A Money Market Account often provides higher interest rates than traditional savings accounts while offering limited check-writing privileges, making it a flexible option for accessing funds. High-Yield Savings Accounts typically deliver competitive interest rates with easy online management and no minimum balance requirements. Choosing between the two depends on balancing the need for liquidity, interest earnings, and account accessibility.

Table of Comparison

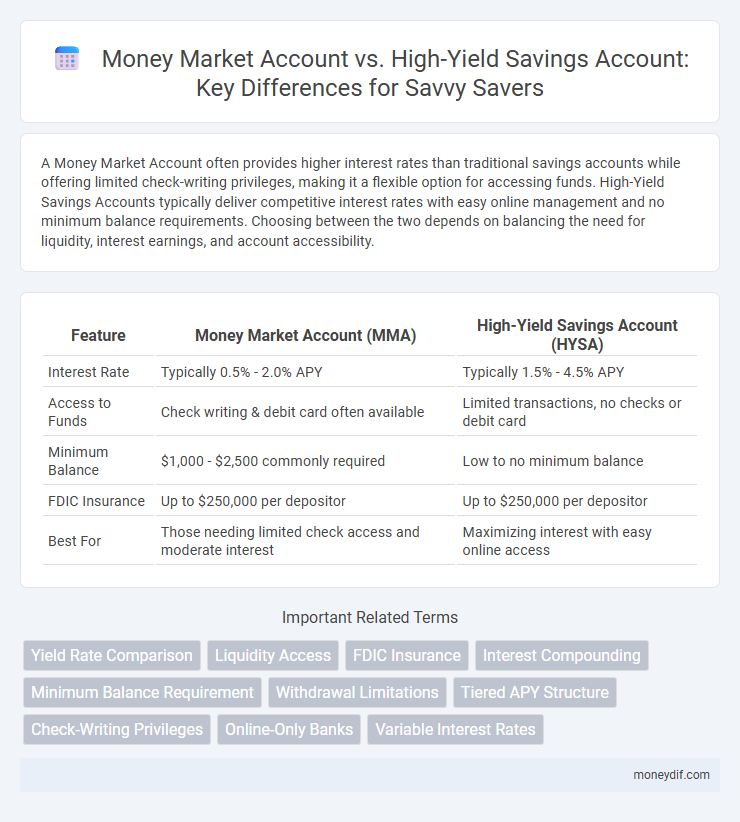

| Feature | Money Market Account (MMA) | High-Yield Savings Account (HYSA) |

|---|---|---|

| Interest Rate | Typically 0.5% - 2.0% APY | Typically 1.5% - 4.5% APY |

| Access to Funds | Check writing & debit card often available | Limited transactions, no checks or debit card |

| Minimum Balance | $1,000 - $2,500 commonly required | Low to no minimum balance |

| FDIC Insurance | Up to $250,000 per depositor | Up to $250,000 per depositor |

| Best For | Those needing limited check access and moderate interest | Maximizing interest with easy online access |

Key Differences Between Money Market and High-Yield Savings Accounts

Money Market Accounts typically require higher minimum balances and offer limited check-writing privileges, whereas High-Yield Savings Accounts focus on maximizing interest rates with fewer transactional features. Money Market Accounts may provide slightly lower yields but greater liquidity and access options compared to High-Yield Savings Accounts, which usually emphasize higher APYs and online access. Understanding these differences helps savers optimize returns while balancing accessibility and account features.

Interest Rates: Which Account Offers Better Returns?

Money Market Accounts typically offer higher interest rates than traditional savings accounts but may have variable rates that fluctuate with market conditions. High-Yield Savings Accounts consistently provide competitive interest rates, often exceeding those of Money Market Accounts, especially with online banks that reduce overhead costs. Evaluating current APYs and account terms is essential to determine which option delivers superior returns for your savings goals.

Accessibility and Withdrawal Options Compared

Money Market Accounts offer check-writing privileges and debit card access, providing greater liquidity and ease of withdrawals compared to High-Yield Savings Accounts, which typically limit transactions to six per month under federal regulations. High-Yield Savings Accounts often feature higher interest rates, but restrict access to online transfers or branch withdrawals without immediate cash withdrawal options. Selecting between the two depends on balancing the need for higher yield versus flexible access to funds.

Minimum Balance Requirements Explained

Money market accounts typically require higher minimum balance thresholds, often ranging from $1,000 to $2,500, to avoid monthly fees and qualify for competitive interest rates. High-yield savings accounts usually have lower minimum balance requirements, sometimes as low as $0 to $100, making them more accessible for savers seeking higher returns without substantial initial deposits. Understanding these minimum balance requirements helps optimize savings strategy by balancing liquidity needs against potential earnings.

Account Fees and Charges: What to Expect

Money Market Accounts often come with higher minimum balance requirements and may charge fees if the balance falls below the threshold, whereas High-Yield Savings Accounts typically have lower minimum balance demands and fewer maintenance fees. Both account types may limit the number of monthly transactions, with potential fees for exceeding federal Regulation D limits. Carefully reviewing fee schedules for both accounts can help investors avoid unexpected charges and maximize savings growth.

FDIC Insurance and Security Features

Money Market Accounts and High-Yield Savings Accounts both offer FDIC insurance, protecting deposits up to $250,000 per account holder, which secures your funds against bank failures. Money Market Accounts typically provide check-writing and debit card features, combining liquidity with safety, while High-Yield Savings Accounts focus more on interest rate advantages and online access. Both account types maintain security through encrypted online platforms and regulatory oversight, ensuring safe access to your savings.

Ideal Users: Who Should Choose Each Account?

Money market accounts are ideal for individuals seeking limited check-writing capabilities with competitive interest rates and a higher minimum balance, often preferred by those who want both liquidity and modest returns. High-yield savings accounts suit savers aiming for maximum interest earnings with lower balance requirements and ease of access through online platforms. Choosing between the two depends on the need for transactional flexibility versus prioritizing higher interest on savings with minimal activity.

Opening and Managing Each Account Type

Opening a Money Market Account typically requires a higher minimum deposit compared to a High-Yield Savings Account, making initial access more selective. Managing a Money Market Account often involves limited check-writing privileges and usually comes with tiered interest rates based on balance thresholds. In contrast, High-Yield Savings Accounts provide easier account setup with lower minimum deposits and focus primarily on competitive interest rates with fewer transaction restrictions.

Pros and Cons of Money Market Accounts

Money Market Accounts offer higher interest rates compared to regular savings accounts, often coupled with check-writing and debit card access for increased liquidity. They typically require a higher minimum balance, which may limit accessibility for some savers, and often have transaction limits imposed by federal regulations. While offering a blend of savings and checking features, Money Market Accounts may have fees and lower interest rates than some High-Yield Savings Accounts, demanding careful evaluation based on individual financial goals.

High-Yield Savings Accounts: Advantages and Drawbacks

High-yield savings accounts offer significantly higher interest rates compared to traditional savings or money market accounts, often yielding between 3% to 5% APY, which accelerates wealth growth through compound interest. These accounts provide easy access to funds with FDIC insurance up to $250,000, ensuring security without sacrificing liquidity. However, high-yield savings accounts may have withdrawal limits of six per month and potential minimum balance requirements, which can restrict flexibility for frequent transactions.

Important Terms

Yield Rate Comparison

Money Market Accounts typically offer competitive yield rates averaging around 0.50% to 1.00%, while High-Yield Savings Accounts provide superior returns often exceeding 4.00%, making them a more lucrative option for maximizing interest earnings. Both account types offer liquidity and FDIC insurance, but the significant yield rate difference impacts long-term savings growth substantially.

Liquidity Access

Money Market Accounts offer greater liquidity than High-Yield Savings Accounts by providing check-writing and debit card access, enabling easier and faster withdrawals. High-Yield Savings Accounts typically restrict transactions to six per month due to federal regulations, limiting immediate access to funds despite offering competitive interest rates.

FDIC Insurance

FDIC insurance protects deposits in both Money Market Accounts and High-Yield Savings Accounts up to $250,000 per depositor, per bank, ensuring the safety of funds even if the financial institution fails. While Money Market Accounts may offer check-writing privileges and slightly higher minimum balance requirements, High-Yield Savings Accounts typically provide higher interest rates with lower minimum balances, both benefiting from FDIC-backed security.

Interest Compounding

Interest compounding in a High-Yield Savings Account typically occurs daily or monthly, enhancing returns through frequent crediting of earned interest, while Money Market Accounts often compound interest monthly but may offer higher liquidity or check-writing privileges. Comparing effective annual yield rates reveals high-yield savings accounts often provide better growth potential due to more frequent compounding and competitive interest rates.

Minimum Balance Requirement

Minimum balance requirements for Money Market Accounts typically range from $1,000 to $2,500, enabling access to higher interest rates and check-writing privileges, while High-Yield Savings Accounts often have lower or no minimum balance thresholds but offer slightly less flexible withdrawal options. These requirements impact account accessibility and potential earnings, with Money Market Accounts favoring customers who maintain larger balances for liquidity and higher returns.

Withdrawal Limitations

Money Market Accounts often impose limited check-writing and debit card transaction restrictions, whereas High-Yield Savings Accounts typically restrict withdrawals to six per month under federal Regulation D. Both account types may enforce fees or penalties for exceeding withdrawal limits, affecting liquidity and account access.

Tiered APY Structure

The tiered APY structure in Money Market Accounts typically offers varying interest rates based on balance thresholds, rewarding higher deposits with increased yields, while High-Yield Savings Accounts often provide a flat APY regardless of balance. This structure allows Money Market Accounts to benefit customers with larger balances seeking optimized returns compared to the uniform rates commonly seen in high-yield savings products.

Check-Writing Privileges

Check-writing privileges in money market accounts offer greater liquidity and flexibility for managing funds compared to high-yield savings accounts, which typically restrict transactions to electronic transfers and limit direct check usage. This feature makes money market accounts ideal for users needing easy access to funds while still earning competitive interest rates.

Online-Only Banks

Online-only banks frequently offer competitive rates on both money market accounts and high-yield savings accounts, with money market accounts providing limited check-writing privileges and debit card access, while high-yield savings accounts focus on maximizing interest earnings through higher annual percentage yields (APYs). Both account types at online-only banks benefit from lower overhead costs, leading to better interest rates and minimal fees compared to traditional banks.

Variable Interest Rates

Variable interest rates in money market accounts often fluctuate based on short-term market conditions, providing potential for higher earnings when rates rise, whereas high-yield savings accounts typically offer more stable, yet competitive, variable rates linked to benchmark indexes like the Federal Reserve's federal funds rate. Choosing between the two depends on your risk tolerance and interest rate sensitivity, as money market accounts may provide check-writing privileges and liquidity, while high-yield savings accounts focus on consistent, high returns with minimal fees.

Money Market Account vs High-Yield Savings Account Infographic

moneydif.com

moneydif.com