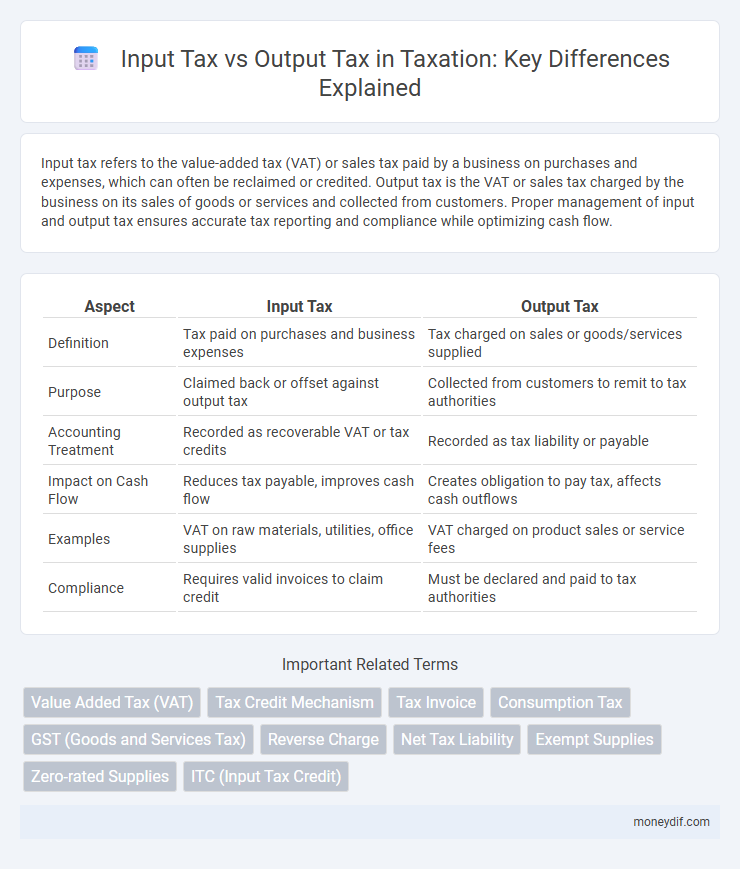

Input tax refers to the value-added tax (VAT) or sales tax paid by a business on purchases and expenses, which can often be reclaimed or credited. Output tax is the VAT or sales tax charged by the business on its sales of goods or services and collected from customers. Proper management of input and output tax ensures accurate tax reporting and compliance while optimizing cash flow.

Table of Comparison

| Aspect | Input Tax | Output Tax |

|---|---|---|

| Definition | Tax paid on purchases and business expenses | Tax charged on sales or goods/services supplied |

| Purpose | Claimed back or offset against output tax | Collected from customers to remit to tax authorities |

| Accounting Treatment | Recorded as recoverable VAT or tax credits | Recorded as tax liability or payable |

| Impact on Cash Flow | Reduces tax payable, improves cash flow | Creates obligation to pay tax, affects cash outflows |

| Examples | VAT on raw materials, utilities, office supplies | VAT charged on product sales or service fees |

| Compliance | Requires valid invoices to claim credit | Must be declared and paid to tax authorities |

Introduction to Input Tax and Output Tax

Input tax refers to the Value Added Tax (VAT) paid on purchases and expenses incurred by a business, which can be reclaimed from the tax authorities. Output tax is the VAT charged on sales of goods or services, representing the tax collected from customers that must be remitted to the government. Understanding the distinction between input and output tax is crucial for accurate VAT reporting and determining the net tax payable or refundable.

Defining Input Tax

Input tax refers to the value-added tax (VAT) a business pays on goods and services purchased for use in its operations. This tax is deductible from the output tax collected on sales, reducing the overall tax liability. Precise documentation and accurate recording of input tax are essential for compliance and maximizing tax credits.

Understanding Output Tax

Output tax is the value-added tax (VAT) a business charges its customers on sales of goods or services, recorded as a liability until remitted to tax authorities. Understanding output tax is crucial for accurate VAT reporting and ensuring compliance with tax regulations. It directly impacts a company's cash flow and tax liabilities by determining the amount payable after deducting input tax credits.

Key Differences Between Input Tax and Output Tax

Input tax refers to the value-added tax (VAT) paid on purchases and expenses incurred by a business, while output tax is the VAT charged on sales and services provided to customers. The key difference lies in their roles in tax calculation: input tax is deductible from output tax to determine the net tax payable to tax authorities. Accurate tracking of input and output tax ensures compliance and optimizes VAT refunds and liabilities.

Calculation Methods for Input and Output Tax

Input tax is calculated based on the amount of VAT paid on business purchases and expenses, while output tax is determined by the VAT charged on sales or services provided. Business entities compute output tax by applying the relevant VAT percentage to the total taxable sales, and input tax is summed from VAT invoices related to allowable purchases. The difference between output tax and input tax determines the net VAT payable or refundable to tax authorities.

Recording and Documentation Requirements

Accurate recording and documentation of input tax and output tax are essential for compliance with tax regulations and for claiming allowable tax credits. Businesses must maintain detailed invoices, receipts, and tax returns that clearly distinguish between input tax paid on purchases and output tax collected on sales. Proper documentation supports audit trails, facilitates tax reconciliation, and ensures timely VAT refund processing.

Input Tax and Output Tax in VAT Systems

Input tax refers to the value-added tax (VAT) paid on purchases of goods and services used in business operations, which businesses can reclaim or offset against their VAT liability. Output tax is the VAT collected by a business on sales of goods or services, representing the tax charged to customers. In VAT systems, the net VAT payable is calculated by subtracting input tax from output tax, ensuring businesses remit only the difference to tax authorities.

Common Mistakes in Input and Output Tax Reporting

Common mistakes in input and output tax reporting often involve misclassifying expenses and revenues, leading to inaccurate VAT declarations. Businesses frequently overlook proper documentation for input tax credits, resulting in disallowed deductions during tax audits. Failure to accurately differentiate between taxable and exempt supplies causes discrepancies in output tax calculations and potential penalties.

Claiming Input Tax Credits

Businesses can claim input tax credits to reduce their tax liability by offsetting the GST or VAT paid on purchases (input tax) against the tax collected on sales (output tax). To qualify for input tax credits, the expenses must be directly related to taxable business activities and supported by valid tax invoices. Proper documentation and timely reporting ensure compliance and maximize the financial benefits of claiming these credits in tax returns.

Impact of Input and Output Tax on Business Cash Flow

Input tax reduces the amount of tax a business owes by allowing it to reclaim VAT paid on purchases, improving cash flow through increased liquidity. Output tax represents the VAT collected from sales, which must be remitted to tax authorities, potentially creating temporary cash flow challenges if collection timing is delayed. Effective management of input and output tax ensures a balanced cash flow, minimizing the risk of short-term financing needs and enhancing operational efficiency.

Important Terms

Value Added Tax (VAT)

Input tax is the VAT paid on business purchases, while output tax is the VAT charged on sales, and businesses remit the difference to tax authorities.

Tax Credit Mechanism

The tax credit mechanism allows businesses to subtract input tax paid on purchases from output tax collected on sales, reducing overall tax liability.

Tax Invoice

A tax invoice details input tax credit on purchases and output tax liability on sales to ensure accurate GST compliance and reporting.

Consumption Tax

Consumption tax requires businesses to remit the difference between output tax collected on sales and input tax paid on purchases, ensuring only the value added is taxed.

GST (Goods and Services Tax)

Input tax is the GST paid on purchases and expenses, which can be claimed as a credit against the output tax collected on sales, reducing the overall GST liability for businesses.

Reverse Charge

Reverse charge mechanism shifts the liability to pay output tax from the supplier to the recipient, making the recipient responsible for accounting input tax and output tax in their GST returns.

Net Tax Liability

Net tax liability equals output tax collected minus input tax paid on purchases, determining the final tax amount owed to tax authorities.

Exempt Supplies

Exempt supplies generate no output tax, preventing the recovery of input tax incurred on related purchases.

Zero-rated Supplies

Zero-rated supplies allow businesses to claim input tax credits on purchases while charging no output tax on sales, improving cash flow and compliance in VAT systems.

ITC (Input Tax Credit)

Input Tax Credit (ITC) allows businesses to deduct the GST paid on input tax from the GST liability on output tax, reducing overall tax payable.

Input tax vs output tax Infographic

moneydif.com

moneydif.com