Thin capitalization occurs when a company is financed through a high level of debt compared to equity, potentially leading to tax challenges due to excessive interest deductions. Undercapitalization refers to a business being funded with insufficient equity, increasing financial risk and attracting scrutiny from tax authorities to prevent profit shifting. Both concepts are crucial in tax planning to balance legitimate financing strategies and compliance with anti-avoidance rules.

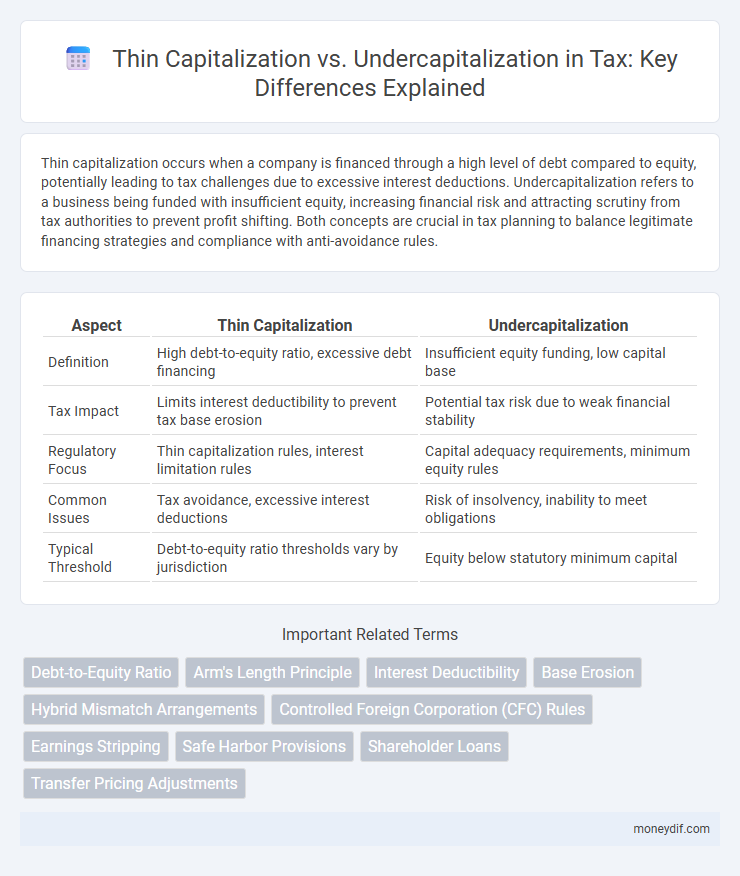

Table of Comparison

| Aspect | Thin Capitalization | Undercapitalization |

|---|---|---|

| Definition | High debt-to-equity ratio, excessive debt financing | Insufficient equity funding, low capital base |

| Tax Impact | Limits interest deductibility to prevent tax base erosion | Potential tax risk due to weak financial stability |

| Regulatory Focus | Thin capitalization rules, interest limitation rules | Capital adequacy requirements, minimum equity rules |

| Common Issues | Tax avoidance, excessive interest deductions | Risk of insolvency, inability to meet obligations |

| Typical Threshold | Debt-to-equity ratio thresholds vary by jurisdiction | Equity below statutory minimum capital |

Introduction to Thin Capitalization and Undercapitalization

Thin capitalization occurs when a company is financed through a high level of debt relative to equity, raising concerns over excessive interest deductions and tax avoidance. Undercapitalization refers to a business having insufficient equity financing, increasing the risk of insolvency and limiting financial flexibility. Both concepts impact tax regulations and influence how tax authorities assess the legitimacy of interest expenses and company solvency.

Defining Thin Capitalization in Tax Context

Thin capitalization in a tax context refers to a situation where a company is financed through a high level of debt compared to equity, often resulting in excessive interest deductions. Tax authorities scrutinize this structure to prevent profit shifting and tax base erosion by limiting interest expense deductibility. The primary goal is to ensure a balanced capital structure that reflects genuine economic activity and prevents abuse through excessive debt financing.

Understanding Undercapitalization in Business

Undercapitalization in business occurs when a company is funded with insufficient equity compared to its debt, increasing financial risk and limiting growth potential. This imbalance often leads to challenges in meeting operational expenses and securing additional financing, thereby impairing business stability. Understanding undercapitalization is essential for maintaining optimal capital structure and avoiding the adverse tax implications associated with excessive debt financing.

Key Differences Between Thin Capitalization and Undercapitalization

Thin capitalization occurs when a company is financed through a high proportion of debt compared to equity, often leading to limitations on interest deductibility under tax laws. Undercapitalization refers to a business having insufficient equity capital to support its operations and financial risks, increasing the likelihood of insolvency. Key differences include thin capitalization focusing on the debt-to-equity ratio affecting tax treatment, while undercapitalization emphasizes inadequate equity causing financial instability.

Tax Implications of Thin Capitalization

Thin capitalization occurs when a company finances its operations through excessive debt compared to equity, often leading to tax implications such as restricted interest deductions. Tax authorities may disallow or limit interest expenses on related-party loans to prevent base erosion and profit shifting, impacting the company's taxable income. Understanding thin capitalization rules is essential for multinational corporations to optimize tax liabilities and maintain compliance with transfer pricing regulations.

Impact of Undercapitalization on Tax Compliance

Undercapitalization often triggers thin capitalization rules, leading to the recharacterization of excessive debt as equity for tax purposes, increasing taxable income. This impacts tax compliance by raising the risk of penalties and interest due to discrepancies in debt-to-equity ratios reported to tax authorities. Accurate capitalization is crucial for maintaining compliance and optimizing tax liabilities while avoiding audits and adjustments.

Anti-Avoidance Rules for Thin Capitalization

Thin capitalization occurs when a company is financed through a high level of debt compared to equity to exploit tax benefits, triggering Anti-Avoidance Rules designed to limit interest deductions on excessive debt. These regulations analyze the debt-to-equity ratio, often setting specific thresholds to prevent profit shifting and tax base erosion by restricting deductible interest beyond arm's length limits. Enforcement of thin capitalization rules ensures tax compliance by disallowing disproportionate interest expenses, thereby safeguarding against abusive financing structures in cross-border taxation.

Legal Risks Associated with Undercapitalization

Undercapitalization poses significant legal risks, including personal liability for corporate debts as courts may pierce the corporate veil to protect creditors. Tax authorities often scrutinize undercapitalized companies for potential reclassification of debt as equity, which can result in denied interest deductions and increased tax liabilities. Maintaining adequate capitalization is critical to avoiding legal challenges and ensuring compliance with both tax regulations and corporate governance standards.

Strategies to Prevent Thin Capitalization and Undercapitalization

Implementing an optimal debt-to-equity ratio tailored to industry standards reduces risks associated with thin capitalization and undercapitalization. Maintaining thorough documentation of funding sources and timely compliance with local tax regulations strengthens defense against transfer pricing adjustments and thin capitalization penalties. Leveraging capital restructuring strategies, including equity injections and third-party financing, enhances financial stability and prevents tax base erosion.

Case Studies and Real-World Examples

Thin capitalization occurs when a company is financed through a high level of debt compared to equity, often leading to tax-deductible interest expenses that reduce taxable income; a notable example is the 1995 U.S. Tax Court case Frank Lyon Co. v. United States, which clarified the limits of debt-equity distinctions under tax law. Undercapitalization, conversely, refers to insufficient equity funding that exposes a firm to financial risk and potential reclassification of debt as equity by tax authorities, as seen in the 2013 Canadian case Canada Permanent Trust Co. v. Canada. These cases emphasize the importance of maintaining appropriate debt-to-equity ratios to comply with thin capitalization rules and avoid adverse tax implications.

Important Terms

Debt-to-Equity Ratio

The Debt-to-Equity Ratio measures a company's financial leverage by comparing total liabilities to shareholders' equity, crucial in assessing thin capitalization where excessive debt financing may trigger regulatory scrutiny and tax implications. Undercapitalization occurs when a business lacks sufficient equity to support its operations, often resulting in disproportionate reliance on debt, which inflates the Debt-to-Equity Ratio and raises concerns about financial stability and creditor risk.

Arm's Length Principle

The Arm's Length Principle ensures that transactions between related entities, including those involving thin capitalization and undercapitalization, are conducted at market terms to prevent tax base erosion through excessive interest deductions or inadequate equity financing.

Interest Deductibility

Interest deductibility rules limit the amount of interest expenses that can be deducted for tax purposes, particularly in cases of thin capitalization where excessive debt leads to restricted deductions compared to undercapitalization scenarios with insufficient debt financing.

Base Erosion

Base erosion occurs when multinational companies use thin capitalization by excessively funding subsidiaries with debt instead of equity, leading to undercapitalization that shifts profits through interest deductions and reduces taxable income in high-tax jurisdictions.

Hybrid Mismatch Arrangements

Hybrid mismatch arrangements exploit differences in tax treatment of instruments or entities, often leading to thin capitalization issues where excessive debt financing reduces taxable income, while undercapitalization refers to inadequate equity funding that may trigger tax penalties.

Controlled Foreign Corporation (CFC) Rules

Controlled Foreign Corporation (CFC) rules aim to prevent tax avoidance by restricting income shifting, addressing issues arising from thin capitalization where excessive debt financing leads to undercapitalization and reduced taxable income.

Earnings Stripping

Earnings stripping involves reducing taxable income through excessive interest deductions, often arising in thin capitalization scenarios where a company is funded with disproportionately high debt compared to equity. Undercapitalization, a related concept, occurs when a business lacks sufficient equity to support its operations, increasing the risk of earnings stripping as firms rely heavily on debt financing.

Safe Harbor Provisions

Safe Harbor Provisions establish clear regulatory thresholds distinguishing thin capitalization, where excessive debt increases tax risks, from undercapitalization, ensuring compliant capital structures for tax efficiency and legal protection.

Shareholder Loans

Shareholder loans can trigger thin capitalization rules when excessive debt from related parties exceeds regulatory debt-to-equity ratios, leading to disallowed interest deductions and concerns of undercapitalization.

Transfer Pricing Adjustments

Transfer pricing adjustments address profit allocation distortions caused by thin capitalization, where excessive debt leads to deductible interest expenses, contrasting with undercapitalization that restricts debt financing and affects tax compliance.

Thin capitalization vs undercapitalization Infographic

moneydif.com

moneydif.com