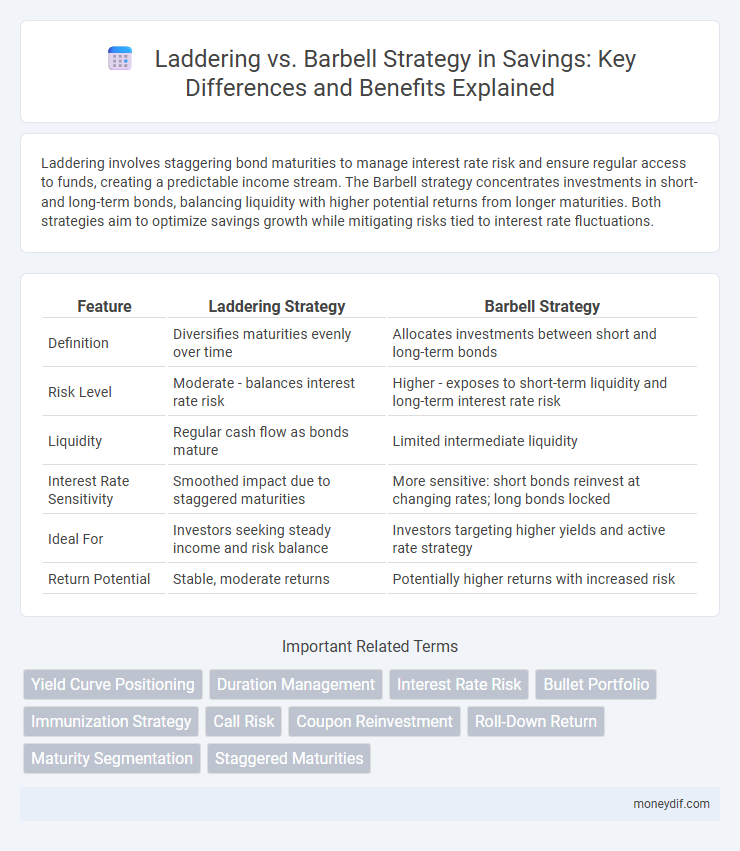

Laddering involves staggering bond maturities to manage interest rate risk and ensure regular access to funds, creating a predictable income stream. The Barbell strategy concentrates investments in short- and long-term bonds, balancing liquidity with higher potential returns from longer maturities. Both strategies aim to optimize savings growth while mitigating risks tied to interest rate fluctuations.

Table of Comparison

| Feature | Laddering Strategy | Barbell Strategy |

|---|---|---|

| Definition | Diversifies maturities evenly over time | Allocates investments between short and long-term bonds |

| Risk Level | Moderate - balances interest rate risk | Higher - exposes to short-term liquidity and long-term interest rate risk |

| Liquidity | Regular cash flow as bonds mature | Limited intermediate liquidity |

| Interest Rate Sensitivity | Smoothed impact due to staggered maturities | More sensitive: short bonds reinvest at changing rates; long bonds locked |

| Ideal For | Investors seeking steady income and risk balance | Investors targeting higher yields and active rate strategy |

| Return Potential | Stable, moderate returns | Potentially higher returns with increased risk |

Understanding Laddering and Barbell Strategies

Laddering and barbell strategies optimize savings by balancing risk and liquidity across different investment maturities. Laddering involves spreading investments evenly across various fixed-income securities with staggered maturities, enhancing cash flow predictability and reducing interest rate risk. Barbell strategy concentrates assets in short- and long-term securities, maximizing yield potential while maintaining flexibility for reinvestment.

Key Differences Between Laddering and Barbell

Laddering involves spreading investments across multiple fixed-income securities with staggered maturities, providing consistent liquidity and reduced interest rate risk. Barbell strategy concentrates on short-term and long-term maturities, avoiding intermediate durations to balance risk and yield more aggressively. Laddering offers steady income and flexibility, while barbell targets higher returns by exploiting interest rate movements at maturity extremes.

How Laddering Maximizes Savings Flexibility

Laddering maximizes savings flexibility by staggering maturity dates of fixed-income investments, allowing access to funds at regular intervals without penalty. This strategy mitigates interest rate risk by continuously reinvesting at potentially higher rates, maintaining liquidity and optimizing returns. Laddering also provides a diversified maturity profile, enhancing the ability to respond to changing financial needs or market conditions.

The Barbell Strategy: Balancing Risk and Return

The Barbell Strategy in savings involves allocating funds between extremely safe, low-yield assets and higher-risk, higher-return investments, creating a balance that manages risk while pursuing growth. This approach mitigates interest rate risk by avoiding intermediate maturities and capitalizes on potential high returns from long-term or riskier instruments. By combining these two extremes, savers optimize their portfolio for stability and potential income enhancement.

Pros and Cons of Laddering for Savers

Laddering offers savers the advantage of consistent liquidity and risk distribution by staggering the maturity dates of investments, which helps mitigate interest rate fluctuations. Its pros include steady access to funds and the ability to reinvest at potentially higher rates as each ladder rung matures, promoting disciplined saving habits. However, the downsides involve potentially lower yields compared to locking all funds in long-term instruments and the complexity of managing multiple maturities effectively.

Barbell Strategy: Benefits and Drawbacks in Savings

The Barbell Strategy in savings involves allocating funds into both very safe, liquid assets and higher-risk, higher-return investments, maximizing growth potential while preserving capital. Benefits include balanced risk exposure and flexibility to capitalize on market opportunities, while drawbacks involve potential vulnerability during market volatility and the need for active management. This approach suits savers seeking stability alongside growth, but requires careful monitoring to maintain the strategy's effectiveness.

Comparing Risk Profiles: Laddering vs Barbell

Laddering spreads investments across staggered maturities, reducing interest rate risk and providing steady liquidity, which suits conservative savers seeking predictable income. Barbell concentrates funds in short- and long-term instruments, increasing exposure to interest rate fluctuations but offering higher yield potential, favored by investors willing to accept greater volatility. Comparing risk profiles, laddering offers balanced risk with moderate returns, while barbell embraces higher risk for enhanced income opportunities.

Which Strategy Suits Your Savings Goals?

Laddering involves spreading investments across multiple maturities to balance risk and liquidity, ideal for savers seeking steady income and flexibility. The barbell strategy allocates funds predominantly in short-term and long-term instruments, maximizing returns while managing interest rate risk, suitable for aggressive savers aiming for higher yields. Choosing between laddering and barbell depends on your risk tolerance, income needs, and investment timeline.

Implementing Laddering and Barbell in Your Savings Plan

Implementing laddering in your savings plan involves purchasing fixed-income securities with staggered maturities to ensure consistent access to funds while capitalizing on varying interest rates. The barbell strategy allocates investments between short-term and long-term maturities, balancing liquidity and higher yields by avoiding intermediate maturities. Combining laddering and barbell techniques can optimize portfolio diversification, manage interest rate risk, and enhance overall savings growth.

Real-World Examples: Laddering and Barbell Outcomes

Laddering strategy involves staggering bond maturities to provide consistent liquidity and reduce interest rate risk, illustrated by investors who reinvest proceeds regularly to capture rising rates. Barbell strategy concentrates investments in short- and long-term bonds, balancing higher yields from long-term bonds with the flexibility of short-term holdings, as demonstrated by retirees seeking income stability and liquidity. Real-world outcomes often show laddering offers steady cash flow with moderate risk, while barbell can yield higher returns but requires careful market timing.

Important Terms

Yield Curve Positioning

Yield curve positioning involves structuring bond portfolios by targeting specific maturities to optimize returns and manage risk; laddering spreads investments evenly across various maturities to reduce interest rate risk, while the barbell strategy concentrates holdings in short- and long-term bonds to capitalize on yield differentials. Laddering provides consistent cash flow and mitigates reinvestment risk, whereas barbell positioning exploits yield curve shape changes for potentially higher income.

Duration Management

Duration management strategically balances interest rate risk by adjusting fixed-income portfolio maturities; laddering spreads investments evenly across various maturities to reduce reinvestment risk, while a barbell strategy concentrates holdings in short and long-term bonds to capitalize on yield curve shifts and enhance return potential. Effective duration management via these methods improves portfolio resilience and optimizes risk-return profiles in fluctuating interest rate environments.

Interest Rate Risk

Interest rate risk varies significantly between laddering and barbell strategies, as laddering diversifies bond maturities to reduce reinvestment and price risks, while the barbell strategy concentrates investments in short- and long-term bonds, increasing sensitivity to interest rate changes. Laddering provides a steadier cash flow and mitigates volatility, whereas the barbell strategy aims for higher yields with potentially greater exposure to interest rate fluctuations.

Bullet Portfolio

Bullet Portfolio strategy focuses on concentrating bond maturities around a specific date to target a future cash need, enhancing yield predictability and interest rate risk management. Unlike Laddering, which staggers maturities evenly over time to provide steady income and reinvestment opportunities, and Barbell, which combines short- and long-term bonds to balance risk and return, the Bullet approach minimizes reinvestment risk by aligning all maturities within a narrow timeframe.

Immunization Strategy

Immunization strategy in finance focuses on matching asset durations with liabilities to minimize interest rate risk, contrasting the laddering strategy which staggers bond maturities evenly, and the barbell strategy which concentrates investments in short- and long-term maturities. The immunization approach ensures portfolio value stability under varying interest rate scenarios, optimizing risk management compared to the income diversification in laddering and yield maximization in barbell strategies.

Call Risk

Call risk in laddering involves the premature redemption of bonds, disrupting the expected cash flow and reinvestment plans, whereas in a barbell strategy, call risk is concentrated on the short-term bonds, potentially requiring reinvestment at lower yields and affecting overall portfolio durability. Managing call risk is crucial for both strategies to maintain income stability and to optimize yield curves in fluctuating interest rate environments.

Coupon Reinvestment

Coupon reinvestment amplifies portfolio growth by continuously allocating interest payments into fixed income securities, with laddering offering systematic maturity diversification and reduced interest rate risk, while the barbell strategy concentrates investments in short- and long-term bonds to balance yield and duration sensitivity. Efficient coupon reinvestment within these frameworks enhances compounding effects and aligns cash flow timing with liability management objectives.

Roll-Down Return

Roll-Down Return maximizes returns by capturing bond price appreciation as maturities shorten, a key element in laddering strategies which stagger bond maturities to manage risk and liquidity. In contrast, the barbell strategy focuses on holding short- and long-term bonds, aiming to balance yield and interest rate sensitivity, often relying less on the steady roll-down effect.

Maturity Segmentation

Maturity segmentation categorizes investments by their time horizons, enabling tailored strategies like laddering, which staggers bond maturities to reduce interest rate risk, or the barbell strategy, which invests in short- and long-term bonds to balance liquidity and yield. Laddering provides steady cash flow by evenly spacing maturities, while the barbell approach targets higher returns from long-term bonds alongside flexibility from short-term bonds.

Staggered Maturities

Staggered maturities in Laddering strategy involve purchasing bonds with evenly spaced maturity dates to reduce reinvestment risk and provide consistent liquidity, while the Barbell strategy concentrates investments in short-term and long-term bonds, balancing yield and interest rate exposure. Laddering offers a more balanced risk-return profile through gradual bond turnover, whereas Barbell can exploit yield curve movements with targeted duration positioning.

Laddering vs Barbell strategy Infographic

moneydif.com

moneydif.com