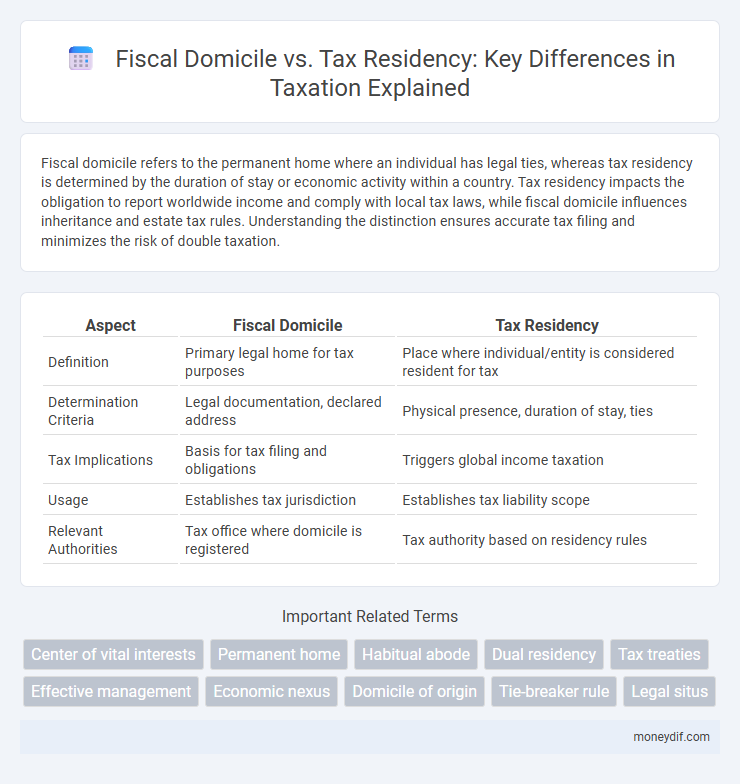

Fiscal domicile refers to the permanent home where an individual has legal ties, whereas tax residency is determined by the duration of stay or economic activity within a country. Tax residency impacts the obligation to report worldwide income and comply with local tax laws, while fiscal domicile influences inheritance and estate tax rules. Understanding the distinction ensures accurate tax filing and minimizes the risk of double taxation.

Table of Comparison

| Aspect | Fiscal Domicile | Tax Residency |

|---|---|---|

| Definition | Primary legal home for tax purposes | Place where individual/entity is considered resident for tax |

| Determination Criteria | Legal documentation, declared address | Physical presence, duration of stay, ties |

| Tax Implications | Basis for tax filing and obligations | Triggers global income taxation |

| Usage | Establishes tax jurisdiction | Establishes tax liability scope |

| Relevant Authorities | Tax office where domicile is registered | Tax authority based on residency rules |

Understanding Fiscal Domicile: Key Definitions

Fiscal domicile refers to the primary location where an individual or entity is legally recognized for tax purposes, often determined by physical presence, permanent home, or economic interests. Tax residency, by contrast, is based on specific criteria such as the number of days spent within a jurisdiction or the location of a taxpayer's vital interests. Understanding the distinctions between fiscal domicile and tax residency is essential for accurate tax compliance and determining the applicable tax obligations across different jurisdictions.

What Is Tax Residency? Core Concepts Explained

Tax residency defines the country where an individual or entity is legally obligated to pay taxes based on their physical presence, economic interests, or permanent home. It determines the scope of tax liabilities, including income tax, capital gains tax, and inheritance tax, influenced by local laws, double tax treaties, and residency tests such as the number of days spent in the country. Fiscal domicile refers to the official tax home where a person has their primary economic interests, but tax residency incorporates a broader set of criteria that affect tax obligations and benefits internationally.

Fiscal Domicile vs Tax Residency: Main Differences

Fiscal domicile refers to the permanent location recognized by tax authorities where an individual has substantial ties, such as family, property, or business interests, while tax residency is determined based on physical presence, typically exceeding a specific number of days in a tax year. The main difference lies in fiscal domicile being a legal concept tied to a fixed location for tax obligations, whereas tax residency depends on actual time spent within a country. Understanding the distinction helps clarify tax liabilities, filing requirements, and avoidance of double taxation in international tax planning.

Criteria for Determining Fiscal Domicile

Fiscal domicile is primarily determined by the location of an individual's permanent home, reflecting where they intend to return after temporary absences. Tax authorities assess criteria such as the duration of physical presence, center of vital interests including family and economic ties, and habitual abode to establish fiscal domicile. Unlike tax residency, which can fluctuate annually, fiscal domicile emphasizes long-term connection and intention to maintain a fixed base.

Factors That Establish Tax Residency Status

Tax residency status is determined by multiple factors including the duration of physical presence within a country, typically defined by the "183-day rule," the location of a permanent home, and the center of vital interests such as economic, social, and family ties. Other considerations include habitual abode, nationality, and specific tax treaties between countries that resolve residency conflicts. These criteria collectively establish whether an individual or entity is taxed as a resident or non-resident under a jurisdiction's fiscal laws.

Legal Implications: Fiscal Domicile and Tax Residency

Fiscal domicile determines the jurisdiction where an individual or entity is legally tied for long-term tax obligations, impacting inheritance and estate taxes significantly. Tax residency governs the period an individual spends in a country, directly influencing income tax liability and eligibility for tax treaties. Distinguishing between fiscal domicile and tax residency is crucial, as discrepancies can lead to double taxation or legal disputes over tax compliance.

International Tax Treaties: Resolving Double Taxation

International tax treaties establish clear criteria to determine fiscal domicile and tax residency, ensuring taxpayers are not subjected to double taxation. These treaties employ tie-breaker rules based on permanent home, center of vital interests, habitual abode, and nationality to resolve conflicting residency claims. By harmonizing residency definitions, tax treaties facilitate cross-border compliance and equitable tax liability distribution between contracting states.

Changing Fiscal Domicile or Tax Residency: Procedures and Challenges

Changing fiscal domicile or tax residency involves complex legal and administrative procedures that vary by jurisdiction, often requiring formal declarations to tax authorities and proof of severance from the previous tax system. Challenges include meeting residency tests such as physical presence, maintaining sufficient ties to the new location, and navigating dual taxation treaties to avoid overlapping tax obligations. Effective planning and professional guidance are essential to ensure compliance and optimize tax liabilities during the transition.

Common Misconceptions about Fiscal Domicile and Tax Residency

Fiscal domicile is often confused with tax residency, but they are distinct concepts with different legal implications for taxation. Many taxpayers mistakenly believe that establishing a fiscal domicile automatically determines their tax residency status, while tax residency depends on broader criteria such as physical presence, permanent home, or center of vital interests. Misunderstanding these differences can lead to incorrect tax filings, potential double taxation, or missed benefits under international tax treaties.

Practical Scenarios: Case Studies on Domicile and Residency

Fiscal domicile determines the primary location where a taxpayer maintains their permanent home, influencing inheritance tax obligations, while tax residency dictates where an individual is subject to income tax based on physical presence and duration of stay. In practical scenarios, a person may have a fiscal domicile in one country but be considered a tax resident in another due to work assignments, creating complex tax reporting requirements. Case studies highlight situations where dual residency triggers treaty tie-breaker rules, requiring individuals to carefully document their ties to each jurisdiction to optimize tax liabilities and ensure compliance.

Important Terms

Center of vital interests

The center of vital interests determines tax residency by evaluating the location of a person's primary personal and economic ties, such as family, property, and business activities. This criterion takes precedence over mere fiscal domicile, ensuring tax obligations align with where the taxpayer's main life interests are concentrated rather than their registered address.

Permanent home

Permanent home plays a crucial role in determining fiscal domicile and tax residency, as it serves as a stable, lasting place of residence used by tax authorities to establish an individual's primary connection for tax purposes. While tax residency often depends on criteria such as the number of days spent in a country, fiscal domicile focuses more on the intent to maintain a permanent home, influencing obligations like income tax and inheritance tax.

Habitual abode

Habitual abode refers to the place where an individual normally lives and spends the majority of their time, influencing tax residency determinations and distinguishing from fiscal domicile, which is the legal home for tax purposes. Tax residency is primarily established by habitual abode criteria, such as physical presence and continuity of stay, while fiscal domicile emphasizes permanent ties like property ownership or family location.

Dual residency

Dual residency occurs when an individual is considered a tax resident in two different countries simultaneously, often due to differing criteria for fiscal domicile and tax residency. Resolving conflicts between fiscal domicile, which focuses on permanent home location, and tax residency, typically based on physical presence or economic ties, requires applying tie-breaker rules within double taxation treaties to determine the primary taxing jurisdiction.

Tax treaties

Tax treaties often define tax residency based on criteria such as permanent home, center of vital interests, habitual abode, and nationality to resolve conflicts between different fiscal domiciles. These agreements aim to prevent double taxation and clarify the taxation rights of individuals and entities by prioritizing tax residency over fiscal domicile in cross-border situations.

Effective management

Effective management determines fiscal domicile by identifying where key strategic decisions are made, which affects tax residency status and compliance obligations. Understanding the distinction between fiscal domicile and tax residency ensures accurate tax reporting and avoids double taxation in cross-border operations.

Economic nexus

Economic nexus determines tax obligations based on business activity within a jurisdiction, regardless of the entity's fiscal domicile or formal tax residency status. Fiscal domicile indicates where a business is registered or headquartered, while tax residency defines where it is legally subject to income tax, making economic nexus a critical factor in state and local tax compliance beyond traditional residency concepts.

Domicile of origin

Domicile of origin refers to the country where a person was born and initially acquired their legal home, which contrasts with fiscal domicile or tax residency, defined by the place where an individual primarily lives and is subject to tax laws. Tax authorities assess fiscal domicile based on factors like physical presence, permanent home, and economic interests, while domicile of origin remains a fixed legal status unless formally changed.

Tie-breaker rule

The tie-breaker rule determines the primary tax residency between conflicting fiscal domiciles by applying criteria such as permanent home location, center of vital interests, habitual abode, and nationality, as outlined in most double tax treaties. This rule ensures that an individual or entity is not simultaneously taxed by two jurisdictions, clarifying fiscal domicile versus tax residency for accurate tax obligation.

Legal situs

Legal situs determines the jurisdiction where an asset is legally located for tax purposes, differing from fiscal domicile which refers to the place recognized by law as an individual's permanent home, while tax residency is based on the actual presence or economic ties to a country, impacting obligations like income tax and estate tax. Understanding these distinctions is crucial for accurately assessing tax liabilities and compliance in cross-border legal and financial contexts.

Fiscal domicile vs tax residency Infographic

moneydif.com

moneydif.com