CFC rules target foreign subsidiaries to prevent profit shifting and ensure income is taxed where economic value is created, while thin capitalization rules limit excessive debt financing to deter interest deductions that erode the tax base. Both regulations aim to protect domestic tax revenue but address different mechanisms of tax avoidance: CFC rules focus on undistributed foreign income, whereas thin capitalization rules focus on debt-to-equity ratios within a company's capital structure. Understanding the distinct scope and application of these rules is crucial for effective tax compliance and planning.

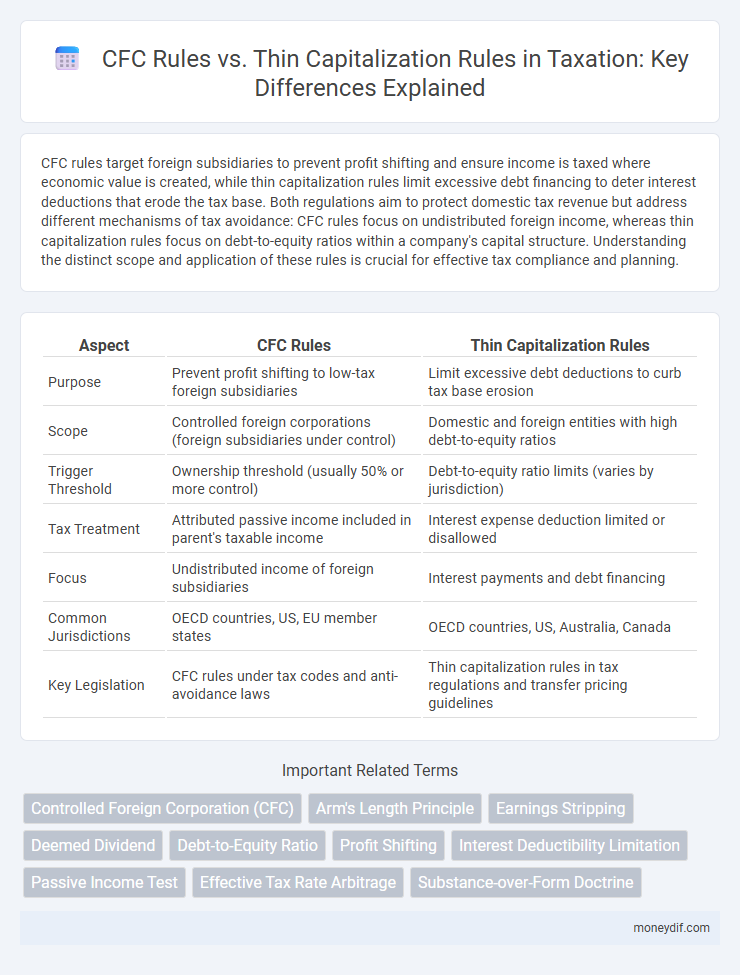

Table of Comparison

| Aspect | CFC Rules | Thin Capitalization Rules |

|---|---|---|

| Purpose | Prevent profit shifting to low-tax foreign subsidiaries | Limit excessive debt deductions to curb tax base erosion |

| Scope | Controlled foreign corporations (foreign subsidiaries under control) | Domestic and foreign entities with high debt-to-equity ratios |

| Trigger Threshold | Ownership threshold (usually 50% or more control) | Debt-to-equity ratio limits (varies by jurisdiction) |

| Tax Treatment | Attributed passive income included in parent's taxable income | Interest expense deduction limited or disallowed |

| Focus | Undistributed income of foreign subsidiaries | Interest payments and debt financing |

| Common Jurisdictions | OECD countries, US, EU member states | OECD countries, US, Australia, Canada |

| Key Legislation | CFC rules under tax codes and anti-avoidance laws | Thin capitalization rules in tax regulations and transfer pricing guidelines |

Understanding CFC Rules: An Overview

Controlled Foreign Corporation (CFC) rules target the taxation of income earned by foreign subsidiaries to prevent tax deferral and profit shifting to low-tax jurisdictions. These regulations require parent companies to include certain types of passive or easily movable income from their CFCs in their taxable income, even if profits are not repatriated. Understanding the specific thresholds, such as ownership percentages and types of income classified under CFC rules, is crucial for effective international tax compliance and planning.

Thin Capitalization Rules Explained

Thin capitalization rules restrict the amount of debt a subsidiary can owe to its parent company to prevent excessive interest deductions that erode the taxable base. These rules often impose leverage ratios or fixed debt-to-equity limits to ensure a reasonable balance between equity and debt financing. Compliance with thin capitalization regulations is crucial for multinational corporations to avoid disallowed interest expenses and potential tax adjustments.

Key Differences Between CFC and Thin Cap Rules

CFC (Controlled Foreign Corporation) rules target the attribution and taxation of passive income earned by foreign subsidiaries to prevent profit shifting and tax deferral, while thin capitalization rules limit the deductibility of interest expenses on excessive debt to curb profit shifting through excessive financing. CFC rules are based on ownership thresholds and focus on passive income types, whereas thin capitalization rules emphasize the debt-to-equity ratio regardless of income classification. Enforcement of CFC rules typically results in direct taxation of undistributed earnings, contrasting with thin capitalization rules that adjust taxable income through interest expense limitations.

Objectives of CFC Rules in Tax Policy

CFC rules aim to prevent profit shifting and tax base erosion by attributing income of controlled foreign entities back to the parent company's jurisdiction. These regulations target passive income and artificial arrangements designed to defer or avoid domestic taxation. By enforcing transparent reporting and taxing undistributed earnings, CFC rules enhance tax compliance and protect national revenue.

Purpose and Impact of Thin Capitalization Regulations

Thin capitalization regulations aim to prevent multinational corporations from excessively funding subsidiaries with debt to reduce taxable income through high interest deductions. These rules limit the amount of debt financing relative to equity, ensuring a fair allocation of tax base within a jurisdiction. By restricting leverage, thin capitalization rules deter profit shifting and protect domestic tax revenues from erosion caused by aggressive debt structuring.

Common Triggers for CFC and Thin Capitalization Rules

Common triggers for Controlled Foreign Corporation (CFC) rules include foreign entities where residents hold significant ownership, typically exceeding 50%, and passive income generation such as dividends, interest, and royalties. Thin capitalization rules are typically triggered when a subsidiary's debt-to-equity ratio surpasses a jurisdiction-specific threshold, often 3:1 or 4:1, indicating excessive reliance on debt financing. Both sets of rules aim to prevent tax base erosion through profit shifting and excessive interest deductions but target different aspects of corporate structuring.

Tax Planning Challenges: CFC vs Thin Cap

Tax planning challenges arise due to the complex interplay between Controlled Foreign Corporation (CFC) rules and thin capitalization regulations, both designed to prevent base erosion and profit shifting. CFC rules target undistributed foreign income of related entities, while thin capitalization rules limit deductible interest on excessive intercompany debt, complicating debt-to-equity structuring and financing strategies. Navigating these contrasting regulations requires careful analysis of jurisdiction-specific thresholds and definitions to optimize tax outcomes while maintaining compliance.

Compliance Requirements Under Both Regimes

Compliance with Controlled Foreign Corporation (CFC) rules requires detailed reporting of income earned by foreign subsidiaries and adherence to specific income inclusion thresholds to prevent tax deferral. Thin capitalization rules mandate maintaining appropriate debt-to-equity ratios, with documentation to support interest deductions and prevent excessive interest expense claims. Both regimes necessitate thorough record-keeping, timely filings, and adherence to jurisdiction-specific thresholds to ensure proper tax treatment and avoid penalties.

Recent Global Trends: CFC and Thin Cap Evolutions

Recent global trends indicate a tightening of Controlled Foreign Corporation (CFC) rules to address profit shifting and tax base erosion, with jurisdictions expanding the scope and lowering thresholds to capture more foreign income. Thin capitalization rules are concurrently evolving to impose stricter debt-to-equity ratio limits and extend attribution to related party loans, aiming to curb excessive interest deductions and preserve taxable income. Countries increasingly integrate CFC regulations with thin capitalization provisions to enhance overall effectiveness in combatting tax avoidance and aligning with OECD BEPS recommendations.

Practical Tax Strategies for Multinational Entities

CFC rules target foreign subsidiaries' passive income to prevent profit shifting, while thin capitalization rules limit excessive debt financing to reduce interest deduction abuse. Multinational entities optimize tax efficiency by balancing equity and debt structures under thin capitalization thresholds and managing controlled foreign company income to utilize exemptions or credits. Strategic compliance with both regimes mitigates double taxation risks and enhances global tax planning.

Important Terms

Controlled Foreign Corporation (CFC)

Controlled Foreign Corporation (CFC) rules target the allocation of income from foreign subsidiaries to prevent tax avoidance, contrasting with thin capitalization rules that focus on limiting excessive debt financing to reduce interest deductions. While CFC rules attribute passive income to the parent company, thin capitalization rules restrict deductible interest expenses based on debt-to-equity ratios, both aiming to protect the domestic tax base from erosion.

Arm's Length Principle

The Arm's Length Principle requires related parties in Controlled Foreign Corporation (CFC) rules and thin capitalization rules to conduct transactions as if they were independent entities, ensuring transfer pricing reflects market conditions. This principle prevents profit shifting through manipulated interest or pricing, enabling tax authorities to adjust taxable income under both CFC anti-avoidance and thin capitalization measures.

Earnings Stripping

Earnings stripping limits interest deductions to prevent multinational corporations from eroding taxable income through excessive related-party debt, often overlapping with Controlled Foreign Corporation (CFC) rules that target profit shifting and artificial income allocation. While CFC rules focus on attributing passive or hybrid income to parent entities, thin capitalization rules specifically cap the debt-to-equity ratio to restrict over-leveraging and base erosion.

Deemed Dividend

Deemed dividend rules under Controlled Foreign Corporation (CFC) regulations aim to tax undistributed profits to prevent profit shifting, whereas thin capitalization rules limit excessive debt deductions by restricting interest expenses on related-party loans to ensure adequate equity funding. Both frameworks work to curb tax avoidance through misuse of corporate structure, but CFC rules focus on passive income attribution while thin capitalization targets debt-to-equity ratios.

Debt-to-Equity Ratio

Debt-to-Equity Ratio serves as a critical metric in both Controlled Foreign Corporation (CFC) rules and thin capitalization rules, assessing the balance between a company's debt and shareholder equity to prevent profit shifting and tax base erosion. While CFC rules use the Debt-to-Equity Ratio to identify excessive debt levels in foreign subsidiaries for attributing income back to the parent company, thin capitalization rules focus on limiting interest deductions at the entity level to discourage overly leveraged capital structures.

Profit Shifting

Profit shifting involves multinational corporations exploiting differences in tax rules to transfer income to low-tax jurisdictions, minimizing their overall tax burden. Controlled Foreign Corporation (CFC) rules target artificial income shifting by taxing passive or certain types of income in the parent company's country, while thin capitalization rules limit excessive debt financing that inflates interest deductions and erodes the taxable base.

Interest Deductibility Limitation

Interest deductibility limitations under Controlled Foreign Corporation (CFC) rules focus on restricting interest expenses to prevent profit shifting and base erosion by limiting deductible interest based on the CFC's income or equity levels. Thin capitalization rules specifically target excessive debt-to-equity ratios to restrict interest deductions, ensuring companies maintain a balanced capital structure and preventing tax avoidance through over-leveraging.

Passive Income Test

The Passive Income Test evaluates Controlled Foreign Corporations (CFCs) to determine if their income primarily consists of passive sources such as dividends, interest, or royalties, which may trigger CFC inclusion under taxation rules. Thin capitalization rules limit the deductibility of interest expenses on related-party debt, aiming to prevent excessive debt financing, and often intersect with CFC regulations to combat base erosion and profit shifting.

Effective Tax Rate Arbitrage

Effective Tax Rate Arbitrage exploits differences between Controlled Foreign Corporation (CFC) rules and thin capitalization regulations, enabling multinational enterprises to optimize their global tax liabilities. By strategically structuring debt and equity financing, companies minimize overall taxation by leveraging lower tax rates in jurisdictions with lenient thin capitalization thresholds while managing CFC inclusion rules to defer or reduce taxable income recognition.

Substance-over-Form Doctrine

The Substance-over-Form Doctrine prioritizes the economic reality of transactions over their legal form, impacting Controlled Foreign Corporation (CFC) rules by ensuring income is attributed based on actual control and substance rather than nominal ownership. This doctrine also influences thin capitalization rules by focusing on the genuine financial structure, preventing entities from disguising equity as debt to evade tax liabilities through excessive interest deductions.

CFC rules vs thin capitalization rules Infographic

moneydif.com

moneydif.com