Tax credits directly reduce the amount of tax owed, offering a dollar-for-dollar decrease in your tax liability, while tax deductions lower your taxable income, which indirectly reduces the tax due by decreasing the income subject to taxation. Tax credits are generally more valuable than deductions because they provide a flat reduction in tax bill rather than percentage savings based on the taxpayer's marginal tax rate. Understanding the differences between tax credits and tax deductions can help optimize tax planning strategies and maximize savings.

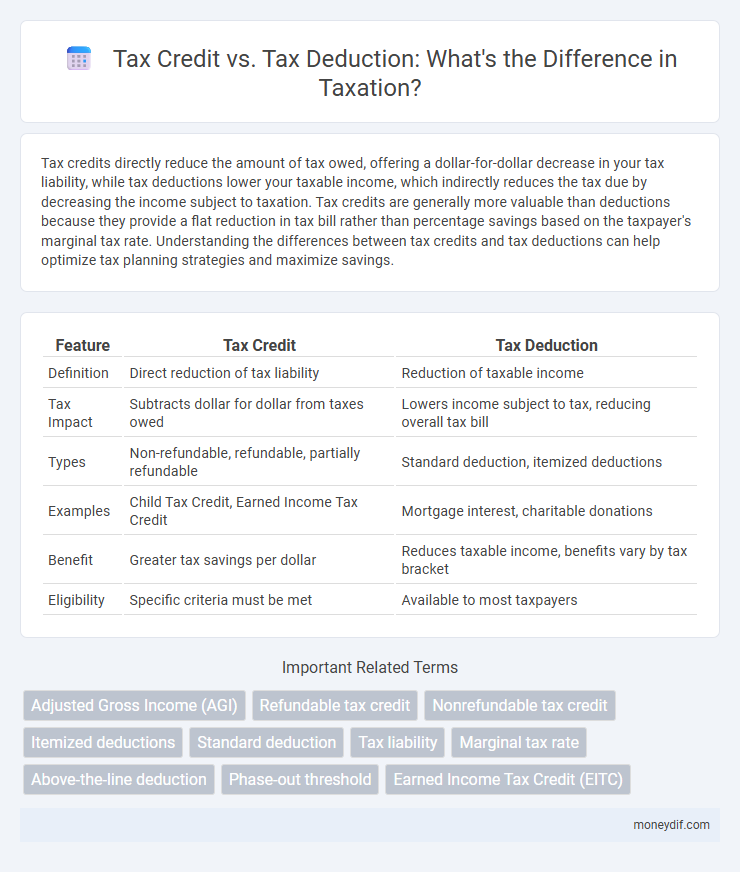

Table of Comparison

| Feature | Tax Credit | Tax Deduction |

|---|---|---|

| Definition | Direct reduction of tax liability | Reduction of taxable income |

| Tax Impact | Subtracts dollar for dollar from taxes owed | Lowers income subject to tax, reducing overall tax bill |

| Types | Non-refundable, refundable, partially refundable | Standard deduction, itemized deductions |

| Examples | Child Tax Credit, Earned Income Tax Credit | Mortgage interest, charitable donations |

| Benefit | Greater tax savings per dollar | Reduces taxable income, benefits vary by tax bracket |

| Eligibility | Specific criteria must be met | Available to most taxpayers |

Understanding Tax Credits and Tax Deductions

Tax credits directly reduce the amount of tax owed, offering a dollar-for-dollar decrease in tax liability, while tax deductions lower taxable income, thereby reducing the overall tax burden based on your tax bracket. Examples of tax credits include the Child Tax Credit and Earned Income Tax Credit, whereas common deductions encompass mortgage interest and charitable contributions. Understanding the distinction between these can maximize tax savings and ensure accurate tax reporting.

Key Differences Between Tax Credits and Tax Deductions

Tax credits directly reduce the amount of tax owed dollar-for-dollar, while tax deductions lower taxable income, thereby reducing tax liability indirectly based on the taxpayer's marginal tax rate. For example, a $1,000 tax credit decreases tax owed by $1,000, whereas a $1,000 deduction reduces taxable income, which might decrease tax owed by $200 if the marginal tax rate is 20%. Understanding these distinctions is essential for optimizing tax savings and maximizing benefits from available tax credits such as the Earned Income Tax Credit or deductions like mortgage interest.

How Tax Credits Work

Tax credits directly reduce the amount of tax owed, offering a dollar-for-dollar reduction on your tax liability. For example, a $1,000 tax credit lowers your tax bill by $1,000, making it more valuable than deductions that only reduce taxable income. Non-refundable tax credits can reduce your tax to zero but not below, while refundable credits allow for a refund if the credit exceeds your tax liability.

How Tax Deductions Work

Tax deductions reduce taxable income by subtracting eligible expenses from your gross income, lowering the amount of income subject to tax. Common deductions include mortgage interest, charitable contributions, and medical expenses, which directly decrease your taxable base. This mechanism differs from tax credits, which reduce the actual tax owed dollar-for-dollar rather than lowering income.

Types of Tax Credits Available

Tax credits include non-refundable, refundable, and partially refundable types, each affecting tax liability differently by directly reducing the amount owed. Common examples are the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), and education credits such as the American Opportunity Credit and Lifetime Learning Credit. These credits often target specific expenses or taxpayer circumstances, making them more beneficial than deductions that only lower taxable income.

Common Tax Deductions to Claim

Common tax deductions include mortgage interest, state and local taxes, medical expenses exceeding 7.5% of adjusted gross income, and charitable contributions, which help reduce taxable income. Tax credits directly lower the amount of tax owed, while deductions decrease the income subject to taxation. Understanding these deductions maximizes tax savings and minimizes overall tax liability.

Which Offers Greater Savings: Credit or Deduction?

Tax credits directly reduce the amount of tax owed dollar-for-dollar, providing greater immediate savings compared to tax deductions, which lower taxable income and reduce tax liability based on the taxpayer's marginal tax rate. For example, a $1,000 tax credit saves $1,000 in taxes, while a $1,000 tax deduction saves $250 if the taxpayer's marginal tax rate is 25%. Understanding this distinction is crucial for maximizing savings, as tax credits generally offer a higher value, especially for lower and middle-income taxpayers.

Eligibility Criteria for Credits and Deductions

Tax credits require taxpayers to meet specific eligibility criteria such as income limits, filing status, and qualifying expenses like education or child care costs. Tax deductions often depend on factors including itemized expenses, business costs, or contributions to retirement accounts, with fewer restrictions on income thresholds compared to credits. Understanding these eligibility requirements helps maximize tax savings by determining whether to claim a credit or deduction based on individual financial situations.

Tips for Maximizing Your Tax Benefits

Maximizing your tax benefits involves understanding the difference between tax credits and tax deductions, where credits reduce your tax liability dollar-for-dollar, and deductions lower your taxable income. Prioritize claiming all eligible tax credits, such as the Earned Income Tax Credit or Child Tax Credit, which offer more substantial savings than deductions. Keep meticulous records of deductible expenses like mortgage interest or charitable contributions to ensure you claim the maximum allowable deductions on your tax return.

Frequently Asked Questions: Tax Credits vs. Tax Deductions

Tax credits directly reduce the amount of tax owed, providing a dollar-for-dollar benefit, while tax deductions lower taxable income, indirectly decreasing tax liability based on the taxpayer's marginal tax rate. Common questions involve eligibility criteria, the difference in financial impact, and how to claim each on tax returns. Understanding these distinctions helps optimize tax savings and ensures compliance with IRS regulations.

Important Terms

Adjusted Gross Income (AGI)

Adjusted Gross Income (AGI) is a key figure used to determine eligibility for various tax credits, which directly reduce tax liability dollar-for-dollar, whereas tax deductions lower taxable income based on AGI, indirectly reducing the amount of tax owed. Understanding the difference between tax credits and deductions in relation to AGI can optimize tax savings by maximizing eligible credits and appropriately applying deductions before calculating final taxable income.

Refundable tax credit

Refundable tax credits allow taxpayers to receive a refund even if the credit exceeds their tax liability, unlike non-refundable tax credits that only reduce taxes owed. Tax deductions lower taxable income, while tax credits directly reduce the amount of tax owed, making refundable credits more valuable for increasing tax refunds.

Nonrefundable tax credit

A nonrefundable tax credit directly reduces the amount of tax owed but cannot result in a refund if it exceeds the tax liability, contrasting with tax deductions which lower taxable income and thus reduce tax owed indirectly. Unlike tax deductions, which vary based on income and tax brackets, nonrefundable tax credits provide a fixed reduction in tax liability, making them more advantageous for maximizing tax savings within the taxpayer's owed amount.

Itemized deductions

Itemized deductions reduce taxable income by allowing taxpayers to subtract specific expenses, such as mortgage interest and medical costs, from their gross income, directly lowering the amount subject to tax. In contrast, tax credits provide a dollar-for-dollar reduction in the tax liability, making credits generally more valuable than deductions when minimizing overall tax payable.

Standard deduction

The standard deduction reduces taxable income by a fixed amount, simplifying tax calculations without itemizing expenses, while tax credits directly decrease the total tax owed dollar-for-dollar, offering greater savings. Tax deductions lower taxable income, potentially reducing the tax bracket, but tax credits provide more immediate financial benefits by cutting tax liability more effectively than deductions alone.

Tax liability

Tax liability is the total amount of tax owed to the government before accounting for any reductions. Tax credits directly reduce tax liability dollar-for-dollar, while tax deductions lower taxable income, resulting in a less significant impact on the overall tax owed.

Marginal tax rate

Marginal tax rate determines the actual tax savings from tax credits and tax deductions by affecting how much tax you owe on the last dollar earned; tax credits provide a dollar-for-dollar reduction in tax liability, while tax deductions reduce taxable income and save money based on the marginal tax rate. Understanding the difference is crucial because a $1,000 tax credit saves exactly $1,000 in taxes regardless of income, whereas a $1,000 tax deduction saves only a portion of that amount depending on the taxpayer's marginal tax bracket.

Above-the-line deduction

Above-the-line deductions reduce adjusted gross income (AGI) directly, providing tax benefits regardless of whether taxpayers itemize deductions, unlike tax credits which directly reduce tax liability dollar-for-dollar. Tax credits offer a more powerful tax relief by lowering the actual tax owed, while above-the-line deductions primarily lower taxable income, affecting the overall tax rate applied.

Phase-out threshold

The phase-out threshold determines the income limit at which the value of a tax credit begins to decrease, contrasting with tax deductions that reduce taxable income without a specific income phase-out range. Tax credits provide direct dollar-for-dollar reductions in tax liability up to the phase-out limit, whereas tax deductions lower taxable income, indirectly impacting tax owed based on the marginal tax rate.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) directly reduces the amount of tax owed by low-to-moderate income working individuals and families, making it a refundable tax credit rather than a tax deduction. Unlike tax deductions that lower taxable income, the EITC provides a dollar-for-dollar reduction in tax liability, potentially resulting in a refund even if no tax is owed.

Tax credit vs Tax deduction Infographic

moneydif.com

moneydif.com