Cost averaging involves regularly investing a fixed amount regardless of market conditions, reducing the impact of volatility and lowering the average purchase price over time. Lump-sum investing deploys all available funds at once, potentially maximizing returns if market timing is favorable but increasing exposure to short-term risk. Choosing between the two strategies depends on risk tolerance, market outlook, and investment horizon.

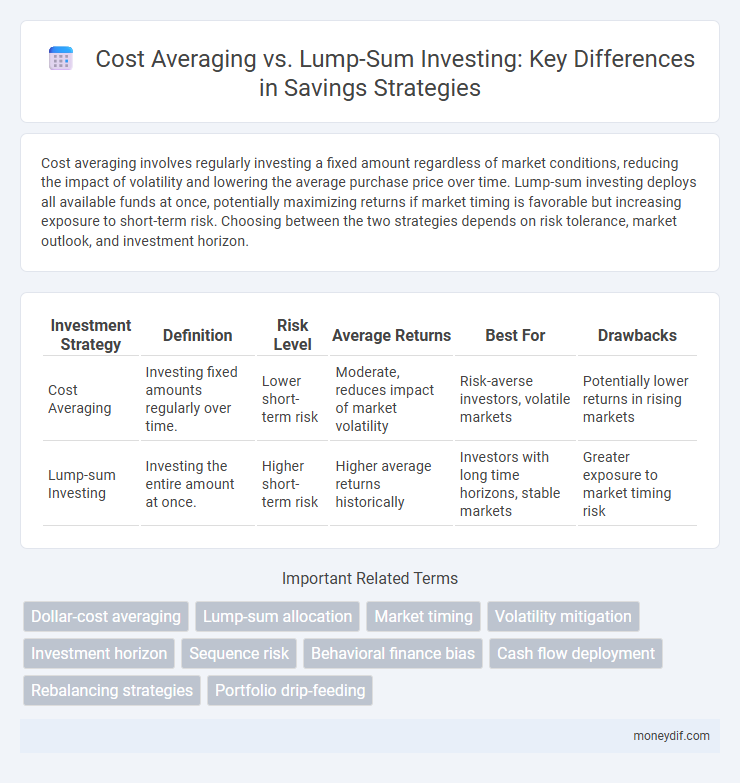

Table of Comparison

| Investment Strategy | Definition | Risk Level | Average Returns | Best For | Drawbacks |

|---|---|---|---|---|---|

| Cost Averaging | Investing fixed amounts regularly over time. | Lower short-term risk | Moderate, reduces impact of market volatility | Risk-averse investors, volatile markets | Potentially lower returns in rising markets |

| Lump-sum Investing | Investing the entire amount at once. | Higher short-term risk | Higher average returns historically | Investors with long time horizons, stable markets | Greater exposure to market timing risk |

Understanding Cost Averaging and Lump-Sum Investing

Cost averaging involves investing fixed amounts regularly over time, reducing the impact of market volatility by purchasing more shares when prices are low and fewer when prices are high. Lump-sum investing allocates a large amount of capital all at once, capitalizing on immediate market exposure and potential long-term growth. Studies show lump-sum investing often outperforms cost averaging due to market growth trends, but cost averaging mitigates risk and emotional investing during downturns.

Key Differences Between Cost Averaging and Lump-Sum Investing

Cost averaging involves investing a fixed amount at regular intervals, reducing the impact of market volatility by purchasing more shares when prices are low and fewer when prices are high. Lump-sum investing allocates the entire investment capital at once, potentially maximizing returns if the market rises but exposing the investor to greater risk during downturns. The key differences include timing, risk exposure, and market return potential, with cost averaging emphasizing risk reduction and lump-sum prioritizing immediate market exposure.

Pros and Cons of Cost Averaging

Cost averaging, often referred to as dollar-cost averaging, involves investing a fixed amount regularly, which reduces the impact of market volatility and lowers the risk of investing a large sum at an inopportune time. This strategy promotes disciplined investing and mitigates emotional decision-making but may result in lower returns compared to lump-sum investing during consistently rising markets. Cost averaging is particularly advantageous for novice investors or those with limited capital, yet it may increase transaction fees and delay full investment exposure.

Pros and Cons of Lump-Sum Investing

Lump-sum investing allows immediate exposure to the entire investment amount, potentially capturing market gains from the start and benefiting from compounding returns. The primary risk involves market volatility, as a sudden downturn can significantly reduce the initial investment value. This strategy is often advantageous when markets are trending upward, but it requires a higher risk tolerance compared to cost averaging.

Risk Management: Cost Averaging vs Lump-Sum Investing

Cost averaging mitigates market volatility by spreading purchases over time, reducing the risk of investing a large sum at an inopportune moment. Lump-sum investing, while offering the potential for higher returns during market upswings, exposes investors to significant downside risk if markets decline shortly after investing. Effective risk management requires evaluating market conditions, investment horizons, and personal risk tolerance to determine the optimal strategy between cost averaging and lump-sum investing.

Historical Performance Comparison

Historical data reveals that lump-sum investing outperforms cost averaging approximately 65-70% of the time in long-term equity markets due to immediate market exposure. Cost averaging reduces downside risk during volatile periods by spreading investments over time but may miss out on gains when markets trend upward. Studies show that over a 20-year horizon, lump-sum investing historically yields higher average returns, though cost averaging offers emotional comfort and mitigates timing risk.

When to Use Cost Averaging in Your Savings Plan

Cost averaging is most effective during periods of market volatility or when investors have limited capital to invest upfront, allowing consistent contributions to reduce the impact of market timing. This strategy minimizes risks by spreading investments over time, which can smooth out the purchase price of assets and avoid investing a large sum at market peaks. It benefits savers who want disciplined investment habits, especially in uncertain markets or when saving over a long time horizon.

Ideal Scenarios for Lump-Sum Investing

Lump-sum investing is ideal when market conditions are favorable, such as during a market downturn or correction, allowing investors to buy at lower prices and maximize potential returns. It suits investors with a long investment horizon who can tolerate short-term volatility and benefit from immediate market exposure. Additionally, having a sizable amount of capital available without immediate liquidity needs makes lump-sum investing a more efficient approach compared to cost averaging.

Common Pitfalls to Avoid in Both Strategies

Common pitfalls in cost averaging include investing during market peaks, which can dilute returns, while lump-sum investing risks committing funds at market highs, leading to potential losses. Both strategies require avoiding emotional decision-making driven by market volatility, as impulsive adjustments often reduce long-term gains. Overlooking fees and taxes in either approach can erode overall profitability and diminish investment growth.

Choosing the Right Investment Approach for Your Savings Goals

Cost averaging involves investing a fixed amount regularly, reducing the impact of market volatility and making it suitable for long-term savings with steady cash flow. Lump-sum investing puts all your capital to work immediately, potentially maximizing returns in a rising market scenario, ideal for investors with a large amount ready to invest. Evaluating your risk tolerance, investment timeline, and market conditions helps determine whether systematic investing or lump-sum deployment aligns best with your savings objectives.

Important Terms

Dollar-cost averaging

Dollar-cost averaging (DCA) involves investing a fixed amount at regular intervals, reducing the impact of market volatility by purchasing more shares when prices are low and fewer when prices are high. Compared to lump-sum investing, which allocates the entire investment at once, DCA lowers the risk of market timing but may result in lower overall returns during prolonged market uptrends.

Lump-sum allocation

Lump-sum allocation involves investing a large amount of capital at once, often resulting in higher average returns compared to cost averaging, which spreads investments over time to mitigate market volatility. Studies show that lump-sum investing outperforms cost averaging approximately two-thirds of the time due to immediate exposure to market gains.

Market timing

Market timing attempts to predict future market movements to optimize investment entry and exit points, often resulting in inconsistent returns. In contrast, cost averaging spreads investments over time to reduce the impact of volatility, while lump-sum investing deploys capital immediately, historically yielding higher average returns despite increased short-term risk.

Volatility mitigation

Volatility mitigation strategies like cost averaging reduce investment risk by spreading purchases over time, lowering the impact of market fluctuations compared to lump-sum investing, which exposes capital to immediate market volatility but may benefit from potential market upswings. Cost averaging smoothes entry prices and helps avoid the pitfalls of market timing, whereas lump-sum investing maximizes growth potential during sustained market gains but carries higher short-term risk exposure.

Investment horizon

Investment horizon significantly impacts the effectiveness of cost averaging versus lump-sum investing; longer horizons typically favor lump-sum investing due to greater market growth potential, while shorter horizons benefit from cost averaging by mitigating timing risk. Studies show lump-sum investing outperforms cost averaging approximately two-thirds of the time, but cost averaging reduces volatility and downside risk, aligning better with conservative investors' timeframes.

Sequence risk

Sequence risk significantly impacts long-term returns, as poor market performance early in retirement can deplete assets faster when using lump-sum investing compared to dollar-cost averaging. Dollar-cost averaging mitigates sequence risk by spreading investment over time, reducing exposure to market volatility at the initial investment phase.

Behavioral finance bias

Behavioral finance bias often causes investors to favor cost averaging due to loss aversion and the desire to avoid regret from market timing errors, even though lump-sum investing statistically yields higher average returns over time. Anchoring and mental accounting biases can further skew decisions, leading individuals to underestimate the opportunity costs of delayed full investment inherent in dollar-cost averaging strategies.

Cash flow deployment

Cash flow deployment strategies significantly impact investment outcomes, with cost averaging involving systematic investment of fixed amounts over time to reduce market volatility risk, while lump-sum investing leverages immediate full investment to capitalize on potential market gains when asset prices are favorable. Analyzing historical market data reveals lump-sum investing tends to outperform cost averaging in rising markets, whereas cost averaging mitigates downside risk during periods of market uncertainty.

Rebalancing strategies

Rebalancing strategies effectively manage portfolio risk by adjusting asset allocations periodically, often leveraging cost averaging to reduce market timing risk through consistent investments over time. Lump-sum investing, while offering potential for higher immediate returns by deploying capital at once, may increase vulnerability to short-term market volatility, making systematic rebalancing essential to maintain target asset mixes.

Portfolio drip-feeding

Portfolio drip-feeding strategically allocates funds into investments incrementally over time, enhancing cost averaging by reducing the impact of market volatility, unlike lump-sum investing which deploys capital all at once and risks market timing. This method mitigates downside risk while potentially increasing returns through systematic contributions that capitalize on market dips.

Cost averaging vs Lump-sum investing Infographic

moneydif.com

moneydif.com