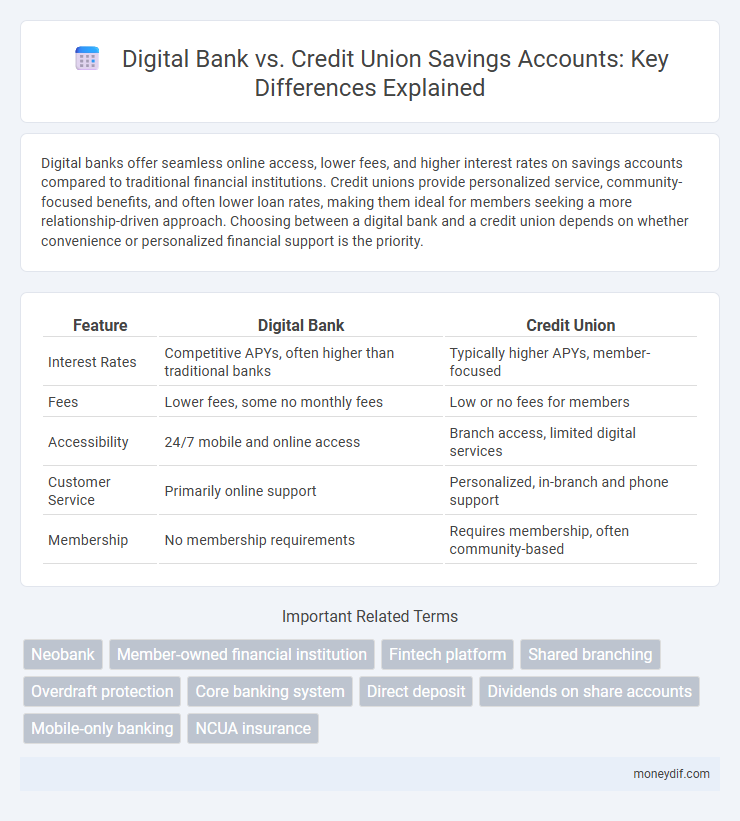

Digital banks offer seamless online access, lower fees, and higher interest rates on savings accounts compared to traditional financial institutions. Credit unions provide personalized service, community-focused benefits, and often lower loan rates, making them ideal for members seeking a more relationship-driven approach. Choosing between a digital bank and a credit union depends on whether convenience or personalized financial support is the priority.

Table of Comparison

| Feature | Digital Bank | Credit Union |

|---|---|---|

| Interest Rates | Competitive APYs, often higher than traditional banks | Typically higher APYs, member-focused |

| Fees | Lower fees, some no monthly fees | Low or no fees for members |

| Accessibility | 24/7 mobile and online access | Branch access, limited digital services |

| Customer Service | Primarily online support | Personalized, in-branch and phone support |

| Membership | No membership requirements | Requires membership, often community-based |

Introduction to Digital Banks and Credit Unions

Digital banks operate entirely online, offering streamlined savings accounts with minimal fees, high interest rates, and 24/7 accessibility through mobile apps. Credit unions are member-owned financial cooperatives prioritizing personalized service and community-focused savings products with competitive interest rates. Both institutions provide secure savings options but differ in operational structure and customer engagement.

Key Differences Between Digital Banks and Credit Unions

Digital banks offer streamlined online-only services with lower fees and high-tech features, while credit unions provide member-owned, community-focused banking often featuring personalized service and competitive loan rates. Credit unions typically require membership eligibility based on factors like location or employment, whereas digital banks are accessible to a wider audience without such restrictions. The regulatory frameworks differ, with credit unions being non-profit institutions protected by the National Credit Union Administration (NCUA), while digital banks operate under traditional banking licenses and Federal Deposit Insurance Corporation (FDIC) insurance.

Account Opening Process: Digital vs. Credit Union

Digital banks offer a streamlined account opening process with fully online applications, instant identity verification, and quicker approval times, often within minutes. Credit unions typically require in-person visits or mailed documentation for account setup, resulting in longer processing times and more personalized service. The convenience of digital banks contrasts with the community-focused, member-driven approach of credit unions during account opening.

Savings Account Interest Rates Comparison

Digital banks generally offer higher savings account interest rates compared to credit unions due to lower overhead costs and streamlined online operations. Credit unions provide competitive rates but often with membership requirements and fewer digital conveniences. Consumers seeking maximum yield on savings frequently favor digital banks for their superior annual percentage yields (APYs) and ease of access.

Fees and Charges: Digital Banks vs. Credit Unions

Digital banks typically offer lower fees and minimal account maintenance charges compared to credit unions, benefiting from streamlined online operations. Credit unions may have modest fees but often provide greater fee waivers and personalized financial advice due to their member-focused structure. Evaluating fee schedules, overdraft charges, and ATM access costs is essential when comparing savings options between these financial institutions.

Security and Privacy of Savings

Digital banks employ advanced encryption and multi-factor authentication to ensure the security and privacy of savings, leveraging cutting-edge technology frameworks. Credit unions often provide personalized security measures and maintain robust privacy policies due to their member-focused, community-driven structure. Both institutions adhere to stringent regulatory standards such as FDIC insurance for digital banks and NCUA protection for credit unions, safeguarding depositor funds effectively.

Customer Service Experience

Digital banks offer 24/7 customer support through multiple channels like chat, email, and phone, providing quick and convenient access to assistance. Credit unions emphasize personalized customer service with in-branch support and relationship-driven interactions, often resulting in higher member satisfaction. Both institutions prioritize secure and efficient service, but credit unions typically excel in building trust through community-oriented service.

Accessibility and Technology Features

Digital banks offer superior accessibility through 24/7 mobile app access, seamless online account management, and instant notifications, making savings management convenient and efficient. Credit unions may have limited physical branches but often provide personalized support and competitive rates, though their technology platforms can lag behind digital banks. Advanced features such as biometric authentication, AI-driven budgeting tools, and real-time transaction tracking are more prevalent in digital banks, enhancing user experience for savings growth.

Membership Requirements and Eligibility

Digital banks offer easy account access with minimal membership requirements, often requiring just a smartphone and online application, making them accessible nationwide. Credit unions generally require membership tied to specific criteria such as geographic location, employer, or affiliation with particular groups, potentially limiting eligibility but fostering community-centric savings benefits. Understanding these differences helps savers choose between the broad accessibility of digital banks and the personalized service of credit unions.

Which Is Better for Your Savings Goals?

Digital banks offer higher interest rates and lower fees, making them ideal for maximizing savings growth quickly. Credit unions provide personalized customer service and often better loan rates, which can support long-term financial stability. Choosing between the two depends on whether prioritizing higher returns or community-oriented banking aligns better with your savings goals.

Important Terms

Neobank

Neobanks leverage fully digital platforms to offer streamlined banking services with lower fees and faster onboarding than traditional credit unions, which provide member-focused, community-oriented financial products through physical branches.

Member-owned financial institution

Member-owned financial institutions like credit unions offer personalized services and lower fees compared to digital banks, emphasizing community-focused ownership and member benefits.

Fintech platform

Fintech platforms enhance digital banking services by offering streamlined online transactions, personalized financial products, and real-time analytics, often outperforming traditional credit unions in technology integration and customer experience.

Shared branching

Shared branching enables credit union members to access their accounts and perform transactions at thousands of partner locations nationwide, offering a convenience advantage over digital banks that typically operate solely online without physical branch access.

Overdraft protection

Digital banks often offer streamlined overdraft protection with instant alerts and automated transfers, while credit unions provide personalized overdraft solutions with lower fees and member-focused financial counseling.

Core banking system

Core banking systems enable digital banks to offer seamless, real-time transaction processing and personalized financial services through integrated online platforms, enhancing customer experience and operational efficiency. In contrast, credit unions often use core banking solutions tailored to member-focused services and community-based financial products, emphasizing security and compliance within a cooperative structure.

Direct deposit

Direct deposit offers faster, fee-free access to funds at digital banks compared to credit unions, which may have slower processing times but provide personalized member services.

Dividends on share accounts

Dividends on share accounts typically offer higher annual percentage yields at credit unions compared to digital banks due to their member-owned structure and nonprofit status.

Mobile-only banking

Mobile-only banking offers seamless, real-time financial services through digital banks that prioritize technology-driven user experience, whereas credit unions typically blend mobile access with personalized, community-focused member support.

NCUA insurance

NCUA insurance protects credit union deposits up to $250,000, providing a safety guarantee that distinguishes credit unions from digital banks, which may rely on FDIC insurance or alternative security measures.

Digital bank vs Credit union Infographic

moneydif.com

moneydif.com