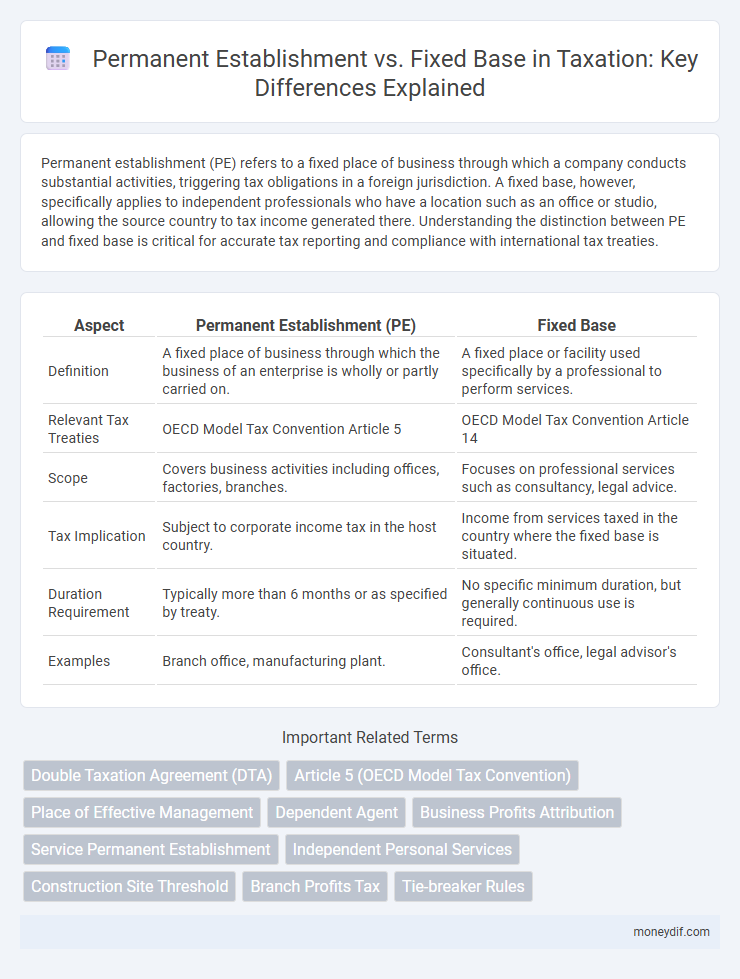

Permanent establishment (PE) refers to a fixed place of business through which a company conducts substantial activities, triggering tax obligations in a foreign jurisdiction. A fixed base, however, specifically applies to independent professionals who have a location such as an office or studio, allowing the source country to tax income generated there. Understanding the distinction between PE and fixed base is critical for accurate tax reporting and compliance with international tax treaties.

Table of Comparison

| Aspect | Permanent Establishment (PE) | Fixed Base |

|---|---|---|

| Definition | A fixed place of business through which the business of an enterprise is wholly or partly carried on. | A fixed place or facility used specifically by a professional to perform services. |

| Relevant Tax Treaties | OECD Model Tax Convention Article 5 | OECD Model Tax Convention Article 14 |

| Scope | Covers business activities including offices, factories, branches. | Focuses on professional services such as consultancy, legal advice. |

| Tax Implication | Subject to corporate income tax in the host country. | Income from services taxed in the country where the fixed base is situated. |

| Duration Requirement | Typically more than 6 months or as specified by treaty. | No specific minimum duration, but generally continuous use is required. |

| Examples | Branch office, manufacturing plant. | Consultant's office, legal advisor's office. |

Definition of Permanent Establishment

Permanent establishment (PE) refers to a fixed place of business through which a foreign enterprise wholly or partly conducts its business activities in another country, serving as a taxable presence under international tax treaties. It typically includes locations such as offices, branches, factories, and construction sites lasting more than a specified period, often six months. Unlike fixed base, which primarily concerns independent professionals providing services, PE covers broader commercial activities indicating significant economic presence and tax liability.

Definition of Fixed Base

A fixed base refers to a durable physical presence through which an enterprise carries out professional services in a foreign country, such as offices, branches, or workshops. It is a specific legal concept primarily used to determine tax obligations for service providers under international tax treaties, often linked to the provision of independent personal services. Unlike a permanent establishment, which generally applies to business operations like trading or manufacturing, a fixed base establishes tax liability based solely on the continuous availability of facilities for delivering professional services.

Key Differences Between Permanent Establishment and Fixed Base

Permanent establishment (PE) refers to a fixed place of business through which an enterprise conducts its operations, typically triggering tax obligations in the host country. A fixed base is a specific subset of PE, primarily related to professions providing services, such as consultants or independent agents, emphasizing the physical presence used to perform these services. Key differences include the scope of activities covered, with PE encompassing broader business operations, whereas a fixed base strictly relates to service provision and proximity requirements defined under tax treaties.

Tax Implications of Permanent Establishment

A Permanent Establishment (PE) triggers significant tax implications by subjecting a foreign company to local corporate taxes on income attributable to the PE, unlike a fixed base which may only affect service income taxation. Tax authorities assess the existence of a PE based on activities such as having a fixed place of business or dependent agents with authority to conclude contracts. Identifying a PE ensures compliance with international tax treaties, preventing double taxation but increasing local tax liabilities and reporting obligations for multinational enterprises.

Tax Implications of Fixed Base

A fixed base represents a physical location, such as an office or agency, where a business carries out professional services, triggering tax obligations in that jurisdiction. Unlike a permanent establishment, which covers broader business operations, a fixed base specifically determines the taxable presence for service providers under income tax treaties. Tax implications include allocation of profits attributable to the fixed base, potential withholding taxes, and compliance with local transfer pricing regulations.

Criteria for Determining Permanent Establishment

The criteria for determining a Permanent Establishment (PE) typically include having a fixed place of business through which the enterprise's business is wholly or partly carried out, with a degree of permanence and substantial activity. A fixed base, often used in the context of independent personal services, requires a dependable physical location from which services are provided continuously. The distinction hinges upon the nature and duration of the presence, as well as the type of business activities conducted at the site.

Criteria for Determining Fixed Base

A fixed base for tax purposes is identified by a place of business with sufficient degree of permanence and a physical presence that enables the provision of professional services. Criteria include the existence of an office, workshop, or similar establishment that is used regularly and consistently by the enterprise. The nature and duration of activities conducted at the location are essential factors in distinguishing a fixed base from a temporary or transient presence.

Examples of Permanent Establishment Scenarios

A permanent establishment (PE) typically involves a fixed place of business such as an office, factory, or branch through which a company carries out its business activities consistently in another country. Examples of PE scenarios include a construction site lasting more than 12 months, a dependent agent with authority to conclude contracts on behalf of the enterprise, or a warehouse used for storage and distribution. In contrast, a fixed base usually refers to a base of operations for professionals like lawyers or consultants, where the presence is linked to the provision of personal services rather than general business operations.

Examples of Fixed Base Situations

A fixed base refers to a stable place of business used by professionals such as lawyers, architects, or consultants to provide services within a country, exemplified by an architect's office or a lawyer's firm. Unlike a permanent establishment, which typically involves business operations like a branch or factory, a fixed base specifically relates to service provision through a fixed location. Examples include a consulting firm's rented office used exclusively for client meetings and service delivery or an accounting advisor's dedicated local office space.

Practical Considerations and Compliance Strategies

Permanent establishment (PE) and fixed base concepts critically influence cross-border taxation, affecting how businesses determine tax liabilities in foreign jurisdictions. Effective compliance strategies involve thorough assessment of activities, contractual arrangements, and local tax laws to distinguish between a PE and a fixed base, ensuring accurate profit attribution and minimizing double taxation risks. Practical considerations include maintaining detailed documentation, monitoring business presence thresholds, and leveraging advance rulings or mutual agreements to align with international tax standards and avoid disputes.

Important Terms

Double Taxation Agreement (DTA)

The Double Taxation Agreement (DTA) distinguishes between Permanent Establishment (PE) and fixed base to determine tax liabilities, where a PE typically involves a fixed place of business generating taxable income in a foreign jurisdiction, while a fixed base specifically relates to a permanent place of professional services. This distinction affects the allocation of taxing rights between countries and prevents double taxation on income derived from cross-border activities.

Article 5 (OECD Model Tax Convention)

Article 5 of the OECD Model Tax Convention defines "Permanent Establishment" as a fixed place of business through which the business of an enterprise is wholly or partly carried on, distinguishing it from a "Fixed Base," which primarily pertains to the place where professional services are performed, impacting taxation rights accordingly.

Place of Effective Management

Place of Effective Management (POEM) determines the tax residency of a company by identifying where key management and commercial decisions are made, crucial for distinguishing between a Permanent Establishment (PE) and a Fixed Base. While a Permanent Establishment involves a fixed place of business generating taxable income, a Fixed Base typically relates to a permanent physical location used by professional service providers, with POEM influencing whether business profits are taxed in the jurisdiction of effective management or where the fixed place operates.

Dependent Agent

A dependent agent who habitually exercises authority to conclude contracts on behalf of a foreign enterprise creates a permanent establishment, whereas a fixed base refers to a physical place of business used by an enterprise for providing services.

Business Profits Attribution

Business profits attribution for Permanent Establishment (PE) involves allocating taxable income based on activities and assets tied to the PE, whereas fixed base relates to profits derived from professional services provided through a stable place of business.

Service Permanent Establishment

A Service Permanent Establishment arises when a company provides services through a fixed base in a foreign country, distinguishing it from general Permanent Establishment by the specific nature of ongoing service activities.

Independent Personal Services

Independent Personal Services often create a Permanent Establishment when performed through a Fixed Base, as defined in international tax treaties under Article 5 of the OECD Model Convention.

Construction Site Threshold

A construction site threshold typically qualifies as a permanent establishment under tax laws if it lasts more than 12 months, distinguishing it from a fixed base which involves a more permanent installation for providing services.

Branch Profits Tax

Branch Profits Tax applies to foreign corporations with a U.S. permanent establishment, distinguishing it from fixed base criteria by taxing attributed earnings exceeding regular corporate income tax on branch profits.

Tie-breaker Rules

Tie-breaker rules resolve conflicts between Permanent Establishment and Fixed Base definitions by determining which jurisdiction has primary taxing rights based on factors such as place of business management, asset location, and client services.

Permanent establishment vs fixed base Infographic

moneydif.com

moneydif.com