BEPS (Base Erosion and Profit Shifting) represents strategies by multinational companies to exploit gaps in tax rules, reducing their overall tax burden and undermining tax revenues. Harmful tax competition occurs when countries implement harmful tax practices, such as preferential tax regimes and opaque regulations, to attract foreign investment at the expense of other jurisdictions. Addressing both BEPS and harmful tax competition requires coordinated international efforts to enhance transparency, establish fair tax standards, and prevent profit shifting that erodes the global tax base.

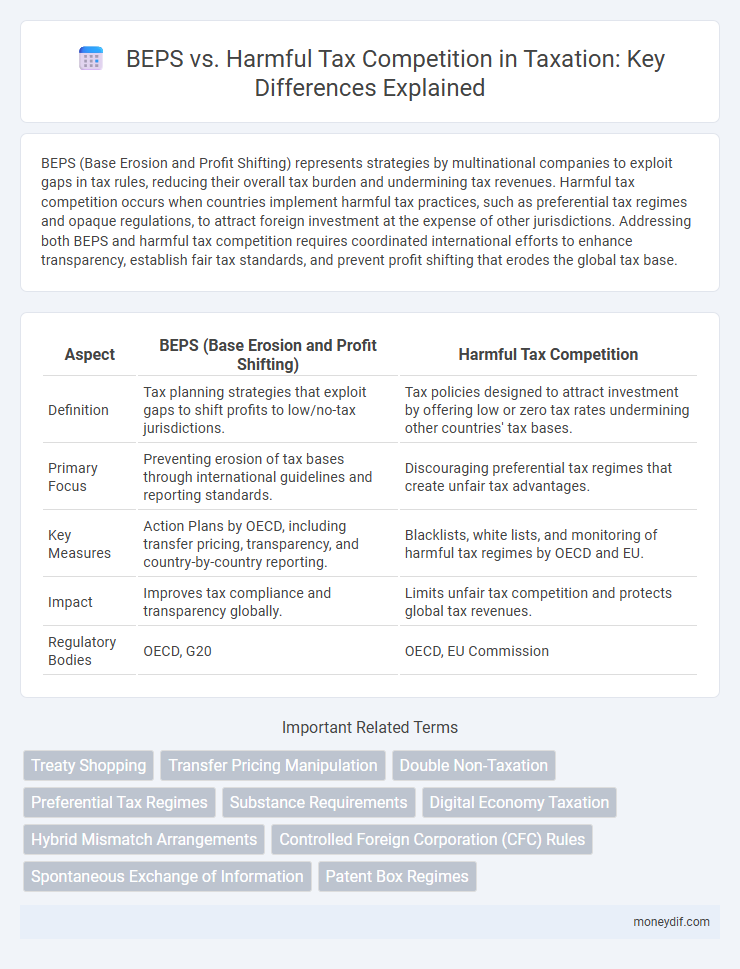

Table of Comparison

| Aspect | BEPS (Base Erosion and Profit Shifting) | Harmful Tax Competition |

|---|---|---|

| Definition | Tax planning strategies that exploit gaps to shift profits to low/no-tax jurisdictions. | Tax policies designed to attract investment by offering low or zero tax rates undermining other countries' tax bases. |

| Primary Focus | Preventing erosion of tax bases through international guidelines and reporting standards. | Discouraging preferential tax regimes that create unfair tax advantages. |

| Key Measures | Action Plans by OECD, including transfer pricing, transparency, and country-by-country reporting. | Blacklists, white lists, and monitoring of harmful tax regimes by OECD and EU. |

| Impact | Improves tax compliance and transparency globally. | Limits unfair tax competition and protects global tax revenues. |

| Regulatory Bodies | OECD, G20 | OECD, EU Commission |

Overview of BEPS and Harmful Tax Competition

Base Erosion and Profit Shifting (BEPS) refers to tax planning strategies used by multinational companies to shift profits from high-tax jurisdictions to low-tax or no-tax locations, eroding the tax base of the higher-tax countries. Harmful tax competition involves jurisdictions offering preferential tax regimes or secrecy to attract foreign investment, which can lead to revenue losses and unfair competitive advantages. International organizations like the OECD work to address both issues by promoting transparency, implementing minimum tax standards, and coordinating tax policy to ensure fair and effective taxation.

Key Differences Between BEPS and Harmful Tax Competition

BEPS (Base Erosion and Profit Shifting) targets strategies multinational corporations use to shift profits to low or no-tax jurisdictions, eroding tax bases globally, whereas harmful tax competition involves countries deliberately setting preferential tax regimes to attract foreign investment unfairly. BEPS primarily addresses tax avoidance through gaps and mismatches in international tax rules, while harmful tax competition focuses on the race-to-the-bottom effect where jurisdictions reduce taxes to competitive lows, impacting fair tax contributions. Key differences include BEPS's emphasis on transparency and information exchange, contrasted with harmful tax competition's focus on eliminating tax rate disparities and preferential regimes.

Historical Background: Evolution of Global Tax Policies

Historical developments in global tax policies trace back to the 1990s when the OECD launched initiatives against harmful tax competition to curb aggressive tax avoidance by multinational corporations. The Base Erosion and Profit Shifting (BEPS) project, introduced in 2013, represented a significant evolution by providing a comprehensive framework to address gaps in international tax rules and promote transparency. This shift from voluntary guidelines to binding measures reflects the increasing global consensus on ensuring fair taxation and reducing profit shifting across jurisdictions.

BEPS Framework: Objectives and Action Plans

The BEPS Framework aims to curtail tax avoidance strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations, undermining the fairness and integrity of tax systems. Its 15 Action Plans focus on enhancing transparency, aligning taxation with economic substance, and improving the coherence of international tax rules to prevent base erosion and profit shifting. These coordinated measures help curb harmful tax competition by promoting tax policy consistency and ensuring multinationals pay taxes where economic activities and value creation occur.

Identifying Harmful Tax Practices: Criteria and Examples

Harmful tax practices are identified using criteria such as preferential tax regimes that distort competition, lack of transparency, and insufficient exchange of information. Examples include jurisdictions offering zero or nominal tax rates to attract artificial profits and implementing ring-fencing measures that isolate tax benefits from local economic activities. The OECD's BEPS framework emphasizes transparency and substance requirements to counteract these harmful tax practices effectively.

Impact of BEPS on International Tax Competition

The Base Erosion and Profit Shifting (BEPS) initiative has significantly reshaped international tax competition by curbing aggressive tax avoidance strategies that erode national tax bases. BEPS measures promote greater transparency, require the disclosure of aggressive tax planning, and encourage jurisdictions to implement minimum standards, reducing harmful tax practices and leveling the playing field for fair tax competition. This shift limits the effectiveness of preferential tax regimes and reduces the incentive for countries to engage in harmful tax competition aimed at attracting multinational enterprises through artificially low or zero tax rates.

Tax Havens and Their Role in Harmful Tax Competition

Tax havens play a central role in harmful tax competition by offering low or zero tax rates that attract multinational corporations seeking to minimize their global tax burdens. These jurisdictions enable base erosion and profit shifting (BEPS) by allowing profits to be artificially shifted away from high-tax countries, eroding their tax bases. International efforts, including the OECD's BEPS initiatives, target tax haven practices to increase transparency and reduce the incentives for profit shifting that undermine fair tax competition worldwide.

Global Responses to BEPS and Harmful Tax Competition

Global responses to BEPS and harmful tax competition emphasize the implementation of the OECD/G20 Inclusive Framework, which includes over 140 jurisdictions collaborating on measures to strengthen tax systems and ensure transparency. Key initiatives such as the Base Erosion and Profit Shifting Action Plan introduce mandatory country-by-country reporting and the Multilateral Instrument, designed to modify bilateral tax treaties to prevent treaty abuse. International organizations and governments are adopting stricter anti-avoidance rules and enhancing information exchange to curb tax base erosion and promote fair competition among multinational enterprises.

Challenges in Addressing Harmful Tax Competition

Addressing harmful tax competition poses significant challenges due to the complex interplay between national sovereignty and the need for international tax cooperation under the OECD BEPS framework. Diverse tax policies and varying enforcement capabilities among jurisdictions hinder the consistent implementation of BEPS measures aimed at curbing profit shifting and base erosion. Effective coordination and transparency remain critical obstacles in mitigating the impact of harmful tax practices on global tax revenues.

Future Trends in Global Tax Governance

Global tax governance is evolving to address Base Erosion and Profit Shifting (BEPS) alongside harmful tax competition, emphasizing increased transparency and cooperative frameworks. Future trends highlight the implementation of unified international tax rules, including digital taxation measures and strengthened dispute resolution mechanisms. Enhanced data sharing and multinational collaboration aim to curb tax avoidance while fostering fair competition among jurisdictions.

Important Terms

Treaty Shopping

Treaty shopping occurs when multinational enterprises exploit tax treaties to minimize tax liabilities by routing income through jurisdictions with favorable treaty provisions, intensifying base erosion and profit shifting (BEPS) challenges. The OECD's BEPS Action Plan targets treaty shopping by promoting measures like the Multilateral Instrument (MLI) to curb harmful tax competition and ensure fair tax practices.

Transfer Pricing Manipulation

Transfer pricing manipulation involves artificial pricing of transactions between related entities to shift profits and minimize global tax liabilities, directly undermining BEPS (Base Erosion and Profit Shifting) initiatives designed to ensure fair taxation. Such manipulation exacerbates harmful tax competition by enabling multinational corporations to exploit low-tax jurisdictions, eroding national tax bases and distorting economic equity among countries.

Double Non-Taxation

Double non-taxation occurs when income escapes taxation in any jurisdiction, a key concern addressed by the OECD's Base Erosion and Profit Shifting (BEPS) project, which implements measures such as the Multilateral Instrument (MLI) to prevent treaty abuse and ensure minimum taxation. Harmful tax competition, often characterized by preferential tax regimes or low tax rates without substantial economic activity, exacerbates double non-taxation by enabling multinational enterprises to shift profits and erode tax bases across countries.

Preferential Tax Regimes

Preferential tax regimes often enable multinational corporations to shift profits and reduce tax liabilities, contributing to Base Erosion and Profit Shifting (BEPS) challenges recognized by the OECD. These regimes can undermine fair tax competition by attracting investments through artificially low tax rates, leading to harmful tax competition that distorts global markets and erodes national tax bases.

Substance Requirements

Substance requirements are critical in the OECD's BEPS (Base Erosion and Profit Shifting) framework to prevent harmful tax competition by ensuring companies maintain genuine economic activities in jurisdictions claiming low or no taxation. These rules mandate tangible operational presence, such as employees, assets, and decision-making processes, to combat profit shifting and uphold fair tax practices globally.

Digital Economy Taxation

Digital economy taxation addresses challenges posed by BEPS (Base Erosion and Profit Shifting) through reforming international tax rules to curb profit shifting and ensure fair tax contributions. Harmful tax competition undermines these efforts by allowing jurisdictions to attract profits with artificially low or zero tax rates, prompting coordinated actions under OECD/G20 frameworks to establish minimum tax standards and increase transparency.

Hybrid Mismatch Arrangements

Hybrid Mismatch Arrangements exploit differences in tax treatment between jurisdictions to achieve double non-taxation or tax deferral, undermining the objectives of the OECD/G20 BEPS project. Addressing harmful tax competition, BEPS Action 2 targets these arrangements by aligning international tax rules to prevent tax base erosion and profit shifting caused by hybrid mismatches.

Controlled Foreign Corporation (CFC) Rules

Controlled Foreign Corporation (CFC) rules are critical in the BEPS (Base Erosion and Profit Shifting) framework to prevent profit shifting to low-tax jurisdictions by attributing income of foreign subsidiaries to the parent company. These rules address harmful tax competition by ensuring multinational enterprises pay a fair share of taxes where economic activities occur, thereby curbing artificial profit diversion and tax base erosion.

Spontaneous Exchange of Information

Spontaneous Exchange of Information (SEI) is a critical tool in combating Base Erosion and Profit Shifting (BEPS) by enabling tax authorities to share relevant data proactively without formal requests, enhancing transparency and reducing opportunities for harmful tax competition. SEI supports the implementation of BEPS Action Plans by facilitating timely and automatic access to financial and tax-related information across jurisdictions, which deters aggressive tax avoidance strategies and protects domestic tax bases.

Patent Box Regimes

Patent Box regimes offer preferential tax rates on income derived from intellectual property to stimulate innovation, but their design and implementation are scrutinized under the OECD's Base Erosion and Profit Shifting (BEPS) framework to prevent harmful tax competition that erodes tax bases. Compliance with the BEPS Action 5 requires that Patent Box regimes link tax benefits to substantial economic activities, ensuring that tax incentives do not become instruments for profit shifting or aggressive tax planning.

BEPS vs harmful tax competition Infographic

moneydif.com

moneydif.com