Excise tax is levied on the manufacture, sale, or consumption of specific goods within a country, often targeting products like alcohol, tobacco, and fuel to discourage consumption or generate revenue. Customs duty is a tariff imposed on goods when they cross international borders, designed to protect domestic industries and regulate trade. Both taxes serve distinct purposes: excise tax influences internal market behavior, while customs duty controls and taxes imports and exports.

Table of Comparison

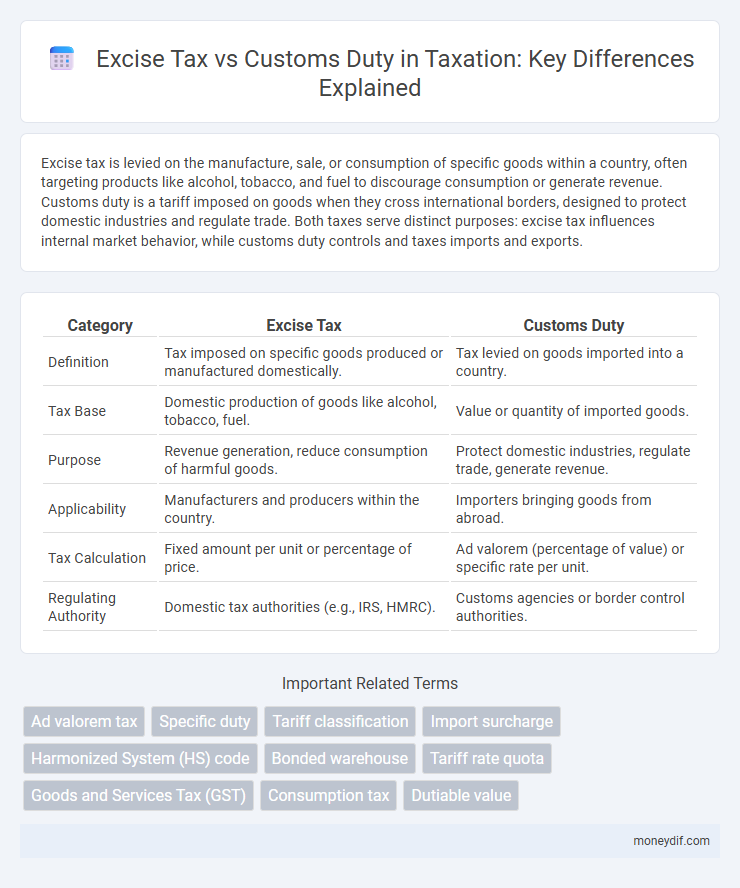

| Category | Excise Tax | Customs Duty |

|---|---|---|

| Definition | Tax imposed on specific goods produced or manufactured domestically. | Tax levied on goods imported into a country. |

| Tax Base | Domestic production of goods like alcohol, tobacco, fuel. | Value or quantity of imported goods. |

| Purpose | Revenue generation, reduce consumption of harmful goods. | Protect domestic industries, regulate trade, generate revenue. |

| Applicability | Manufacturers and producers within the country. | Importers bringing goods from abroad. |

| Tax Calculation | Fixed amount per unit or percentage of price. | Ad valorem (percentage of value) or specific rate per unit. |

| Regulating Authority | Domestic tax authorities (e.g., IRS, HMRC). | Customs agencies or border control authorities. |

Definition of Excise Tax vs Customs Duty

Excise tax is an internal tax levied on the manufacture, sale, or consumption of specific goods such as alcohol, tobacco, and fuel within a country. Customs duty is a tariff imposed on goods imported into or exported out of a country, aimed at protecting domestic industries and generating revenue. Both taxes serve different regulatory purposes, with excise taxes targeting internal transactions and customs duties governing cross-border trade.

Key Differences Between Excise Tax and Customs Duty

Excise tax is imposed on the manufacture, sale, or consumption of specific domestic goods such as alcohol, tobacco, and fuel, while customs duty is a tariff levied on imported and exported goods crossing international borders. Excise taxes are designed primarily to regulate domestic markets and raise revenue from specific goods, whereas customs duties protect local industries by making imported goods more expensive and control foreign trade flows. The essential distinction lies in excise tax applying internally within a country and customs duty applying to international trade transactions.

Types of Goods Subject to Excise Tax and Customs Duty

Excise tax primarily targets specific domestically produced goods such as alcohol, tobacco, and fuel, designed to regulate consumption and generate revenue. Customs duty applies to imported goods including electronics, textiles, and vehicles, aiming to protect domestic industries and control trade balances. Understanding these distinctions helps businesses comply with tax obligations and optimize cost management in international trade and manufacturing sectors.

How Excise Tax is Calculated

Excise tax is calculated based on specific criteria such as the quantity, volume, or value of goods produced or sold within a country, often targeting products like alcohol, tobacco, and fuel. Unlike customs duty, which is imposed on imported goods at varying rates depending on classification and origin, excise tax rates are usually fixed or ad valorem, applied directly at the point of manufacture or sale. Governments use excise tax calculations to generate revenue and regulate consumption of certain goods by adjusting rates according to policy objectives.

How Customs Duty is Assessed

Customs duty is assessed based on the classification, origin, and value of imported goods according to the Harmonized System (HS) codes and trade agreements. The declared customs value, often determined by the transaction value method, plays a crucial role in calculating the duty owed. Customs authorities also consider specific rates, which vary by product category, country of origin, and applicable tariff schedules.

Legal Framework Governing Excise Tax and Customs Duty

The legal framework governing excise tax and customs duty is established through national statutes and international trade agreements, ensuring compliance and standardized tax administration. Excise tax laws typically address the production, sale, and consumption of specific goods within a country, while customs duty regulations focus on the import and export of goods across international borders. Enforcement agencies such as customs authorities and tax departments are empowered to impose penalties and conduct inspections to uphold these legal provisions.

Impact on Importers and Exporters

Excise tax directly affects importers by increasing the cost of specific goods, often leading to higher retail prices and reduced demand, while exporters may face fewer impacts unless their products are subject to excise taxes in the destination country. Customs duty imposes a financial burden on importers through tariffs and fees on imported goods, raising overall costs and affecting supply chain decisions. Exporters can experience indirect effects from customs duties if retaliatory tariffs are imposed, potentially decreasing competitiveness in foreign markets.

Compliance and Documentation Requirements

Excise tax compliance requires meticulous internal documentation such as production records and tax payment receipts to certify the proper reporting of taxable goods. Customs duty mandates thorough import documentation including bills of lading, customs declarations, and invoices to ensure accurate tariff classification and valuation for duty calculation. Both excise tax and customs duty enforcement rely heavily on detailed record-keeping to prevent fraud and facilitate audits by tax authorities.

Recent Changes in Excise Tax and Customs Duty Legislation

Recent changes in excise tax legislation include increased rates on tobacco products and alcoholic beverages to curb consumption and boost government revenue. Customs duty regulations now emphasize stricter valuation methods and enhanced compliance requirements to prevent under-invoicing and smuggling. These legislative updates reflect global trends toward improved tax enforcement and revenue optimization in international trade.

Strategies for Minimizing Excise Tax and Customs Duty Liability

To minimize excise tax and customs duty liability, businesses should leverage tariff classification reviews to ensure accurate product categorization and explore duty drawback programs for imported goods used in export production. Implementing transfer pricing strategies and utilizing free trade agreements (FTAs) can reduce taxable value and duty rates. Effective supply chain restructuring and timely customs valuation compliance further optimize tax obligations and regulatory adherence.

Important Terms

Ad valorem tax

Ad valorem tax is calculated as a fixed percentage of the item's value, commonly applied in customs duties to tax imported goods based on their declared price, whereas excise tax is typically a specific amount imposed on particular goods regardless of their value. Unlike excise taxes that target domestic production or consumption of goods such as tobacco and alcohol, ad valorem customs duties directly influence international trade by adjusting the cost according to the product's assessed monetary worth.

Specific duty

Specific duty under excise tax is a fixed amount charged per unit of goods produced or manufactured domestically, reflecting internal taxation on items like alcohol or tobacco. In contrast, customs duty involves levies on imported goods, calculated based on value, weight, or quantity, intended to regulate trade and protect domestic industries.

Tariff classification

Tariff classification determines the appropriate category for goods under the Harmonized System, directly impacting the calculation of customs duties applied at import, whereas excise tax is imposed internally on specific goods like alcohol, tobacco, and fuel regardless of their origin. Accurate tariff classification ensures compliance and proper duty assessment at customs, while excise taxes regulate consumption and generate revenue within domestic markets.

Import surcharge

Import surcharge applies as an extra fee on imported goods, often calculated based on customs duty but separate from excise tax, which targets specific products like alcohol or tobacco. Customs duty is a tariff imposed on goods crossing borders, while excise tax is an internal tax levied on particular categories regardless of import status.

Harmonized System (HS) code

The Harmonized System (HS) code is a standardized numerical method for classifying traded products, essential for determining customs duties applied at import or export points. Excise tax, unlike customs duty, is imposed domestically on specific goods such as alcohol, tobacco, and fuel, based on HS classifications but targeted at consumption rather than cross-border trade.

Bonded warehouse

A bonded warehouse allows goods to be stored without immediate payment of excise tax or customs duty, deferring tax liabilities until the items are removed for consumption or sale. This facility helps businesses manage cash flow by delaying excise tax and customs duty payments, optimizing inventory control under customs supervision.

Tariff rate quota

Tariff rate quota (TRQ) limits the quantity of imports allowed at a lower tariff rate within a specified quota, after which higher customs duties apply to excess imports. Excise tax differs as it is a domestic tax imposed on specific goods regardless of import quantity, while customs duty applies directly to imported goods subject to TRQ regulations.

Goods and Services Tax (GST)

Goods and Services Tax (GST) integrates indirect taxes by subsuming Excise tax, which previously applied on manufacturing domestically, whereas Customs duty continues as a separate levy on imported and exported goods to regulate international trade. GST simplifies tax structures by replacing excise and other central taxes, but Customs duty remains critical for protecting domestic industries and generating revenue from cross-border transactions.

Consumption tax

Consumption tax is a broad levy imposed on goods and services at the point of purchase, differing from excise tax which targets specific domestically produced goods such as alcohol, tobacco, and fuel. Customs duty applies to imported goods, imposed at the border to regulate trade and protect domestic industries, whereas consumption tax primarily affects final consumer transactions within the domestic market.

Dutiable value

Dutiable value is the assessed worth of imported goods used to calculate customs duty and excise tax, typically including the cost, insurance, and freight (CIF) price. Excise tax applies to specific goods like alcohol and tobacco based on their dutiable value, while customs duty is a broader tariff levied on all imported products to regulate trade and protect domestic industries.

Excise tax vs customs duty Infographic

moneydif.com

moneydif.com