Head of household status offers a higher standard deduction and more favorable tax brackets compared to single filer status, making it beneficial for taxpayers supporting dependents. To qualify as head of household, you must be unmarried, pay more than half the cost of maintaining a home, and have a qualifying dependent living with you for more than half the year. This filing status can reduce your overall tax liability and increase eligibility for certain credits and deductions unavailable to single filers.

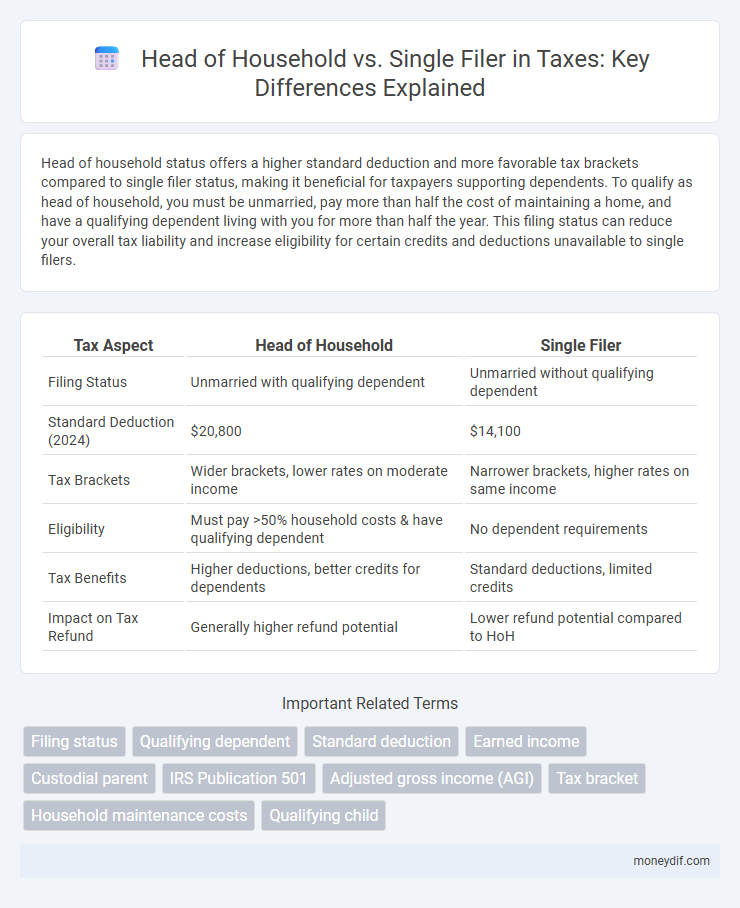

Table of Comparison

| Tax Aspect | Head of Household | Single Filer |

|---|---|---|

| Filing Status | Unmarried with qualifying dependent | Unmarried without qualifying dependent |

| Standard Deduction (2024) | $20,800 | $14,100 |

| Tax Brackets | Wider brackets, lower rates on moderate income | Narrower brackets, higher rates on same income |

| Eligibility | Must pay >50% household costs & have qualifying dependent | No dependent requirements |

| Tax Benefits | Higher deductions, better credits for dependents | Standard deductions, limited credits |

| Impact on Tax Refund | Generally higher refund potential | Lower refund potential compared to HoH |

Definition of Head of Household and Single Filer

Head of household is a tax filing status for unmarried individuals who pay more than half the cost of maintaining a home for a qualifying person, such as a child or dependent relative, allowing for higher standard deductions and favorable tax brackets. Single filer applies to taxpayers who are unmarried, divorced, or legally separated and do not qualify for head of household status, typically facing higher tax rates and lower deduction amounts. The IRS defines head of household filing status to provide tax benefits to those supporting dependents, distinguishing it from the single filer status with stricter qualification criteria.

Key IRS Criteria for Each Filing Status

Head of household filing status requires taxpayers to be unmarried or considered unmarried at the end of the tax year, provide more than half the cost of maintaining a home, and have a qualifying dependent living with them for more than half the year. Single filer status applies to individuals who are unmarried, divorced, or legally separated with no qualifying dependents. The IRS uses these key criteria to determine tax brackets, standard deduction amounts, and eligibility for specific tax credits.

Eligibility Requirements for Head of Household

To qualify for Head of Household filing status, a taxpayer must be unmarried or considered unmarried on the last day of the tax year, have paid more than half the cost of maintaining a home, and have a qualifying dependent living with them for more than half the year. The dependent can be a child, parent, or other relative who meets IRS relationship and residency tests. This status offers a higher standard deduction and more favorable tax brackets compared to Single filer status.

When to File as Single

File as Single if you are unmarried, divorced, or legally separated on the last day of the tax year and do not qualify for Head of Household status by failing to maintain a household for a qualifying dependent. The Single filer status applies when you do not provide more than half the cost of keeping up a home for a dependent, which distinguishes it from Head of Household eligibility. Choosing the correct filing status impacts your standard deduction and tax rate, making accurate status determination crucial for tax benefits.

Tax Benefits of Head of Household vs Single

Filing as Head of Household offers a higher standard deduction and more favorable tax brackets compared to Single filer status, reducing taxable income significantly. Taxpayers qualifying for Head of Household status can benefit from a lower tax rate on a wider income range, leading to substantial tax savings. Additionally, this status can increase eligibility for tax credits such as the Earned Income Tax Credit and Child Tax Credit, further enhancing overall tax benefits.

Standard Deduction Differences

The standard deduction for head of household filers in the 2023 tax year is $20,800, significantly higher than the $13,850 standard deduction for single filers. This difference reflects the IRS's recognition of the additional financial responsibility borne by heads of household, who typically provide more than half the cost of maintaining a home for a qualifying person. Claiming head of household status can result in substantial tax savings compared to filing as a single individual.

Impact on Tax Brackets and Rates

Filing as Head of Household offers more favorable tax brackets with wider income ranges compared to Single filer status, resulting in lower tax rates on higher income levels. The standard deduction for Head of Household is significantly higher, directly reducing taxable income. These differences can lead to substantial tax savings for qualifying taxpayers with dependents.

Qualifying Dependents for Head of Household

Qualifying dependents are essential for filing as Head of Household, enabling a taxpayer to claim a higher standard deduction than Single filers. To qualify, dependents must live with the taxpayer for more than half the year and be a child, relative, or foster child who meets specific IRS criteria. Filing as Head of Household requires maintaining a home for the dependent and can result in significant tax savings compared to the Single filing status.

Common Mistakes When Choosing Filing Status

Common mistakes when choosing between Head of Household and Single filer include incorrectly claiming Head of Household without maintaining a qualifying dependent or failing to meet the residency requirements. Taxpayers often overlook the necessity of paying more than half the cost of household expenses, which disqualifies them from Head of Household status. Misfiling can lead to incorrect tax calculations, reduced deductions, and potential IRS penalties.

How to Decide: Head of Household or Single?

Determining whether to file as Head of Household or Single hinges on your living situation and financial responsibilities; claim Head of Household status if you are unmarried, pay more than half the household expenses, and support a qualifying dependent living with you for over half the year. Single filer status applies if you do not meet these criteria, meaning you live independently without dependents. Accurately choosing your filing status impacts your tax brackets, standard deduction amounts, and eligibility for tax credits, making correct classification crucial for maximizing tax benefits.

Important Terms

Filing status

Head of household filing status applies to taxpayers who are unmarried and pay more than half the cost of maintaining a home for a qualifying person, offering a higher standard deduction and more favorable tax brackets compared to single filers. Single filer status applies to unmarried individuals who do not qualify for head of household, resulting in lower standard deductions and tighter tax brackets.

Qualifying dependent

A qualifying dependent affects tax filing status determination, where claiming a dependent typically enables the Head of Household status, offering higher standard deductions and favorable tax brackets compared to Single filer status. Single filers do not qualify for Head of Household benefits and generally have lower thresholds for tax credits linked to dependents.

Standard deduction

The standard deduction for Head of Household in the 2023 tax year is $20,800, significantly higher than the $13,850 available to Single filers, providing greater tax relief for individuals supporting dependents. This increased deduction reflects the IRS recognition of added financial responsibilities for taxpayers maintaining a household for qualifying dependents.

Earned income

Earned income plays a crucial role in determining tax benefits for Head of Household versus Single filers, with the Head of Household status providing a higher standard deduction and more favorable tax brackets for individuals supporting dependents. This filing status maximizes tax credits such as the Earned Income Tax Credit (EITC) and Child Tax Credit, resulting in lower overall tax liability compared to the Single filer status with similar earned income levels.

Custodial parent

A custodial parent filing as Head of Household qualifies for a higher standard deduction and more favorable tax brackets compared to a Single filer due to maintaining a home for a qualifying child. The Internal Revenue Service (IRS) recognizes custodial parents who provide over half the cost of housing as eligible for Head of Household status, maximizing tax benefits tied to dependents.

IRS Publication 501

IRS Publication 501 defines the criteria for filing as Head of Household versus Single filer, highlighting that Head of Household status requires paying more than half the cost of maintaining a home for a qualifying person. This status offers a higher standard deduction and more favorable tax brackets compared to Single filer, resulting in potential tax savings.

Adjusted gross income (AGI)

Adjusted Gross Income (AGI) determination varies between Head of Household and Single filer statuses, with Head of Household requiring qualifying dependents and offering higher standard deductions, potentially reducing taxable income more than a Single filer with similar earnings. Taxpayers filing as Head of Household generally benefit from more favorable tax brackets and credits compared to Single filers, impacting overall tax liability and eligibility for various deductions.

Tax bracket

Head of household tax brackets offer higher income thresholds before reaching higher tax rates compared to single filer brackets, providing increased tax benefits for individuals supporting dependents. The IRS 2024 tax brackets show that head of household filers can earn significantly more income at lower rates, enhancing tax savings opportunities relative to single filers.

Household maintenance costs

Household maintenance costs for a Head of Household typically exceed those of a Single Filer, as they cover expenses for dependents such as children or elderly family members, including housing, utilities, food, and healthcare. Tax benefits and deductions available to Heads of Household often help offset higher costs compared to Single Filers, who primarily bear expenses for themselves.

Qualifying child

A qualifying child for Head of Household filing status must live with the taxpayer for more than half the year and be claimed as a dependent, providing a tax benefit unavailable to Single filers, who cannot claim this status without a qualifying dependent. The Head of Household status offers a higher standard deduction and more favorable tax brackets compared to the Single filing status, making it advantageous when supporting a qualifying child.

Head of household vs Single filer Infographic

moneydif.com

moneydif.com