Principal refers to the initial amount of money invested or saved, while corpus represents the total accumulated value, including interest or returns over time. Understanding the difference is crucial for effective savings growth and long-term financial planning. Focusing on increasing the principal can accelerate corpus growth through compounding benefits.

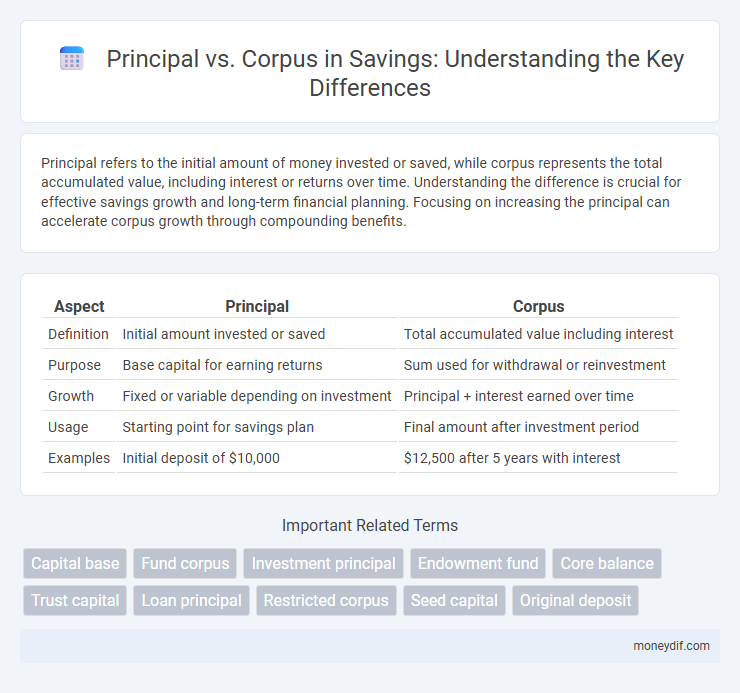

Table of Comparison

| Aspect | Principal | Corpus |

|---|---|---|

| Definition | Initial amount invested or saved | Total accumulated value including interest |

| Purpose | Base capital for earning returns | Sum used for withdrawal or reinvestment |

| Growth | Fixed or variable depending on investment | Principal + interest earned over time |

| Usage | Starting point for savings plan | Final amount after investment period |

| Examples | Initial deposit of $10,000 | $12,500 after 5 years with interest |

Understanding Principal and Corpus in Savings

Principal refers to the initial sum of money invested or saved before any interest or returns are added, serving as the foundation for wealth accumulation. Corpus represents the total amount in a savings account or investment at a given time, combining the principal and the accumulated interest or earnings. Understanding the distinction between principal and corpus is crucial for accurate financial planning and evaluating the growth of savings over time.

Principal vs Corpus: Key Differences

Principal refers to the original amount of money invested or saved, while corpus denotes the total value of that investment, including accumulated interest or returns. The principal remains constant unless additional contributions or withdrawals are made, whereas the corpus fluctuates over time based on investment performance. Understanding the distinction between principal and corpus is crucial for effective financial planning and assessing the growth of savings.

How Principal Impacts Your Savings Growth

The principal is the original amount of money invested or saved, serving as the foundation for your savings growth. Its size directly impacts the interest earned, with larger principals generating more returns through compound interest over time. Understanding how the principal influences savings helps optimize investment strategies and maximize long-term financial goals.

The Role of Corpus in Wealth Accumulation

Corpus represents the accumulated capital or total savings that serve as the foundation for generating future wealth through investments and interest earnings. Unlike the principal, which refers to the initial amount invested, the corpus grows over time by reinvesting returns and adding subsequent contributions, thereby accelerating wealth accumulation. A larger corpus enables diversification across multiple asset classes, reducing risk and increasing potential for sustained financial growth.

Building Your Principal for Long-Term Savings

Building your principal is essential for maximizing long-term savings growth, as the principal represents the initial amount of money invested or saved. Consistently adding to your principal through regular contributions accelerates the compounding effect, increasing the corpus--the total accumulated value including interest or returns. A larger principal base enables higher returns over time, ensuring financial security and growth for future goals.

Corpus Calculation: Methods and Importance

Corpus calculation involves determining the total amount of savings accumulated over time through consistent contributions and compounded returns. Methods such as the future value of a series formula or using compound interest calculations are essential for accurate corpus estimation. Understanding corpus size is crucial for setting realistic financial goals and ensuring sufficient funds for long-term needs.

Principal Reduction vs Corpus Withdrawal

Principal reduction refers to paying down the original loan amount or initial investment, which decreases debt and preserves the corpus. Corpus withdrawal involves taking funds directly from the accumulated capital or savings, potentially reducing the long-term financial foundation. Maintaining a balance between principal reduction and corpus withdrawal is essential for sustainable wealth growth and financial stability.

Strategies to Grow Your Savings Corpus

Maximizing your savings corpus requires a clear understanding of the principal amount and the interest it generates over time. Implement strategies such as regular contributions, compounding interest, and diversification across high-yield savings accounts, fixed deposits, and mutual funds. Monitoring inflation rates and adjusting asset allocation help protect and grow the overall corpus efficiently.

Tax Implications for Principal and Corpus

Principal refers to the original amount of money invested or saved, while corpus denotes the total sum, including accrued interest or returns. Tax implications on the principal are generally minimal as the initial investment is not taxed, whereas taxes on the corpus depend on the type of investment and the gains realized, such as capital gains tax or income tax on interest. Understanding the differential tax treatment on principal versus corpus helps optimize savings strategies and maximize after-tax returns.

Protecting Your Principal and Maximizing Corpus

Protecting your principal is essential to preserving the original amount invested, ensuring that it remains intact despite market fluctuations or withdrawals. Maximizing your corpus involves reinvesting returns and compounding earnings to grow the total value of your savings over time. A strategic balance between safeguarding the principal and actively growing the corpus can lead to sustained financial stability and wealth accumulation.

Important Terms

Capital base

Capital base represents the total funds available for investment or business operations, encompassing both principal and corpus components. The principal refers to the original amount invested or contributed, while the corpus includes accumulated earnings or reinvested profits that enhance the overall capital base.

Fund corpus

The fund corpus represents the original sum of money invested or donated, distinct from the principal which often refers to the initial amount before any earnings or withdrawals; the corpus remains intact while generated income can be utilized. Managing the fund corpus ensures long-term sustainability by preserving capital, enabling continuous funding without depleting the core investment.

Investment principal

Investment principal refers to the original amount of money invested before earnings or interest, serving as the foundation for calculating returns. It is distinct from the corpus, which includes the principal plus accumulated income, gains, or reinvested dividends, representing the total value of an investment at any given time.

Endowment fund

An endowment fund's principal, often referred to as the corpus, represents the original capital invested, which is preserved intact to generate investment income. The fund's earnings are used to support ongoing expenses, ensuring long-term financial stability without depleting the corpus.

Core balance

Core balance refers to the portion of funds that remains untouched to preserve the principal or corpus, ensuring long-term capital preservation. Distinguishing principal from corpus highlights that while the principal is the original investment amount, the corpus can include accumulated interest or returns reinvested to maintain fund sustainability.

Trust capital

Trust capital represents the total assets held within a trust, encompassing both the principal (corpus) and any accumulated income or gains. The principal, or corpus, specifically refers to the original assets placed into the trust, forming the foundational financial base from which income is generated and distributed.

Loan principal

Loan principal refers to the original sum of money borrowed that must be repaid, excluding interest and fees, whereas corpus in financial terms represents the total accumulated amount including principal, interest, and any reinvested earnings. Understanding the distinction between principal and corpus is crucial for accurately calculating loan repayments and investment growth over time.

Restricted corpus

A restricted corpus refers to a limited dataset curated for specific linguistic research, often contrasting with a principal corpus that serves as a comprehensive, representative body of language data. The principal corpus aims to provide broad, generalizable language patterns, while the restricted corpus focuses on specialized domains or contexts for detailed analysis.

Seed capital

Seed capital represents the initial funding used to start a venture, often considered part of the principal, which is the original investment amount excluding any earnings or growth. The corpus refers to the entire fund value, including the principal seed capital plus accumulated returns and reinvested profits.

Original deposit

Original deposit refers to the initial sum of money placed into an account, forming the basis of both principal and corpus in financial contexts. The principal represents the original deposit amount that accrues interest, while the corpus includes the principal plus accumulated earnings or reinvested returns.

Principal vs Corpus Infographic

moneydif.com

moneydif.com