The arm's length principle ensures that transactions between related parties are conducted as if they were between independent entities, maintaining fair market value. Transfer pricing refers to the methods used to set and document these prices for intercompany transactions to comply with tax regulations. Proper application of the arm's length principle in transfer pricing prevents tax base erosion and ensures alignment with international tax standards.

Table of Comparison

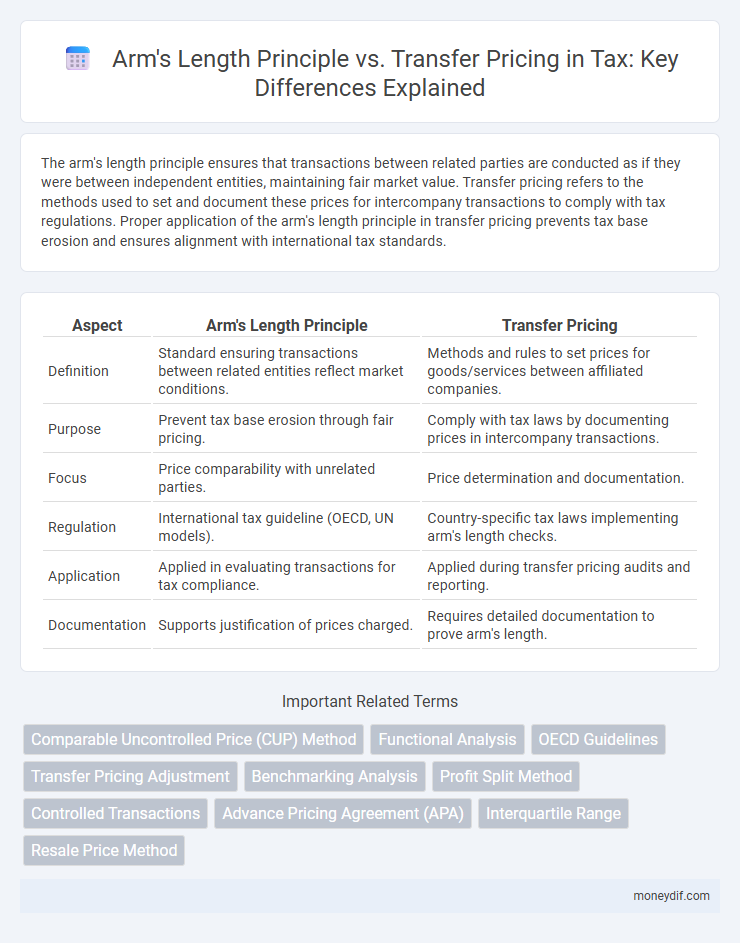

| Aspect | Arm's Length Principle | Transfer Pricing |

|---|---|---|

| Definition | Standard ensuring transactions between related entities reflect market conditions. | Methods and rules to set prices for goods/services between affiliated companies. |

| Purpose | Prevent tax base erosion through fair pricing. | Comply with tax laws by documenting prices in intercompany transactions. |

| Focus | Price comparability with unrelated parties. | Price determination and documentation. |

| Regulation | International tax guideline (OECD, UN models). | Country-specific tax laws implementing arm's length checks. |

| Application | Applied in evaluating transactions for tax compliance. | Applied during transfer pricing audits and reporting. |

| Documentation | Supports justification of prices charged. | Requires detailed documentation to prove arm's length. |

Introduction to the Arm’s Length Principle

The arm's length principle is a fundamental guideline in international tax law that ensures transactions between related parties are conducted as if they were between independent entities. This principle is crucial for determining transfer pricing, as it requires that prices charged in related-party transactions reflect market conditions to prevent profit shifting and tax base erosion. Tax authorities worldwide rely on the arm's length principle to assess whether intercompany transactions comply with fair market pricing and to maintain equitable taxation across jurisdictions.

What is Transfer Pricing?

Transfer pricing refers to the rules and methods for pricing transactions between related entities within a multinational corporation, ensuring that prices reflect market conditions. The arm's length principle mandates that these internal prices must be equivalent to those charged between unrelated parties in comparable circumstances. Accurate transfer pricing is critical for tax compliance, preventing profit shifting, and ensuring fair allocation of taxable income across jurisdictions.

Key Differences: Arm’s Length Principle vs Transfer Pricing

The arm's length principle establishes that transactions between related parties must be conducted as if they were between independent entities, ensuring fair market value pricing. Transfer pricing encompasses the methods and regulations used by tax authorities to enforce the arm's length principle in cross-border transactions to prevent tax base erosion. Key differences include the arm's length principle serving as the foundational guideline, while transfer pricing refers to the practical application, documentation, and compliance measures based on that principle.

The Role of the OECD Guidelines

The OECD Guidelines play a crucial role in defining and enforcing the arm's length principle, which ensures that transfer pricing between related entities is conducted as if they were independent parties. These guidelines provide detailed methodologies and documentation requirements to prevent tax base erosion and profit shifting across jurisdictions. By adhering to the OECD standards, multinational enterprises and tax authorities achieve greater consistency, transparency, and fairness in global tax compliance.

Importance in International Taxation

The arm's length principle is a fundamental standard in international taxation, ensuring that transactions between related entities are priced as if they were between independent parties. Transfer pricing regulations are designed to implement this principle by requiring multinational enterprises to set prices for cross-border transactions that reflect market conditions. Adherence to the arm's length principle prevents tax base erosion and profit shifting, thereby promoting fair tax distribution among jurisdictions.

Common Methods of Applying the Arm’s Length Principle

Common methods of applying the arm's length principle in transfer pricing include the Comparable Uncontrolled Price (CUP) method, the Resale Price Method (RPM), and the Cost Plus Method. The CUP method compares the price charged in a controlled transaction to the price charged in a comparable uncontrolled transaction between independent parties. RPM determines the arm's length price by subtracting an appropriate gross margin from the resale price to an independent party, while the Cost Plus Method adds an arm's length markup to the costs incurred by the supplier of goods or services.

Transfer Pricing Documentation Requirements

Transfer Pricing Documentation Requirements focus on substantiating that intercompany transactions comply with the arm's length principle, ensuring prices mirror market conditions between unrelated parties. Comprehensive documentation must include a transfer pricing report, functional analysis, comparability study, and economic analyses demonstrating how prices comply with regulatory guidelines. Regulatory authorities use this documentation to assess tax compliance and prevent profit shifting, making detailed and accurate records crucial for multinational enterprises.

Challenges and Risks in Transfer Pricing Compliance

Transfer pricing compliance faces significant challenges due to the complexity of applying the arm's length principle accurately across diverse jurisdictions with varying tax laws and enforcement standards. Multinational enterprises encounter risks including double taxation, adjustments, and penalties when transactions do not reflect market conditions, compounded by documentation requirements and increased scrutiny from tax authorities. The need for thorough benchmarking studies and consistent methodology implementation heightens the compliance burden and potential disputes in transfer pricing audits.

Impact on Multinational Corporations

The arm's length principle is a key standard in transfer pricing used by tax authorities to ensure that transactions between related entities within multinational corporations (MNCs) are priced as if conducted between independent parties. This principle impacts MNCs by requiring precise documentation and adherence to market-based pricing to prevent profit shifting and tax base erosion. Non-compliance can lead to significant adjustments, penalties, and increased scrutiny from tax authorities globally.

Future Trends in Arm’s Length and Transfer Pricing Regulations

Future trends in arm's length and transfer pricing regulations emphasize enhanced digital economy taxation and increased transparency through global cooperation, such as the OECD's Pillar One and Pillar Two frameworks. Countries are adopting stricter documentation requirements and advanced data analytics to assess transfer pricing risks and ensure compliance. Automation and artificial intelligence play a growing role in monitoring intercompany transactions, driving more precise application of the arm's length principle.

Important Terms

Comparable Uncontrolled Price (CUP) Method

The Comparable Uncontrolled Price (CUP) Method evaluates transfer prices by comparing them to prices charged in comparable transactions between unrelated parties, ensuring compliance with the arm's length principle in transfer pricing. This method is preferred for its direct reflection of market conditions, enhancing the accuracy of intercompany price assessments.

Functional Analysis

Functional analysis in transfer pricing evaluates the economic activities performed, assets used, and risks assumed by related parties to determine appropriate arm's length prices for intercompany transactions. This detailed assessment ensures compliance with the arm's length principle by accurately reflecting the value contribution of each entity in multinational enterprises.

OECD Guidelines

The OECD Guidelines establish the arm's length principle as the standard for determining transfer pricing between affiliated enterprises to ensure that transactions reflect prices comparable to those between independent parties in the open market. These guidelines provide detailed methods and documentation requirements to prevent profit shifting and tax base erosion, promoting transparency and consistency in international tax compliance.

Transfer Pricing Adjustment

Transfer Pricing Adjustment ensures transactions between related entities comply with the arm's length principle, which mandates pricing comparable to independent parties in similar circumstances. This adjustment corrects profits shifted through transfer pricing practices, aligning taxable income with market-based benchmarks to prevent tax base erosion and profit misallocation.

Benchmarking Analysis

Benchmarking analysis in transfer pricing involves comparing controlled transaction prices with comparable uncontrolled transactions to ensure compliance with the arm's length principle mandated by tax authorities. This method uses databases of independent market prices to establish appropriate transfer prices that reflect fair market conditions, minimizing tax adjustment risks.

Profit Split Method

The Profit Split Method allocates combined profits between related entities based on their relative contributions, aligning with the arm's length principle by ensuring transactions reflect market conditions. This method is essential in complex transfer pricing scenarios where traditional transaction-based approaches are impractical.

Controlled Transactions

Controlled transactions involve related parties where prices must adhere to the arm's length principle, ensuring that transfer pricing reflects market conditions as if the parties were independent. Transfer pricing regulations require that these transactions be priced consistently with comparable uncontrolled transactions to prevent profit shifting and tax base erosion.

Advance Pricing Agreement (APA)

Advance Pricing Agreements (APAs) provide taxpayers and tax authorities with a pre-determined agreement on the transfer pricing methodology, ensuring compliance with the arm's length principle by reflecting market conditions between related entities. By establishing these pricing terms in advance, APAs reduce the risk of transfer pricing disputes and offer certainty in cross-border transactions involving related parties.

Interquartile Range

Interquartile Range (IQR) is crucial for applying the arm's length principle in transfer pricing, as it helps identify the central 50% range of comparable uncontrolled transaction prices, ensuring reliable benchmarking of intercompany transactions. Using the IQR filters out outliers and enhances compliance with tax authorities by establishing a defensible arm's length range for pricing adjustments.

Resale Price Method

The Resale Price Method (RPM) determines an arm's length price by subtracting an appropriate gross margin from the resale price charged to an independent party, ensuring compliance with transfer pricing rules. This method aligns with the arm's length principle by comparing controlled transactions to comparable uncontrolled transactions, particularly useful when the reseller adds minimal value.

arm’s length principle vs transfer pricing Infographic

moneydif.com

moneydif.com