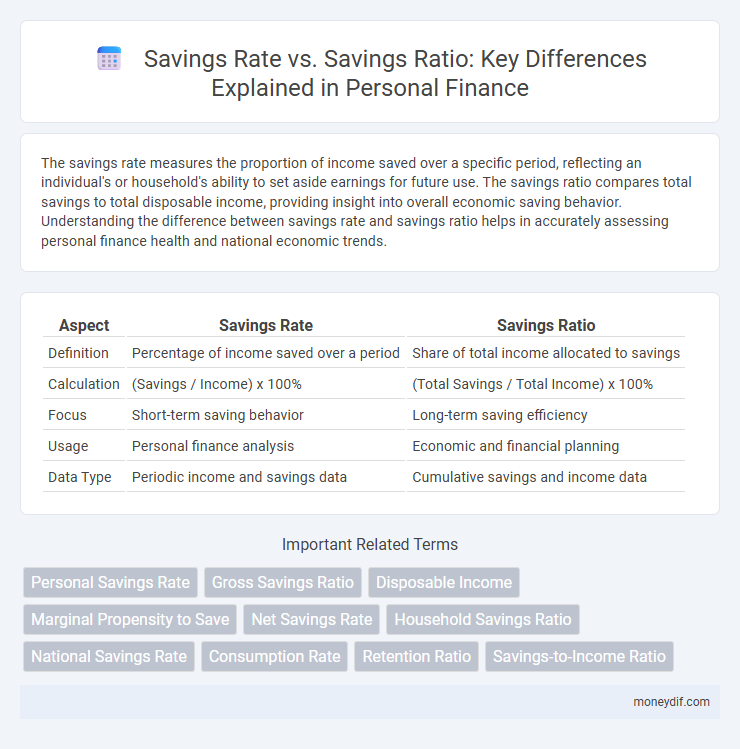

The savings rate measures the proportion of income saved over a specific period, reflecting an individual's or household's ability to set aside earnings for future use. The savings ratio compares total savings to total disposable income, providing insight into overall economic saving behavior. Understanding the difference between savings rate and savings ratio helps in accurately assessing personal finance health and national economic trends.

Table of Comparison

| Aspect | Savings Rate | Savings Ratio |

|---|---|---|

| Definition | Percentage of income saved over a period | Share of total income allocated to savings |

| Calculation | (Savings / Income) x 100% | (Total Savings / Total Income) x 100% |

| Focus | Short-term saving behavior | Long-term saving efficiency |

| Usage | Personal finance analysis | Economic and financial planning |

| Data Type | Periodic income and savings data | Cumulative savings and income data |

Introduction to Savings Rate and Savings Ratio

Savings rate represents the percentage of income that individuals set aside as savings over a specific period, reflecting personal financial discipline. Savings ratio compares total household savings to disposable income, indicating the broader economic capacity to accumulate wealth. Understanding both metrics provides insight into individual and collective financial health and informs economic and personal planning decisions.

Defining Savings Rate: What Does It Measure?

The savings rate measures the percentage of disposable income that households or individuals set aside rather than spend, reflecting their financial discipline and ability to accumulate wealth. This metric helps evaluate economic stability by indicating how much income is preserved for future needs or investments. Unlike the savings ratio, which compares savings to total income, the savings rate specifically focuses on after-tax income, providing a clearer picture of personal savings behavior.

Understanding Savings Ratio: Key Components

Savings ratio measures the percentage of disposable income set aside as savings within a specific period, highlighting personal financial discipline and wealth accumulation potential. Key components include total income after taxes, recurring expenses, and the actual amount diverted to savings accounts, investments, or emergency funds. Understanding these elements helps individuals optimize their savings behavior and improve long-term financial stability.

Differences Between Savings Rate and Savings Ratio

The savings rate measures the percentage of disposable income that individuals save over a specific period, highlighting personal saving behavior. In contrast, the savings ratio represents the proportion of total income saved by an entire economy, reflecting aggregate national savings. Understanding these differences clarifies how savings are analyzed at microeconomic and macroeconomic levels.

Importance of Measuring Personal Savings

Measuring personal savings accurately requires understanding the difference between savings rate and savings ratio, where the savings rate reflects the percentage of income saved over a period, while the savings ratio compares total savings to total expenditures. A high savings rate indicates disciplined financial behavior, essential for wealth accumulation and financial security. Tracking these metrics enables individuals to set realistic savings goals and adjust spending habits to improve overall financial health.

Factors Influencing Your Savings Rate

Savings rate reflects the percentage of your income that you actively set aside, while savings ratio compares total savings to overall expenditures, capturing different financial behavior aspects. Key factors influencing your savings rate include income stability, monthly expenses, debt obligations, and personal financial goals. Understanding these elements helps optimize your ability to increase discretionary savings, build wealth, and improve long-term financial security.

How to Calculate Your Savings Ratio

To calculate your savings ratio, divide your total monthly savings by your total monthly disposable income and multiply by 100 to get a percentage. This ratio provides a clear picture of how much of your income you save after taxes and essential expenses. Tracking your savings ratio helps optimize financial planning and improve long-term wealth accumulation strategies.

Comparing Savings Habits Across Countries

Savings rate measures the percentage of disposable income that households save, while savings ratio reflects total savings relative to overall income, including non-disposable sources. Countries like China exhibit consistently high savings rates above 40%, driven by cultural emphasis on future security, whereas the United States records savings rates near 7%, reflecting greater consumer spending habits. Comparing these metrics reveals significant differences in national savings behavior influenced by economic policies, income levels, and social safety nets.

Practical Tips to Improve Your Savings Rate

Improving your savings rate requires tracking the percentage of income saved each month rather than just the savings ratio, which compares savings to total expenses. Automating monthly transfers to a dedicated savings account helps consistently increase your savings rate. Reducing discretionary spending and setting clear financial goals also effectively boost the proportion of income you save over time.

Which Metric Matters More for Financial Health?

The savings rate measures the percentage of income saved over a specific period, highlighting an individual's ability to allocate earnings towards future goals. The savings ratio compares total savings to total income, offering insight into overall financial balance and sustainability. For assessing financial health, the savings rate is more dynamic, reflecting current saving behavior, while the savings ratio provides a broader perspective on accumulated wealth relative to income.

Important Terms

Personal Savings Rate

The Personal Savings Rate measures the percentage of disposable income individuals save, distinct from the Savings Ratio which compares total savings to total income including corporate and government sectors. Understanding the Personal Savings Rate is crucial for assessing household financial health and economic behavior compared to the broader Savings Ratio used in macroeconomic analysis.

Gross Savings Ratio

Gross Savings Ratio measures the proportion of total savings to gross domestic product (GDP), reflecting the economy's capacity to invest and grow. Savings Rate typically refers to the percentage of disposable income saved by households, whereas Savings Ratio encompasses a broader macroeconomic view including corporate and government savings relative to GDP.

Disposable Income

Disposable income represents the amount of personal income left after taxes, directly influencing both the savings rate and savings ratio used to analyze financial health. The savings rate measures the percentage of disposable income saved over a specific period, while the savings ratio compares total savings to disposable income, providing insights into consumer spending and saving behaviors.

Marginal Propensity to Save

The Marginal Propensity to Save (MPS) measures the portion of additional income that households save rather than consume, directly influencing the overall savings rate, which represents the percentage of total income saved within an economy. Unlike the savings ratio, which compares total savings to total income at a specific point in time, MPS focuses on behavioral responses to income changes, making it crucial for understanding consumption patterns and forecasting economic growth.

Net Savings Rate

The Net Savings Rate measures the proportion of income saved after adjusting for consumption and investment outflows, providing a clearer picture of actual savings growth compared to the Savings Rate, which simply reflects the percentage of income not spent. Unlike the Savings Ratio that focuses on the ratio of total savings to disposable income, the Net Savings Rate accounts for asset depreciation and liabilities, offering a more precise evaluation of financial health and long-term wealth accumulation.

Household Savings Ratio

The Household Savings Ratio measures the proportion of disposable income that households save, reflecting actual savings behavior, while the Savings Rate often indicates the intended or planned savings out of income. Understanding the distinction between the two metrics is crucial for accurate economic analysis and forecasting consumer financial health.

National Savings Rate

National Savings Rate measures the percentage of a country's income saved rather than spent, providing insight into economic stability and future investment potential. Unlike the Savings Ratio, which typically refers to individual or household savings relative to income, the National Savings Rate aggregates savings across all sectors including households, businesses, and government.

Consumption Rate

The consumption rate measures the proportion of disposable income spent rather than saved, contrasting with the savings rate, which quantifies the share of income set aside for future use. Savings ratio compares total savings to income, providing insight into financial behavior by highlighting the balance between spending and saving within an economy or household.

Retention Ratio

Retention ratio measures the proportion of net income retained in a company rather than distributed as dividends, similar to how savings rate indicates the portion of income individuals save instead of spend. While savings ratio broadly reflects total savings relative to income, retention ratio specifically focuses on corporate earnings reinvested for growth, making it a key metric for assessing internal funding capacity.

Savings-to-Income Ratio

The Savings-to-Income Ratio quantifies the proportion of income allocated to savings, serving as a direct metric to assess financial discipline and wealth accumulation capacity. Unlike the Savings Rate, which often refers to the percentage of current income saved within a specific period, the Savings Ratio encompasses a broader timeframe, comparing total savings accrued to total income earned, providing a longitudinal perspective on savings behavior.

Savings Rate vs Savings Ratio Infographic

moneydif.com

moneydif.com